This Week in Crypto: Second Bottom As A Gift

Your ultimate crypto briefing — market trends, investment signals, and exclusive airdrop news.

TL;DR

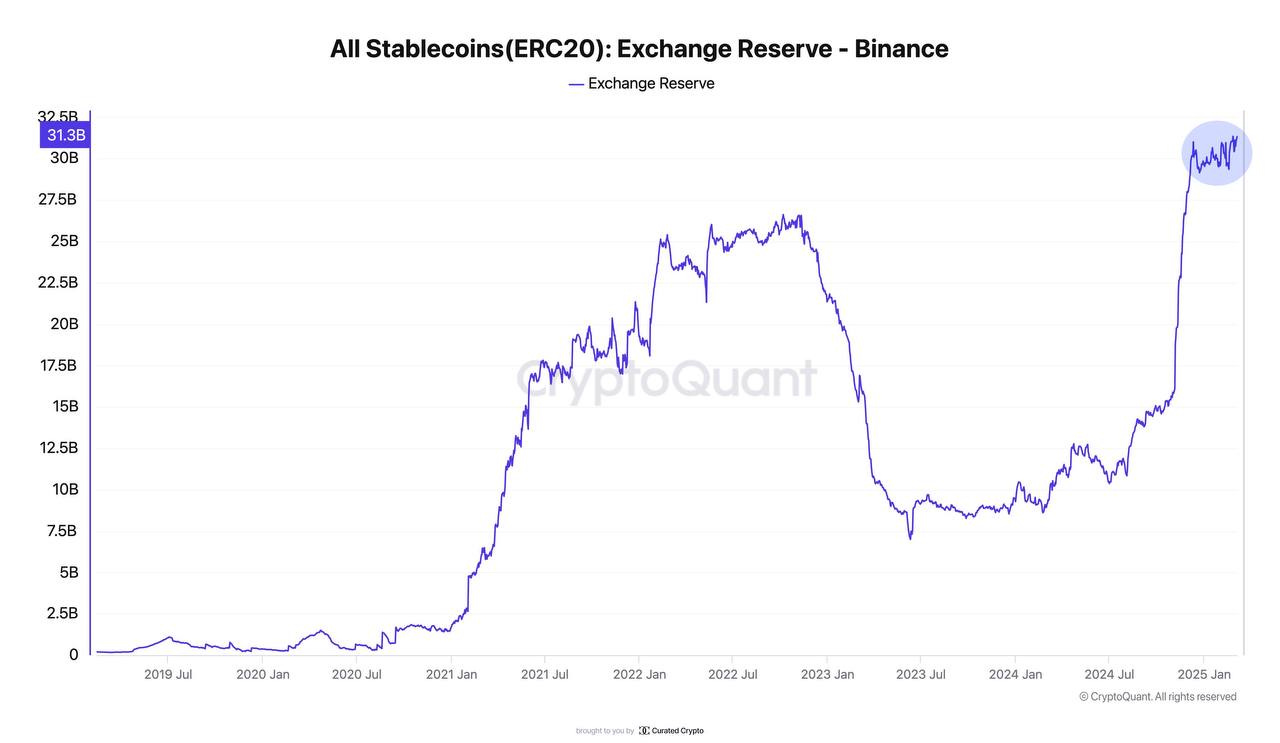

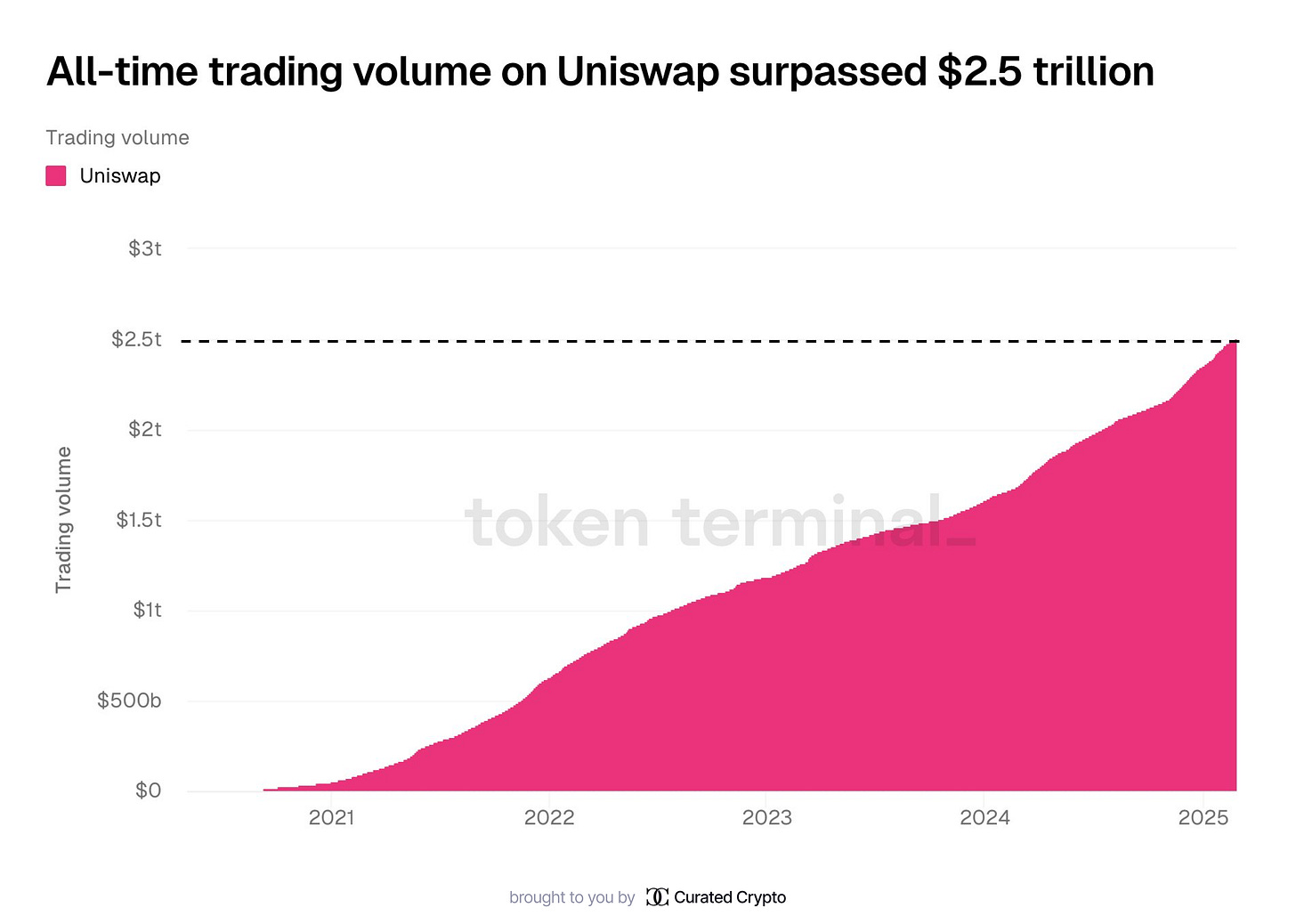

Market Sentiment: Over the past week, $876M was withdrawn from crypto funds due to macroeconomic pressure and profit-taking. Major outflows hit Bitcoin and Ethereum, while regulatory developments and supportive signals offer hope for stabilization. Bitcoin remains in a corrective phase, with a breakout above $100K potentially driven by rising global liquidity and renewed investor confidence, signaling the next rally. Binance’s stablecoin reserves hit a record $31.3B, showing market readiness, and Uniswap surpassed $2.5T in trading volume, confirming its DeFi dominance.

Yield Opportunities: DeFi in 2025 offers high-yield strategies like BTC-neutral leverage (100%+ APY) via Solv, fixed BTC yields (10%) on Pendle, and 25% APY with Contango, while SOL options include 17% APR on fragSOL, 20%+ on Kamino, and 10%+ with ezSOL. Institutional moves (Bitwise + Maple), yield-bearing stablecoins like USDN (~4.15% APY), and platforms like Mantle expand opportunities across crypto assets.

New Airdrops: Monad, a high-performance Layer 1 blockchain, is preparing for its Mainnet launch with projects like APR Labs, Kintsu, and Magma Staking offering staking opportunities. Testnets such as 0G Labs and Sonic also provide reward-earning chances.

Upcoming TGEs and Token Sales: This week’s crypto events include the public mainnet launch of $MOVE, $SKATE token sale, $APT token unlock, and $ARB token unlock, while Coinbase updates its listing roadmap with projects like Aethir, Syrup, and Cookie DAO, and RedStone launches its $RED token for staking and decentralization.

Key Developments: The Ethereum development team has successfully activated the Pectra upgrade on the Sepolia testnet.

Special note: Crypto Fundraising Trends.

Research of the week: “How to Utilize AI Agents in DeFi Platforms”

Crypto Market Faces Decline Amid Economic Uncertainty and Policy Concerns

The cryptocurrency market is currently experiencing a downturn, driven by growing pessimism about the broader economic outlook, particularly the potential impact of Trump’s policies, which some analysts believe could lead to a recession. Goldman Sachs has raised the likelihood of a recession within the next year from 15% to 20%, while Morgan Stanley has forecasted “softer growth” than originally anticipated.

Last week, the crypto market showed signs of optimism due to the upcoming White House Crypto Summit, but since then, the market has struggled to maintain momentum, with a lack of new narratives and incentives leading to a downturn.

Macro-Economic Factors and Regulatory Pressure

Trade wars and new tariffs introduced by the Trump administration have heightened market instability, leading to massive sales of crypto assets and liquidation of positions worth over $2 billion.

Low liquidity and panic among retail investors have exacerbated the decline. For Bitcoin to recover, it needs to break through the $100,000 level.

What’s Next?

Experts note that the current downturn may be temporary. If the economic situation stabilizes and regulatory measures become more predictable, the market has a chance to recover.

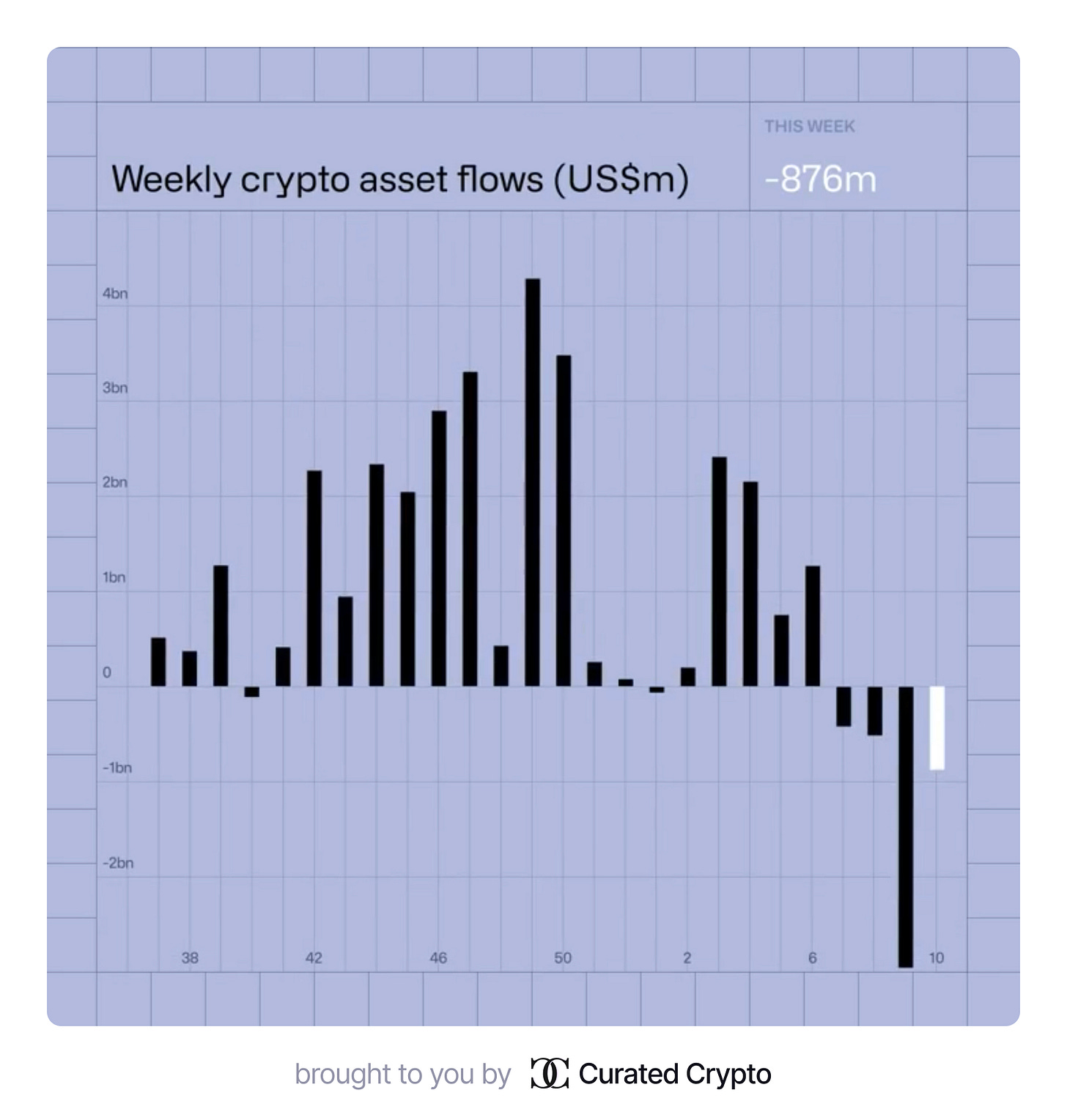

Record Outflows from Cryptocurrency Funds: Weekly Summary

Over the past week, $876 million was withdrawn from cryptocurrency investment funds, continuing a multi-week trend of outflows despite positive announcements in the U.S.

Key Reasons for Outflows

1 Macroeconomic Instability:

Tight monetary policies by central banks have increased pressure on the crypto market.

Negative news and scandals in the industry have further eroded investor confidence.

2 Profit-Taking:

After a period of growth, investors are cashing out profits amid market uncertainty.

Asset Statistics

Bitcoin (BTC): The largest outflows were seen in Bitcoin, reflecting waning interest in the leading cryptocurrency.

Ethereum (ETH) and Other Assets: Significant outflows were also recorded for Ethereum and other cryptocurrencies.

Geographic Breakdown

The majority of capital withdrawals occurred in major financial hubs like the U.S., Switzerland, and Canada.

Potential Stabilizing Factors

Despite the negative trend, certain developments in the U.S. may shift investor sentiment:

Regulatory Initiatives: Discussions on regulation and the role of cryptocurrencies in the financial system could attract new investors.

Crypto-Supportive Measures: Announcements about creating cryptocurrency reserves or other supportive actions may stabilize the market.

The cryptocurrency market remains under pressure due to macroeconomic factors and declining trust. However, U.S. initiatives offer potential for long-term stabilization and growth.

Bitcoin’s Current Corrective Phase: Is a Historical Pattern Repeating?

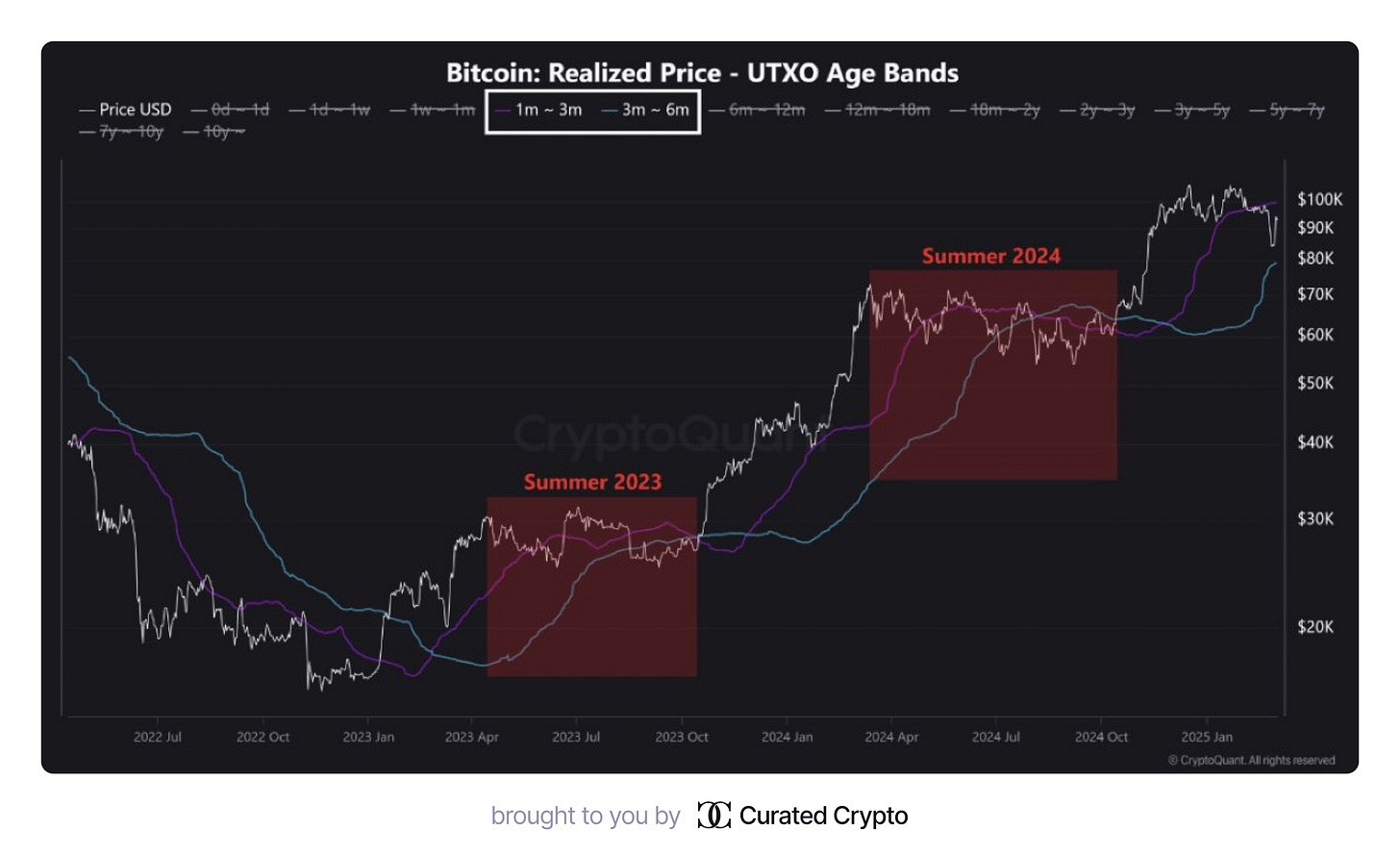

Bitcoin is currently in its third corrective phase within the ongoing bullish cycle that began in early 2023, as indicated by the UTXO Age Bands for the 1-3 month and 3-6 month groups.

Key Highlights:

During the summers of 2023 and 2024, Bitcoin experienced multi-month corrective phases, each lasting approximately six months.

During these periods, the 3-6 month band showed upward movement, gradually closing the gap with the 1-3 month band. This zone historically acted as resistance, where Bitcoin initially faced rejection before breaking through and triggering a new rally.

If history repeats itself, the current correction could last another 2 to 3 months, with BTC ranging between $80K and $100K.

A breakout above the $100K level could signal the end of this corrective phase and pave the way for a rally toward $130K.

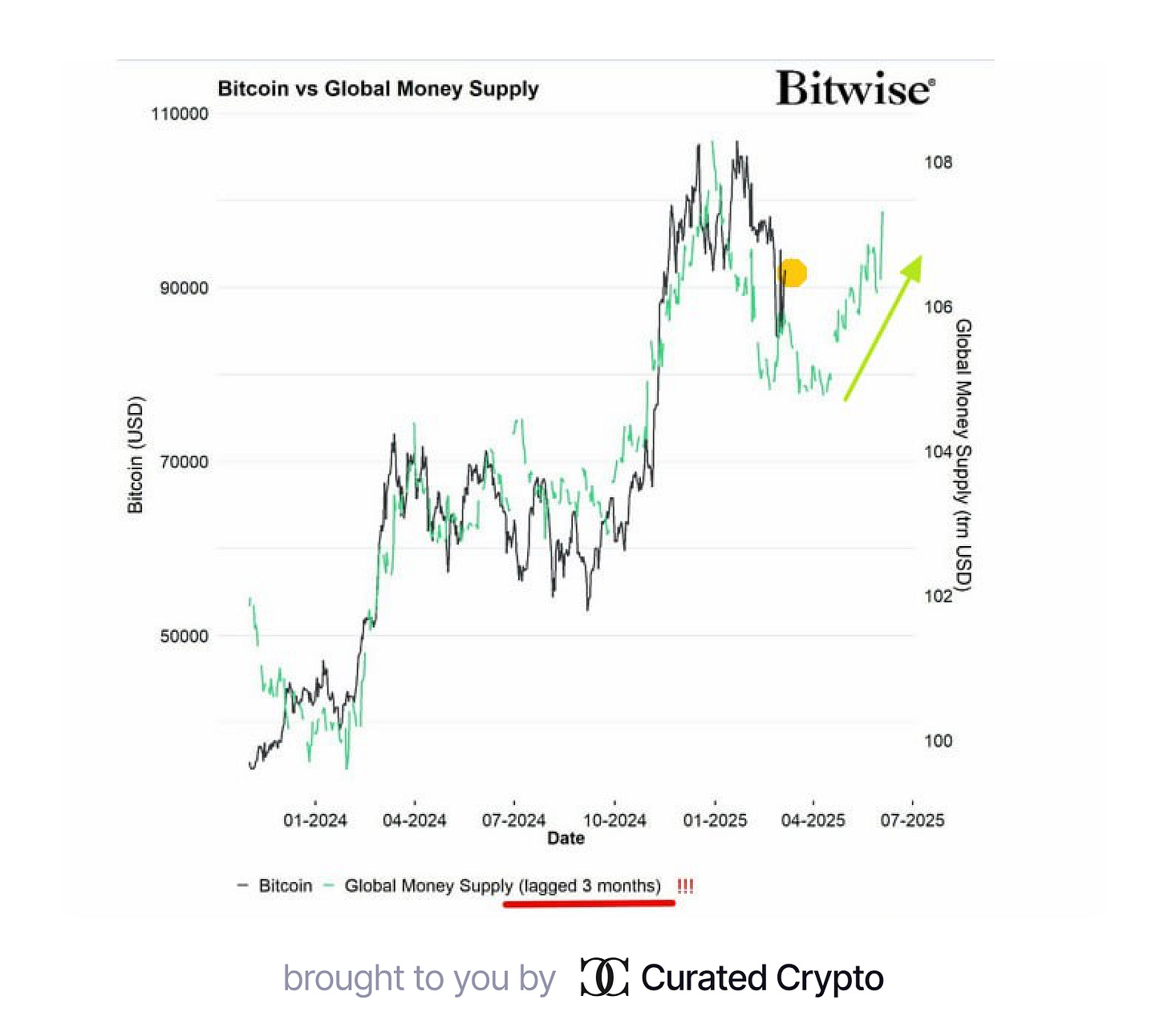

Impact of Global Liquidity:

Bitwise also highlights the recent acceleration in global liquidity growth (M2), which began several months ago. This trend could indicate a local bottom forming for BTC and other risk assets, as increased liquidity traditionally supports asset price growth. The chart shows that M2 growth (lagged by three months) aligns with a potential price reversal for Bitcoin.

Market participants should closely monitor the structural dynamics of premium bands. A confirmed breakout above resistance could indicate the start of Bitcoin’s next parabolic bull market phase.

Crypto Exchanges: Records, Outflows, and Trends

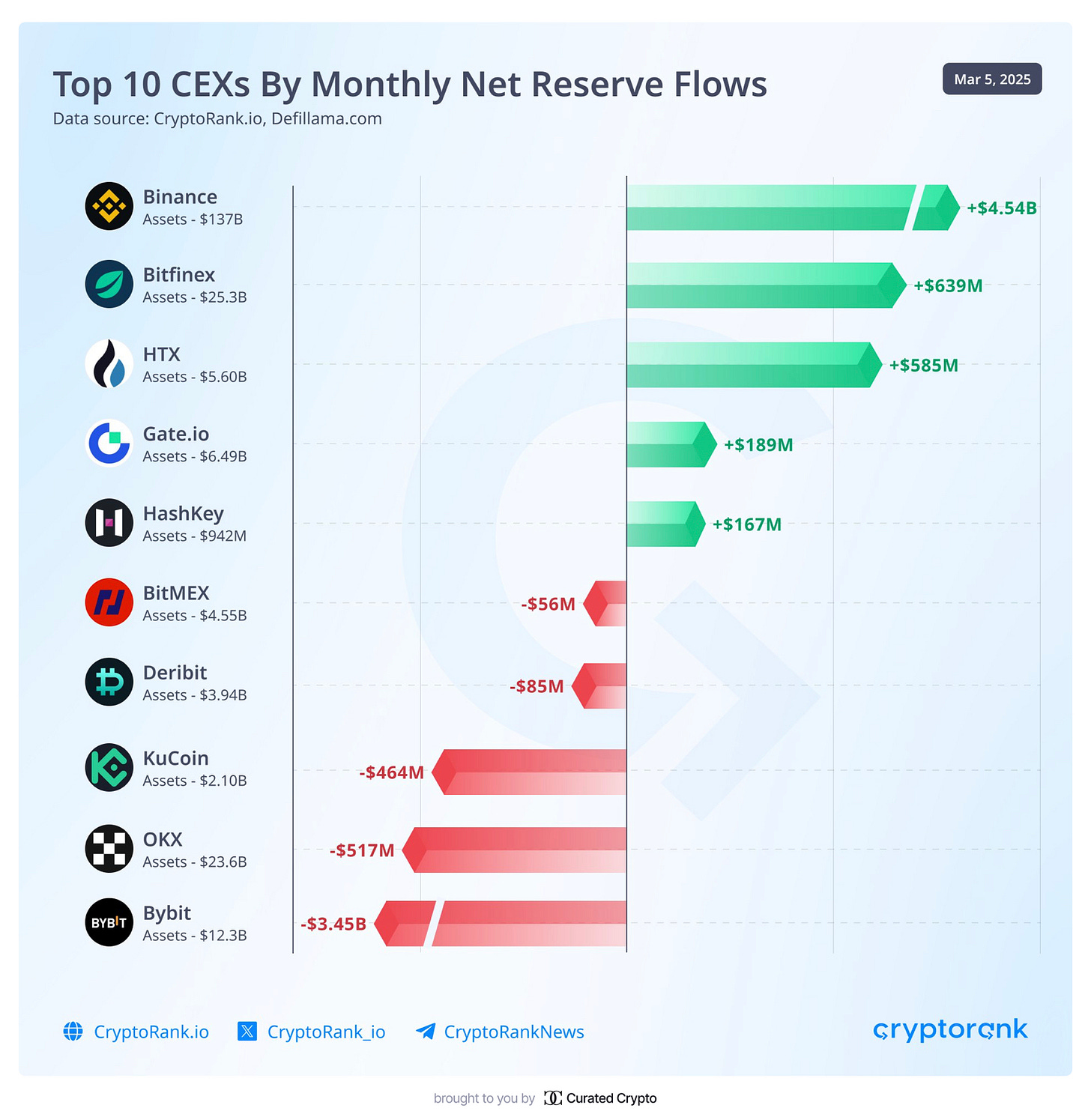

Binance recorded net inflows of $4.5B over the past month, while Bybit saw $3.45B in outflows, reportedly due to a hack situation.

Meanwhile, Bitfinex and HTX reported positive inflows, with $639M and $585M, respectively. In contrast, OKX and KuCoin experienced significant outflows of $517Mand $464M, respectively.

Binance’s Stablecoin Reserves Hit a New ATH!

Stablecoin (ERC-20) reserves on Binance have reached a new all-time high, surpassing $31.3B today.

– When we observe an increase in stablecoin reserves on Binance—currently the exchange with the highest trading volumes—it indicates a positive momentum –

This surge in Binance’s stablecoin reserves can be attributed to two main factors:

• Investors are channeling liquidity into Binance in preparation for market entry, reflecting confidence in both the market and the exchange.

• Binance is expanding its available stablecoin reserves as demand grows.

Historically, periods of rising stablecoin reserves on Binance have often coincided with, or even preceded, an increase in prices and a broader upswing in the crypto market.

Uniswap: A $2.5 Trillion Milestone in DeFi

Uniswap, the leading decentralized exchange (DEX) on Ethereum, has achieved a groundbreaking milestone by surpassing $2.5 trillion in all-time trading volume. This achievement underscores Uniswap’s pivotal role in the decentralized finance (DeFi) ecosystem and its continued dominance among DEX platforms.

Key Highlights:

Uniswap’s innovative Automated Market Maker (AMM) model has revolutionized trading by eliminating intermediaries and providing seamless liquidity.

The platform has consistently outperformed competitors like SushiSwap, Curve, and Balancer in trading volume and user engagement.

With the introduction of Uniswap V3, the platform has further optimized capital efficiency, attracting more liquidity providers and traders.

This milestone reflects the growing adoption of DeFi solutions as users increasingly prioritize decentralization, transparency, and control over their assets. Uniswap’s success is a testament to the power of decentralized protocols in reshaping global finance.

Weekly Report: Earn Passive Crypto Income

Top 3 Bitcoin Yield Strategies for 2025

If you’re looking to earn yield on Bitcoin (BTC), here are three of the most promising strategies available today. For those interested in even more options, you can find three additional strategies in the original thread here.

1. Solv Protocol’s BTC-Neutral Strategies

Solv allows you to collateralize BTC, borrow other assets, and earn yield while maintaining your BTC exposure.

By integrating with platforms like Euler Finance and BOB, you can amplify returns. For example, Optimism’s incentive campaign currently offers yields exceeding 100% APY with leverage.

2. Pendle Finance Fixed Yields

Pendle provides fixed APY options on BTC-related assets. Berachain pre-deposit vaults still offer up to 10% fixed APY, though minting new tokens is currently limited.

Euler also supports Pendle markets with shorter maturities, such as March expirations.

3. Contango’s Leveraged PT-LBTC Yields

Contango offers up to 25% APY on leveraged PT-LBTC pools via Morpho Labs. Even with 8 BTC as collateral, you can achieve over 15% APY. However, leverage risks and market volatility should be carefully managed.

These strategies showcase how DeFi is unlocking new opportunities for earning yield on BTC. However, always be mindful of risks like impermanent loss, leverage, and market volatility. If you know of other great BTC yield opportunities, feel free to share them!

For more details and additional strategies, check out the original thread here.

Top 3 SOL Yield Strategies for 2025

Believe it or not, Solana is a thriving DeFi ecosystem.

1. Fixed Rate fragSOL with RateX

RateX offers a fixed rate return of 17% APR on fragSOL.

Earn Rate-X points in addition to the competitive fixed rate yield, which lasts for the next six months.

2. Leveraged SOL LSTs on Kamino

Utilize Kamino to loop your $SOL using their multiply function.

Choose from various $SOL LSTs (Liquid Staking Tokens), many of which are considered decent options.

Strategies like $JUPSOL have historically hovered around 20% APR at 5x leverage, making it attractive for SOL maximalists.

3. Renzo’s ezSOL

ezSOL potentially offers the highest possible SOL yield currently available.

Earn around 10.12% APY, as ezSOL benefits from both staking yield and other incentives.

To explore even more strategies and insights, check out the original thread here.

Bitwise Partners with Maple Finance to Expand into DeFi

Bitwise, a leading crypto index fund manager, has partnered with Maple Finance, marking its first move into decentralized finance (DeFi). This collaboration gives institutional clients access to regulated on-chain credit opportunities.

Key Highlights:

Maple Finance specializes in issuing both secured and unsecured loans backed by digital assets.

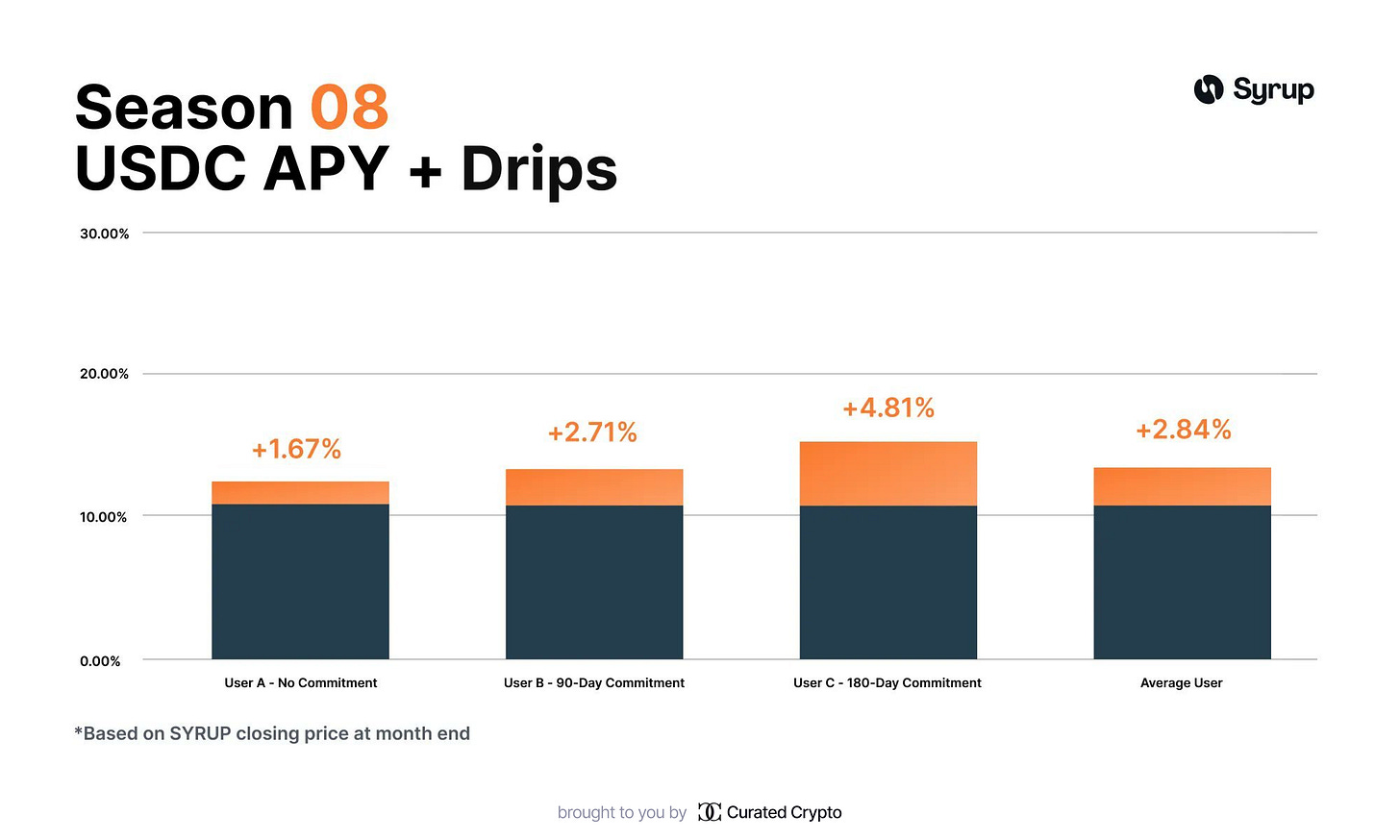

Its structured product, syrupUSDC, offers stablecoin yield farming, with over $100M TVL and growing.

Maple recently launched a “Lend + Long” product, combining high-yield lending with Bitcoin call options.

The platform’s total value locked (TVL) is expected to surpass $1 billion next quarter.

With over $12 billion AUM, Bitwise aims to bridge traditional finance and DeFi, providing clients with innovative investment options. This partnership reflects the growing institutional interest in on-chain lending solutions.

Noble Launches Yield-Paying USDN Stablecoin on Cosmos

Noble has launched its $USDN stablecoin, which offers users a yield based on U.S. Treasury bill collateral. Currently, USDN holders can earn around 4.15% APY, though this rate will fluctuate.

Key Features:

$USDN aims to align incentives by distributing revenue from Treasury holdings to developers, app builders, validators, wallets, and exchanges. This differs from stablecoins like $USDT and $USDC, where the issuers retain the profits.

Initial support: USDN is available in the Keplr Wallet and can be purchased with credit cards via Moonpay.

M^0 Protocol: USDN is built using the M^0 protocol, enabling customizable stablecoins.

Noble Points Program: Users can earn points through Staking and Flexible Vaults. Staking Vault users forgo yield payments for point accumulation, while Flexible Vault offers a boosted yield.

Noble is known as the native asset issuance network for Circle’s $USDC stablecoin in the Cosmos ecosystem, having facilitated over $6.5 billion in stablecoin transfersacross 80+ blockchain applications. They previously partnered with Hashnote on the tokenized short-duration yield fund USYC.

How to Earn Yield on Mantle: Key Highlights

Mantle offers a unique ecosystem with various yield opportunities, incentives, and rewards. Its yield-bearing tokens include $MNT, $mETH, $cmETH, and $COOK. Here are the main ways to earn yield on Mantle:

1. Mantle Rewards Station

Lock $MNT to build MNT Power (MP).

Allocate MP to pools to earn rewards.

Longer lock periods yield higher MNT Power Boosts.

2. Merchant Moe

High-yield pools like $mETH/$WETH and $MNT/$WETH offer significant APRs.

All pools are liquid with millions in daily volume.

3. WOOFi

Earn APY on $cmETH, $mETH, and $USDT.

Additional $MNT rewards are available.

4. mETH Protocol

Stake or restake $mETH and $cmETH for a straightforward yield option.

Mantle Network is a Layer 2 Ethereum solution that enhances capital efficiency using ZK-rollup technology, supporting high-value asset settlements and sustainable yields.

We also strongly recommend that you don't miss “Yield-Bearing Stablecoins: Comparing Risks, Rewards, and Market Trends”

Maximizing Gains: Airdrop Farming Strategies

Monad Ecosystem: Key Projects and Opportunities

Monad, a high-performance Layer 1 blockchain, is preparing for its Mainnet launch. Now is the ideal time to engage with promising ecosystem projects. Below are six key projects to explore, with actionable steps embedded in the links:

APR Labs ($10M funding):

Kintsu ($4M funding):

Stake test $MON here.

Withdraw 10% for added activity.

Magma Staking ($3.9M funding):

Stake $MON on Magma Staking.

Withdraw 10-20% for additional engagement.

Ambient Finance ($6.5M funding):

Kuru Exchange ($2M funding):

Trade across various pairs on Kuru Exchange.

Fantasy Top ($4.25M funding):

Open packs here.

Participate in tournaments.

Focus on quality projects, role farming, and content creation to maximize your participation in the Monad ecosystem!

Top Testnets

Testnets offer a unique opportunity to earn substantial rewards with zero initial investment. Here’s a concise guide to five promising testnets you should explore:

1. OG Labs

What it is: Decentralized AI operating system for blockchain applications.

Steps to farm:

Visit OG Labs Testnet.

Add the testnet to your wallet and request tokens.

Upload files periodically on OG Storage.

Join their Discord.

2. Monad

What it is: High-performance Layer 1 blockchain with EVM compatibility.

Steps to farm:

Access the Monad Testnet.

Request tokens from faucets and trade assets on the platform.

3. Sonic

What it is: High-speed blockchain (10,000+ TPS) compatible with Solana.

Steps to farm:

Swap tokens on Sonic’s Dashboard.

Earn points by holding specific assets like scUSD or USDC.e.

4. Succinct

What it is: Zero-knowledge infrastructure for secure cross-chain communication.

Steps to farm:

Visit Succinct Testnet.

Complete tasks and join their Discord for roles.

5. Portal

What it is: Decentralized marketplace for data using Bitcoin-based protocols.

Steps to farm:

Install the Portal Wallet Extension.

Perform tasks on their testnet.

Each activity takes only a few minutes but could yield significant rewards in future airdrops!

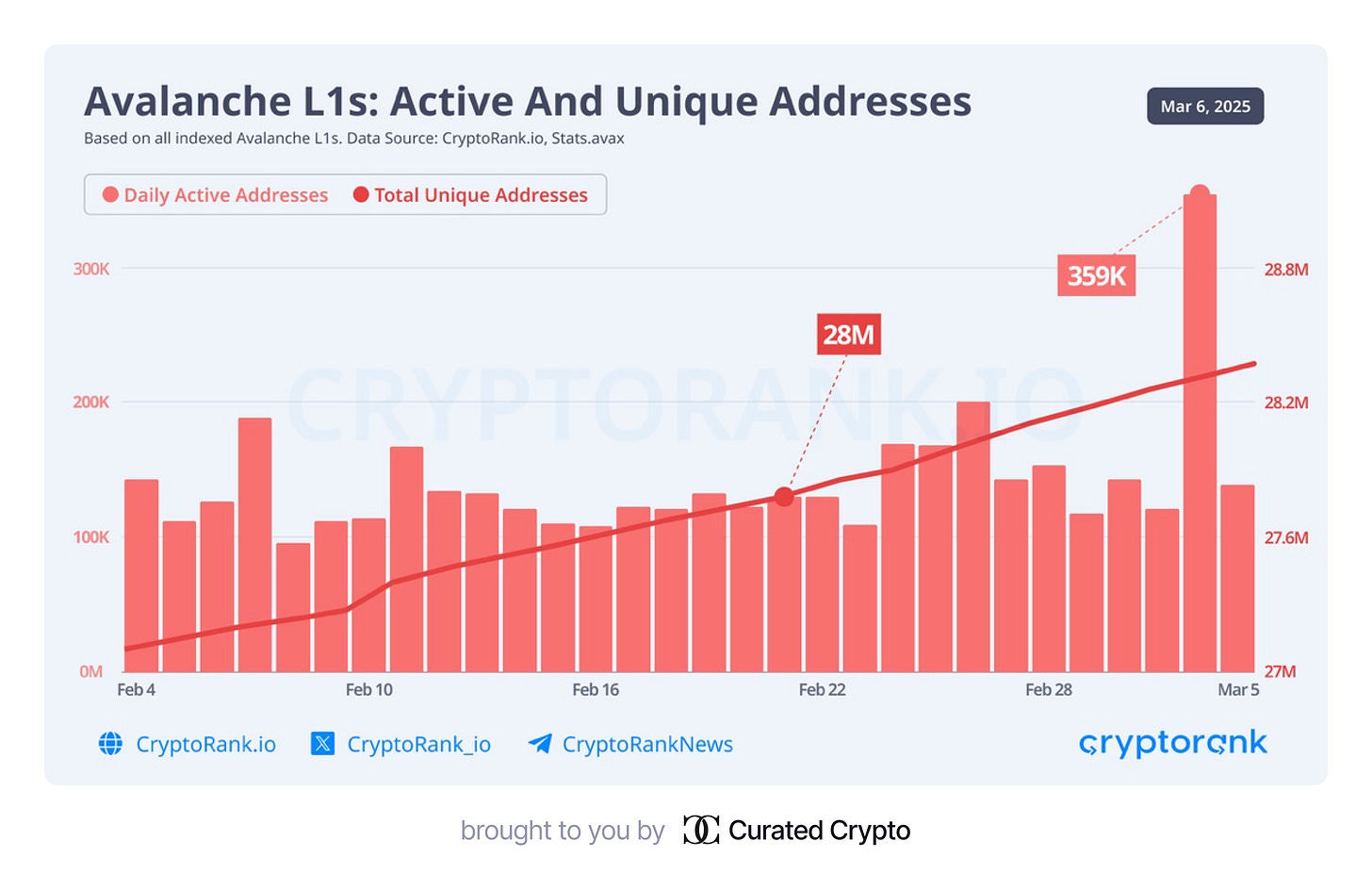

Avalanche Network Sees Activity Surge After BLUB Airdrop

The Avalanche L1 blockchain experienced a massive spike in activity following the BLUB token airdrop by BlubBlobCoin and the growing popularity of the $KET token from Yellowcatdao.

Key Highlights:

Active Addresses Doubled: On March 4, the number of active addresses on Avalanche L1 more than doubled, reaching 359,000.

Unique Addresses Growth: In February 2025, Avalanche L1 surpassed 28 million unique addresses, marking significant adoption within the ecosystem.

Explore the Avalanche ecosystem to stay updated on its growth: Avalanche Ecosystem.

Mastering TGE: Key Token Offerings

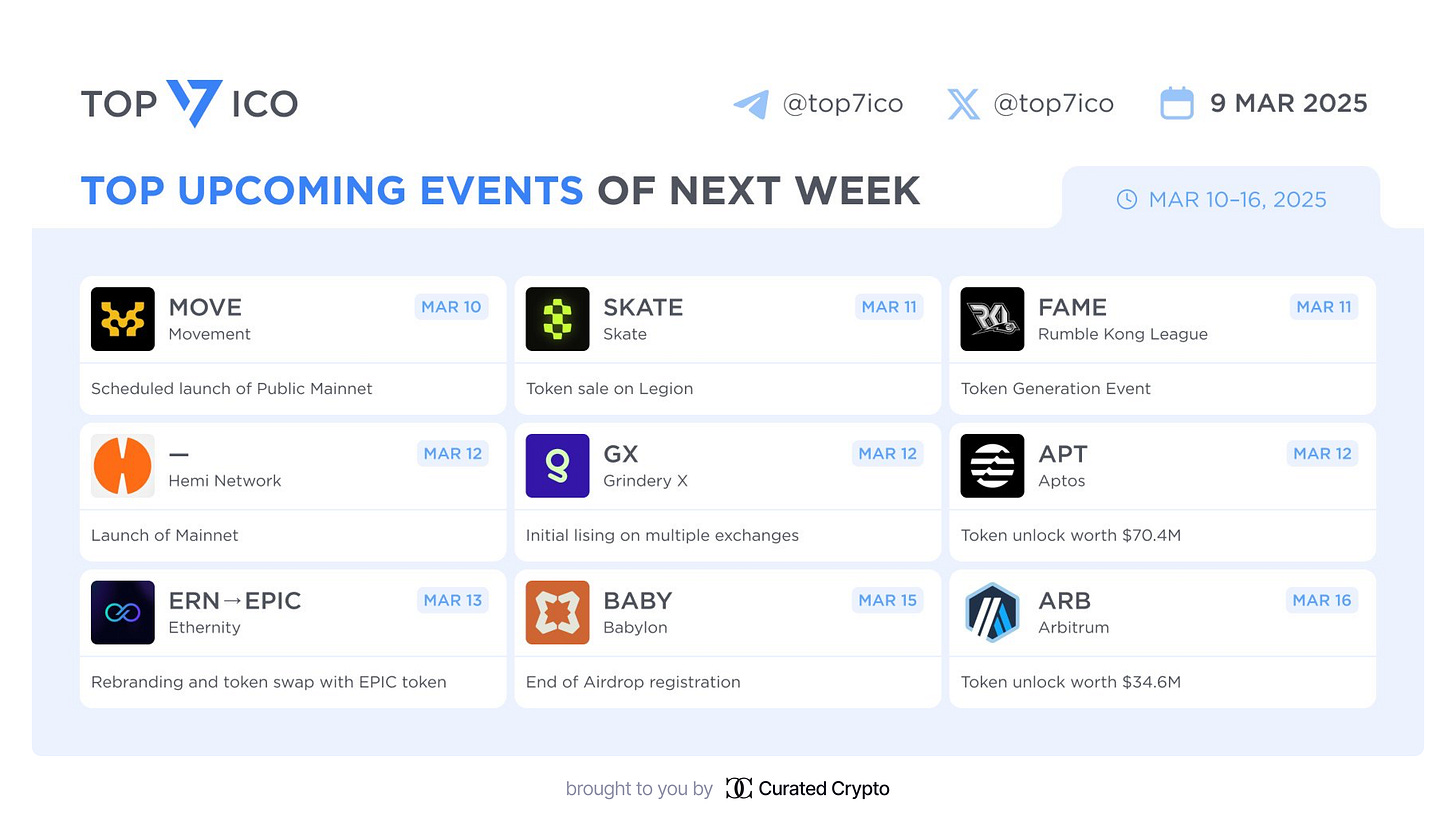

Top Upcoming Crypto Events of Next Week

The crypto market is buzzing with exciting developments this week. From token unlocks to mainnet launches, these events could have a significant impact on the industry. Here’s a quick overview of what to watch for:

$MOVE (Movement)

Date: March 10

Event: Scheduled launch of Public Mainnet.$SKATE (Skate)

Date: March 11

Event: Token sale on Legion.$FAME (Rumble Kong League)

Date: March 11

Event: Token Generation Event.Hemi Network

Date: March 12

Event: Launch of Mainnet.$GX (Grindery X)

Date: March 12

Event: Initial listing on multiple exchanges.$APT (Aptos)

Date: March 12

Event: Token unlock worth $70.4M.$ERN → $EPIC (Ethernity)

Date: March 13

Event: Rebranding and token swap with EPIC token.$BABY (Babylon)

Date: March 15

Event: End of airdrop registration.$ARB (Arbitrum)

Date: March 16

Event: Token unlock worth $34.6M.

Stay informed and monitor these events closely, as they may present opportunities for traders and investors alike. Whether you’re looking at new projects or established networks, this week is packed with potential!

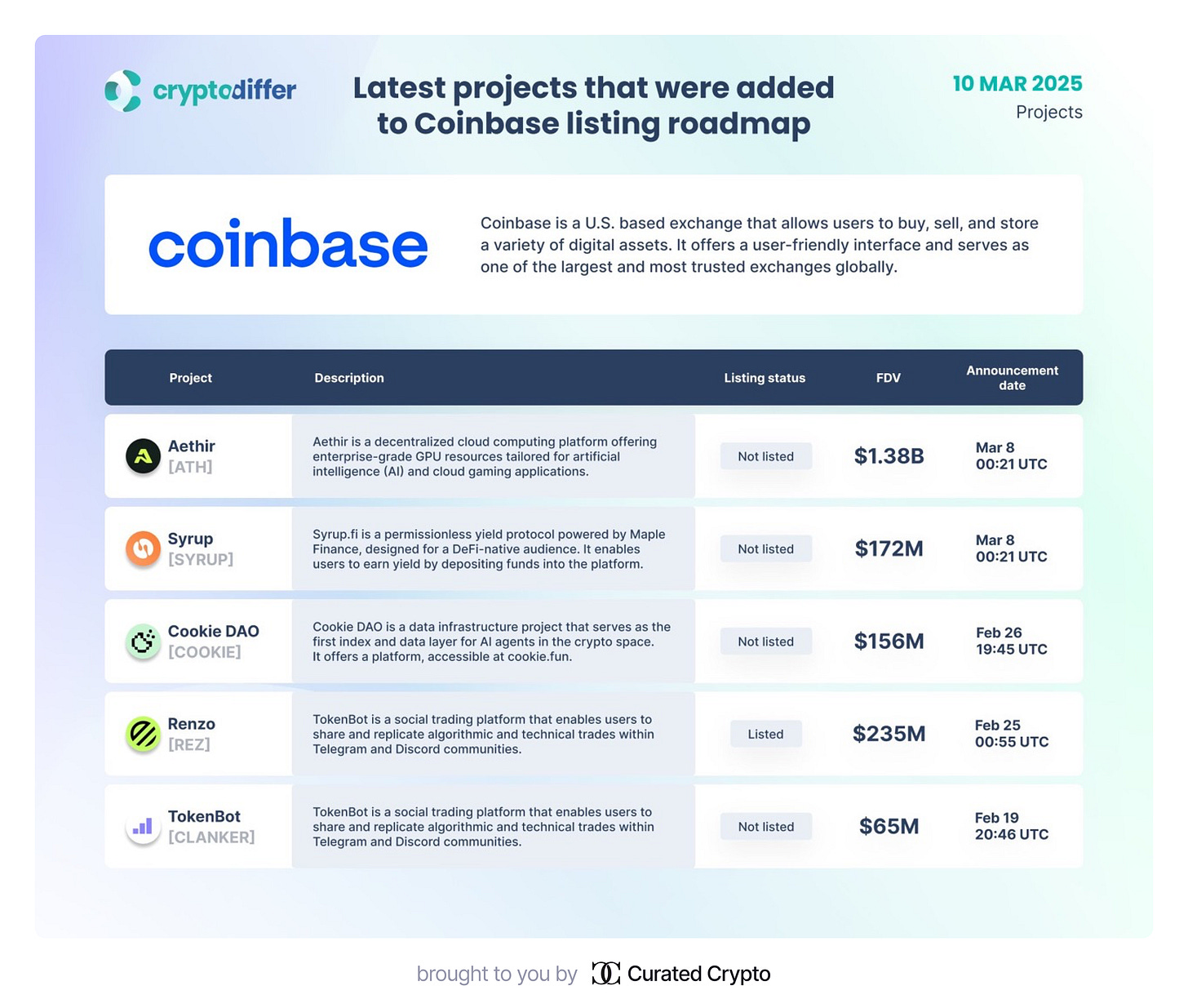

Latest Projects Added to Coinbase Listing Roadmap

Coinbase, one of the largest and most trusted cryptocurrency exchanges globally, has recently updated its listing roadmap. Several promising projects have been added, signaling potential upcoming listings. Here’s a breakdown of the latest additions:

Aethir ($ATH)

Description: A decentralized cloud computing platform offering enterprise-grade GPU resources for AI and cloud gaming applications.

Listing Status: Not listed

FDV: $1.38B

Announcement Date: March 8, 00:21 UTCSyrup ($SYRUP)

Description: A permissionless yield protocol powered by Maple Finance, designed for DeFi-native audiences. It enables users to earn yield by depositing funds into the platform.

Listing Status: Not listed

FDV: $172M

Announcement Date: March 8, 00:21 UTCCookie DAO ($COOKIE)

Description: A data infrastructure project that serves as the first index and data layer for AI agents in the crypto space. Accessible via cookie.fun.

Listing Status: Not listed

FDV: $156M

Announcement Date: February 26, 19:45 UTCRenzo ($REZ)

Description: A social trading platform enabling users to share and replicate algorithmic and technical trades within Telegram and Discord communities.

Listing Status: Listed

FDV: $235M

Announcement Date: February 25, 00:55 UTCTokenBot ($CLANKER)

Description: Another social trading platform allowing users to replicate algorithmic and technical trades within Telegram and Discord communities.

Listing Status: Not listed

FDV: $65M

Announcement Date: February 19, 20:46 UTC

These projects highlight Coinbase’s focus on innovative platforms in AI, DeFi, and social trading. Keep an eye out for potential listings in the coming days!

RedStone Launches RED Token: Decentralization and Staking Rewards Begin

RedStone, a leading blockchain oracle provider, has launched its $RED token on Ethereum, marking a significant step toward decentralizing its infrastructure and enhancing security through staking. Here are the key highlights:

Community Airdrop:

10% of the total supply (1 billion $RED tokens) is allocated to the community. Early supporters and participants in the “RedStone Expedition” program can now claim their tokens. Only 4,000 out of 200,000 members qualified for this initial airdrop.Tokenomics:

10% for protocol development

20% for core contributors

31.7% for early backers

Remaining portions for ecosystem growth and other initiatives.

Market Performance:

$RED tokens debuted at $0.84, with a market cap of $235M and a fully diluted valuation (FDV) of $840M.Staking Opportunities:

$RED holders can stake via EigenLayer or Mega DAO Magpie, earning rewards in $RED and potentially other assets like ETH and BTC in the future.Ecosystem Impact:

RedStone supports over 70 blockchains, including Ethereum, TON, and Polygon, securing $6.4B in Total Value Secured (TVS).

This launch positions RedStone as a key player in decentralized oracles, offering innovative solutions for scalable and cost-efficient data delivery.

Also be sure to check out the thread “Breaking down RedStone $RED Tokenomics, Utility & Vesting Schedules”

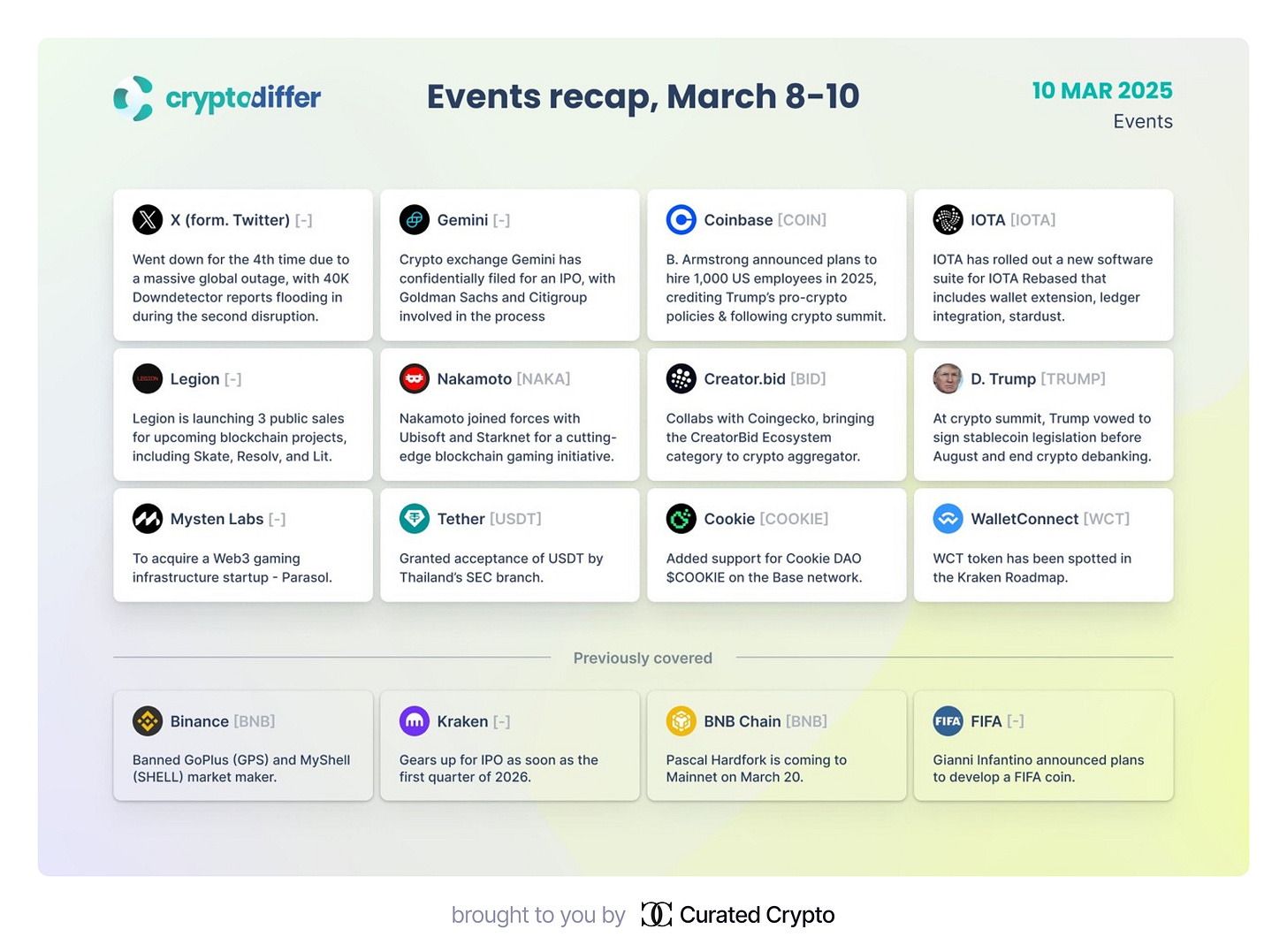

Key Events Reshaping the Landscape

Crypto Events Recap

Here’s a summary of the most notable crypto developments from March 8–10:

X (formerly Twitter)

Experienced its 4th global outage, with over 40K Downdetector reportsduring the second disruption.Gemini

Filed confidentially for an IPO, with Goldman Sachs and Citigroup involved in the process.Coinbase (COIN)

Announced plans to hire 1,000 US employees in 2025, citing pro-crypto policies and a summit influence.IOTA (IOTA)

Launched a new software suite for IOTA Rebased, featuring wallet extension, ledger integration, and Stardust.Legion

Preparing to launch three public sales for blockchain projects: Skate, Resolv, and Lit.Nakamoto (NAKA)

Partnered with Ubisoft and Starknet for a cutting-edge blockchain gaming initiative.Creator.bid (BID)

Collaborated with CoinGecko to integrate the CreatorBid Ecosystem category into crypto aggregators.Tether (USDT)

Received approval from Thailand’s SEC for the acceptance of USDT.Cookie DAO (COOKIE)

Added support for COOKIE on the Base network.WalletConnect (WCT)

WCT token was spotted on the Kraken Roadmap.

Previously Covered Highlights:

Binance (BNB): Banned GoPlus (GPS) and MyShell market makers.

Kraken: Preparing for an IPO by Q1 of 2026.

BNB Chain: Pascal Hardfork scheduled for March 20.

FIFA: Gianni Infantino announced plans to develop a FIFA coin.

These events reflect ongoing innovation and regulatory shifts in the crypto sector—stay tuned for further updates!

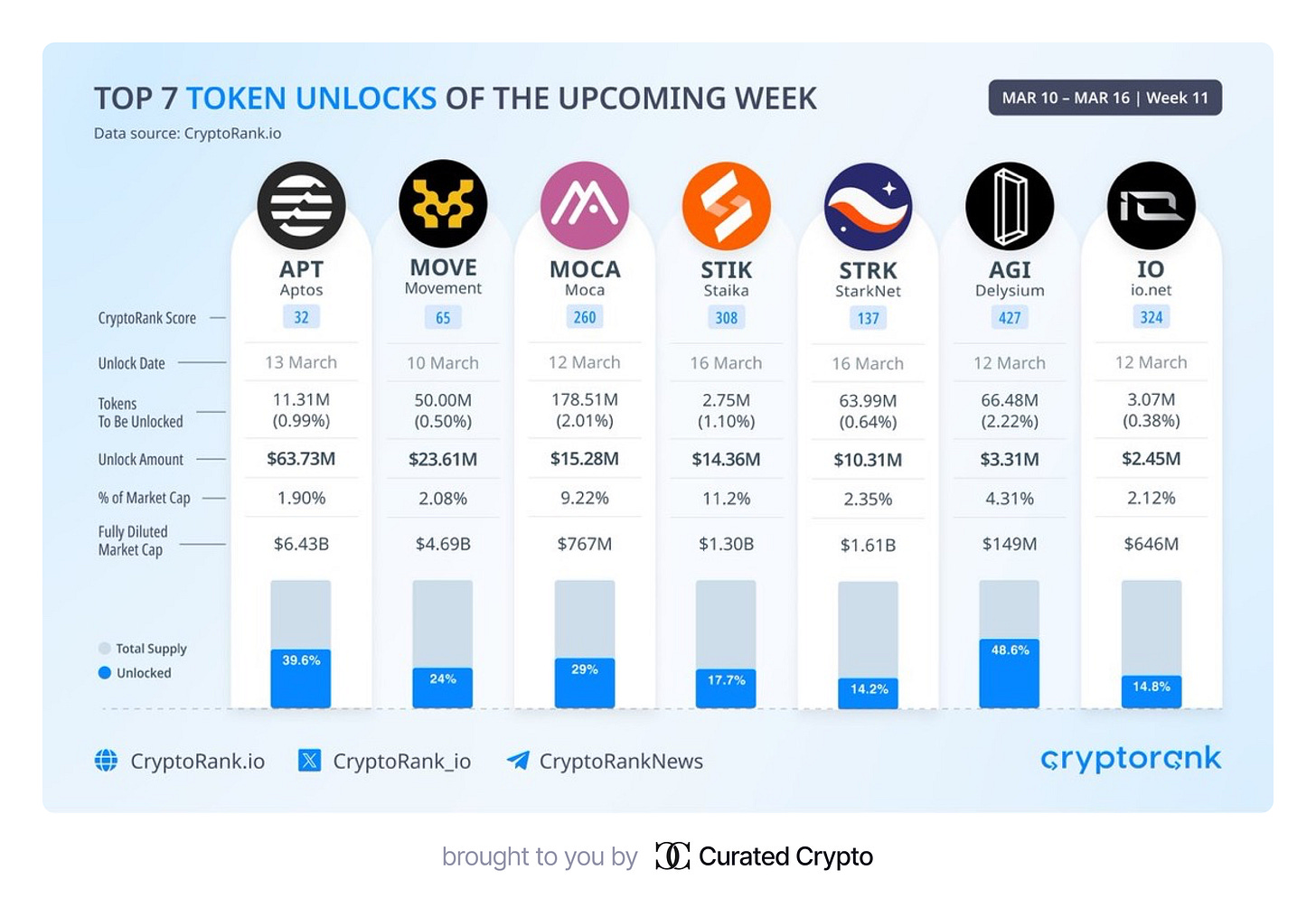

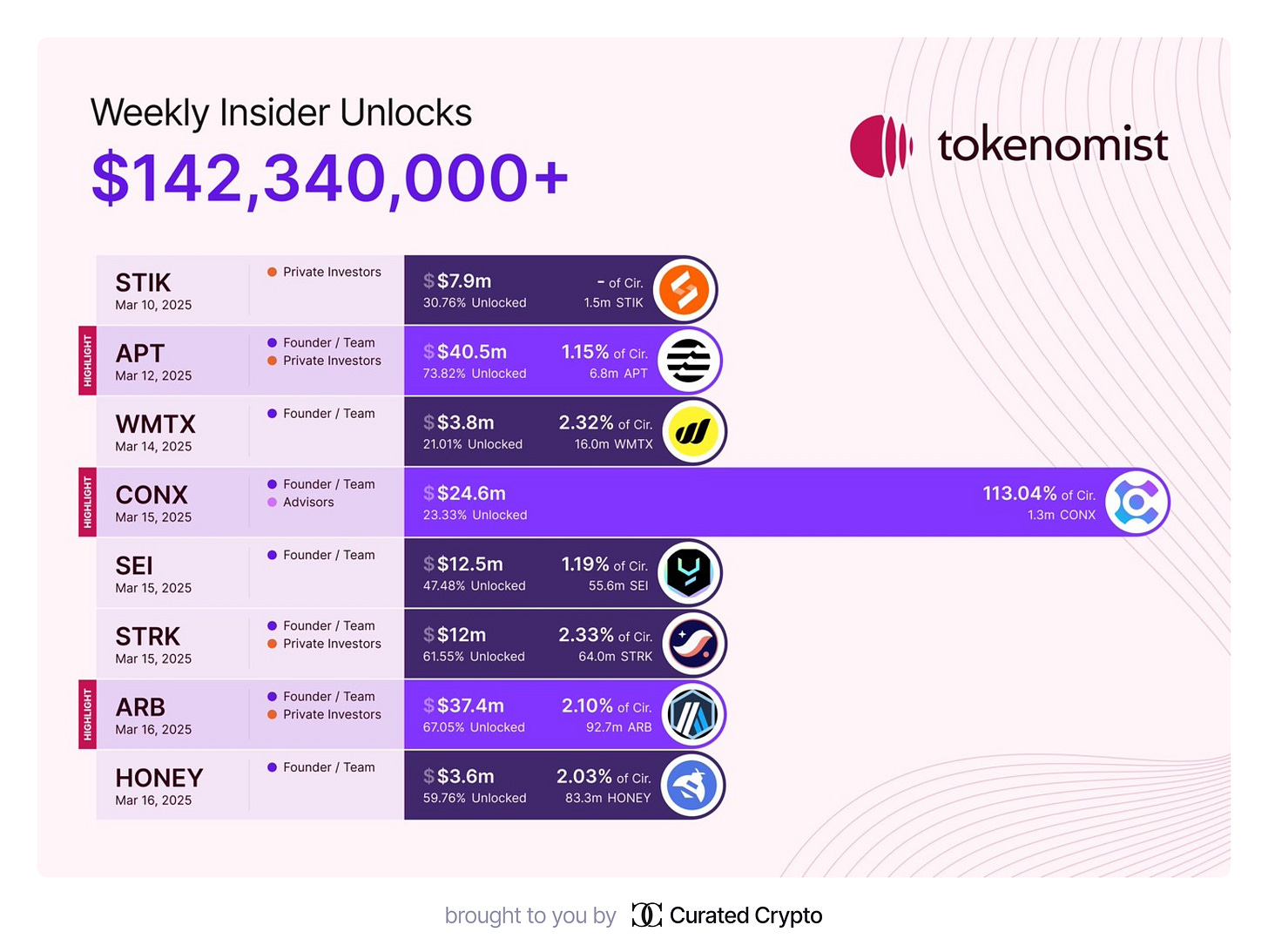

Top 7 Token Unlocks of the Week

This week features significant token unlock events, with major projects releasing millions in tokens. Here’s a breakdown of the top 7 unlocks:

$APT (Aptos)

Unlock Date: March 13

Tokens Unlocked: 11.31M (0.99%)

Value: $63.73M

Market Cap Impact: 1.90%

Fully Diluted Market Cap (FDV): $6.43B$MOCA (Moca)

Unlock Date: March 12

Tokens Unlocked: 178.51M (2.21%)

Value: $15.28M

Market Cap Impact: 9.52%

FDV: $767M$STIK (Staika)

Unlock Date: March 16

Tokens Unlocked: 2.75M (1.10%)

Value: $14.36M

Market Cap Impact: 11.20%

FDV: $1.30B$STRK (StarkNet)

Unlock Date: March 16

Tokens Unlocked: 63.99M (0.64%)

Value: $10.31M

Market Cap Impact: 2.35%

FDV: $1.61B$AGI (Delysium)

Unlock Date: March 12

Tokens Unlocked: 66.48M (2.22%)

Value: $3.31M

Market Cap Impact: 4.31%

FDV: $149M$IO (io. net)

Unlock Date: March 12

Tokens Unlocked: 3.07M (0.38%)

Value: $2.45M

Market Cap Impact: 2.12%

FDV: $646M

These unlocks represent significant movements in token supply and may impact market dynamics for the respective projects—stay tuned!

Weekly Insider Unlocks

This week, insider token unlocks total over $142.34M, with several major projects releasing tokens that could impact market dynamics. Here’s the detailed breakdown by project and insider category:

$STIK (Staika)

Unlock Date: March 10

Value Unlocked: $7.9M

Insiders: Private Investors

Percentage of Circulating Supply Unlocked: 30.76%$APT (Aptos)

Unlock Date: March 12

Value Unlocked: $40.5M

Insiders: Founders, Team, and Private Investors

Percentage of Circulating Supply Unlocked: 1.15%$WMTX (Wrapped Metrix)

Unlock Date: March 14

Value Unlocked: $3.8M

Insiders: Founders and Team

Percentage of Circulating Supply Unlocked: 2.32%$CONX (Conflux Network)

Unlock Date: March 15

Value Unlocked: $24.6M

Insiders: Founders and Advisors

Percentage of Circulating Supply Unlocked: 113.04%$SEI (Sei Network)

Unlock Date: March 15

Value Unlocked: $12.5M

Insiders: Founders and Team

Percentage of Circulating Supply Unlocked: 1.19%$STRK (StarkNet)

Unlock Date: March 15

Value Unlocked: $12M

Insiders: Founders, Team, and Private Investors

Percentage of Circulating Supply Unlocked: 2.33%$ARB (Arbitrum)

Unlock Date: March 16

Value Unlocked: $37.4M

Insiders: Founders, Team, and Private Investors

Percentage of Circulating Supply Unlocked: 2.10%$HONEY (Honey Protocol)

Unlock Date: March 16

Value Unlocked: $3.6M

Insiders: Founders and Team

Percentage of Circulating Supply Unlocked: 2.03%

These insider unlocks represent significant shifts in token supply and could influence price movements across these projects—keep an eye on the market!

Ethereum Activates Pectra Upgrade on Sepolia Testnet

The Ethereum development team has successfully activated the Pectra upgrade on the Sepolia testnet, marking the final phase before its anticipated mainnet rollout in early April. Here are the key details:

Sepolia Activation

The upgrade went live on March 11, 2025, at 2:30 am ET. Sepolia serves as a testing ground for Pectra’s features under simulated network conditions before deployment on Ethereum’s mainnet.Final Testnet Phase

This marks the second phase of testnet activations, following the initial rollout on Holesky on February 24. Despite earlier issues on Holesky—such as chain splits caused by incorrect deposit contract addresses—developers resolved these problems to ensure a smooth Sepolia activation.What is Pectra?

Named as a combination of “Prague” (execution layer changes) and “Electra” (consensus layer updates), Pectra introduces significant improvements to Ethereum’s scalability, security, and usability. Key enhancements include:EIP-7702: Improved crypto wallet user experience and account abstraction.

EIP-7251: Raising validator stake limits from 32 ETH to 2,048 ETH.

EIP-7691: Increasing maximum blob counts to enhance rollup scalability.

Mainnet Timeline

If Sepolia performs well, Ethereum developers are expected to finalize the mainnet activation date during an All Core Developers (ACD) call. The launch is tentatively set for early April 2025.Building on Dencun Hard Fork

Pectra builds upon the March 2024 Dencun hard fork, which reduced Layer 2 fees and reinforced Ethereum’s competitive edge in blockchain technology.

This upgrade underscores Ethereum’s ongoing commitment to scalability and innovation, setting the stage for its next evolution in blockchain infrastructure.

Protocols in Focus

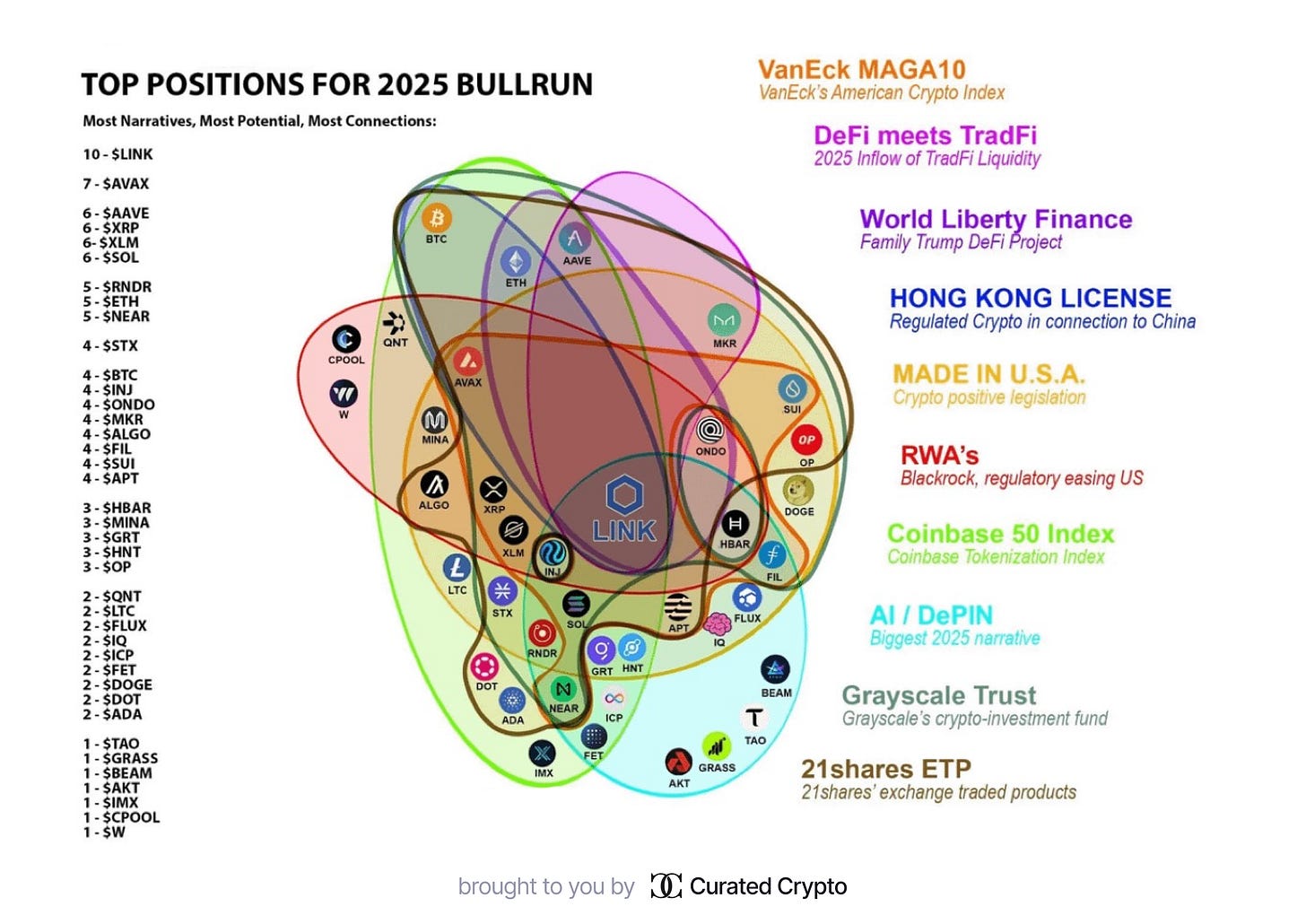

Top Positions for the 2025 Bullrun

The provided image highlights key cryptocurrencies and narratives expected to drive the next major bullrun in 2025. Below is a breakdown of the information based on the chart:

Cryptocurrencies Ranked by Potential

The ranking is based on narratives, connections, and growth potential.

10/10: Top Tier

$LINK (Chainlink): The leading decentralized oracle network connecting blockchains with external data.

7/10: High Potential

$AVAX (Avalanche): A fast and scalable blockchain platform for decentralized applications.

6/10: Strong Contenders

$AAVE: A prominent DeFi protocol for lending and borrowing.

$XRP: Focused on efficient cross-border payments.

$XLM (Stellar): A blockchain platform for financial systems interoperability.

$SOL (Solana): Known for its high speed and low transaction costs.

5/10: Promising Projects

$RNDR (Render): A decentralized GPU rendering network.

$ETH (Ethereum): The leading smart contract platform.

$NEAR: A scalable blockchain integrating AI technologies.

4/10: Solid Performers

$BTC (Bitcoin): The original cryptocurrency, often referred to as “digital gold.”

$INJ (Injective): A blockchain optimized for decentralized finance.

$ALGO (Algorand): Focused on security, scalability, and decentralization.

$FIL (Filecoin): A decentralized storage network.

$SUI: Designed for high-speed applications.

$APT: Developed by former Meta engineers, emphasizing scalability.

3/10: Emerging Innovators

$HBAR (Hedera): A high-speed distributed ledger technology.

$MINA: A lightweight blockchain leveraging zero-knowledge proofs.

$GRT (The Graph): A data indexing protocol for Web3 applications.

$HNT (Helium): Decentralized networks for IoT and 5G connectivity.

2/10: Potential Leaders

$QNT (Quant): Focused on blockchain interoperability solutions.

$DOT (Polkadot): Enables cross-chain communication between blockchains.

$ADA (Cardano): Competes with Ethereum in the smart contract space.

1/10: Rising Stars

$TAO: A decentralized AI network.

$GRASS: Incentivized data-sharing infrastructure.

$IMX: Layer 2 solutions for NFTs and gaming.

Key Narratives Driving Growth in 2025

DeFi Meets TradFi: Increased liquidity from traditional finance entering decentralized finance markets.

AI / DePIN: Artificial intelligence and decentralized physical infrastructure networks as major trends.

RWA’s (Real World Assets): Tokenization of physical assets supported by regulatory advancements and institutions like BlackRock.

Grayscale Trust & 21Shares ETP: Crypto-focused investment funds gaining traction among institutional investors.

Made in USA: Positive crypto legislation in the United States boosting adoption and innovation.

World Liberty Finance & Hong Kong License: Regulatory developments connecting crypto to global markets, including China.

Conclusion

This chart provides a comprehensive overview of cryptocurrencies and narratives poised to dominate the market in 2025. Chainlink ($LINK) emerges as the centerpiece due to its extensive connections across various narratives, while other projects like Avalanche ($AVAX), Ethereum ($ETH), and Render ($RNDR) show significant promise. Narratives such as AI integration, tokenization of real-world assets, and regulatory advancements will likely shape the industry’s trajectory.

Comparison of Sonic, Monad, and Sei

Current Status

Sonic: Leading the race with major DeFi protocols like Aave and Pendle already deployed on its platform. Its mainnet is live with 39 validators.

Monad: Has a strong community presence and plans for greater decentralization with 57 validators on its testnet, scaling up to 100–200 validators at mainnet launch.

Sei: Early mover in the tech space; its v2 mainnet is live but lacks network effects compared to Sonic and Monad.

Key Features Driving Adoption

Performance Metrics: While all three chains aim for high transaction throughput (100K TPS) and sub-1-second block finality, these metrics are unlikely to be a differentiator moving forward.

Community and Ecosystem Support:

Sonic has a fee-sharing program that generates daily revenue for app developers, attracting developer interest.

Monad has cultivated a loyal community and plans initiatives to increase awareness.

Sei is running creator grants to educate users about its ecosystem.

Liquid Market Creation: New chains like Monad must focus on building innovative liquid markets that attract retail users by offering earning opportunities.

Technology: All three chains use parallel execution, optimized database storage, and their own versions of Byzantine Fault Tolerance (BFT) consensus for scalability.

Strengths and Challenges

Sonic: Competitive edge due to early adoption by DeFi protocols and its live mainnet.

Monad: Advantage in decentralization and community-building efforts but still needs to launch its mainnet.

Sei: Strong technical foundation but weaker network effects compared to competitors.

Sonic currently holds the lead due to its established ecosystem support, while Monad shows promise in decentralization and community engagement. Sei remains technically strong but must enhance its network effect to compete effectively. The ultimate winner will depend on which chain can create new liquid markets and attract retail participants through innovative earning opportunities.

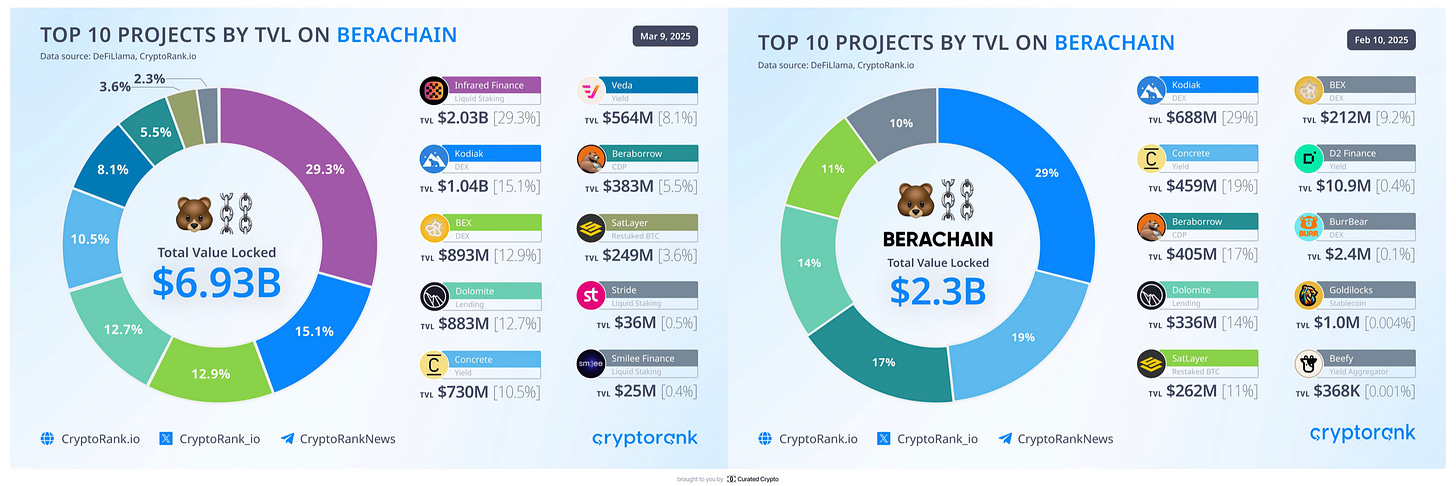

Berachain TVL Growth: February vs March 2025

Over the course of just one month, the Berachain ecosystem experienced explosive growth in Total Value Locked (TVL), rising from $2.3 billion (as of February 10, 2025) to $6.93 billion (as of March 9, 2025). This remarkable increase also brought significant changes in the rankings and distribution of projects within the network.

Key Changes:

Total TVL:

February 2025: $2.3 billion

March 2025: $6.93 billion

This represents an impressive growth of nearly 200%, highlighting Berachain’s rapid expansion.

Top Projects by TVL:

In February, the leading project was KodiakFi (DEX) with $688 million (29% of total TVL). By March, KodiakFi remained in the top tier but saw its share drop to 15.1%, despite growing to $1.04 billion.

Infrared Finance (Liquid Staking) emerged as the new leader in March with $2.03 billion (29.3% of total TVL), a project that was absent from February’s rankings.

Shifts in Distribution:

In February, the top five projects accounted for 90% of the total TVL. By March, the distribution became more diversified due to the rise of new major players.

Projects like Dolomite (Lending) and BEX (DEX) saw substantial growth: Dolomite increased from $336 million to $883 million, while BEX jumped from $212 million to $893 million.

New Entrants:

March’s rankings included new projects such as Stride ($36 million) and Smilee Finance ($25 million), which were not present in February.

Berachain is showcasing extraordinary momentum, fueled by both the growth of existing projects and the onboarding of new major players. Market leaders have shifted positions, with Infrared Finance and Veda making strong debuts, while established projects like KodiakFi and Dolomite continue to thrive. This diversification and expansion signal a bright future for Berachain in the DeFi space.

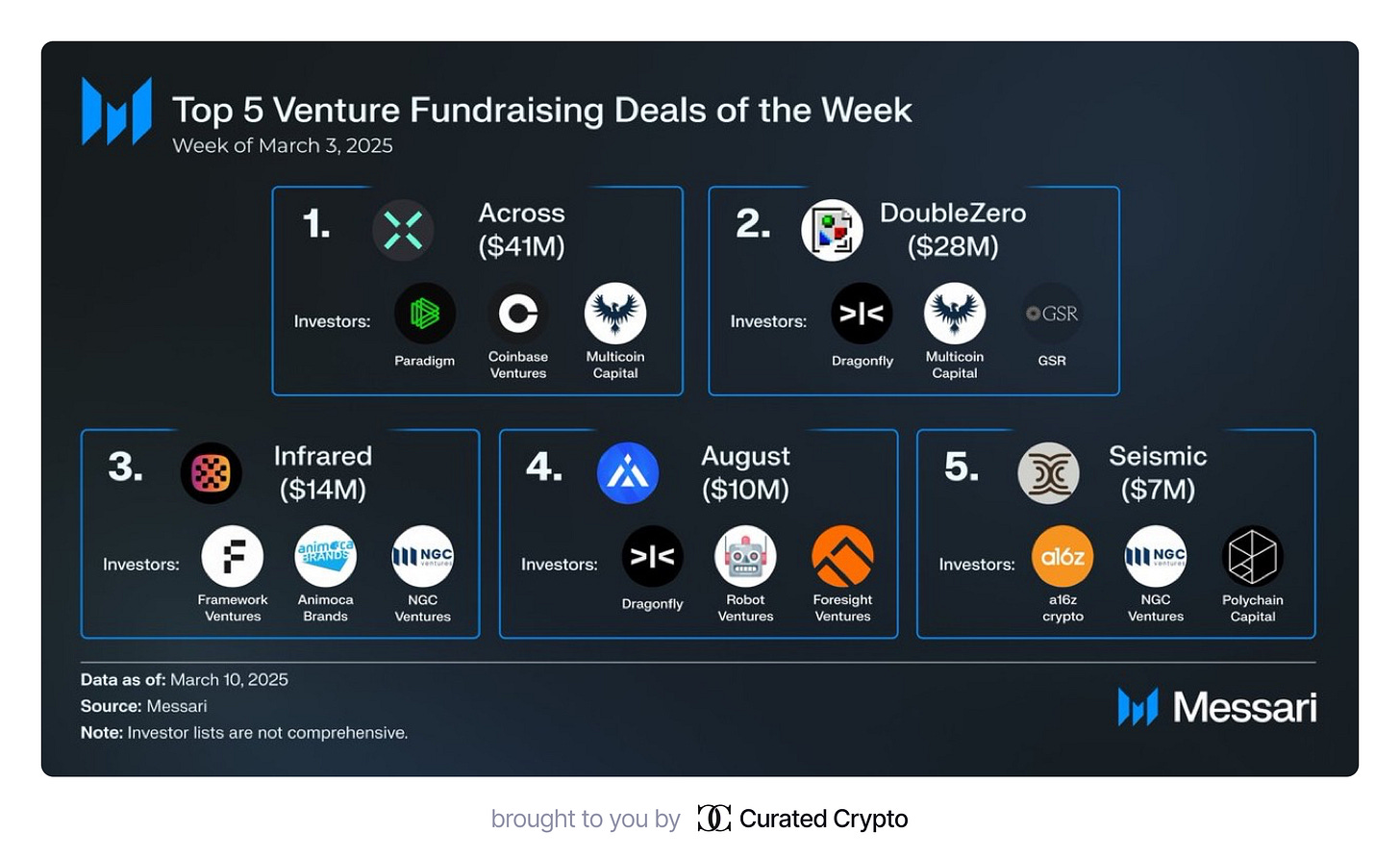

Key VC Rounds of the Week

Top 5 Venture Fundraising Deals of the Week

The week saw significant venture fundraising activity in the blockchain and crypto space, with five standout projects securing substantial investments from leading firms. These deals highlight the growing interest in innovative solutions across DeFi, infrastructure, and other blockchain technologies. Here’s a breakdown of the top fundraising deals:

1. Across Protocol ($41M)

Investors: Paradigm, Coinbase Ventures, Multicoin Capital

Overview: Across Protocol leads the week with a $41 million raise, backed by major players like Paradigm and Coinbase Ventures. The project focuses on bridging solutions for cross-chain liquidity, solidifying its position as a key player in the interoperability space.

2. DoubleZero ($28M)

Investors: Dragonfly, Multicoin Capital, GSR

Overview: DoubleZero secured $28 million, emphasizing its potential in decentralized finance (DeFi). With support from Dragonfly and GSR, the project is poised to enhance its offerings in DeFi infrastructure.

3. Infrared Finance ($14M)

Investors: Framework Ventures, Animoca Brands, NGC Ventures

Overview: Infrared Finance raised $14 million to further develop its liquid staking solutions. This funding aligns with its rapid growth in TVL on Berachain, where it recently emerged as the leading project in terms of total value locked.

4. August ($10M)

Investors: Dragonfly, Robot Ventures, Foresight Ventures

Overview: August attracted $10 million from prominent investors like Robot Ventures and Foresight Ventures. This funding will likely accelerate its efforts in blockchain-based data analytics and automation tools.

5. Seismic ($7M)

Investors: a16z crypto, NGC Ventures, Polychain Capital

Overview: Seismic rounded out the top five with a $7 million raise. Backed by heavyweights such as a16z crypto and Polychain Capital, Seismic aims to innovate in blockchain infrastructure and scalability solutions.

Key Takeaways:

Dominance of Established Investors: Paradigm, Multicoin Capital, and Dragonfly continue to lead funding rounds for high-potential projects.

Focus Areas: The fundraising highlights strong interest in cross-chain solutions (Across), liquid staking (Infrared), and infrastructure scalability (Seismic).

Berachain Connection: Infrared Finance’s inclusion underscores its growing influence within the Berachain ecosystem after achieving $2 billion TVL.

These deals reflect the ongoing momentum in blockchain innovation and investor confidence in projects driving the next wave of decentralized technologies.

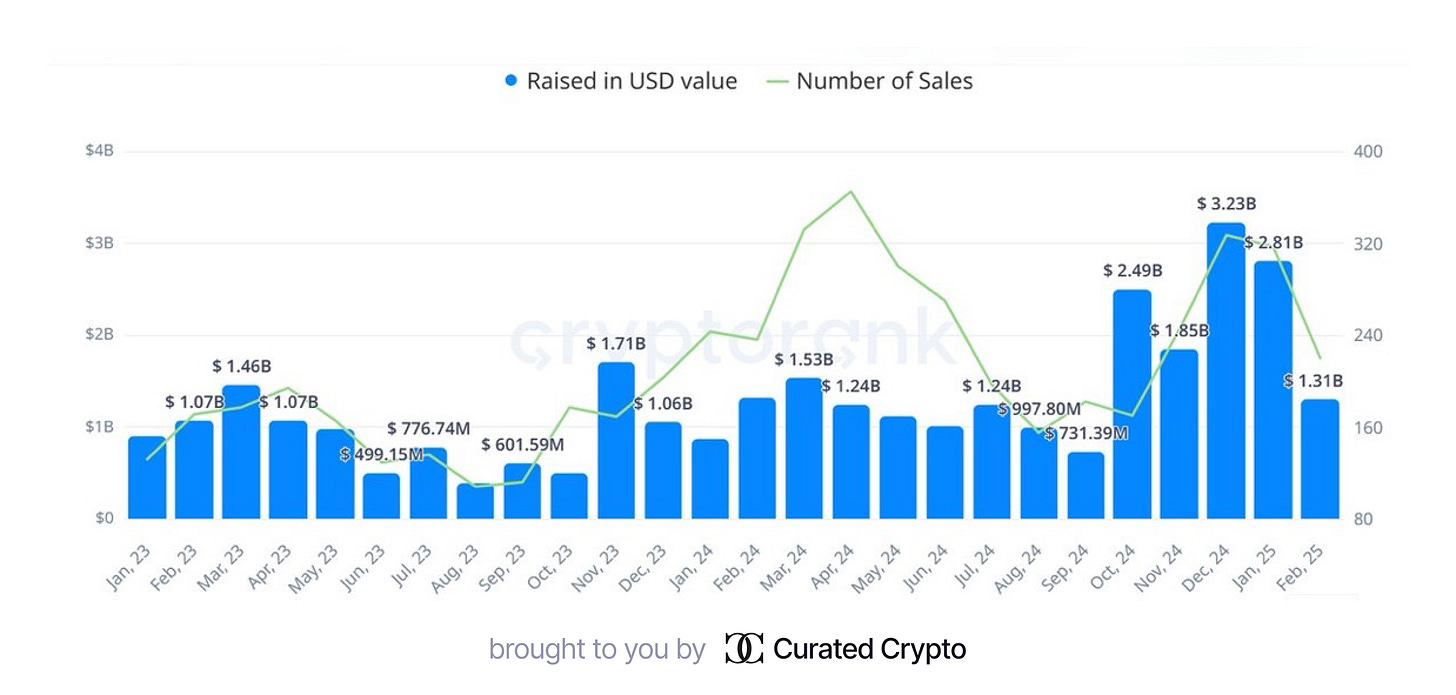

Crypto Fundraising Trends: January 2023 to February 2025

The attached chart illustrates the monthly trends in crypto fundraising over the past two years, showcasing fluctuations in both the total amount raised (in USD) and the number of sales. Notably, the fundraising landscape saw a significant surge following Donald Trump’s re-election in October 2024, marking the highest levels in over two and a half years.

Key Observations:

Early Stability (January–June 2023):

Fundraising remained relatively stable during the first half of 2023, with amounts hovering around $1 billion monthly.

The number of sales showed moderate activity, peaking slightly in February 2023 alongside $1.46 billion raised.

Mid-Year Decline (July–September 2023):

A noticeable drop occurred in July 2023, with funds raised falling to $776.74 million and continuing to decline to $601.59 million by September.

Sales activity also decreased during this period, reflecting reduced investor interest.

Recovery and Growth (October 2023–March 2024):

Fundraising rebounded strongly in late 2023, reaching $1.71 billion in November.

This growth continued into early 2024, with consistent monthly totals exceeding $1 billion and peaking at $1.53 billion in March.

Post-Election Surge (October–December 2024):

Following Trump’s re-election in October 2024, crypto fundraising surged dramatically:

October 2024: $2.49 billion raised.

December 2024: A record-breaking $3.23 billion raised, alongside heightened sales activity.

This period marked the most significant fundraising momentum since January 2023.

Recent Decline (January–February 2025):

While still strong, fundraising cooled slightly from its December peak:

January 2025: $2.81 billion raised.

February 2025: $1.31 billion raised, indicating a return to more normalized levels.

The crypto fundraising landscape has demonstrated resilience and adaptability over the past two years, with notable surges tied to macroeconomic and political events like Trump’s re-election. Despite recent cooling, the sector remains robust, driven by increasing institutional interest and innovation within blockchain technologies.

Decrypting Market Trends: A Look at Long-Term Crypto Effects

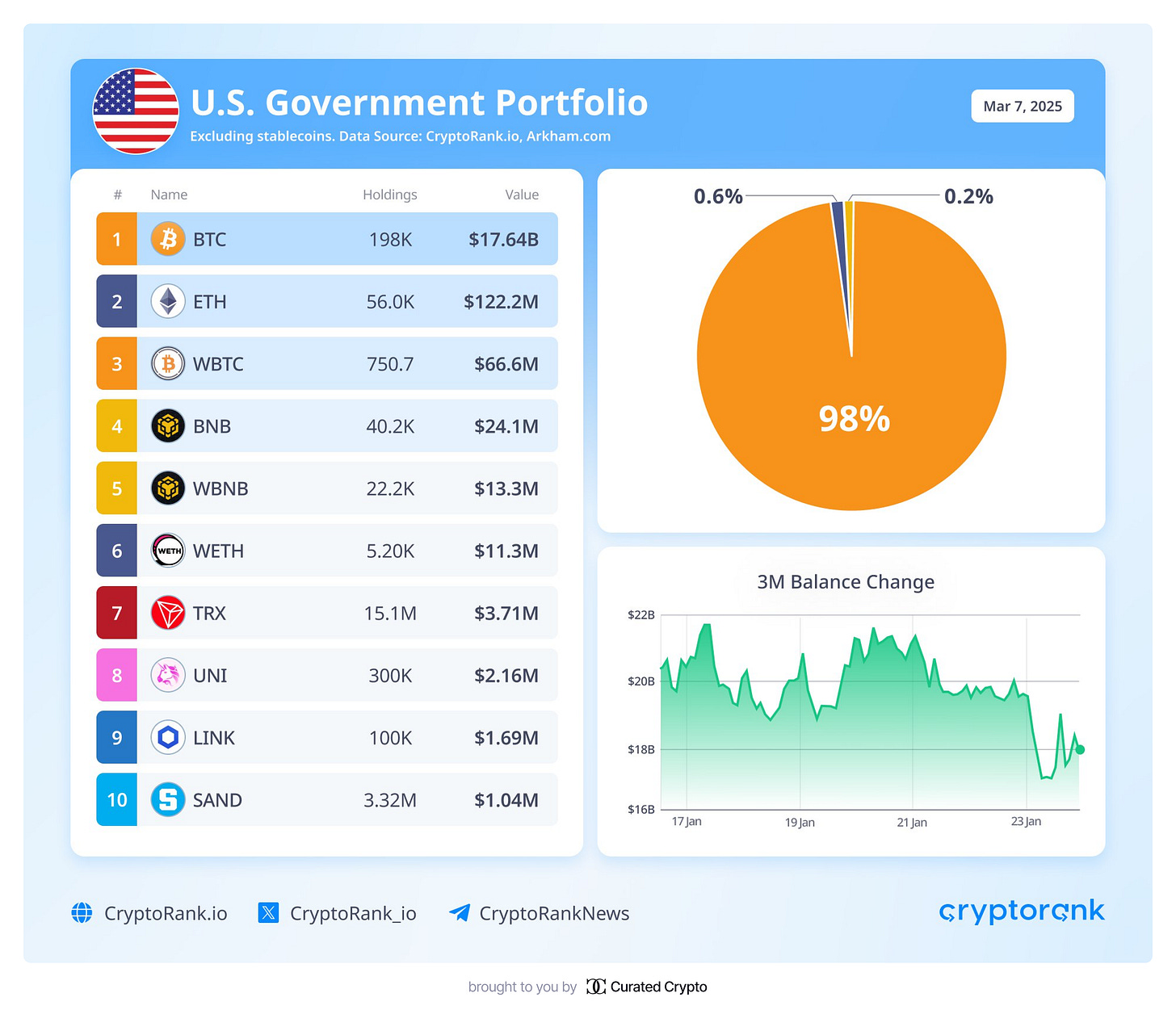

Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile: Key Points

President Trump has established a new initiative for managing digital assets, with a focus on Bitcoin. Here are the main details of this strategic move:

Strategic Bitcoin Reserve

Source: The reserve will be created using Bitcoin forfeited in criminal or civil proceedings.

Purpose: Bitcoin will be maintained as a store of reserve assets.

Policy: These Bitcoin reserves will not be sold.

Expansion: The Treasury and Commerce departments are authorized to develop budget-neutral strategies for acquiring additional Bitcoin.

U.S. Digital Asset Stockpile

Scope: This stockpile will include other forfeited digital assets beyond Bitcoin.

Acquisition Policy: The government will not purchase additional assets for this stockpile beyond what is obtained through forfeitures.

Accountability and Leadership

Reporting: Government agencies are required to provide a full accounting of digital assets to the Treasury.

Strategic Position: This initiative aims to position the United States as a leader in government digital asset strategy.

This move represents a significant shift in the U.S. government’s approach to cryptocurrencies, particularly Bitcoin, recognizing its potential as a strategic asset while leveraging existing legal processes to build reserves.

Tether Freezes $27 Million in USDT on Russian Exchange Garantex

Stablecoin operator Tether has frozen $27 million worth of USDT on the sanctioned Russian cryptocurrency exchange Garantex. This action has forced the platform to suspend all operations, including withdrawals, and place its website under maintenance.

Background and Context

The freeze comes shortly after the European Union included Garantex in its 16th package of sanctions against Russia on February 26, 2025. These sanctions are part of ongoing measures related to Russia’s actions in the Ukraine conflict. The EU specifically targeted Garantex for its ties to Russian banks already under sanctions.

This marks a significant step by the EU, as it is the first time a cryptocurrency exchange based in Russia has been directly sanctioned. The U.S. had previously imposed sanctions on Garantex through the Department of the Treasury’s Office of Foreign Assets Control (OFAC) in April 2022.

Garantex’s Response

In a statement on March 6, Garantex accused Tether of “entering the war against the Russian crypto market” by freezing wallets containing over 2.5 billion rubles (approximately $27 million). The exchange warned its users that “all USDT in Russian wallets is currently under threat” and declared its intention to fight back, though no specific course of action was outlined.

Implications for the Crypto Market

The freeze highlights Tether’s ability to enforce compliance with international sanctions, raising concerns among users about the security of their funds on platforms affected by geopolitical tensions. It also underscores the growing scrutiny on cryptocurrency exchanges and stablecoin operators as tools for enforcing financial restrictions.

This development adds another layer to the complex relationship between cryptocurrencies and global regulatory frameworks, particularly in politically sensitive regions.

The Future of Finance: SWIFT, ISO 20022, and Digital Asset Integration

SWIFT is actively shaping the future of global finance by focusing on standardizationand integration between traditional systems and emerging technologies like Distributed Ledger Technology (DLT) and digital assets. Below are key updates and initiatives:

ISO 20022 Adoption

The migration to ISO 20022 continues globally, with 74% of payment market infrastructures (PMIs) already transitioned, covering 31% of Swift’s PMIs.

Updated guidelines for CBPR+ include new message types (admi.024 and camt.025) and harmonized practices for interbank statement messages.

By March 2025, U.S. banks must complete their transition to ISO 20022 for cross-border payments, marking a major milestone.

Digital Asset Trials

SWIFT is launching live trials in 2025 to integrate tokenized deposits, CBDCs, and regulated digital assets into its network.

These trials aim to address “digital islands” by creating a unified platform for seamless transactions across fiat and digital currencies.

SWIFT is collaborating with BIS’s Project Agorá to explore tokenized commercial bank deposits and wholesale CBDCs on a single system.

Standards Evolution

SWIFT is updating its FINplus standards to support richer ISO 20022 message formats, enhancing compatibility across securities and funds transactions.

The organization continues refining technical standards to align with business changes and emerging technologies.

Significance

These developments highlight SWIFT’s commitment to enabling interoperabilitybetween legacy systems and new financial technologies. By harmonizing standards like ISO 20022 and integrating digital assets, SWIFT is paving the way for a more connected and efficient global financial ecosystem.

Research Spotlight

Defining Tokens: A Framework by a16z Crypto

Andreessen Horowitz (a16z) explores token classification frameworks, distinguishing utility, governance, and value accrual tokens. It emphasizes the role of tokens in incentivizing participation and fostering decentralized ecosystems.

Source: a16z Crypto

What the Dogecoin Community Thinks About Elon Musk

This article delves into the Dogecoin community’s mixed reactions to Elon Musk’s influence. While some praise his support for DOGE adoption, others criticize his impact on market volatility and speculative hype.

Source: Decrypt

Solana vs. Ethereum: A Decentralized Finance Perspective

This report compares Solana’s scalability and low fees with Ethereum’s security and decentralization in DeFi applications. It examines their adoption trends and future potential in decentralized finance ecosystems.

Source: Franklin Templeton

DePIN Market Analysis

This Twitter thread analyzes the DePIN (Decentralized Physical Infrastructure Networks) market, highlighting its fundamentals, growth, and key sectors like Machine Learning, File Storage, and Streaming & Rendering. It also notes the increasing adoption in emerging markets and interest from Web2 giants.

Source: Stacy Muur

AI Agents: Adoption Phase

This Twitter thread discusses the adoption cycle of AI agents in crypto, noting the shift from initial hype to disillusionment, and emphasizing the importance of researching solid projects with profitable models.

Source: DeFi Warhol

How to Utilize AI Agents in DeFi Platforms

This guide explains how AI agents optimize DeFi by automating trading strategies, risk management, and portfolio rebalancing. It highlights their role in improving user experience and driving mass adoption of decentralized finance.

Source: Cointelegraph