This Week in Crypto: Phase 2 of the Bullrun

Welcome to our weekly series, designed to provide you with a realistic view of the market. Featuring highlights essential for everyone — from traders to airdrop hunters.

TL;DR

Market Sentiment: The sentiment is decisively bullish, with liquidity inflows driving the crypto market cap higher. As focus shifts from BTC to more speculative assets, less risk-averse narratives like RWAs and older coins are outperforming higher-risk assets, including memecoins and AI tokens.

Yield Opportunities: While speculation remains a key focus, several new stablecoin opportunities stand out:

Binance’s high-yielding BFUSD stablecoin offering 19.55% APY.

A profitable strategy from Ethena.

The highlight of the week: an impressive 280%+ APR for USDC on Euler.

New Airdrops: Airdrop enthusiasts should look out for Magic Eden, Avalanche9000, a fresh wave of $JUP airdrops, Theoriq, and more.

Upcoming TGEs and Token Sales: Recent token launches include Morpho, Hyperliquid, and Moongate, with Magic Eden’s TGE planned for early December.

Key Developments: It’s a hot season for protocol upgrades and releases:

Stripe is expanding its crypto services to Aptos, strengthening its DeFi ecosystem.

Arbitrum has introduced a $1M AI grant program to support innovation.

Research of the week: Will bitcoin-based stablecoins make a comeback?

The market pulse: Finally a bullish momentum

The cryptocurrency market is in a pivotal phase, marked by significant liquidity inflows, diverse sectoral performance, and shifting investor sentiment. Here's a deep dive into the key trends shaping the market this week.

Liquidity inflows: A golden opportunity for traders

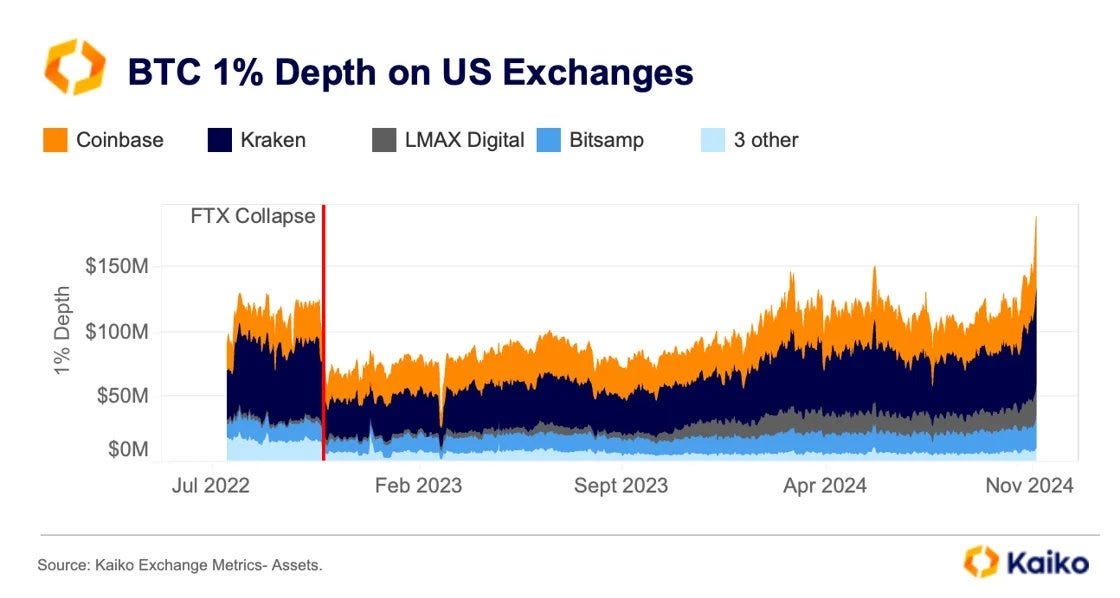

The past week has seen a surge in liquidity on exchanges, making this an ideal time for arbitrage traders and long-term holders looking to realize profits. Data from Kaiko reveals that the gap in market liquidity created by the collapse of FTX has finally been bridged, signaling the end of the prolonged "crypto winter."

Supporting this recovery, stablecoins processed over $750 billion in transaction volume last week, with USDC alone accounting for $338 billion. This immense flow of capital underscores growing confidence and activity in the market. Additionally, on-chain trading volumes surged by 32%, according to Santiment, highlighting renewed enthusiasm among investors.

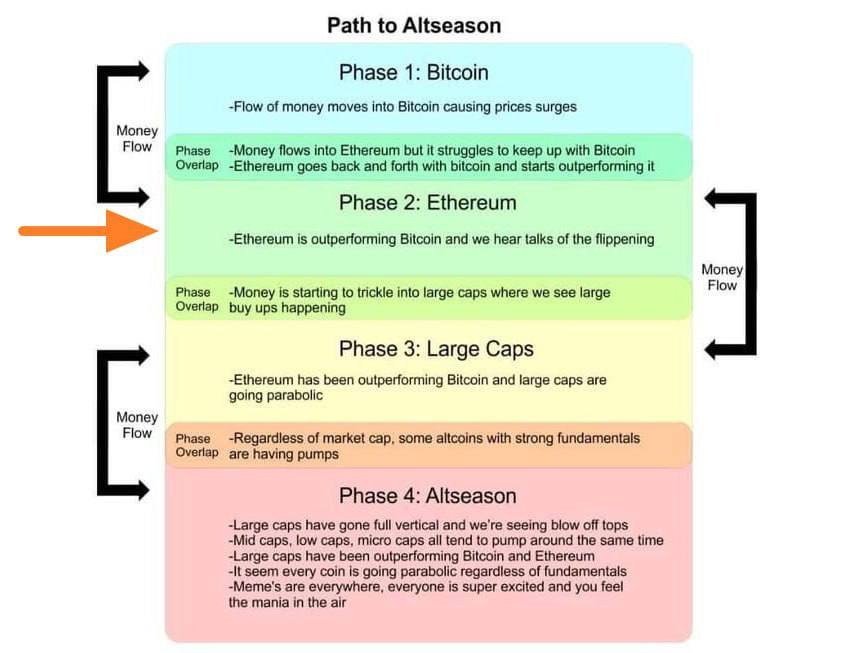

However, the large inflows in BTC-ETF a week earlier were replaced by outflows, while the opposite happened in ETH-ETF. This signals that the market is moving into Phase 2, where Ethereum starts outperforming BTC, paving the way for a wider alt season.

Shifting focus: From BTC to speculative assets

While Bitcoin remains a market cornerstone, profits from its all-time high are gradually redistributing to speculative assets. This movement reflects a more risk-on approach among traders, aiming to capitalize on emerging opportunities.

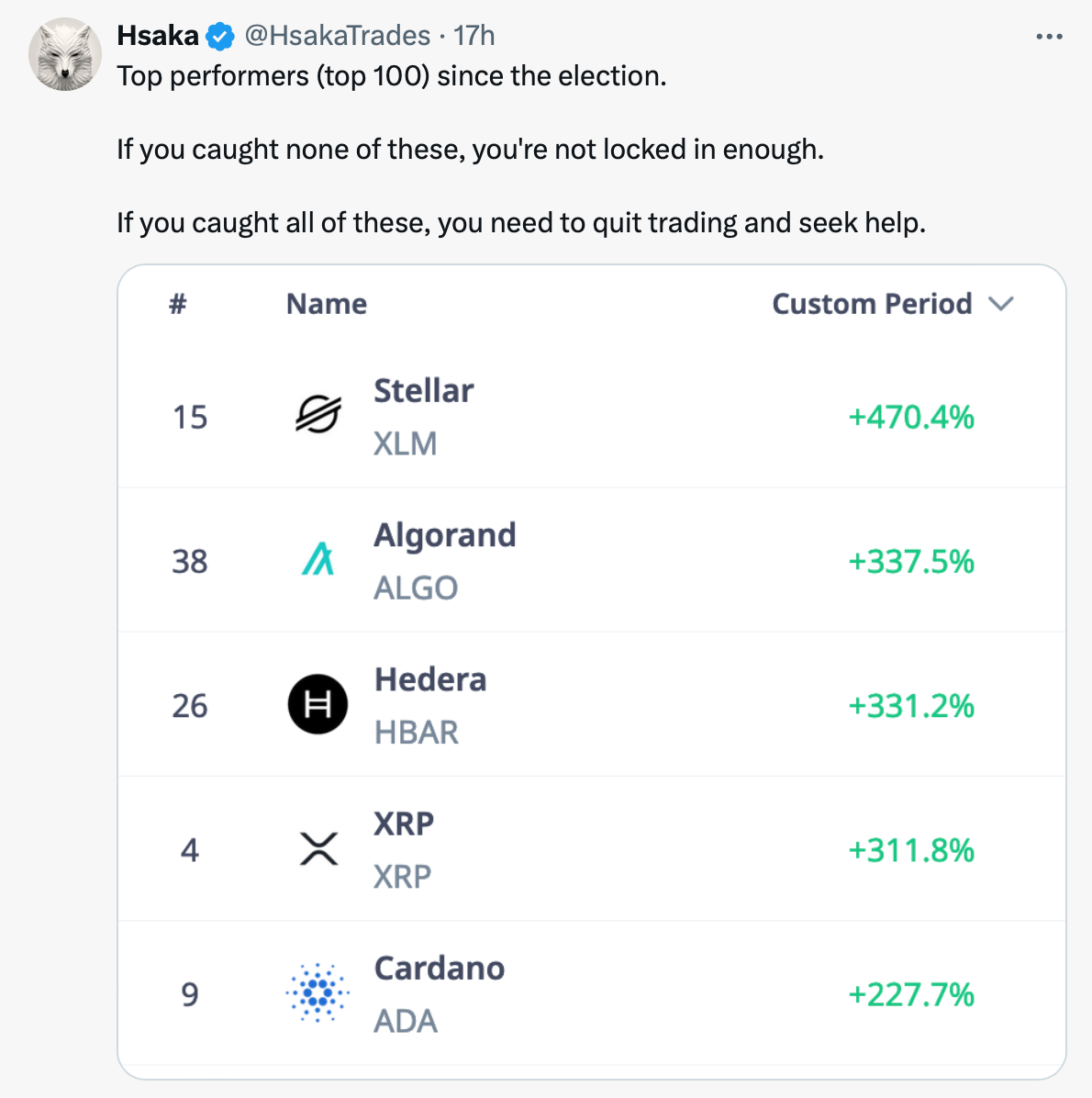

Contrary to popular expectations, it wasn't memecoins leading the charts. Instead, OG assets like $XLM, $ALGO, $HBAR, $XRP, and $ADA have surged the most on the list of top-100 assets by market cap.

Market fatigue and underperforming sectors

Certain sectors, particularly those dominated by extreme speculation, are showing signs of fatigue. Notably, Pump.Fun, a memecoin platform popular among speculative token creators, has banned further streaming due to unethical promotional tactics that escalated from outlandish promises to shocking threats.

This burnout is reflected in market performance, with memecoins, DeSci, and AI tokens ranking as the worst-performing sectors over the past week.

However, it's too early to write off these sectors entirely. DeSci offers potential for utility-driven innovation in the memecoin space, while AI's focus on AI agents could unlock new applications in the near future.

Record-breaking stats

Investor confidence in digital assets remains robust, as evidenced by substantial inflows into the sector:

Weekly inflows hit $3.13 billion, the largest on record, bringing year-to-date inflows to $37 billion.

Total assets under management (AuM) in digital assets reached a historic peak of $138 billion, highlighting the growing institutional and retail interest.

The inflows were concentrated in:

Bitcoin: Dominating with $1.48 billion in inflows, alongside $49 million directed into short Bitcoin products, reflecting a nuanced investor sentiment.

Ethereum: Surged with $646 million in inflows, signaling renewed optimism after a period of subdued performance.

However, outflows totaling $866 million in the latter half of the week—driven by Bitcoin’s all-time highs—indicate profit-taking as a natural response to significant price movements.

Macroeconomic factors, including the US election dividend, played a key role in spurring inflows into digital assets. Between November 10 and 17, an additional $2.2 billion flowed into the sector.

Passive Yield Opportunities: Key Highlights for the Week

Passive yield seekers have plenty to explore this week, with exciting updates across stablecoins, restaking protocols, and new DeFi instruments. Here’s a roundup of noteworthy opportunities and insights to help you make informed decisions.

BFUSD on Binance: A High-Yield Stablecoin

Binance introduced BFUSD, a yield-bearing stablecoin offering an impressive 19.55% APY, which can also serve as collateral in the Binance ecosystem.

Investor Sentiment: The high yield has piqued interest but also drawn skepticism due to echoes of the TerraLUNA collapse. Binance has proactively addressed concerns in this blog post, analyzing the risks and rewards associated with BFUSD.

Key Takeaway: For yield seekers, BFUSD offers significant returns, but its long-term viability and stability merit cautious optimism.

283% APR on USDC via Euler Labs

Incentives for borrowing USDC on Euler Labs have driven its supply rate to 24.55%, with creative strategies allowing users to loop lesser-utilized stables like $wM against it.

Stephen from DeFi Dojo breaks down how this strategy can yield up to 283% APR in his thread.

Key Takeaway: While this opportunity offers eye-popping yields, it requires careful planning and risk management.

Ethena's USDe: Soaring Yields Amid Market Recovery

Ethena’s USDe, a yield-bearing token, grew by $1 billion in a month, reaching $3.44 billion in TVL, driven by rising perpetual funding rates.

The token now offers an annualized yield of 29%, rebounding from a period of underperformance.

Future Outlook: DeFi lenders and exchanges listing USDe as collateral assets, along with governance token revenue distribution plans, could further boost its appeal.

USDC on Coinbase Wallet

Holders of USDC on Coinbase Wallet can now earn 4.7% APY, paid monthly on Coinbase’s Layer 2 network Base. While this yield is more modest compared to other opportunities, its simplicity and lower risk profile make it appealing for conservative investors.

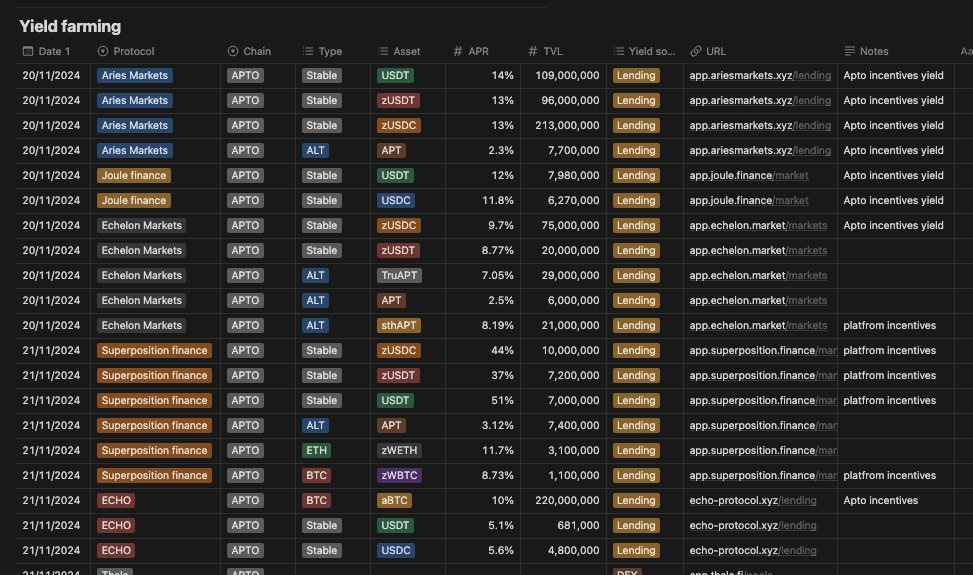

Best yield on Aptos this week

Aptos offers opportunities for attractive yields. Check this thread for more detailed insights on the best yield strategies this week.

Macro Consideration: Inflation’s Impact on Yields

As appealing as these opportunities may seem, it's critical to remember that inflation eats into returns. A thought-provoking thread warns that many assets are inflating rapidly, potentially offsetting yield gains. Passive investors should account for inflation when evaluating opportunities.

It’s never too late for airdrops

For airdrop hunters, we've got good news about several airdrops at once:

Magic Eden traders set to receive $312M worth of ME tokens in airdrop

Solana DEX Jupiter puts $1.5B Worth of JUP airdrops up to vote.

Avalanche9000 goes live on testnet, unlocks $40M rewards for builders.

Also check out this set from DeFi Warhol:

Chainbase: Claim Zircons by linking your socials, completing simple tasks, and chatting with their AI.

Theoriq: Earn XP by completing social interactions, using their AI model, voting, and giving feedback.

Humanity Protocol: Claim daily RWT reward tokens, and reserve your Human ID.

Details and a few more giveaways can be found at this link.

In addition to the fact that FTX plans to start reimbursing users by March 2025 as restructuring wraps up.

Token sales & TGEs

The TGEs dates and listing of the following tokens have become known:

Morpho was listed on Binance Futures on November 27;

Moongate announced TGE on November 28;

Magic Eden announced TGE on December 10;

While the week was relatively quiet on the ICO/IDO front, a standout development is Hyperliquid's readiness for TGE. Hyperliquid, a promising project with strong performance metrics and ambitious plans, is gaining attention for its innovative approach to decentralized finance.

For those interested, detailed insights about Hyperliquid’s TGE are available on Delphi Digital.

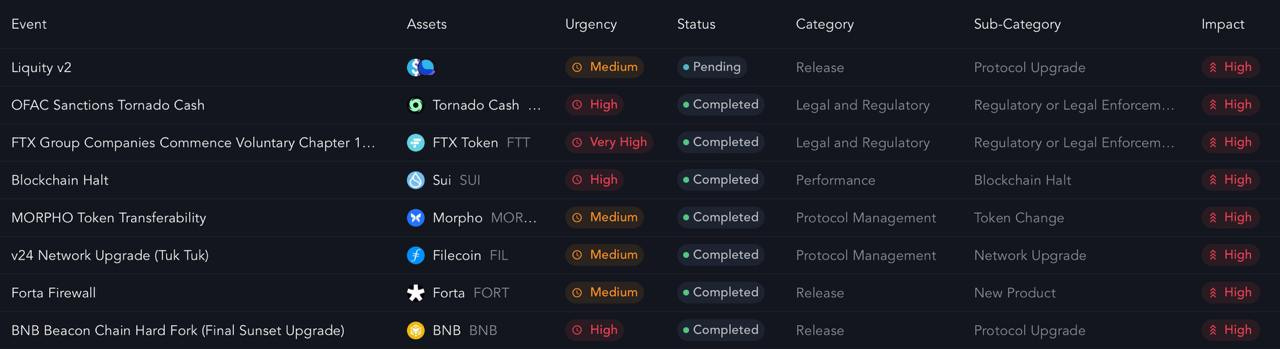

Major events & developments: Watching protocols

The cryptocurrency space continues to witness dynamic changes, with major token unlocks, strategic developments across protocols, and emerging initiatives shaping the market.

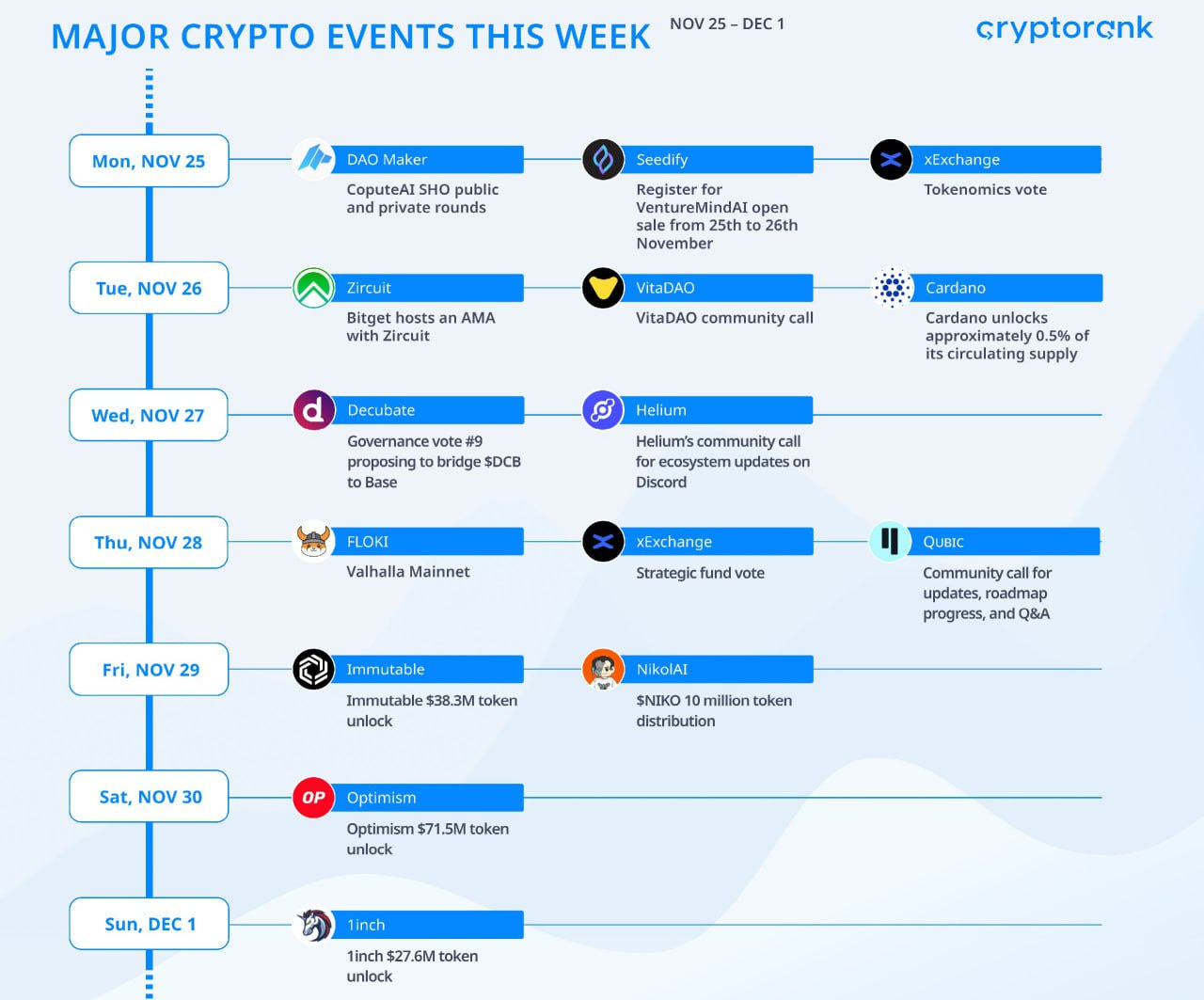

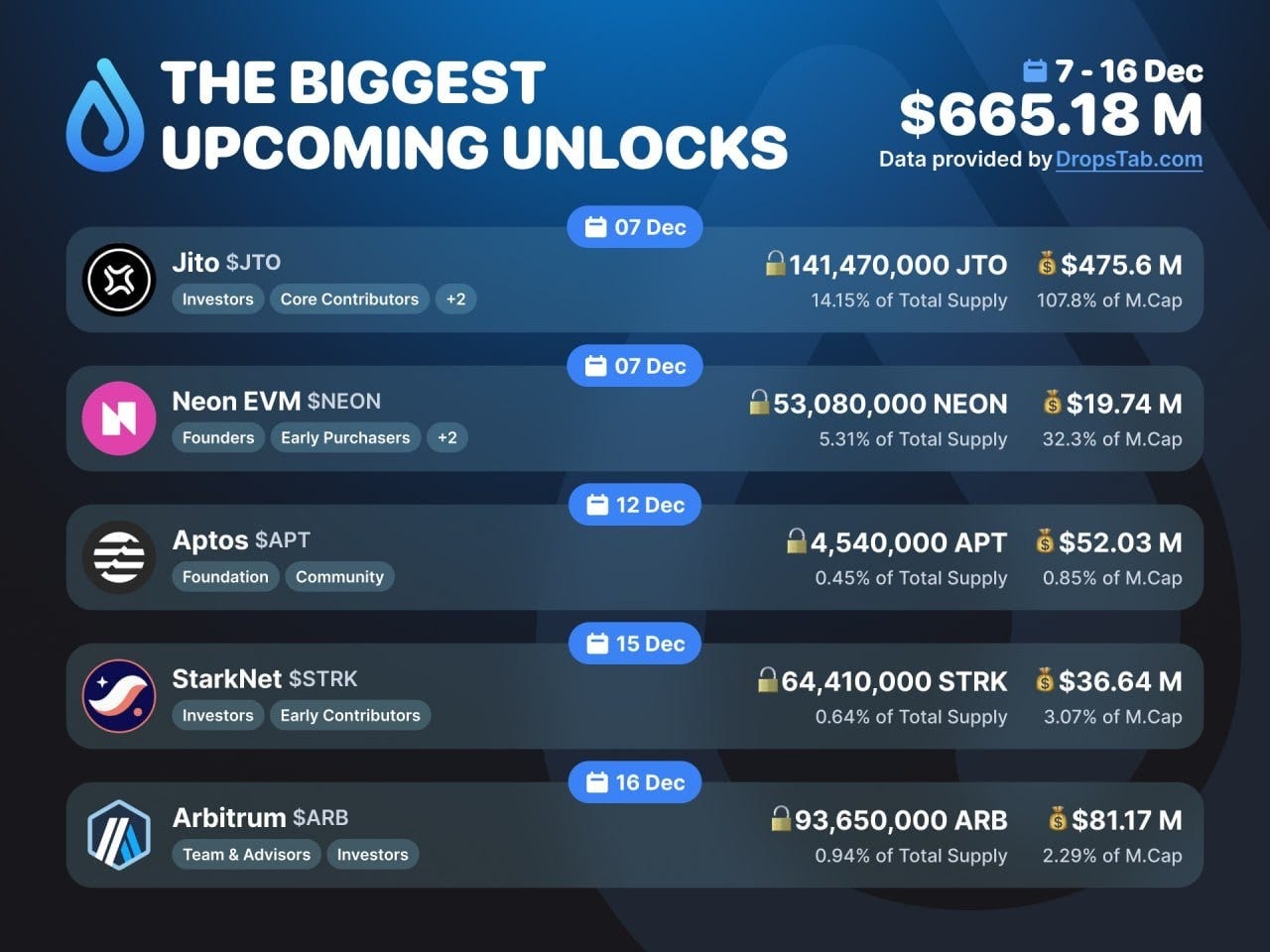

Major token unlocks

This week saw several significant token unlocks across prominent projects, which could influence market dynamics:

Cardano: Unlocked approximately 0.5% of its circulating supply. This modest release may add liquidity without significant market disruption.

Immutable: A token unlock worth $38.3 million, potentially impacting its market price and liquidity.

Optimism: The largest unlock this week, totaling $71.5 million, could weigh on its short-term price performance.

1inch: Released $27.6 million worth of tokens into circulation, with implications for its liquidity and valuation.

These unlocks are critical for traders and investors to monitor, as they often precede shifts in supply-demand dynamics.

Protocols in focus

This week has been very active and packed with announcements from protocols. Here’re some of the most important things that happened.

Sui network faced first major outage.

Trezor records 600% jump in weekly wallet sales amid massive BTC rally.

Stripe, a global payments leader, is expanding its crypto services to Aptos, further solidifying its position in the market.

Starknet has become the first Ethereum Layer 2 network to enable staking.

Appeals court rules against OFAC, says Tornado Cash sanctions unlawful.

Arbitrum announces the Trailblazer AI Grant Program, a $1 million fund, that aims to boost innovation in AI on the Arbitrum network.

On the fundamentals side, there have also been several noteworthy trends:

Monthly DEX volume on Solana exceeded $100 billion for the first time, a monumental milestone for the ecosystem.

Users return to TON DEXs STONfi and DeDust: Historically, when the number of tokens traded on STONfi and DeDust increases significantly, it is often accompanied by a significant increase in the TON price.

10 coins have seen an increase in whale activity, among them: Frax Finance $FRAX (On Arbitrum), USDD $USDD (On Ethereum), First Digital Labs $FDUSD, Axelar Network $AXL, Mantra $OM, FTX $FTT, The Sandbox $SAND, Rocket Pool $RETH, Quant $QUANT, Jasmy-MGT $JASMY.

Protocols with the biggest 7d growth in MAU: kusama, Acala, World, Symbiotic, Cosmos Hub.

Marketcap of Ethena's USDe stablecoin surged by 60% in six weeks.

Key VC rounds of the week

Modular DEX protocol Valantis raises seed round at $40 million valuation.

Crypto casino Monkey Tilt raises $30 million Series A led by Pantera Capital.

Bitfinity Network launches a Bitcoin L2 with $12M backing.

Kernel $10M Funding round with participation from Binance Labs.

Former Robinhood employees raise $5 million for crypto-AI startup OpenLayer.

AlbionVC leads $4M seed extension round for stablecoin yield products firm OpenTrade.

Crypto News of the Week: Long-Term Market Impacts

This week has been pivotal for the crypto industry, with regulatory moves, institutional advancements, and international adoption shaping the landscape.

Trump’s Presidency and Its Crypto Implications

Donald Trump’s return to political prominence is fueling speculation about a pro-crypto shift in U.S. policy. Here are the key developments:

Treasury Secretary Frontrunners: Pro-crypto stances among potential appointees suggest a favorable regulatory environment. Source.

Commerce Department Nomination: Trump nominated a pro-crypto CEO to lead the department, signaling potential regulatory clarity for the industry. Source.

Bakkt Acquisition Rumors: Trump’s media group is reportedly eyeing crypto exchange Bakkt, hinting at deeper involvement in the sector. Source.

Crypto Role in the White House: Trump’s team is discussing the creation of a dedicated crypto policy post within the White House. Source.

Gensler’s Exit: SEC chief Gary Gensler has announced plans to resign upon Trump’s inauguration, signaling potential regulatory shifts.

Key Insight: Trump’s pro-crypto stance could catalyze a Wall Street “land grab” for digital assets and pave the way for a more supportive regulatory environment. Read more.

Bitcoin ETFs and Options: A New Era of Liquidity

The launch of spot Bitcoin ETF options marks a milestone for institutional adoption:

Grayscale's Plans: Following BlackRock’s record-breaking ETF debut, Grayscale is preparing to launch Bitcoin ETF options. Source.

CME Futures Record: Open interest on CME surpassed 215,000 BTC, highlighting growing institutional engagement. Source.

Strategic Insight: Spot options could unlock the world’s deepest liquidity pools, enabling large market makers and retail investors to participate at unprecedented scale. Read more.

MicroStrategy and the Bitcoin Standard

MicroStrategy continues to champion Bitcoin adoption:

Ranked among the top 100 U.S. public companies by market capitalization. Source.

Michael Saylor plans to pitch a Bitcoin-buying strategy to Microsoft’s board. Source.

Raised $2.6 billion in zero-interest notes to purchase additional Bitcoin. Source.

Global Adoption: Companies like Remixpoint (Japan) and Rumble (U.S.) are also adopting Bitcoin standards, reflecting a broader trend.

Global Adoption and Legal Recognition

China: A Shanghai court ruled that Bitcoin and cryptocurrencies are legal property under Chinese law. Source.

Singapore Gulf Bank: Plans to acquire a stablecoin payments company, underscoring Asia’s leadership in crypto innovation. Source.

India: The Reserve Bank of India is expanding its cross-border payments platform, enhancing crypto’s utility in international trade. Source.

Brazilian lawmaker proposes national bitcoin reserve to hedge economic risks. Source.

Insightful List: Top governments by Bitcoin holdings highlight potential strategic reserves among nations.

BitGo’s Expansion in Asia

BitGo, a leading custody and wallet provider, launched operations in Singapore, with plans to expand into other crypto-friendly regions in Asia. Source.

Research spotlight

We can't leave you without further reading materials. Here's a curated list of this week's best research and articles.

DeSci – (How) Will It Make Research Great Again? Source.

Pump Science combines DeSci with Memecoins. Source.

Restaking Opportunities: Ethereum, Solana, & Cosmos. Source.

What if Bitcoin had the flexibility of Ethereum? Source.

Will bitcoin-based stablecoins make a comeback? Source.

The Future of Blockchain: How Modularity is Revolutionizing the Industry. Source.

Winning in crypto: It’s all about attention. Source.

How to stay safe on-chain? Source.