Last Week Under the Old Rules

The definitive guide for investors, traders, and airdrop fans—featuring top insights and news you can’t miss.

TL;DR

Market Sentiment: Cryptocurrency investment products saw record weekly inflows of $2.2 billion, driven by heightened excitement around Donald Trump’s inauguration, with Bitcoin leading the inflows at $1.9 billion. Ethereum-focused ETFs gained momentum, signaling institutional adoption of Ethereum's ecosystem. In DeFi, a shift toward Liquid Staking, Lending, and Bridges signals a maturing market. Retail demand remains subdued, with a 22% drop in activity, but Google searches for "how to buy crypto" hit an all-time high, indicating a potential resurgence in retail interest.

Yield Opportunities: Grayscale has launched its XRP Trust for accredited investors, Nubank expanded its USDC rewards program offering 4% annual returns, and platforms like Perena, Avalon Labs, and Resolv Labs are leading stablecoin farming opportunities, while Pendle Finance offers top yields for Berachain vaults.

New Airdrops: Orbiter Finance ($OBT), SoSo Value ($SOSO), and Solv Protocol ($SOLV) have launched new tokens, offering airdrops and community-focused incentives. Nillion has allocated 75M tokens for its Alpha Mainnet airdrop, while Humanity Protocol updates its system, allowing users to boost $RWT rewards by up to 60% by linking social media accounts.

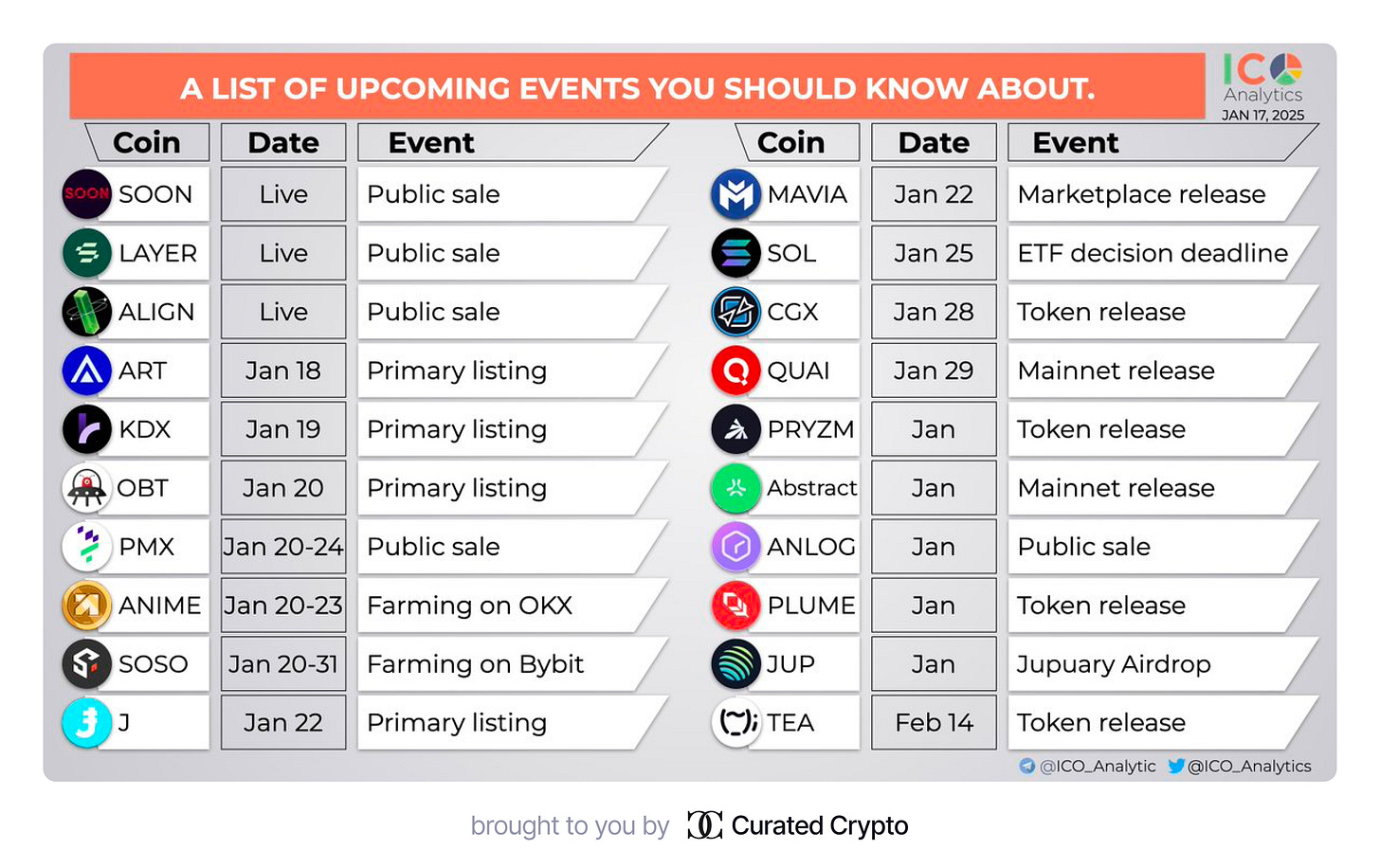

Upcoming TGEs and Token Sales: Crypto events to watch include token releases such as $PMX from Jan 20-24, and $J on Jan 22. Notable listings include $ANIME farming on OKX from Jan 20-23, and $SOSO on Bybit from Jan 20-31. $QUAI (Quai Network) mainnet goes live on Jan 29. Plus, $SOL (Solana) ETF decision is due by Jan 25.

Key Developments:

Soneium, backed by Sony, debuts its network mainnet;

Injective integrates with io.net.

Special note: AI Agents Landscape: January 2025 Overview.

Research of the week: 2024 Crypto Survey. Exchange Use and Investor Behavior

Mid-January Market Insights: New Records and Rising Expectations

In the first half of January, the crypto market revealed key trends such as Bitcoin retail activity reaching local lows and short-term holders moving toward capitulation, setting the stage for potential accumulation. Altcoin dominance surged on Binance, and global liquidity patterns hinted at parallels with previous cycles, shaping expectations for 2025.

This week’s analysis will delve into developments in the second half of January, including upcoming token unlocks, liquidity shifts, altcoin trends, and their impact on long-term market sentiment.

Crypto Investment Inflows Hit Record High Amid Market Euphoria

Cryptocurrency investment products experienced record weekly inflows of $2.2 billion, the largest since the start of 2025, as noted by CoinShares. Analysts attributed this surge to heightened market excitement surrounding Donald Trump’s inauguration, which boosted overall investor sentiment.

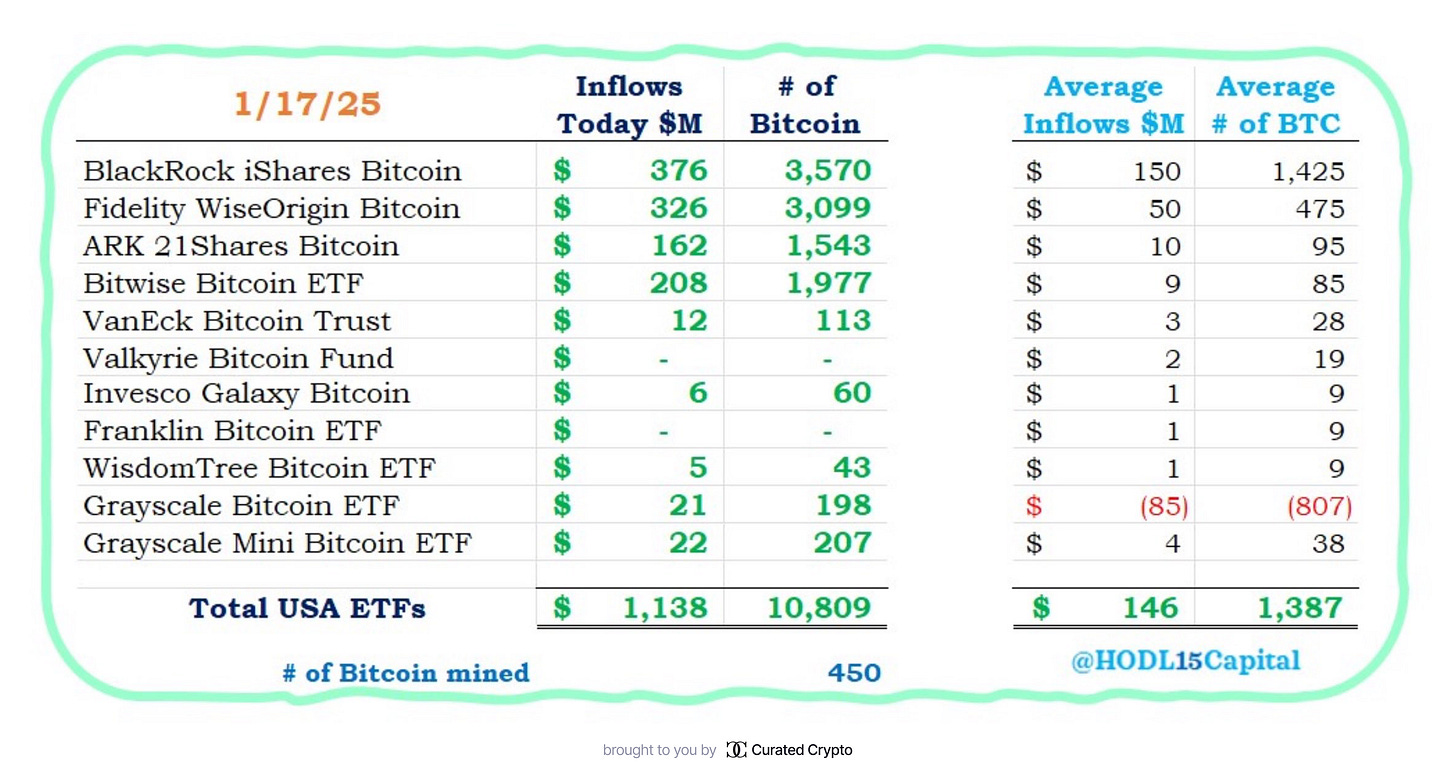

Spot BTC and ETH ETFs continued to see robust inflows. Bitcoin dominated the inflows with $1.9 billion, reaffirming its position as a market leader. Ethereum also saw significant interest, drawing $246 million in new investments. This trend underscores growing confidence in both established assets amid volatile market conditions.

Notably, Ethereum-focused ETFs gained momentum, reflecting increased interest in Ethereum-based products, according to SoSoValue. Analysts believe this uptick signals a broader institutional embrace of Ethereum’s ecosystem.

These developments highlight a pivotal moment for the crypto market, with rising inflows indicating renewed investor confidence and potential for continued growth in 2025. Full details can be found in CoinShares' latest report here.

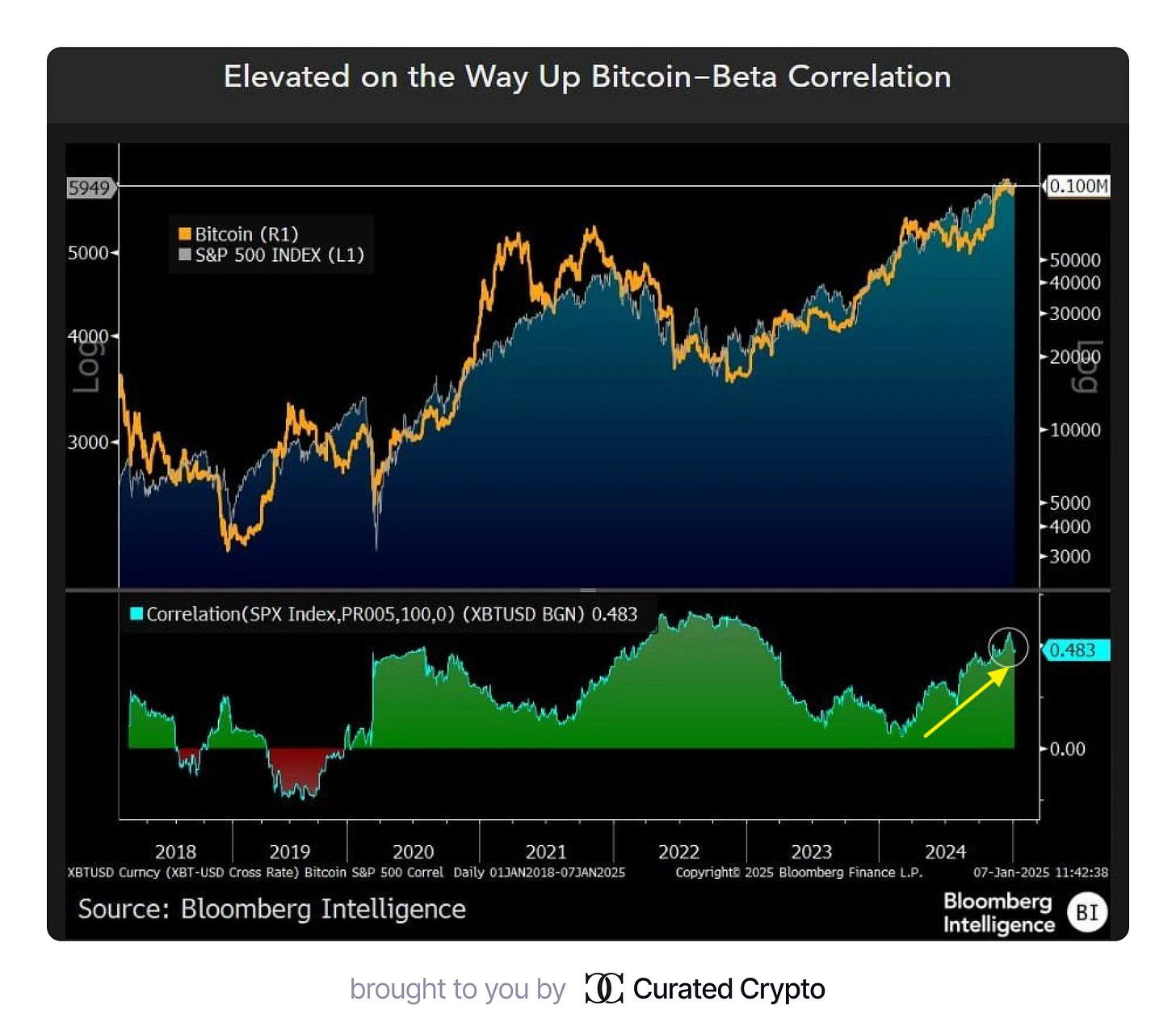

Bitcoin Faces Increased Stock Market Correlation and Risks

The correlation between Bitcoin and equities rose significantly in 2024, according to Bloomberg Intelligence. A sharp decline in the stock market is the biggest risk for Bitcoin, as noted by senior Bloomberg analyst Eric Balchunas. This growing link underscores Bitcoin's sensitivity to broader financial markets.

Additionally, stablecoin minting has slowed, signaling potential consolidation in the crypto market, according to Matrixport. This trend could curb liquidity and limit short-term growth opportunities, reinforcing the importance of monitoring macroeconomic conditions.

DeFi Landscape Transformed: Shifting Trends in TVL and Trading

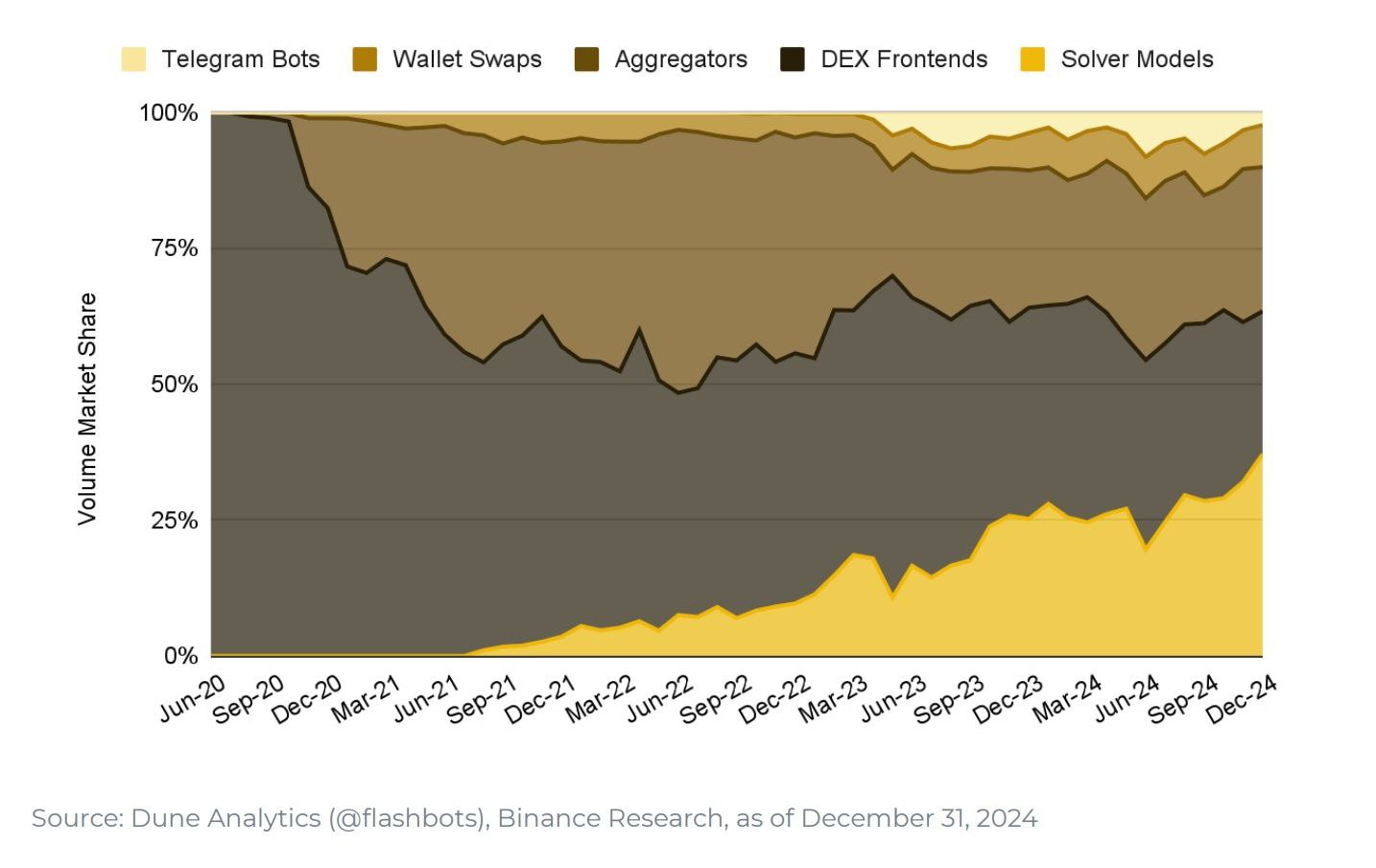

The composition of Total Value Locked (TVL) in DeFi has evolved drastically since 2021. Once dominated by DEXes, Lending, and CDPs, today’s top categories are Liquid Staking, Lending, and Bridges, with DEXes, Restaking, and Liquid Restaking also gaining prominence, according to DefiLlama.

On-chain trading volumes are increasingly routed through external frontends rather than directly originating from DEXes, signaling a growing preference for intermediary platforms and user-centric interfaces, as noted in Binance Research.

This shift underscores a maturing DeFi market, where innovative use cases like Liquid Restaking and improved accessibility drive adoption. Meanwhile, the rise of Bridges highlights the demand for cross-chain solutions to enhance liquidity and interoperability.

As the ecosystem evolves, 2025 could see further diversification in DeFi categories and trading tools, with new technologies shaping how users interact with decentralized finance platforms.

Retail FOMO: Is It Truly Here?

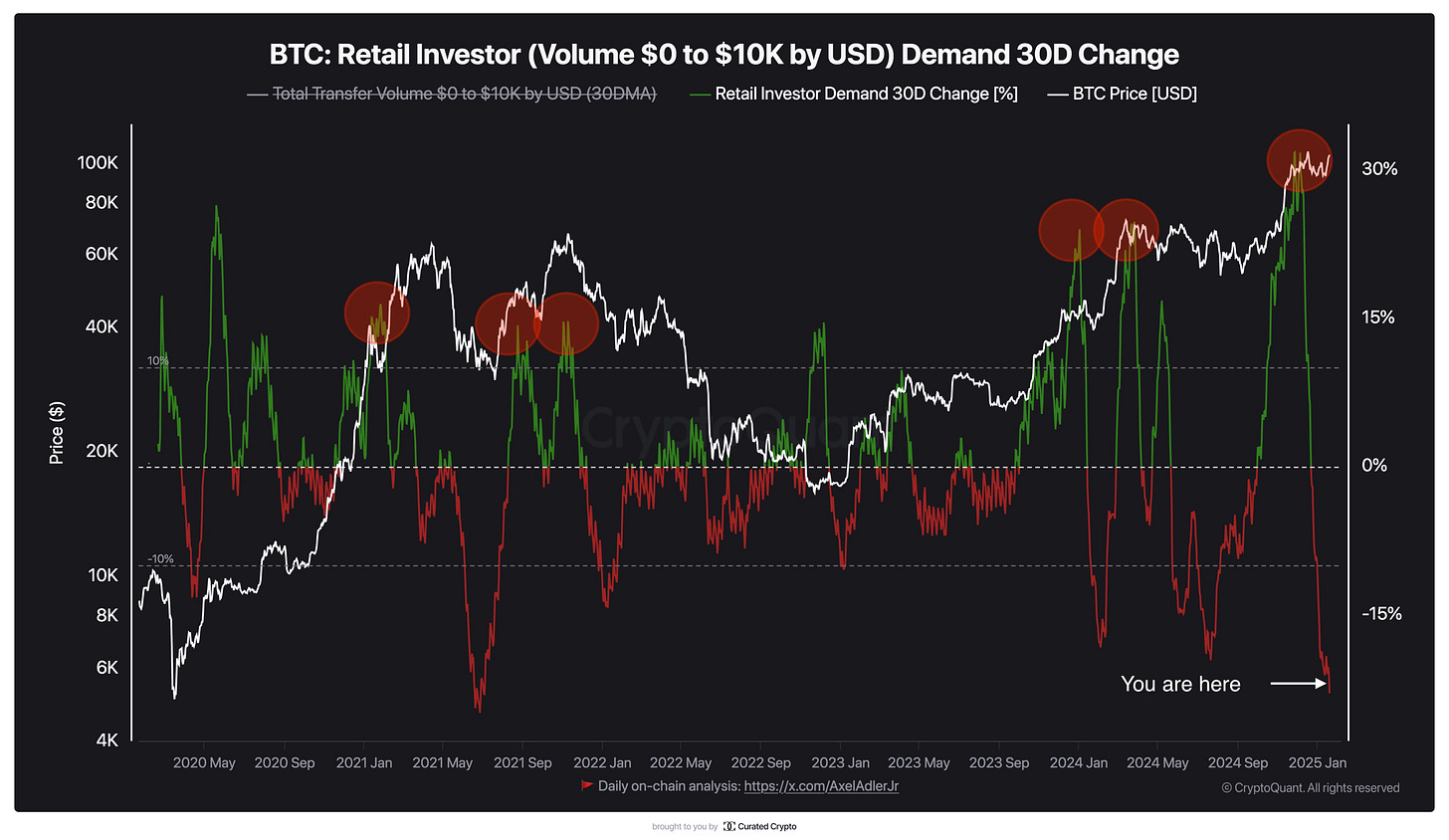

FOMO may be stirring, but retail activity suggests a slow start. Binance founder CZ hinted that “FOMO is just starting,” yet data paints a more nuanced picture. Retail demand is down 22% over the past 30 days, hitting one of its lowest levels ever, signaling caution among small investors.

In contrast, Google searches for “how to buy crypto” just hit a new all-time high, marking their first ATH in four years. This resurgence in search interest could be an early indicator of retail’s gradual return to the market.

While major players and institutions appear to be positioning for the next market cycle, retail participation remains subdued but shows hints of reawakening. As sentiment shifts, a full retail-driven FOMO wave could be on the horizon.

Maximize Your Crypto Yield: Weekly Updates

Grayscale Launches XRP Trust for Accredited Investors

Grayscale has introduced its XRP Trust, now available to qualified accredited investors. This product provides exposure to XRP assets without requiring direct ownership or management.

As of January 16, 2025, the net asset value (NAV) per share stands at $65.20. Positioned as one of the first dedicated investment securities for XRP, the trust simplifies access to XRP for institutional and accredited investors, aligning with the growing demand for regulated crypto investment vehicles.

Nubank Expands USDC Rewards Program

Brazil’s Nubank has extended its USDC rewards program to all users of Nubank Cripto, offering 4% annual returnson balances of 10 USDC or more, calculated daily. This decision follows a successful pilot program that tested variable rates throughout the past year.

This move aligns with Nubank's broader strategy to enhance its digital offerings and increase crypto adoption in Brazil. By providing stable, predictable rewards in USDC, Nubank is catering to both new and experienced digital asset users.

Keep Calm and Keep Farming: Top Stablecoin Opportunities

Perena – A Solana-native stablecoin ecosystem, promising innovative liquidity strategies.

Avalon Labs – CeDeFi-based Bitcoin-backed stablecoin with unique farming options.

Resolv Labs – A well-known platform for stablecoin farming with accessible tools to maximize yields.

💡 Pro Tip: If you're farming $aUSD from Avalon or Resolv, deposit it on Level to enable cross-farming opportunities and boost returns.

Explore these platforms to take advantage of the evolving stablecoin farming ecosystem! More details - here.

Top Yields for Bluechip Assets You Shouldn’t Miss

Berachain vaults shine on Pendle

Berachain BOYCO vaults on Pendle Finance are leading the yield pack: 28% on stables, 16% on ETH, and 14% on BTC. Future integrations with platforms like Euler Finance and Morpho Labs could amplify opportunities.Stone ETH loops with Bera

By borrowing against stoneETH on Morpho, users access 16% implied yields for Berachain pre-deposits at just 4% borrowing costs (91.5% LTV).

A dozen more options can be recognized in this thread.

Be sure to explore the "Passive Yield Supercar" thread

From Airdrops to Profits: Your Farming Guide

Key Token Launches and Airdrop Details

Orbiter Finance (OBT Token):

The cross-chain bridge Orbiter Finance has officially launched its OBT token, with a total supply of 10 billion coins. At the launch, 2.8 billion tokens entered circulation, and a substantial 40% of the supply is reserved for the community to encourage adoption. The token generation event (TGE) will take place on January 20, marking a significant milestone for the project as it looks to expand its ecosystem.SoSo Value (SOSO Token):

SoSo Value, a prominent ETF analytics platform, introduced the SOSO token with a total issuance of 1 billion coins. The project announced an airdrop for the first season, distributing 49 million SOSO tokens (4.9% of the total supply) to reward early participants. The TGE is scheduled for next week, promising to boost engagement and community activity.Solv Protocol (SOLV Token):

Solv Protocol successfully conducted its TGE, introducing the SOLV token with a total supply of 8.4 billion tokens. The project allocated 8.5% of the supply to the community and plans additional rewards through various campaigns. The token is already listed on major exchanges, including Binance, providing wide accessibility to investors and enhancing the protocol’s reach.

These launches reflect a growing trend of token incentives designed to foster community engagement and expand the adoption of decentralized finance tools. Each project offers unique opportunities for participants, emphasizing strong community involvement through airdrops and targeted distributions.

Nillion Airdrop: 75M Tokens for the Community

Airdrop Details:

Nillion is celebrating its journey to the Alpha Mainnet with a NIL token airdrop, rewarding early adopters and community contributors. Registration is open until February 3rd, 5 PM UTC, via the eligibility checker. Failing to register in time will result in losing eligibility.Token Allocation:

Nillion has allocated 7.5% of the total supply (75M tokens) for:

• Verifier Program participants

• Developers

• Community effortsHow to Participate:

Check eligibility and register here: claims.nillion.com

Humanity Protocol Airdrop Update

Boost Rewards by 60%:

Humanity Protocol now allows users to link social media accounts to their testnet accounts, boosting daily $RWT rewards by up to 60%.Mainnet Airdrop Reminder:

Daily $RWT claims will convert into the mainnet airdrop. Don’t miss the chance to maximize your rewards!Steps to Join:

Link accounts via: testnet.humanity.org

Token Generation Events: Sales and Listings Overview

Upcoming Crypto Events & Releases to Watch

The crypto space is buzzing with activity, and January is packed with events you won't want to miss. From token launches and primary listings to groundbreaking mainnet releases, this month marks significant milestones for various projects. Whether you're a trader, investor, or enthusiast, these developments present opportunities to stay ahead.

Here’s a shortlist of TGEs, primary listings, and key product updates scheduled for late January and beyond:

Token Sales & Releases:

• $PMX (Primex Finance): Token sale, Jan 20-24

• $BADAI (BAD Coin): Token release, Jan 20

• $J (Jambo): Token release, Jan 22

• $PLUME (Plume Network): Token release, JanListings & Farming:

• $ANIME (ANIME): Farming on OKX, Jan 20-23

• $SOSO (SoSoValue Research): Farming on Bybit, Jan 20-31Product & Mainnet Launches:

• $MAVIA (Heroes of Mavia): Marketplace release, Jan 22

• $QUAI (Quai Network): Mainnet release, Jan 29

• Abstract: Mainnet release, JanOther Highlights:

• $SOL (Solana): ETF decision deadline, Jan 25

• $TEA (tea Protocol): Token release, Feb 14

January's lineup reflects the dynamic growth of the crypto ecosystem, offering a mix of innovation, investment opportunities, and strategic releases. With dates subject to confirmation, staying informed is crucial for making timely decisions. Keep tracking these projects to capitalize on their developments.

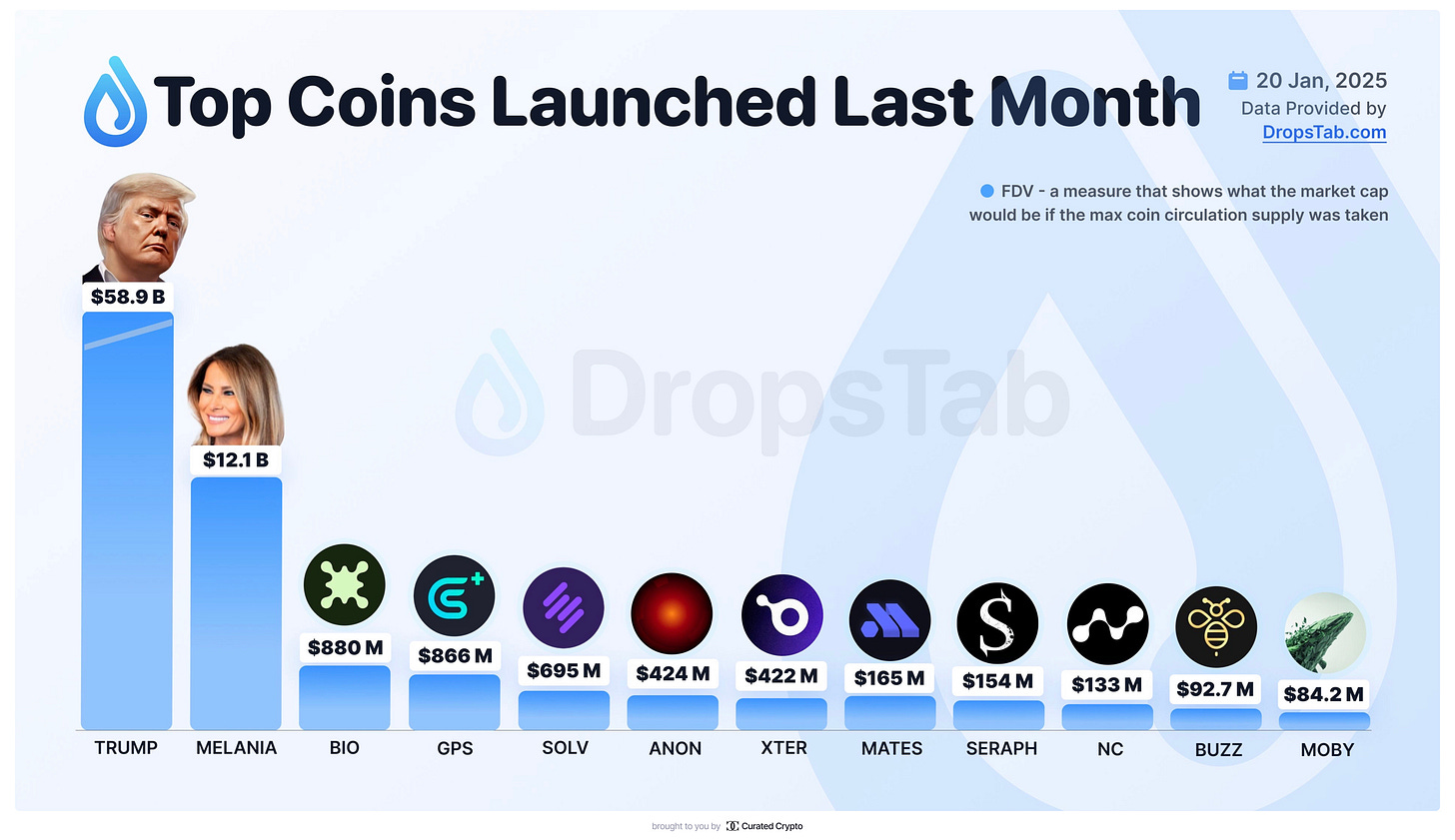

Top Coins Launched Last Month by Fully Diluted Valuation (FDV)

The cryptocurrency space continues to see vibrant activity, with new projects emerging each month. Last 30D brought a mix of notable token launches, showcasing the growing interest in diverse sectors of the market. Here's a snapshot of the most prominent coins by FDV as of January 20, 2025:

$TRUMP: $58.9B

$MELANIA: $12.1B

$BIO: $880M

$GPS: $866M

$SOLV: $695M

$ANON: $424M

$XTER: $422M

$MATES: $165M

$SERAPH: $154M

$NC: $133M

$BUZZ: $92.7M

$MOBY: $84.2M

These coins reflect a wide range of use cases, from utility-based projects to more speculative narratives, driving both interest and investment.

To stay informed on these and other rising tokens, check out the detailed profiles on DropsTab: Top Coins by FDV. New opportunities and trends continue to emerge—be sure to keep an eye on them!

Major Highlights and Industry Movements

Crypto Catalysts to Watch This Week

This week marks a crucial period for the crypto market, with several key events likely to influence trends and market sentiment. From regulatory decisions to major protocol launches, these catalysts could set the stage for significant shifts in the industry.

Gary Gensler’s Resignation – US SEC Chair Gary Gensler will resign on January 20, paving the way for the first pro-crypto SEC Chair.

MicroStrategy Shareholder Meeting – On January 21, shareholders will discuss increasing BTC holdings.

Mantle’s Announcements – Mantle will reveal its 2025 roadmap and launch a new product on January 22, with mETH Protocol announcing significant updates.

AIXBT Terminal Tiered Access Launch – AIXBT AI Agent Terminal rolls out tiered access this week, likely driving revenue growth.

Solana ETF Approval Deadline – The deadline for spot Solana ETFs approval is January 23. There’s an 80% chance that an SOL ETF will be approved in 2025, according to Polymarket.

Liquity V2 Launch – The Liquity V2 protocol will launch on January 23, introducing support for liquid staking tokens as collateral, user-set borrowing rates, and lower liquidation penalties.

The events this week could set a tone for further shifts in market trends and provide opportunities for investors and traders to react strategically. Make sure to monitor these developments closely, as they are expected to shape the next phase of the crypto market.

Weekly Emission Overview: January 20-26, 2025

This week, we’re seeing significant token unlock events that could impact the market. Notable tokens and their unlock values include:

$IMX (1.43%): $33.59 million

$ALT (10.39%): $24.38 million

$APEX (18.71%): $18.80 million

$ENA (0.42%): $12.11 million

$ID (4.29%): $8.14 million

$EIGEN (0.55%): $4.33 million

These unlocks represent a large portion of the circulating supply and may influence price movements throughout the week. Make sure to stay updated for any potential market shifts resulting from these releases.

Protocols in focus

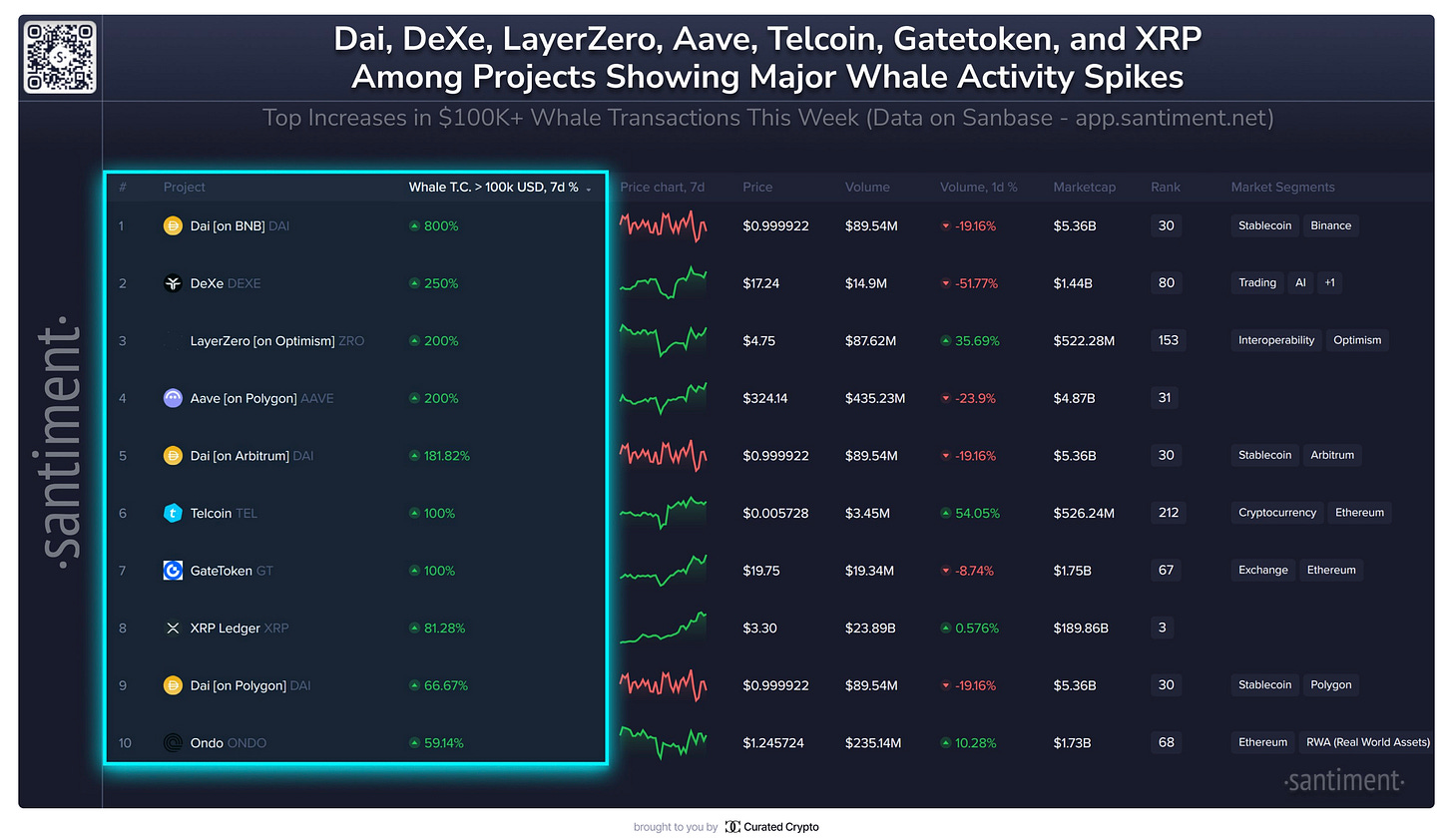

Whale Activity Spikes Among Altcoins This Week

This week, several altcoins with market caps over $500M saw notable increases in whale transactions, a key indicator of potential price movements. These spikes are often tied to significant market actions like profit-taking or purchasing during price dips.

MakerDAO $DAI (on BNB): +800%

DexeNetwork $DEXE: +250%

LayerZero $ZRO (on Optimism): +200%

Aave $AAVE (on Polygon): +200%

MakerDAO $DAI (on Arbitrum): +182%

Telcoin $TEL: +100%

GateToken $GT: +100%

Ripple $XRP: +81%

MakerDAO $DAI (on Polygon): +182%

OndoFinance $ONDO: +59%

Whale activity around stablecoins, like $DAI, often signals preparations for fund swaps into altcoins with common trading pairs, particularly those associated with ETH-based assets.

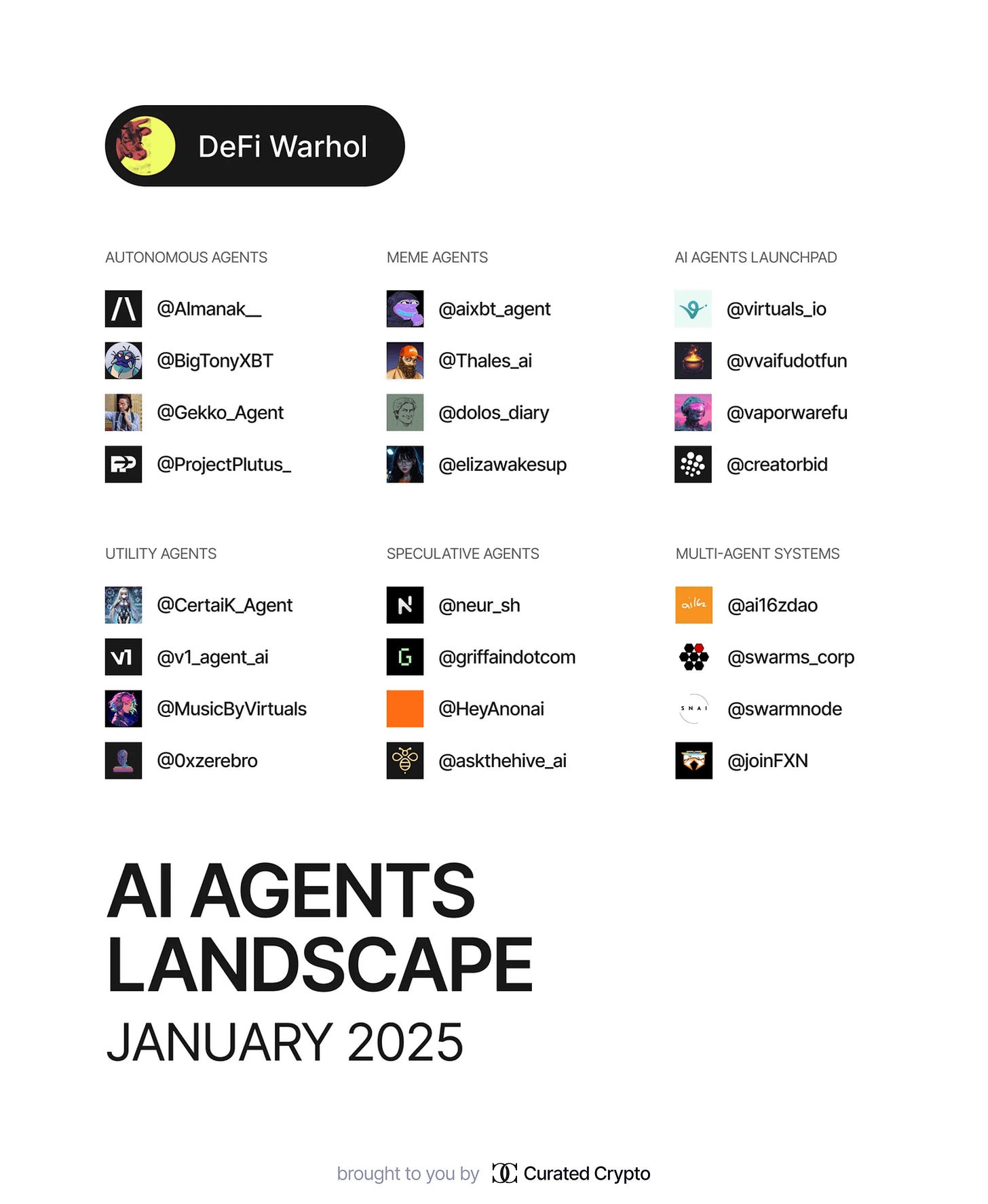

AI Agents Landscape: January 2025 Overview

The AI agents landscape in January 2025 is diverse, with platforms and projects categorized based on their unique functionalities and technological focuses. These span from meme-driven agents to sophisticated multi-agent systems, each contributing to the evolving AI space. Here’s a breakdown of key players and their categories:

Autonomous Agents

Almanak: A platform for building and managing financial strategies with AI agents. No token yet.

Big Tony: Profitable autonomous trading agent, $TONY with $5.3M FDV.

Gekko AI: Known for high-frequency data-driven trades, $GEKKO with $16.7M FDV.

Meme Agents

aixbt: Leading KOL in crypto, $AIXBT with $564M FDV.

Thales: Combines crypto analysis with degen culture, $THALES with $19M FDV.

Dolos: Known for roasts and witty remarks, $BULLY with $49M FDV.

AI Agent Launchpads

Virtuals Protocol: No-code AI Launchpad, $VIRTUALS with $2.7B FDV.

vvaifu.fun: AI platform for creators, $VVAIFU with $62M FDV.

Utility Agents

CertaiK: AI auditing platform, $CERTAI with $5.4M FDV.

v1 Agent: Simplifies blockchain operations, $V1 with $1.8M FDV.

Speculative Agents

neur: DeFi copilot agent on Solana, $NEUR with $41M FDV.

griffain: Platform for token swaps and automated actions, $GRIFFAIN with $372M FDV.

Multi-Agent Systems

ai16z: Infrastructure layer for AI agents, $AI16Z with $1.3B FDV.

SwarmNode.ai: AI agent marketplace, $SWARMS with $123M FDV.

The market continues to grow as innovative platforms cater to various use cases across AI-powered systems. More details can be found on Defi_Warhol’s thread.

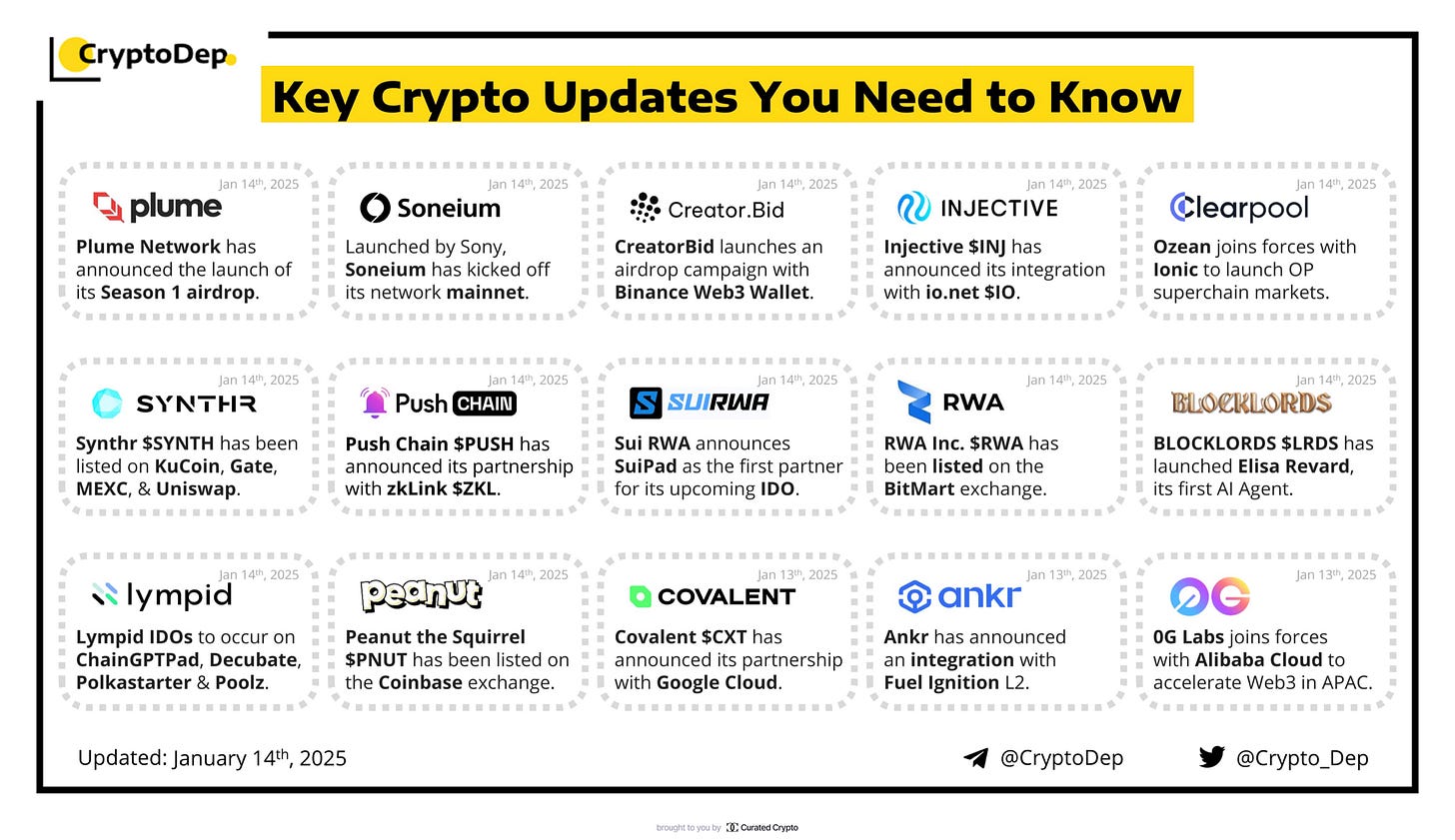

Key Crypto Updates You Need to Know - January 2025

The crypto landscape is buzzing with significant updates across various projects. Here are the latest highlights:

Plume Network launches Season 1 airdrop.

Synthr $SYNTH is now listed on major exchanges like KuCoin, Gate, MEXC, and Uniswap.

Soneium, backed by Sony, debuts its network mainnet.

Push Chain $PUSH partners with zkLink $ZKL.

CreatorBid kicks off an airdrop campaign with Binance Web3 Wallet.

Sui RWA partners with SuiPad for an upcoming IDO.

For full details, visit this thread.

Key VC rounds of the week

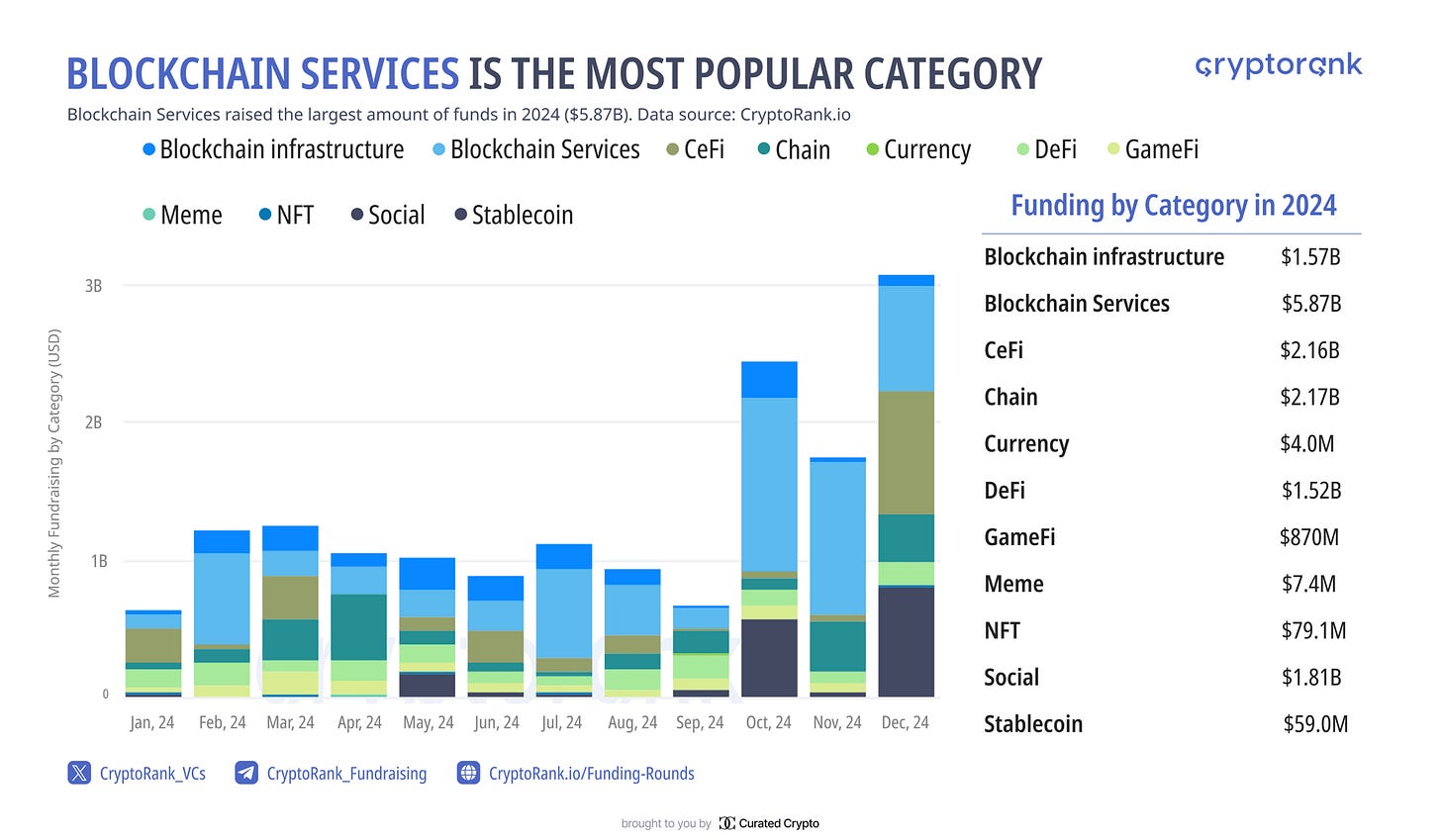

Blockchain Services Dominate Funding in 2024

In 2024, Blockchain Services led all categories in funding raised, totaling $5.87 billion. This category outpaced all others, reflecting a growing interest from venture capitalists in innovative solutions that extend beyond traditional blockchain models.

Funding by Category (2024):

Blockchain Infrastructure: $1.57B

Blockchain Services: $5.87B

CeFi: $2.16B

Chain: $2.17B

DeFi: $1.52B

GameFi: $870M

This data highlights the increasing prominence of blockchain services as a central focus for investors.

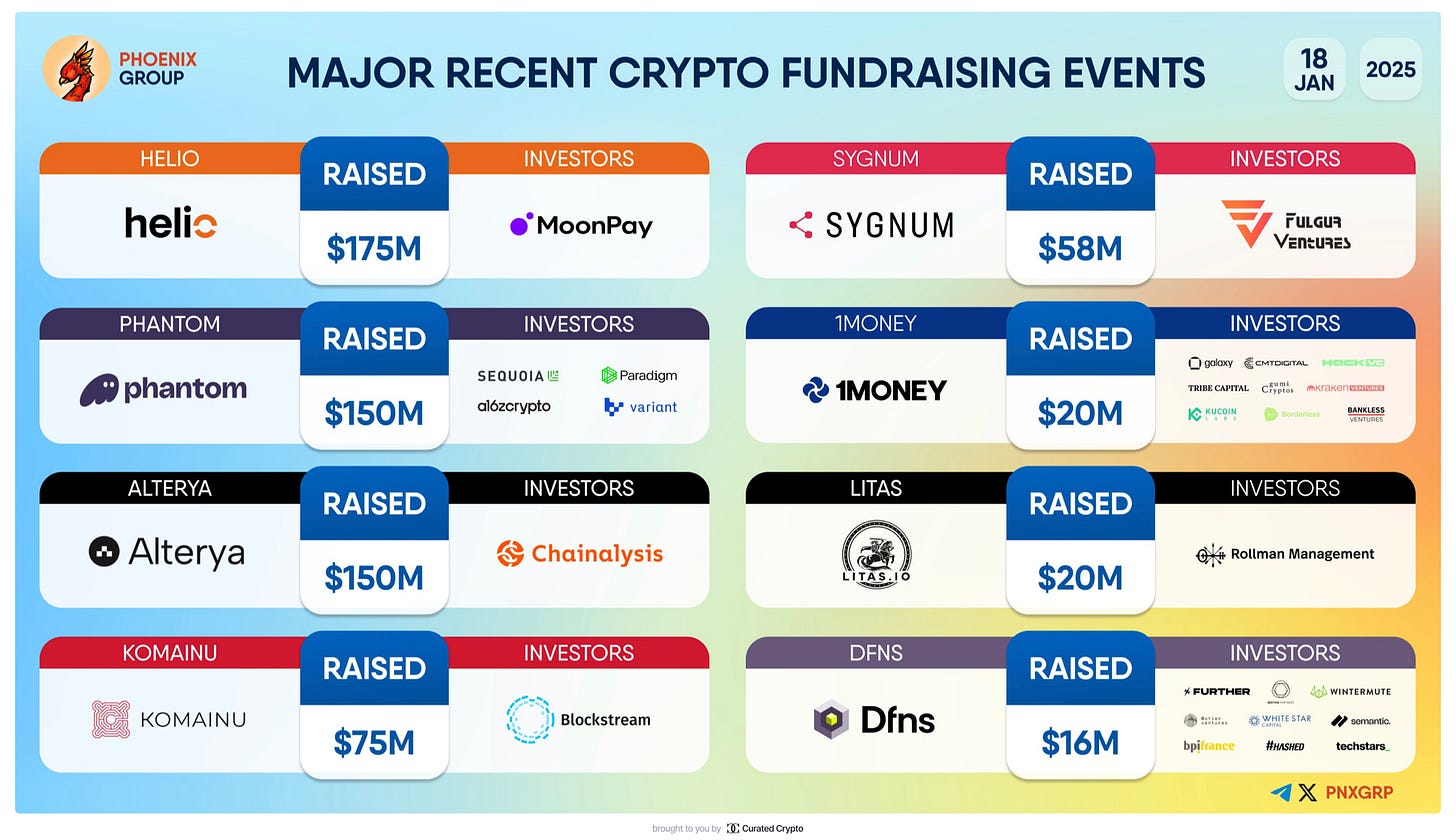

Major recent crypto fundraising events

In recent weeks, the cryptocurrency space has seen a significant number of funding rounds, demonstrating strong investor interest in a variety of blockchain and Web3 projects. These funds will help drive innovation and growth, with key areas being crypto wallets, privacy solutions, decentralized identity, and digital asset management. This surge in investment shows that the crypto industry continues to expand, despite market fluctuations.

Phantom Wallet secured $150 million in Series C funding to further its development as a leading Web3 wallet.

1Money Network raised $20 million in seed funding, aimed at enhancing its crypto-financial solutions.

Privasea completed a $15 million Series A funding round, advancing privacy features in blockchain apps.

Reown closed $13 million in Series B funding to expand its decentralized identity platform.

Merit Systems secured $10 million in seed funding for its digital asset management platform.

The above projects reflect the ongoing trend of increased investment in the cryptocurrency space, as companies continue to grow and scale their operations. As the blockchain ecosystem matures, more opportunities for innovation arise, making these investments pivotal in shaping the future of the industry.

From Headlines to Impact: The Long-Term View of Crypto News

Justin Sun Increases Investment in World Liberty Financial to $75 Million

Justin Sun, the founder of TRON, has committed an additional $45 million to World Liberty Financial, bringing his total investment to $75 million. This new infusion of funds strengthens his position as the largest investor in the platform.

This development follows a $30 million token purchase in November 2024, which had already made Sun the biggest stakeholder. In addition to the financial boost, World Liberty Financial has confirmed that Sun will continue to serve as an advisor to the company.

Furthermore, World Liberty Financial is now looking to acquire TRON (TRX) tokens for its treasury, marking a deepening of ties between the two entities.

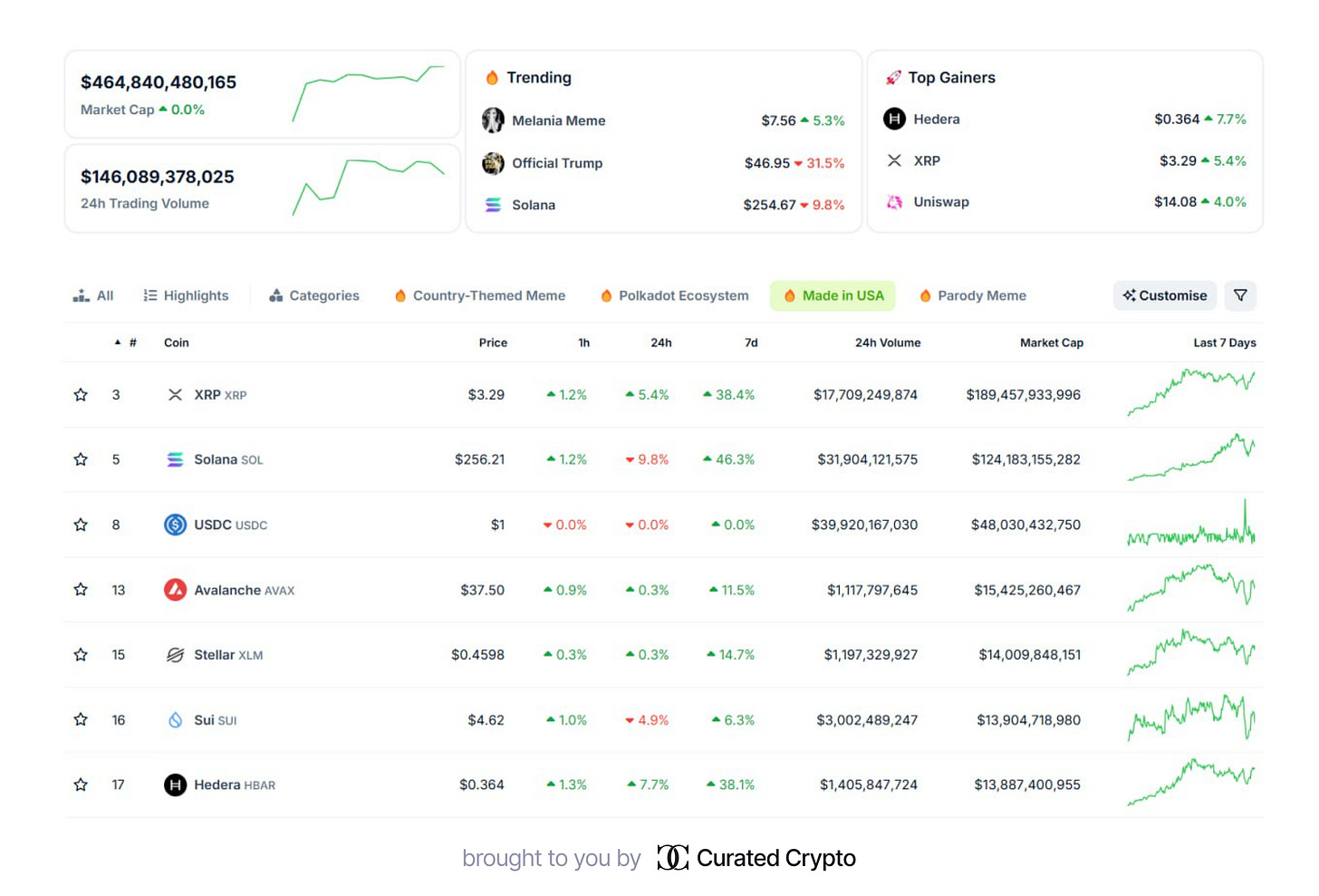

USA Crypto Projects Spotlighted

A new “Made in the USA” category has been added to a leading cryptocurrency aggregator platform, featuring the most influential U.S.-based crypto projects. The list highlights some of the industry's top names, including Ripple, Solana, Circle (USDC), Chainlink, and Hedera, with a combined market capitalization exceeding $563 billion. This category is a significant move to showcase the growing dominance of American blockchain technologies in the global market.

The inclusion of these projects emphasizes the pivotal role the U.S. plays in shaping the crypto landscape. With the industry becoming more competitive, this curated list could guide investors, developers, and enthusiasts seeking U.S.-backed innovations. This initiative also reflects broader trends of governmental and regulatory focus on domestic cryptocurrency solutions.

As U.S.-based platforms continue to gain ground, this aggregation could help users navigate the diverse and rapidly growing blockchain ecosystem, offering a clear view of the country's contributions to the sector.

Litecoin ETF: Next in Line for U.S. Approval?

Analyst Eric Balchunas from Bloomberg has shared a prediction that a Litecoin-based ETF could soon become the next spot crypto-ETF approved by the U.S. Securities and Exchange Commission (SEC). This prediction follows the October 2024 application submitted by Canary Capital for an LTC-ETF. The firm has already received preliminary feedback from the SEC, suggesting a positive outcome.

The regulatory body's recent involvement in the application process further fuels optimism in the crypto community. While no approval is guaranteed, the SEC's engagement and the fact that Canary Capital has responded to its inquiries suggest momentum is building. This could mark a significant shift in the approval process for crypto-based investment funds in the U.S.

The potential approval of the Litecoin ETF also comes at a critical juncture, with the SEC's new chairperson taking office. The appointment of this new chair could prove pivotal, as their stance on cryptocurrency funds could heavily influence future decisions. If this ETF were approved, it would represent a notable development in the U.S. crypto market, further legitimizing digital assets in mainstream investment.

Research spotlight

When to Sell Crypto

A Cointelegraph guide explores smart exit strategies for crypto investors, emphasizing the importance of planning. It discusses setting price targets, assessing market conditions, and managing risk to avoid emotional decisions during volatility.

Source

zkVM: A New Paradigm for Web3 Computing

This post delves into zero-knowledge virtual machines (zkVMs), their role in Web3, and their potential to enhance privacy and scalability in decentralized ecosystems.

Source

Front-End Exploits in DeFi

Learn about securing decentralized platforms against front-end attacks to protect user funds and data.

Source

A Love Letter: 8 Billion Humans, 800 Trillion AI Agents

This reflection imagines a future shaped by the coexistence of humanity and AI agents in everyday life.

Source

The Year Ahead in Crypto

Pantera Capital outlines trends shaping crypto in 2025, from technological advancements to evolving regulations.

Source