This Week in Crypto: Between Hackers & Yappers

Essential weekly insights for traders, investors, and airdrop seekers—don’t miss the key updates.

TL;DR

Market Sentiment: FTX has begun repaying creditors, distributing $16 billion, while Bybit has fully replenished $1.4 billion in ETH after a hack. Meanwhile, global liquidity is accelerating, altcoin dynamics are shifting towards stronger fundamentals, and the regulatory focus on crypto intensifies, especially in Argentina and with new ETF filings.

Yield Opportunities: Stablecoins are evolving with new regulatory milestones, crypto ETFs gaining institutional interest, and DeFi platforms offering high yield opportunities, signaling significant growth and transformation in the market.

New Airdrops: Kaito launches a native token airdrop on Base, with listings planned for major exchanges, while the MONAD ecosystem expands with over 10 airdrops and innovative projects in GameFi, DeFi, and social platforms, including Multipli, which offers yield on RWA.

Upcoming TGEs and Token Sales: February and March are packed with major crypto events, including the OBOL token sale, Ethereum's Petra upgrade, PARSIQ's REACT token migration, Sonic: Mobius mainnet release, and Humans.ai's Human v1 launch, offering significant investment opportunities.

Key Developments:

Hyperliquid launches HyperEVM on mainnet;

Monad has deployed a public testnet.

Special note: DeFi Landscape Overview

Research of the week: The Real Ethereum Hasn't Been Tried Yet

Unprecedented Movements in Crypto: Are We Heading for a Storm?

Last week, significant events unfolded in the cryptocurrency world: Bitcoin reserves on exchanges hit a three-year low, coinciding with growing demand from large corporate investors. OTC desks are also seeing a decline in BTC reserves, suggesting coins are moving into cold storage — a trend that could lead to a supply squeeze and price surge. In the U.S., the regulatory race continues, with states pushing BTC reserve bills, while memecoins take the political spotlight. Additionally, the debate over Jack Dorsey being the true Satoshi Nakamoto has reignited, sparking renewed discussions on Bitcoin’s origins.

This week, however, was marked by the largest-ever hack of a cryptocurrency exchange. Other key events include continued outflows from spot BTC and ETH ETFs, the ongoing recovery of FTX debts, and the associated reputational risks. Attention is also focused on the impact of growing global M2 liquidity on BTC and cryptocurrencies in general. Meanwhile, new testnets and platforms are being launched, along with airdrops and opportunities for yield, alongside ongoing regulatory developments.

When Markets Shake: Crypto’s Latest Setbacks and What’s Next

FTX has begun the process of repaying creditors on February 18, 2025, distributing $16 billion among affected customers. An initial $1.2 billion is allocated to claims under $50,000, allowing 98% of customers to receive approximately 118% of their requested amounts. The next payments are scheduled for April 11 and May 30.

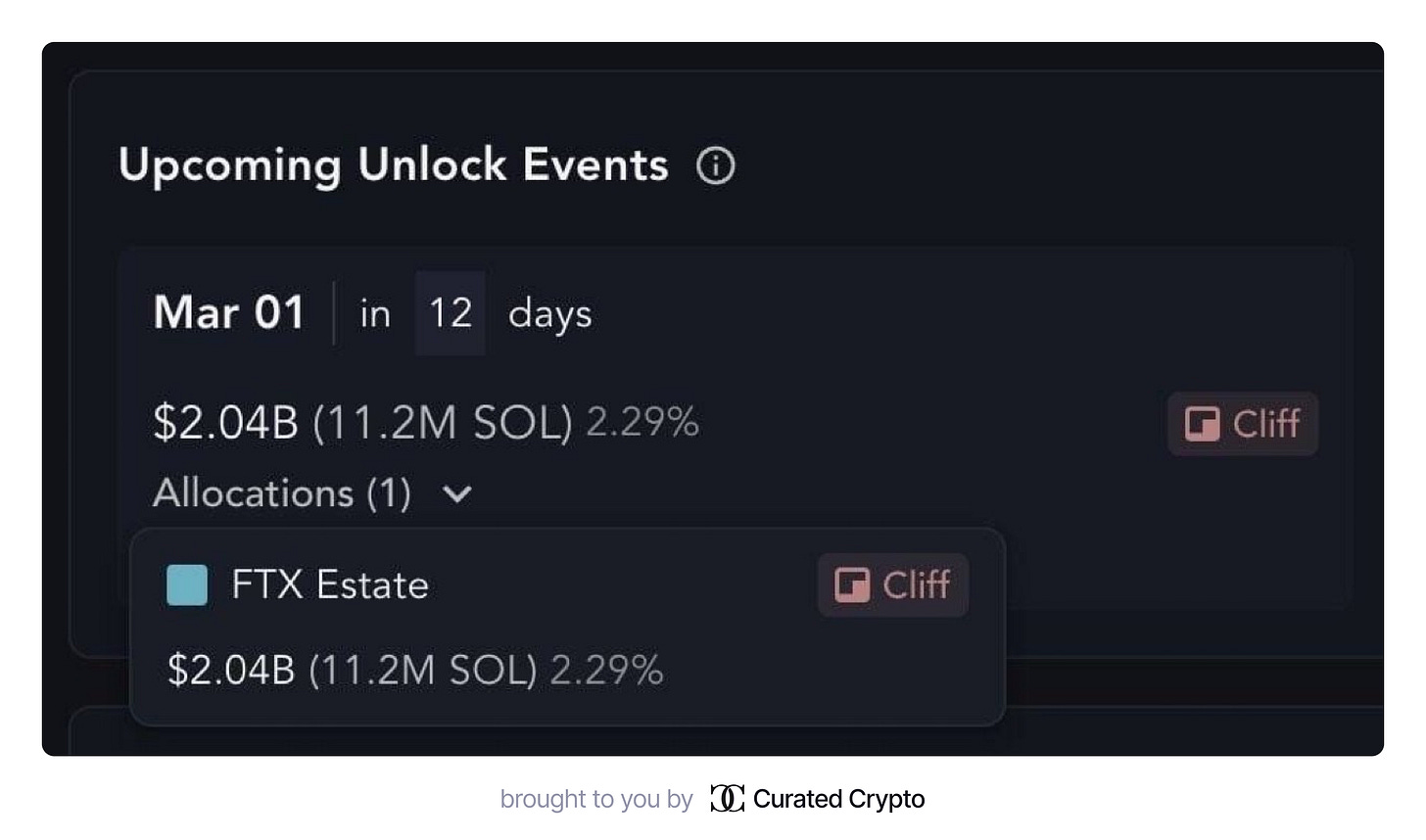

To ensure transparency and efficiency, FTX is collaborating with crypto platforms BitGo and Kraken. Additionally, on March 1, $2.06 billion worth of SOL tokens will be unlocked, which could impact the crypto market.

Cryptocurrency exchange Bybit has fully replenished the $1.4 billion in Ether (ETH) lost during a hack attributed to North Korea's Lazarus group. CEO Ben Zhou announced that all client assets are now backed 1:1, with a new audited proof-of-reserve report to be published soon.

According to Lookonchain, Bybit acquired 446,870 ETH (approximately $1.23 billion) through loans, whale deposits, and purchases. Of this, 157,660 ETH (around $437.8 million) were obtained from investment firms Galaxy Digital, FalconX, and Wintermute via over-the-counter deals. The remaining $304 million in ETH was purchased through centralized and decentralized exchanges.

CryptoQuant analysts highlight a bullish divergence for Ethereum: despite a price decline, taker buying volume is increasing, which has historically signaled the end of bearish trends. Additionally, in the last 24 hours, Short-Term Holders (STH) have realized significant losses, likely panic-selling BTC in response to the recent Bybit hack news. However, such capitulation events have often preceded local bottoms in the short term.

Be sure to check out the profile on Lazarus

What’s Lurking Behind Crypto’s Next Leap?

From February 17 to 23, 2025, digital asset investment products experienced outflows totaling $508 million, bringing the two-week total to $924 million following an 18-week period with a total of $29 billion. Investors are exercising caution amid uncertainties surrounding the U.S. presidential inauguration and potential changes in trade tariffs, inflation, and monetary policy. Trading volume has decreased from $22 billion two weeks ago to $13 billion last week.

The primary outflows were from the U.S., with $560 million recorded. In contrast, Europe is seeing positive trends: Germany and Switzerland attracted $30.5 million and $15.8 million, respectively. Bitcoin was the main focus of outflows, totaling $571 million, with some investors increasing short positions, leading to an inflow of $2.8 million into short Bitcoin products. Interest in altcoins remains: XRP attracted $38.3 million, Solana — $8.9 million, Ethereum — $3.7 million, and Sui — $1.47 million.

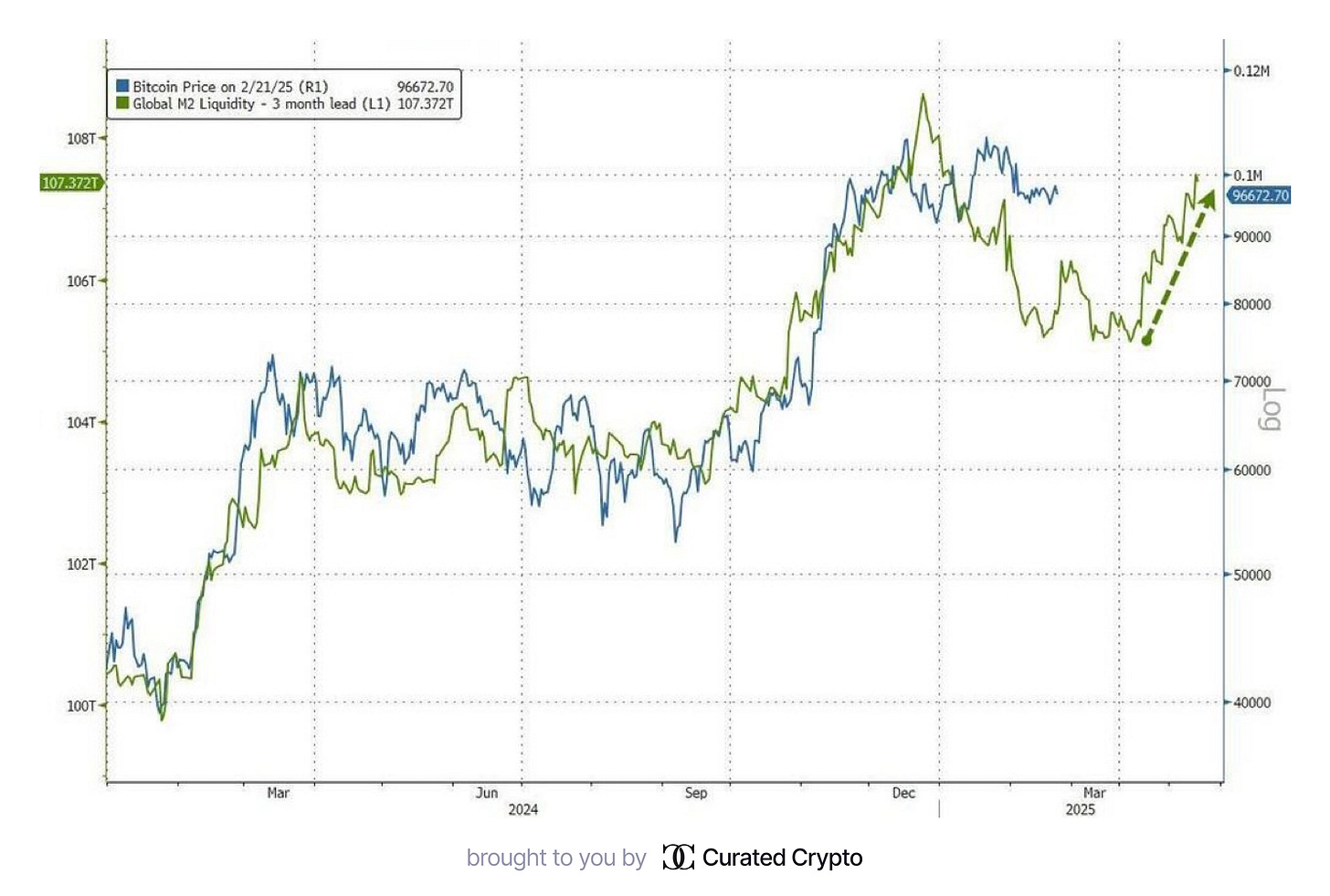

The dynamics of global M2 liquidity continue to show signs of acceleration, historically being bullish for BTC, cryptocurrencies, and other risk assets. Back in December 2024, we noted in the article "New ATHs, AI, and Robots" that the current pattern may mirror 2016-2018. However, based on global liquidity analysis, there could be further downside for Bitcoin before the next growth phase, signaling the potential end of the short-term bearish trend.

The Future of Crypto-ETFs in 2025

Canary Capital has filed for a spot Litecoin ETF, now added to the DTCC website, signaling growing interest in crypto ETFs and creating potential opportunities for investors in 2025.

Eric Balchunas from Bloomberg ETF predicted that Litecoin and Dogecoin have the highest chances of approval — 90% and 75% respectively. Meanwhile, Solana and XRP have approval chances of 70% and 65%.

Litecoin's popularity is confirmed by the rising open interest in LTC futures, which has reached a four-year high, adding confidence to the continuation of a bullish trend.

A New Perspective on Altseason: Crypto Investors Focus on Fundamentals

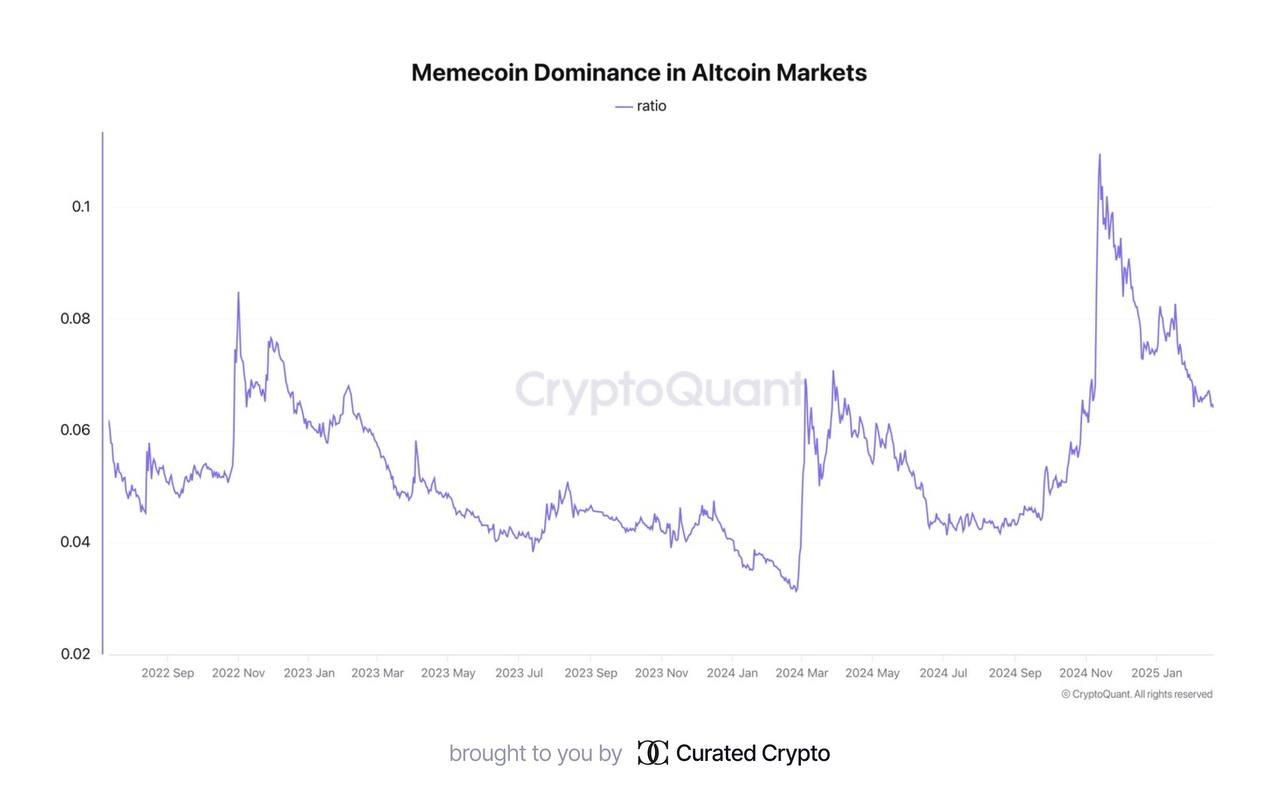

CryptoQuant's CEO has introduced a new take on the altseason, claiming the traditional cycle where all altcoins rise together is outdated. Instead, he predicts that in the future, only those altcoins with strong fundamentals will see growth. This shift will create new opportunities for investors who can differentiate between promising projects and those with weaker foundations.

In recent months, memecoin dominance has sharply decreased in the crypto market. This shift reflects the growing interest in altcoins with stronger economic fundamentals and better technological backing.

This trend could form the basis for a more stable crypto market moving forward. By shifting focus from memecoins to altcoins with better fundamentals, investors are not only positioning themselves for potentially higher returns but also contributing to the strengthening of the market, improving its resilience. This will create more favorable conditions for the continued growth and development of cryptocurrency assets.

Argentine President Javier Milei has strongly denied any wrongdoing in his first public response to the crypto scandal. He insists that there were no violations and that the situation is simply a misunderstanding. This incident has garnered attention from both local and international analysts, with questions regarding cryptocurrency regulation remaining a key issue in the country's political agenda.

More about this can be found in our previous article “CZ, Unichain, and Presidential Memecoins”.

Crypto Passive Income: Weekly Yield Insights

Stablecoins Are Reaching the Next Level

The stablecoin market is undergoing significant changes. Figure Markets, founded by Mike Cagney, has received SECapproval to launch YLDS, a US dollar-pegged stablecoin designed for lending and payments. This regulatory milestone highlights the growing acceptance of stablecoins in traditional finance and paves the way for their deeper integration into financial systems.

Meanwhile, Tether co-founder William Quigley is developing a new yield-bearing stablecoin that will offer interest rates to holders. This could intensify competition in the sector, shifting the perception of stablecoins and attracting investors looking for passive income in the crypto industry. Both developments mark the evolution of stablecoins from simple digital dollars to advanced financial instruments with new functionalities and regulatory support.

Institutional Adoption of Crypto ETFs Gains Momentum

Franklin Templeton has introduced a new crypto ETF covering Bitcoin and Ethereum, highlighting the increasing presence of traditional financial firms in the crypto space. This product aims to provide investors with balanced exposure to the two largest digital assets, reflecting the rising demand for diversified investment options.

Meanwhile, the SEC has acknowledged 21Shares’ proposal to allow staking on an Ethereum ETF. If approved, this move could enable yield generation on ETH through regulated investment products, potentially attracting more institutional investors. Both developments signal a growing institutional interest in crypto assets and the evolution of more sophisticated financial instruments in the sector.

Yield in Crypto Expands Beyond Traditional Assets

Yield opportunities in DeFi are no longer limited to ETH or USDT. Multipli.fi, the winner of KaitoAI Yapper Leaderboard, offers:

Up to 24% APR on xUSDT and xUSDC, even in the current market.

Native asset holders will soon be able to earn 20-30% annually.

How is this possible?

Liquidity is hedged against impermanent loss on DEXs.

Trading fees flow back to users as yield.

The model’s sustainability is proven by:

$50M TVL accumulated in just a few days.

Strong investor interest.

Decentralized finance is on the brink of fundamental changes.

New Yield Opportunities on Gasp

The Gasp platform offers incredible yield opportunities on cryptocurrency assets:

$USDC / $ANON: 330% APY — high rates make this pair attractive for users seeking maximum returns.

$USDT / $USD₮0: 194% APY — solid yield on stable assets, continuing to draw investors seeking steady returns.

$USDT / $ETH: 129% APY — a pair with strong growth potential, ideal for those willing to take on a moderate level of risk.

$USDT / $USDC: 91% APY — a more stable pair with steady returns in a volatile market.

The Gasp platform offers new opportunities for users wishing to earn yield on their cryptocurrencies, providing returns on both stable and riskier assets.

Airdrop Farming Made Simple: Increase Your Profits

Kaito launches token airdrop for 'Yappers' community on Base platform

InfoFi network Kaito has announced the commencement of its native token airdrop.

Platform: Base.

Upcoming listing: The token will be available on centralized exchanges, including Binance, Coinbase, and OKX.

Initial distribution: 10% of tokens are allocated to:

Early Kaito Yapper community members.

Genesis NFT holders.

Ecosystem partners and participants.

MONAD Ecosystem Expansion: Airdrops & Key Projects

The MONAD ecosystem is rapidly growing, offering 10+ airdrop campaigns and unique decentralized applications. Users can earn tokens by engaging with various platforms, including GameFi, DeFi, and social networks.

Top 5 Projects in MONAD Ecosystem:

Fantasy Top – GameFi Platform

Visit: monad.fantasy.top

Connect wallet → Claim XP

Join leagues → Win $fMON, Fragments, and XP

Kizzy – Social Betting App

Visit: kizzy.io/home

Create an account → Place bets on creators → Earn "KESO"

Nad.fun – Meme Coin Creation

Visit: testnet.nad.fun

Connect wallet → Create a meme coin using $MON faucet

Claim points in the reward section

Kuru – Trading Platform

Visit: kuru.io

Create a wallet on Kuru → Deposit $MON → Start trading

Curvance – DeFi Platform ($3.6M in Funding)

Visit: monad.curvance.com

Connect wallet → Claim faucet tokens

Deposits, lending, staking $CVE → Earn "Bytes"

More projects and details available in the original thread: X

The Next Big RWA Airdrop: Monad Testnet

Multipli: A New Era of Yield

Multipli (which has already been talked about a bit in the past section) democratizes yield on native and tokenized real-world assets (RWA), allowing users to earn on any asset. The private mainnet is already live, offering early access to users.

Partners: Binance, OKX, Hyperliquid & more

Backers: Pantera, Sequoia, Spartan & others

Multipli’s Points Program – Season 1 is Live!

Two ways to qualify for the airdrop:

Free method (Monad Testnet)

Deposit stablecoins on BSC or Ethereum

1. Free Method (Monad Testnet)

Go to: testnet.multipli.fi

Connect your EVM wallet (e.g., MetaMask)

Click "Initiate" → Verify Message → Enable

Switch to Monad Testnet

Claim 100 USDC from the faucet

After that, the dApp will show a pop-up to claim an additional 50 USDC. Claim it.

Now you have a total of 150 USDC. Stake all of it, and you’ll start earning tORBs (points), which qualify you for the airdrop.

2. Deposit Stablecoins (Higher Rewards)

Go to: app.multipli.fi

Connect your EVM wallet (e.g., MetaMask)

Click "Initiate" → Verify Message → Enable

Select a chain: BSC or Ethereum mainnet

Deposit USDC or USDT to receive xUSDC or xUSDT

Once you receive xUSDC or xUSDT, you’ll start earning Orbs (points), qualifying you for the airdrop.

You can swap xUSDC or xUSDT back to USDC or USDT anytime, but withdrawals take 7 days—so plan accordingly.

Full guide: earn3.app/airdrop/how-to-qualify-for-multipli-airdrop

Be sure to check out this article “The Evolution of Airdrops: From Simple Token Distributions to Complex Community Building”

Mastering TGE: Key Token Offerings

Major Upcoming Events in February-March

February and March are packed with major developments in the crypto space. From token sales to groundbreaking network updates, here are the key events to watch:

February 24 – OBOL token sale kicks off on CoinList

February 24 – Ethereum developers launch Petra upgrade on Holesky testnet

February 25 – PARSIQ migrates token from PRQ to REACT and launches Reactive Network mainnet

February 25 – $AWS token public sale on Polkastarter

February 27 – Sonic: Mobius mainnet release

February – Kernel DAO - Token Generation Event (TGE) expected

February – Simon’s Cat publicly launches its platform

March 1 – Humans.ai launches Human v1 public version

March 2 – IOST - launches its V3 shifting to become BNB Chain's L2

March 3 – Onyx launches Goliath mainnet

March 3 – Hatom Labs - $USH stablecoin rolls out on MultiversX mainnet

These milestones could have a significant impact on the market, creating new investment opportunities. Stay updated to catch the most promising projects!

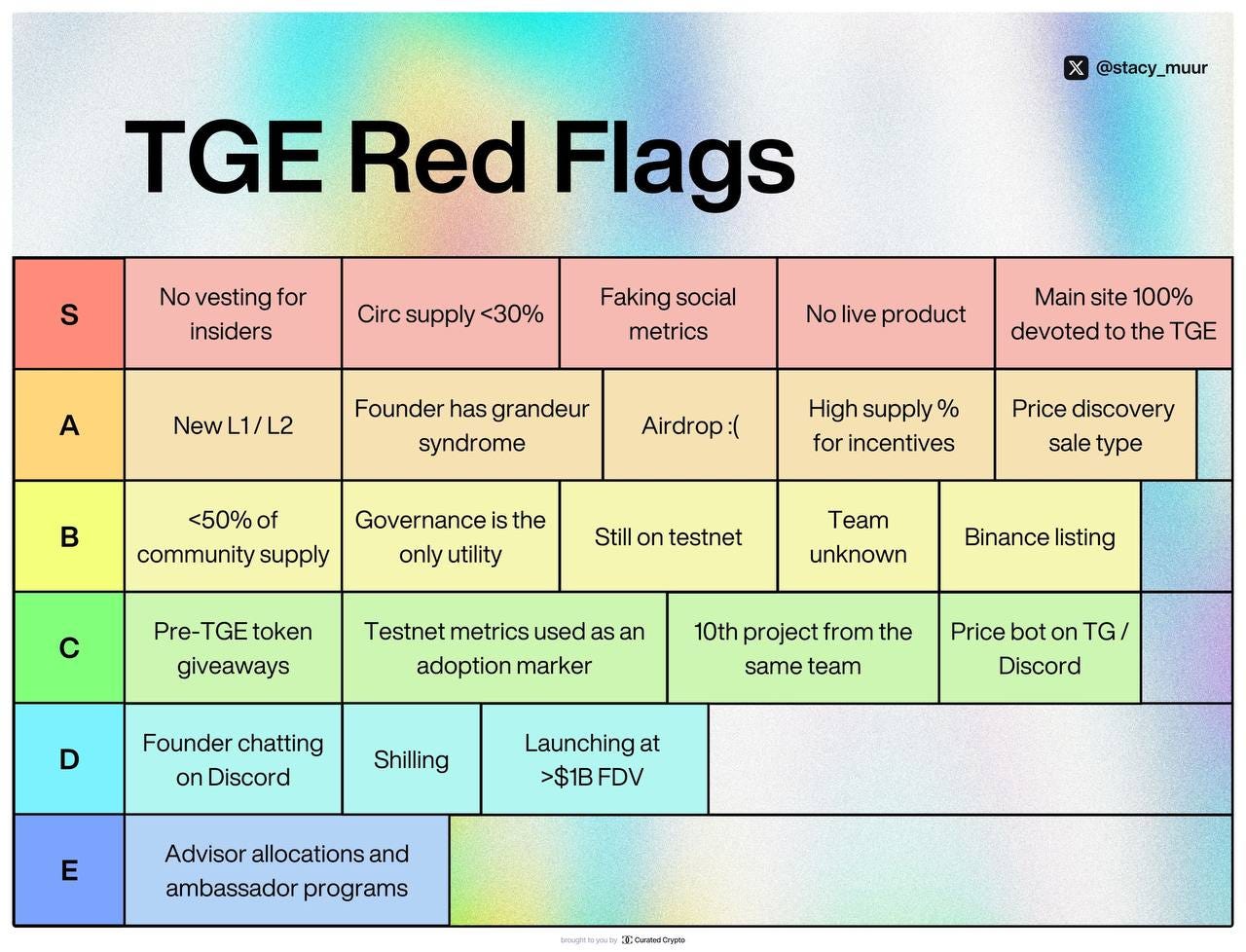

TGE Red Flags

Write in the comments whether you agree with this opinion or not.

Trends and Events Defining the Market

Crypto Watchlist for the Week

The upcoming week is packed with significant crypto events, including major unlocks, token launches, and ecosystem updates. Here’s what to watch:

Next Week: AAVE Goes Live on Sonic L1

AAVE, one of the largest DeFi platforms, is expected to launch on Sonic L1, expanding lending and borrowing opportunities within the network.

February 26: Nvidia Earnings Call – Impact on AI Tokens

Nvidia’s upcoming earnings report could have a significant impact on AI-related tokens like FET, AGIX, and OCEAN. Positive AI-related revenue growth could drive increased interest in these assets.

February 25: Stacks ($STX) Increasing sBTC Deposit Cap

Stacks will raise deposit limits for sBTC, its Bitcoin-backed yield-bearing token. This could drive additional liquidity into the ecosystem.

Next Week: $KAITO Staking Rewards Begin

Kaito is set to start distributing network fees to KAITO stakers, potentially increasing demand and price action.

February 27: ETHDenver Conference Kicks Off

One of the largest Ethereum-focused events, ETHDenver, is expected to bring major announcements from Ethereum L2s, DeFi protocols, and key developers.

These developments could impact market trends, creating both risks and opportunities. Stay informed and watch for key price movements!

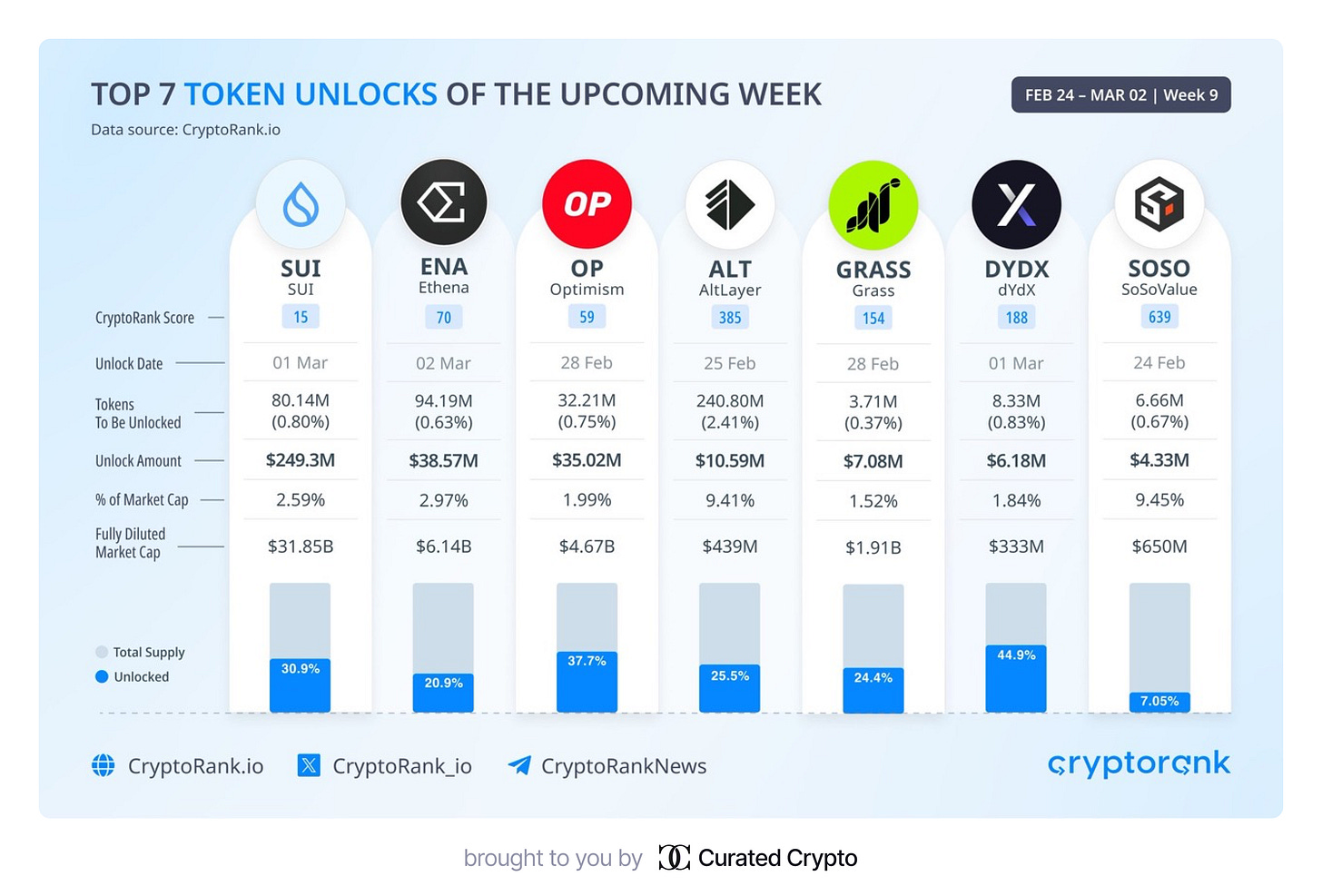

Top 7 Token Unlocks of the Upcoming Week

This week, $630 million worth of tokens will be unlocked, potentially impacting market dynamics. Here’s a detailed breakdown of the largest unlocks:

1. Sui ($SUI) — $249M

Date: March 1

Amount: 64.3M tokens (around 8% of circulating supply)

Details: Sui’s scheduled unlock could put downward pressure on its price, depending on whether recipients sell or hold.

2. Ethena ($ENA) — $38.5M

Date: February 29

Amount: 93M tokens

Details: Ethena’s token supports the USDe synthetic dollar ecosystem, and its staking mechanism may help absorb sell pressure.

3. Optimism ($OP) — $35M

Date: February 29

Amount: 24.16M tokens (about 2.4% of total supply)

Details: Optimism’s gradual token release is ongoing. While it could create selling pressure, it also provides opportunities for new investors.

4. AltLayer ($ALT) — $10.6M

Date: February 29

Amount: 166M tokens

Details: The RaaS (Rollup-as-a-Service) project sees a significant unlock that may trigger short-term volatility.

5. Grass ($GRASS) — $7.08M

Date: February 28

Amount: 13.5M tokens

Details: Grass is focused on on-chain data analysis and is growing its user base, which may support demand.

6. dYdX ($DYDX) — $6.18M

Date: February 29

Amount: 2.5M tokens

Details: The leading decentralized exchange continues its token unlock schedule, with moderate expected impact.

7. Soso ($SOSO) — $4.33M

Date: February 27

Amount: 27.4M tokens

Details: A growing player in the social token sector, with an unlock that may attract investor attention.

What to Expect?

$SUI is the largest unlock of the week, potentially leading to price swings.

High-demand projects like $ENA and $OP may absorb unlock pressure more effectively.

Unlock events often create short-term price drops but can offer buying opportunities.

Stay alert to market reactions and liquidity conditions before making investment decisions!

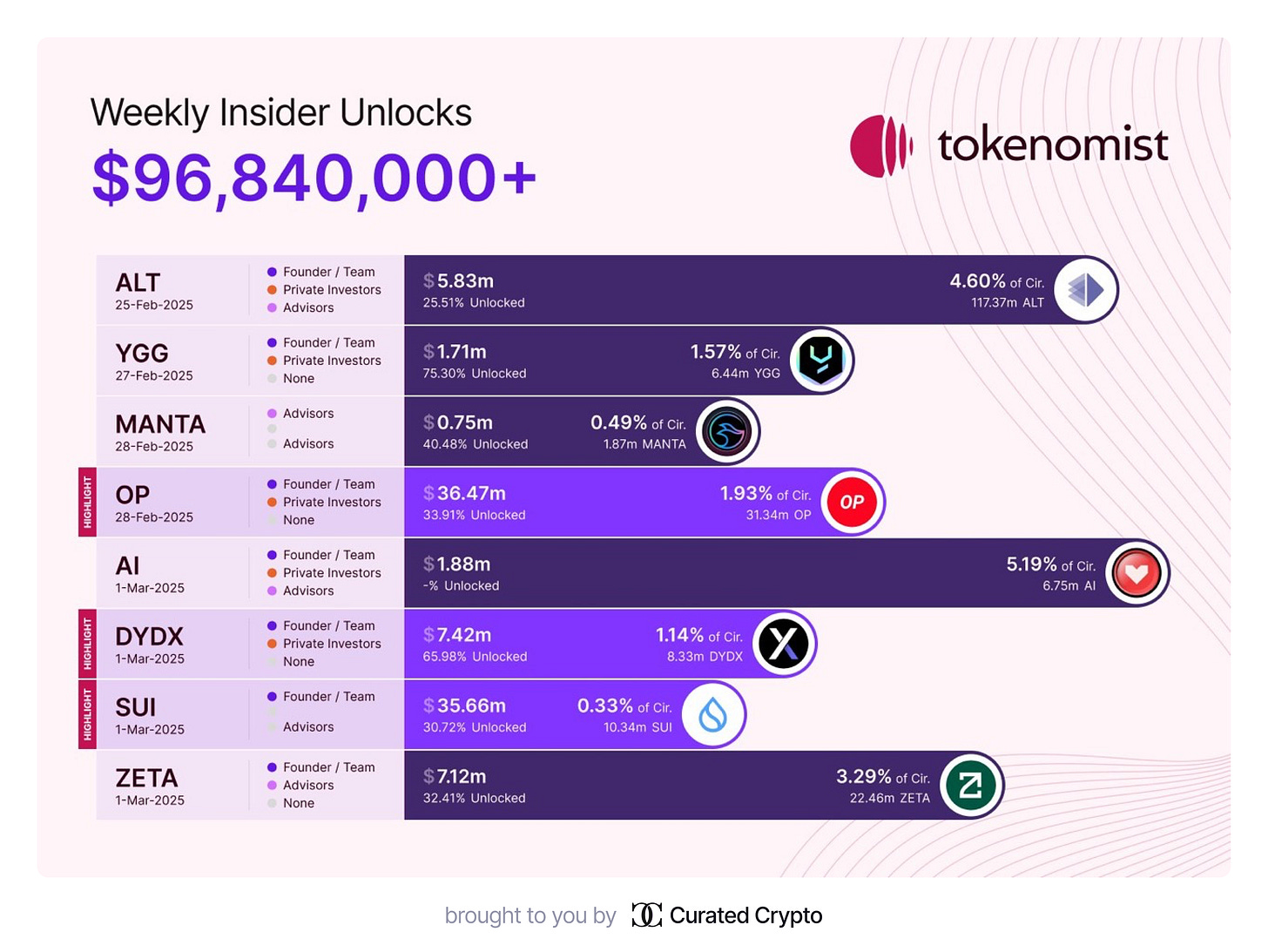

Weekly Insider Unlocks: 24 Feb - 2 Mar '25

In the upcoming week, several major token unlocks will take place, including significant amounts going to insiders such as founders, teams, advisors, and private investors. The total value of these unlocks is $96.84 million, which may impact token prices. Here’s a detailed breakdown:

1. Optimism ($OP)

Date: February 27

Unlock: $36.47M (1.93% of circulating supply)

Participants: Founders, teams, early investors

Details: This unlock could lead to increased selling pressure and market volatility. However, with the network’s growth and partnerships, long-term prospects remain positive.

2. Sui ($SUI)

Date: March 1

Unlock: $35.66M (0.33% of circulating supply)

Participants: Advisors, team, founders

Details: A significant unlock, though the overall supply share is small. The impact on price might be moderate, but it’s an event worth watching.

3. dYdX ($DYDX)

Date: February 28

Unlock: $7.42M (1.14% of circulating supply)

Participants: Team, founder

Details: dYdX’s price impact from this unlock will likely be mild, as it mainly concerns the team and internal assets, with no major effect on the market.

4. AltLayer ($ALT)

Date: March 2

Unlock: $5.83M (4.60% of circulating supply)

Participants: Advisors, investors, team

Details: This unlock is notable due to the large percentage of circulating supply being released. It may cause short-term price fluctuations, but the project’s partnerships help maintain its market credibility.

5. Sleepless AI ($AI)

Date: February 28

Unlock: $1.88M (5.19% of circulating supply)

Participants: Team, investors

Details: Sleepless AI continues its token release. This unlock will mainly affect the team and early investors, with minimal impact on price.

6. Yield Guild Games ($YGG)

Date: February 27

Unlock: $1.71M (1.57% of circulating supply)

Participants: Team, advisors

Details: Yield Guild Games will continue to release tokens, but its impact on price is expected to be modest, as the unlocked tokens will mainly go to the team and partners.

Takeaways:

A total of $96.84M in tokens will be unlocked this week, potentially leading to price fluctuations.

Optimism and Sui are the largest unlocks, and their release could create market volatility.

Unlocks for dYdX, AltLayer, Sleepless AI, and Yield Guild Games will have a more moderate impact.

Pay attention to the market’s reaction, as these unlocks could lead to short-term price movements if insiders decide to sell their tokens.

Protocols in Focus

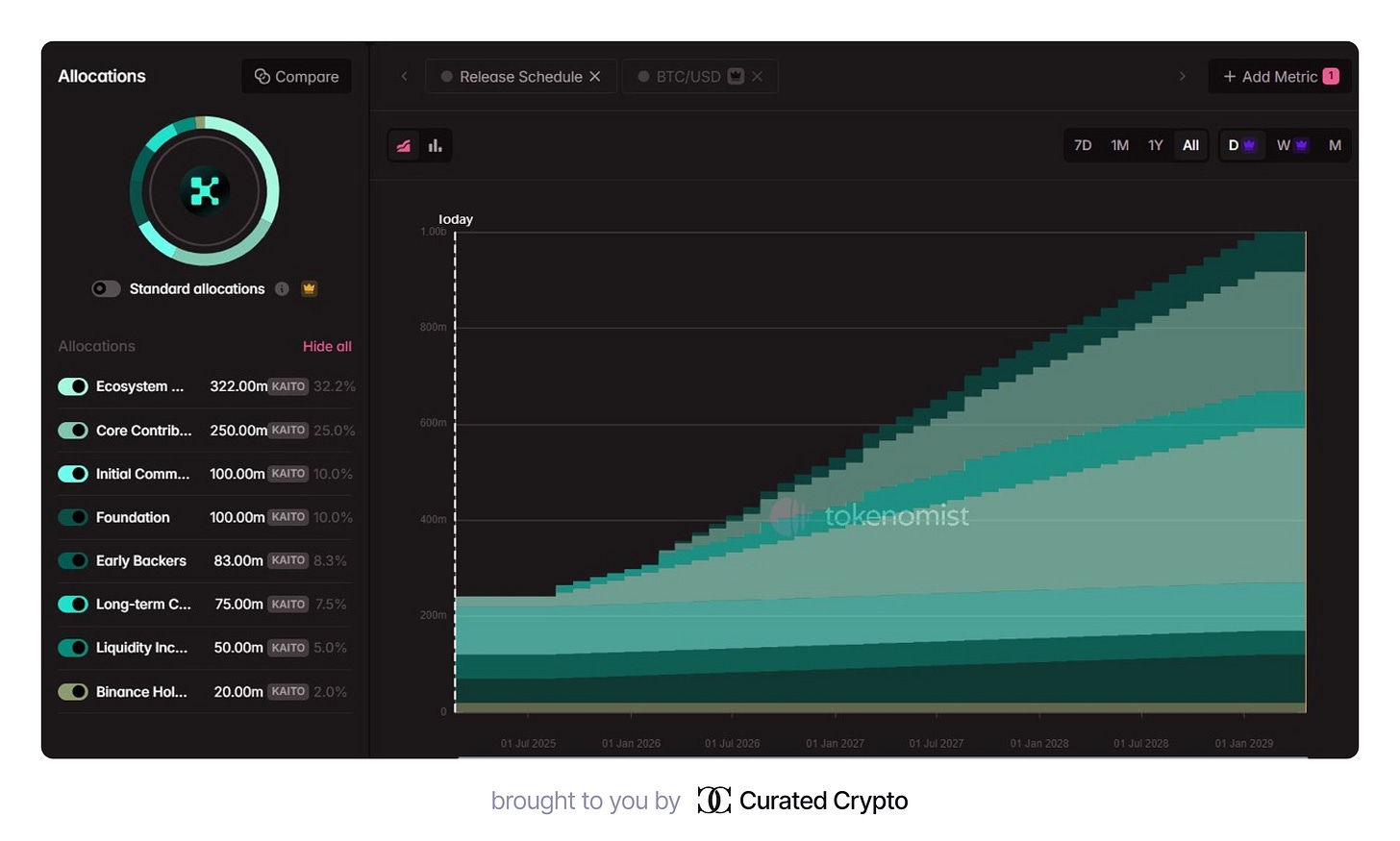

$KAITO: Tokenomics Breakdown, Utility & Allocations Analysis

Key Highlights:

10% initial airdrop

Token distribution includes YAPs, NFTs, and ecosystem contributors/partners

No significant emissions for the next 6 - 12 months

What is Kaito?

Kaito is an AI-powered research platform that aims to streamline cryptocurrency and financial data aggregation. It uses AI technology to collect and analyze insights from a variety of sources, offering fast and efficient research for traders, investors, and institutions.

Token Utility

Network Currency – Used for transactions and payments within the Kaito platform.

Community Governance – Enables holders to vote on key decisions and platform updates.

Staking & Rewards – Stake $KAITO to earn rewards and unlock various platform benefits.

AI Tool Access – Access premium AI research tools by using the token.

Ecosystem Incentives – Tokens used to reward ecosystem contributors, developers, and partners.

Tokenomics Breakdown

Core Contributors: 25%

Ecosystem & Network Growth: 32.2%

Binance Hodler: 2%

Initial Community & Ecosystem Claim: 10%

Long-Term Creator Incentives: 7.5%

Liquidity Incentives: 5%

Early Backers: 8.3%

Foundation: 10%

Tokenomics Highlights:

Zero Dilution Until August

$75-100M allocated for future YAP/Creators incentives

1 year cliff for teams and investors

The tokenomics structure presents a bullish outlook for the next 6-12 months, as there are no insider unlock events during this time. However, previous projects with heavy airdrops and no vesting mechanisms often saw aggressive sell-offs on Day 1. Despite this, @KaitoAI is taking the long-term approach, with a working product and profitability already achieved—indicators of long-term sustainability.

For more detailed information, check out the original thread:

Read more here

Hyperliquid Launches HyperEVM on Mainnet

Hyperliquid has launched HyperEVM on the mainnet, enabling general-purpose programmability for decentralized applications. This upgrade enhances performance and flexibility for all users on the platform.

Key Features of HyperEVM:

General-purpose computation support for programs.

Enhanced speed and reduced transaction costs.

Improved compatibility for running smart contracts.

Updates in HyperEVM’s Borrowing and Lending Landscape

HyperEVM will launch with a variety of lending and borrowing protocols, including Felix, Hypurrfi, Sentiment, Hyperyield, Hyperlend, KeikoFinance, Hyperstable, Hyperdrive, and Kibl.Felix: CDP model with user-set interest rates for feUSD minting.

HypurrFi: A CDP model similar to Aave GHO with isolated markets.

Sentiment: Isolated pools for riskier collateral assets.

Hyperyield: Zerolend fork for HyperEVM.

Hyperlend: Aave v3 fork with core and isolated markets.

Keiko Finance: CDP model with dynamic interest rates.

Hyperstable: USDH launch with adaptive interest rates.

Hyperdrive: Segmented lending markets with tokenized HLP market and liquid staking.

Kibl: Information is limited at the moment.

Liquid Staking Protocols on HyperEVM

Main liquid staking tokens (LSTs) for HYPE:Kinetiq (kHYPE): StakeHub validator selection system.

Thunderhead (stHYPE): Independent frontend for stHYPE delegations.

Additional LSTs are expected from other teams in the future.

Automated Market Makers (AMM)

Three major AMMs running on HyperEVM:Curve: Curve instance with stableswap mechanism.

HyperSwap: UniV2 and UniV3 models for liquidity concentration.

KittenSwap: Fork of Velodrome v1 with incentive mechanisms. All AMMs will provide incentives on the mainnet, and liquidity choice will depend on available aggregators.

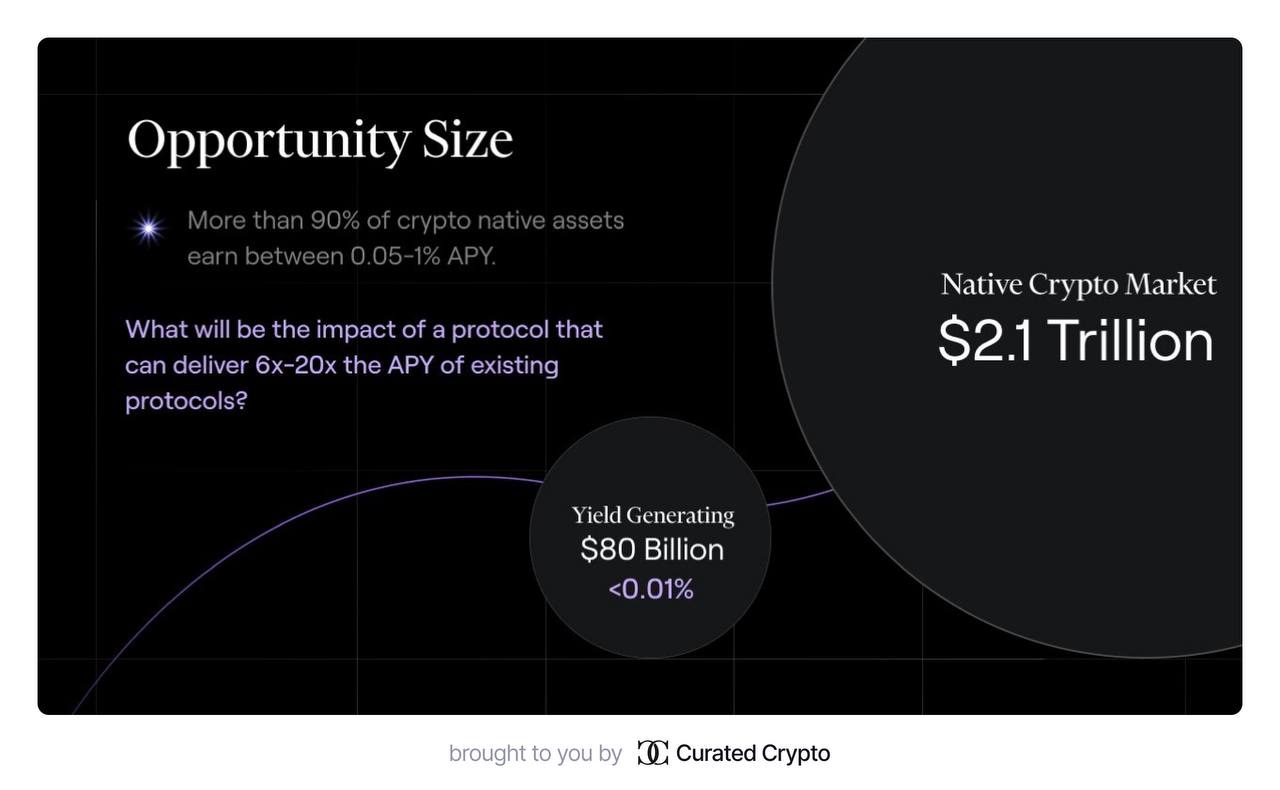

DeFi Landscape Overview

The current Total Value Locked (TVL) stands at $232 billion, remaining within a ±20% range for almost a year, indicating stability in the DeFi sector.

Growth Potential for TVL

Further increases in TVL could be driven by the Real-World Asset (RWA) sector if crypto regulations become clearer and more favorable. As regulatory clarity improves, institutional investors may be more inclined to enter the market, and new RWA-based products could drive additional growth.

Key VC Rounds of the Week

The Biggest Fundraising Rounds in the Last 7 Days

Over the past week, several projects secured significant funding, reflecting the growing interest in Web3 and blockchain startups. Here are some of the largest rounds:

$50M - Blockaid

Blockaid is a Web3 security startup tackling cybercrime and crypto fraud. This project received the largest funding, highlighting the critical importance of security in the cryptocurrency ecosystem.$20M - Cygnus

Cygnus is a modular real yield layer and the first Web3 Instagram App Layer. The platform allows users to create and use Web3 apps while generating real yields, creating a new interaction layer for users.$20M - Kinto

Kinto is an Ethereum L2 network with built-in compliance mechanisms. This project focuses on improving Ethereum's scalability while ensuring compliance with regulations, a key aspect for the industry's growth.$11M - Altius

Altius is a framework builder for modular, high-performance, VM-agnostic systems. The platform enables the creation of more flexible and scalable solutions for decentralized applications.$9M - Universal

Universal is a cross-chain wrapped asset protocol. This protocol aims to improve the interaction between blockchain networks, offering a more flexible and secure way to use assets across different chains.$8M - Fluent

Fluent is an Ethereum L2 that integrates Wasm, EVM, and SVM apps into one network. The project is focused on creating a universal environment for different types of applications, expanding Ethereum's capabilities.$6.5M - Primus

Primus is a privacy-focused encryption layer protocol. The platform is designed to protect user data, which is a crucial aspect of security in blockchain applications.$4M - Acre

Acre is a liquidity layer for Bitcoin scaling. The project aims to address Bitcoin's scalability issues, which could increase its adoption in various sectors.$3M - MANSA

MANSA is a cross-border payment services platform. This solution improves cross-border transactions, which is a key factor for financial applications.$3M - Maestro

Maestro is a multi-product ecosystem of cryptocurrency bots on Telegram. The platform offers solutions for automating trading and managing crypto assets through the popular messaging app.

These projects showcase the diversity of Web3 and blockchain, focusing on security, scalability, and integration with existing financial systems.

Latest DePIN Funding Rounds

Recently, several projects in the Decentralized Physical Infrastructure Networks (DePIN) space have secured significant funding, reflecting growing interest in this area. Here are the largest funding rounds:

$13.5M - Beamable

Beamable is a platform that helps create and monetize gaming and digital assets using blockchain technologies. The raised funds will allow the project to expand its developer offerings and enhance system functionality.$10M - Privasea AI

Privasea.ai is an AI startup specializing in improving data security and privacy within decentralized networks. The funding will help the project develop technologies aimed at strengthening user protection.$8M - NodeGo

NodeGoAI is a company creating solutions for automating and optimizing data processing using artificial intelligence. These funds will help the project enhance its AI offerings and further integrate with blockchain networks.$6M - BitRobot

BitRobot is created to meaningfully advance Embodied AI research using crypto incentives.Built as a network of subnets, each subnet contributes valuable outputs, from compute resources to real-world robot fleets, to datasets (real-world or synthetic), to Embodied AI models, across a wide variety of robotic tasks and robotic embodiments, from sidewalk robots to humanoids.

$5.6M - Wingbits

Wingbits is a startup focusing on creating blockchain solutions for the Internet of Things (IoT). The funding will help advance innovative technologies in the DePIN space.

These projects highlight the growing interest and investment in the DePIN sector, which continues to attract attention from both developers and investors looking for innovative solutions for decentralized ecosystems.

Decrypting Market Trends: A Look at Long-Term Crypto Effects

Shifting Regulatory Landscape: SEC Eases Pressure on Crypto Industry

The U.S. Securities and Exchange Commission (SEC) appears to be shifting its stance on crypto regulation, dropping investigations and lawsuits against major industry players. This could mark a turning point for the legal status of cryptocurrencies in the U.S.

Key Developments:

Coinbase – The SEC is reportedly considering withdrawing its lawsuit against the exchange, a crucial moment for the broader regulatory environment.

Robinhood – The regulator closed its investigation into Robinhood’s crypto division without taking any action.

OpenSea – The probe into the NFT marketplace ended shortly after it confirmed an upcoming SEA token airdrop.

Binance – The SEC has ceased its enforcement action against the exchange, signaling a broader shift in regulatory pressure.

These moves suggest that the SEC may be adopting a more lenient approach toward the crypto sector, potentially paving the way for clearer regulations and market stability.

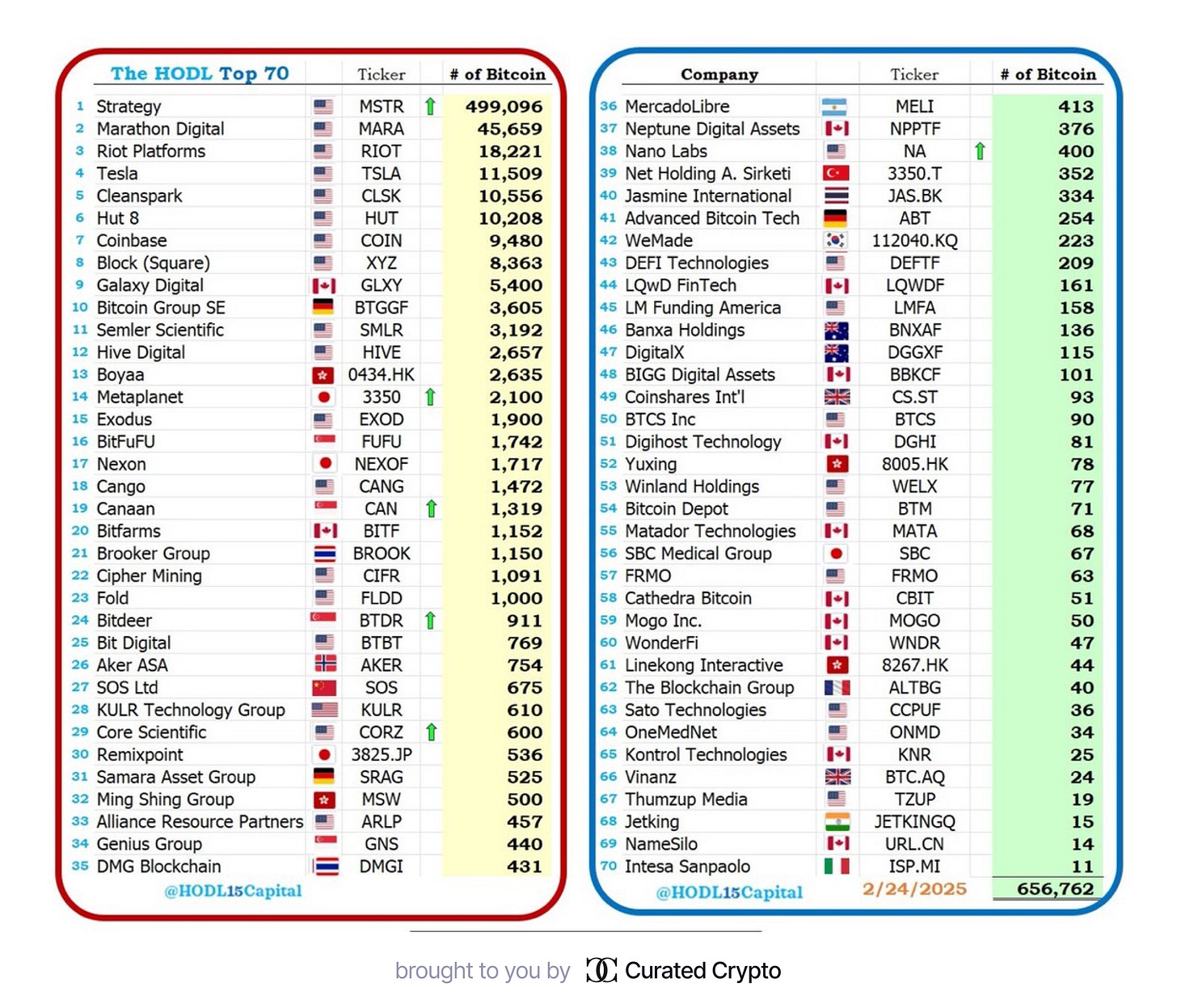

Michael Saylor's Bitcoin Strategy Inspires Corporate Adoption

Michael Saylor, co-founder of MicroStrategy, has significantly influenced corporate investment strategies by allocating substantial company funds to Bitcoin. Since 2020, MicroStrategy has invested approximately $27.9 billion to acquire 446,400 bitcoins, representing about 2% of the total supply. This bold move has led to a twentyfold increase in the company's share price and its inclusion in the Nasdaq 100 index.

Inspired by MicroStrategy's success, 78 public companies worldwide have adopted similar strategies, integrating Bitcoin into their corporate treasuries. Notable examples include KULR Technology, Semler Scientific, and Metaplanet, all of which have seen significant stock price appreciation following their Bitcoin investments. This trend has been facilitated by changes in U.S. accounting rules, allowing companies to report Bitcoin holdings at fair market value.

However, this approach is not without risks. The inherent volatility of Bitcoin can lead to substantial financial exposure. Critics argue that such strategies may prioritize short-term stock gains over long-term business fundamentals, potentially jeopardizing the company's core operations.

Hong Kong Explores New Token Listings, Derivatives, and Staking Amid Growing Global Competition

Hong Kong is actively working to bolster its position as a leading crypto hub by exploring new avenues for token listings, derivatives, and staking. With the increasing global competition in the crypto market, Hong Kong aims to attract more crypto businesses by providing a clear regulatory framework that promotes innovation while ensuring investor protection.

The city's Securities and Futures Commission (SFC) is in the process of drafting new rules that would allow crypto exchanges to list a wider range of tokens and offer new derivative products, such as Bitcoin and Ethereum futures. This move is intended to enhance the trading experience and diversify the offerings available to investors.

Additionally, the SFC is considering the inclusion of staking services as part of the regulatory framework. These services would enable users to participate in blockchain networks by holding and staking their tokens to earn rewards. This potential addition is aimed at increasing institutional interest in the region and could lead to greater adoption of Proof of Stake (PoS) networks.

In response to global competition, particularly from markets like Singapore and Dubai, Hong Kong is striving to balance regulation with fostering a thriving crypto ecosystem. This includes creating a more welcoming environmentfor businesses that wish to operate in the region, with an emphasis on transparency, security, and compliance.

Research Spotlight

The Real Ethereum Hasn't Been Tried Yet

The article argues that Ethereum's true potential can only be realized with a cryptonative credit primitive, enabling uncollateralized lending based on future productivity. It introduces 3Jane, a project using on-chain credit scoring and zkTLS to offer trustless credit lines and revolutionize credit markets within the Ethereum ecosystem.

Mastering AMM, Order Books, and Intents

The article explores the evolution of decentralized exchange (DEX) models, highlighting the benefits of integrating automated market makers (AMMs) with order books and intent-based trading. It discusses how this hybrid model can improve liquidity, trade execution, and user experience by combining the flexibility of AMMs with the precision of order books.

How to Use Cryptocurrency for Peer-to-Peer (P2P) Car Rentals

The article explains how cryptocurrency can be used to facilitate peer-to-peer car rental transactions, offering advantages like faster payments and lower fees compared to traditional methods. It also explores the role of smart contracts in ensuring secure and transparent rentals, highlighting the growing trend of integrating blockchain technology into the sharing economy.

Agree

Really enjoying your substack !