This Week In Crypto: Spring Flare-up

The must-read weekly digest for crypto enthusiasts—trends, insights, and airdrop opportunities in one place.

TL;DR

Market Sentiment: The cryptocurrency market shows signs of revival in 2025, with a significant influx of $644 million into digital assets, leading to increased assets under management and optimistic forecasts for Bitcoin’s price, while the stablecoin market cap reaches $236.7 billion, potentially signaling a forthcoming market rally.

Yield Opportunities: Mantle, Solv Protocol, Pendle Finance, Sonic, and Silo Finance offering innovative yield strategies, staking opportunities, and farming methods for maximizing returns on various cryptocurrencies, particularly ETH and BTC-related assets.

New Airdrops: the most promising testnets include Sentient, Chaos Labs, Plasma, Mira, and Yala, each offering innovative blockchain and cryptocurrency solutions and having received significant funding.

Upcoming TGEs and Token Sales: $JACK (Mar 26), $RSLV, $POLLEN (Mar 28), $KERNEL, $STB (Mar 31), $AAA (Apr 3), and mainnets $OG, $INIT (March).

Key Developments:

The launch of Proof of Liquidity on Berachain took place on March 24;

The activation of the Pectra upgrade for Ethereum on the Hoodi platform is scheduled for March 26.

Special note: The Landscape of Tokenized RWAs

Research of the week: The State of Stablecoins 2025: Supply, Adoption & Market Trends

Digital Waves: The Crypto Market’s New Tide

The cryptocurrency market is showing signs of revival after a period of uncertainty. Recent data indicates a significant influx of investments into digital assets, breaking a five-week streak of outflows. The total inflow amounted to $644 million USD, leading to a 6.3% increase in assets under management from the March 10th low. This reversal in investor sentiment is accompanied by optimistic forecasts from some analysts regarding the future dynamics of the Bitcoin price.

Geographically, the main inflow of funds was observed in the United States, followed by Switzerland, Germany, and Hong Kong, indicating a widespread positive sentiment. Against this backdrop, market experts such as Arthur Hayes predict a potential testing of Bitcoin’s all-time high, linking this to expected changes in the Fed’s monetary policy.

These trends form an intriguing context for analyzing the current state and prospects of the cryptocurrency market, taking into account both quantitative indicators of investment inflows and qualitative assessments from influential industry figures.

The Ebb and Flow: Bitcoin’s Conflicting Signals in a Maturing Market

The cryptocurrency market continues to present a complex landscape, with Bitcoin (BTC) at the center of conflicting indicators and market dynamics. Recent data paints a picture of strong institutional demand juxtaposed against potential retail investor fatigue and bearish sentiment indicators.

ETF Appetite Outpaces Miner Production

U.S. Bitcoin ETFs have demonstrated a voracious appetite for BTC, significantly outpacing the rate of new coin production. According to HODL15Capital, American spot Bitcoin ETFs purchased nearly triple the amount of BTC mined in the same period last week. This trend underscores the growing institutional interest in Bitcoin and suggests a potential supply squeeze if sustained.

Short-Term Holder Resilience

Despite recent market volatility, short-term Bitcoin holders are showing resilience. Glassnode data indicates that while unrealized losses among this cohort have increased, they have not yet reached levels typically associated with mass capitulation. This suggests that many recent investors are maintaining their positions, potentially providing some stability to the market.

Bearish Sentiment Indicators

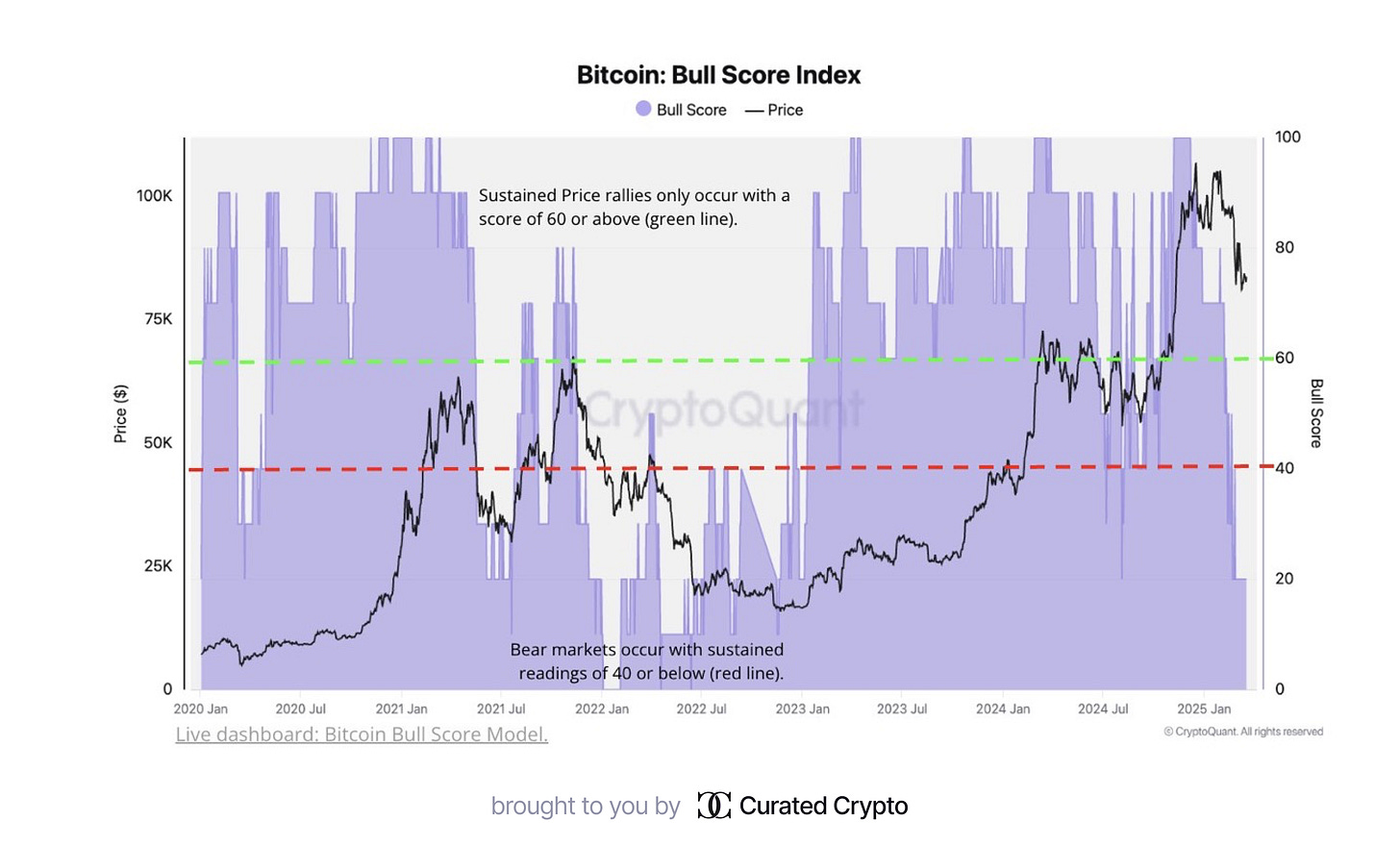

However, not all metrics paint a bullish picture. The CryptoQuant Bull Score Index has plummeted to 20, its lowest level since January 2023. This score suggests:

A weak investment environment for Bitcoin

Reduced likelihood of a sustained rally in the near term

Potential continuation of bearish market conditions if the score remains below 40 for an extended period

Bitcoin’s Growing Share of Global Money Supply

Despite these bearish indicators, Bitcoin’s long-term trajectory remains noteworthy. With a current market capitalization of $1.7 trillion, Bitcoin now represents 1.3% of the global money supply. This milestone highlights Bitcoin’s gradual integration into the world financial system, though experts from River emphasize that this adoption is still in its early stages.

To put this in perspective:

Bitcoin’s market cap: $1.7 trillion

Global money supply: Approximately $110 trillion

Bitcoin’s current share: 1.3%

This data suggests significant room for growth as Bitcoin continues to penetrate the broader financial markets.

Conclusion

The current state of the Bitcoin market presents a dichotomy of strong institutional demand through ETFs and bearish sentiment indicators. While short-term holders show resilience, the low Bull Score suggests caution. However, Bitcoin’s growing share of the global money supply indicates its increasing relevance in the financial ecosystem. As the market matures, these conflicting signals may lead to increased volatility in the short term, while the long-term trajectory remains a subject of keen interest for investors and analysts alike.

Whale Activity and Institutional Interest Surge Amid Ethereum’s Mixed Signals

The Ethereum ecosystem is experiencing a complex interplay of bullish and bearish indicators, with significant whale accumulation and institutional interest contrasting against declining on-chain activity.

Whale Accumulation and Institutional Moves

Whales have been actively accumulating ETH since March 18, according to Sentiment data. This trend is further corroborated by Token Terminal, which reports a 30% increase in whale wallets holding 10,000 to 100,000 ETH since mid-March.

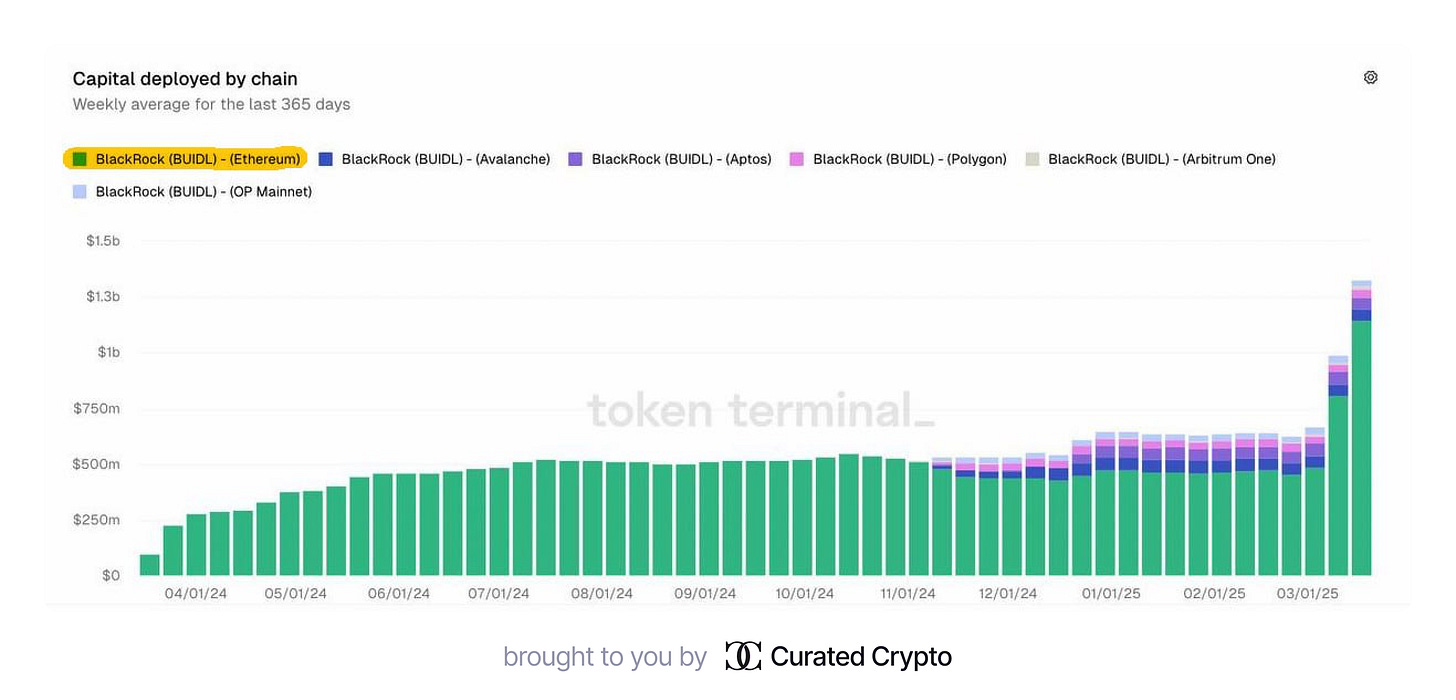

Institutional interest is also on the rise, with BlackRock significantly increasing its ETH holdings for its tokenized BUIDL fund. The fund’s Ethereum holdings have grown to $1.145 billion, up from $990 million just a week earlier. This 15% increase in ETH allocation signals strong institutional confidence in Ethereum’s long-term prospects.

Adding to the institutional momentum, Fidelity has filed an application to register a tokenized version of its Fidelity Treasury Digital Fund (FYHXX) on the Ethereum network. This move by one of the world’s largest asset managers further legitimizes Ethereum’s role in the tokenization of traditional financial assets.

Supply Dynamics and Exchange Outflows

Ethereum’s supply dynamics are showing intriguing trends. The supply of ETH on exchanges has plummeted to 8.97 million ETH, the lowest level since November 2015[8]. This significant reduction in exchange liquidity suggests that investors are moving their ETH to cold storage, potentially setting the stage for a supply shock.

This trend mirrors a similar pattern observed with Bitcoin earlier this year, where reduced exchange reserves preceded a sharp price surge. The ETH/BTC ratio has also hit a 5-year low, indicating potential undervaluation of Ethereum relative to Bitcoin.

Declining On-Chain Activity

Despite the bullish signals from institutional interest and whale accumulation, Ethereum’s on-chain metrics paint a different picture. The network has experienced a sharp decline in activity:

The daily ETH burn rate hit an all-time low of 53.07 ETH on March 22, 2025.

Transaction fees have plummeted to their lowest levels since late August, averaging just $0.41 per transfer.

The number of daily active addresses and transactions has dropped to a two-year low.

This reduction in on-chain activity is largely attributed to the migration of transactions to Layer 2 scaling solutions, which offer lower costs and faster processing.

The Ethereum ecosystem is at a crossroads, with strong institutional backing and whale accumulation contrasting against declining on-chain activity. While the reduced network usage raises concerns about Ethereum’s immediate demand, the significant institutional interest and supply dynamics suggest potential for future price appreciation. As the market digests these mixed signals, Ethereum’s ability to maintain its position as a leading blockchain platform will likely depend on the success of upcoming upgrades and its adaptation to the evolving DeFi and Layer 2 landscape.

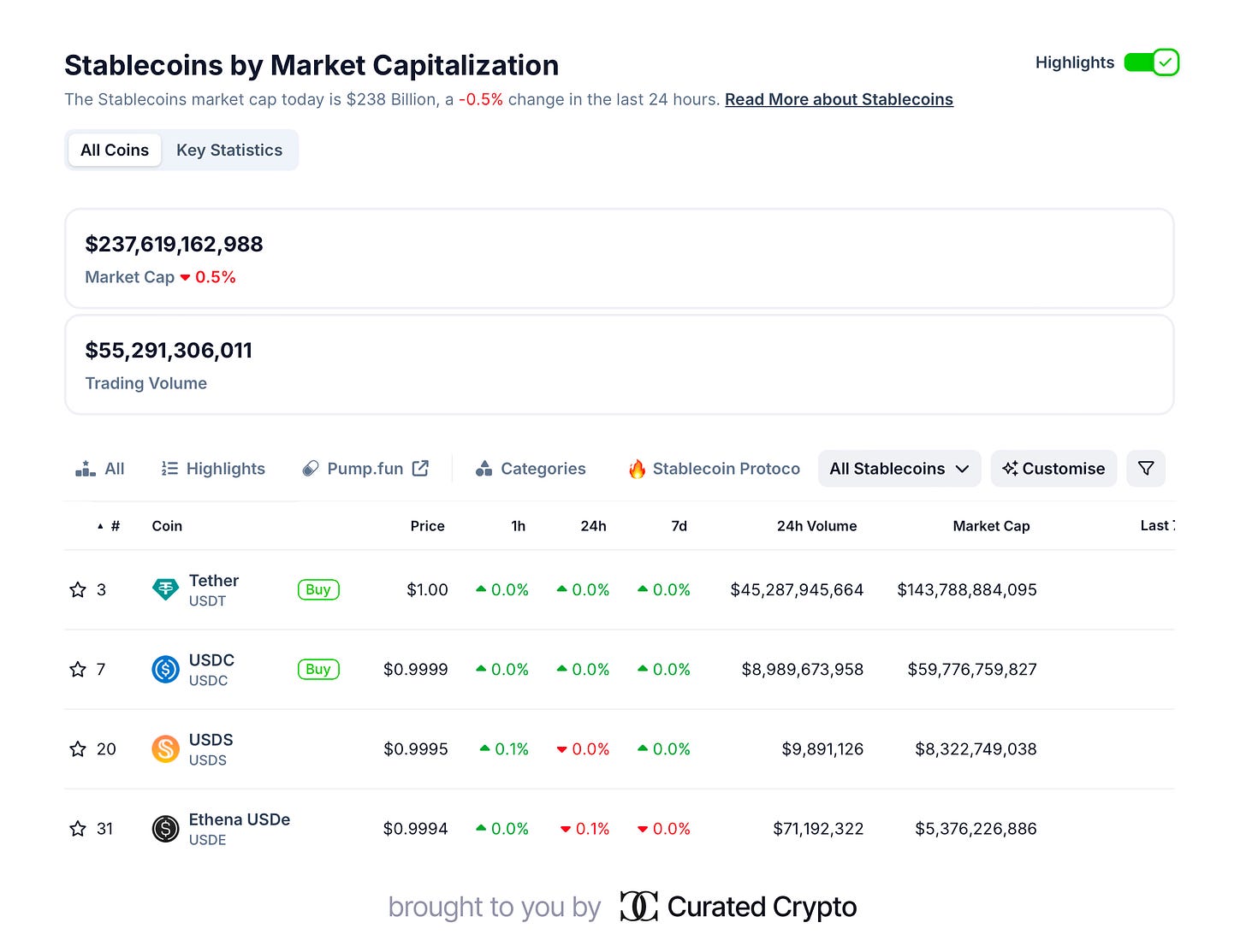

Stablecoins on the Rise: Market Cap Surpasses $236 Billion

According to the latest data from CoinGecko, as of March 25, 2025, the total market capitalization of stablecoins has reached a record level of $237.6 billion. This marks a significant increase from the $230 billion mark recorded just a few days ago. Such rapid growth indicates growing liquidity and potential for a powerful rally in the cryptocurrency market in the near future.

Tether (USDT) and USD Coin (USDC) remain the market leaders in the stablecoin sector. As of March 21, 2025, USDT’s market cap stood at nearly $144 billion, accounting for 62.6% of the entire stablecoin market. USDC holds the second position with a market cap of around $59 billion. Notably, the total stablecoin market cap has grown by $2.3 billion over the past week, and compared to the same period last year, the growth is an impressive 56%.

Despite the recent price decline in Bitcoin and other cryptocurrencies, the steady growth in stablecoin market cap demonstrates the maturity and resilience of this market segment. Investors are increasingly using stablecoins as a safe haven during times of heightened volatility, as well as to facilitate trading and participate in decentralized finance (DeFi) applications.

Analysts note that the high liquidity of stablecoins could act as a catalyst for the next bull cycle in the cryptocurrency market. Historically, large stablecoin reserves on exchanges have preceded significant rallies. Once market sentiment shifts positively, this liquidity could quickly flow into assets such as Bitcoin and Ethereum, triggering price increases across the market.

It’s important to note the emergence of new players in the stablecoin market. For example, the recently launched Ripple stablecoin RLUSD has already reached a circulating supply of $160 million. This indicates growing diversity and competition in the stablecoin sector.

Be sure to review this document: “The State of Stablecoins 2025: Supply, Adoption & Market Trends”

Crypto Yield Insights: Weekly Opportunities

Mantle: The Rising Star in DeFi Yield Strategies for ETH

Mantle is emerging as a key player in the DeFi space, offering attractive yield strategies for ETH. While many focus on Sonic, Mantle provides more lucrative opportunities.

mETH Protocol

4th largest liquid staking protocol

Successfully handled the Bybit security incident

Offers mETH (liquid staking) and cmETH (liquid restaking) tokens

Yield Strategies

Deposit cmETH in Pendle:

Stable 6.7% yield with ~100 days to maturity

Low risk, easy to use

Deposit cmETH in WOOFi Supercharger:

15% APY (3.5% from liquid staking + 11.5% in $wMNT)

No impermanent loss risk

Neutral Strategy

Long cmETH (via WOOFi or Pendle)

Short ETH (on Binance or Hyperliquid)

Total yield of about 15% APY without direct ETH exposure

Additional Opportunities

New Reward Station on WOOFi: chance to win a share of 800K $WOO by locking $MNT

Metamorphosis Season 3 approaching, potentially a good time to interact with Mantle DeFi apps

Mantle offers diverse strategies to maximize ETH yield, from simple deposits to complex neutral positions, catering to various risk appetites and investment goals.

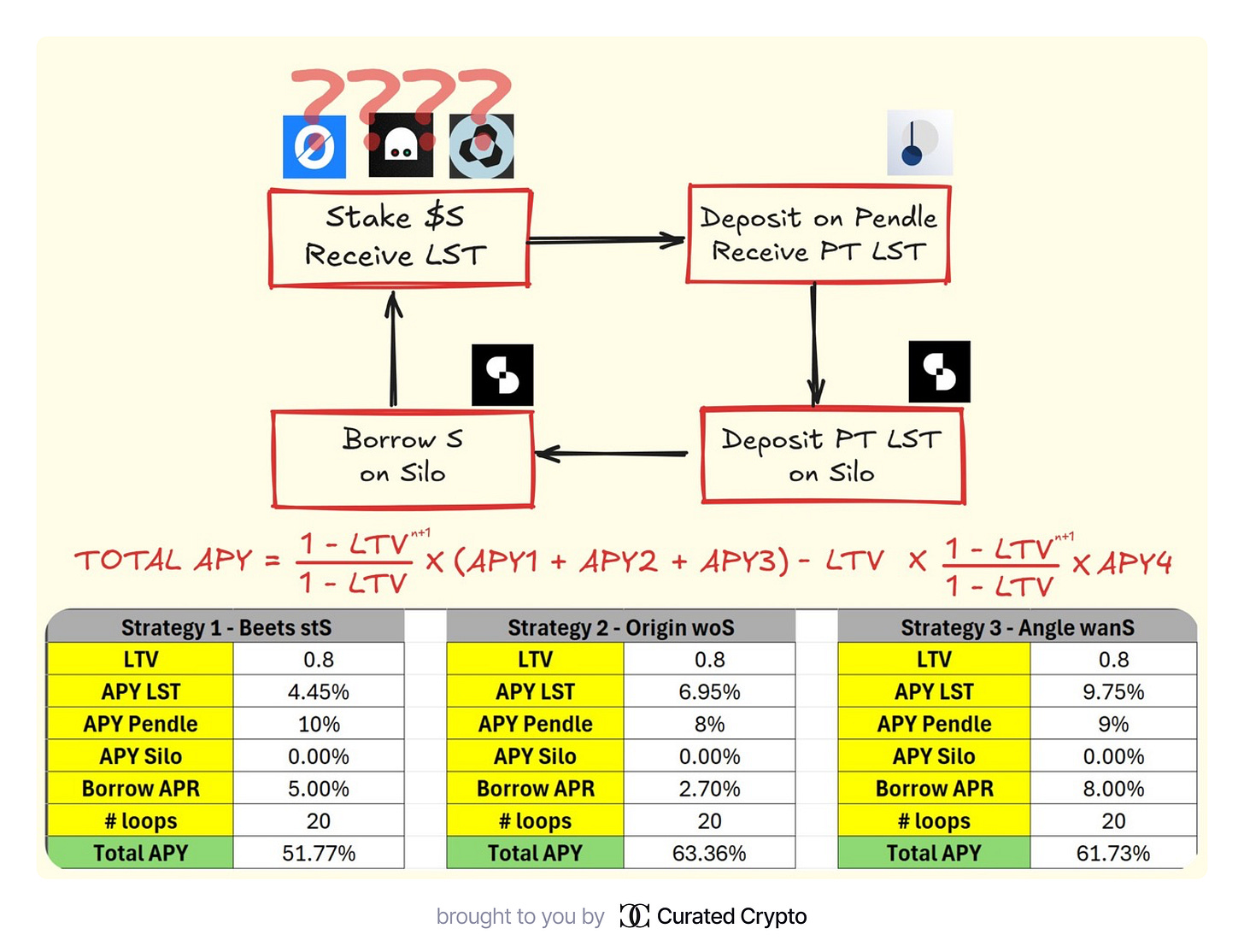

Comparison of Liquid Staking Looping Strategies on Sonic Labs

Sonic Labs offers attractive opportunities to maximize $S yield through liquid staking looping strategies. Here are the key points:

General Strategy

Liquid stake $S

Deposit liquid staking tokens on Pendle

Deposit PT LST on Silo Finance

Borrow $S

Repeat the cycle

Provider Comparison

1. Beets

$S staking: 4.45% APR

Total yield: 51.77% APY

$S staking: 6.95% APR

Total yield: 63.36% APY

wOS maturity: 66 days

3. Angles

$S staking: 9.75% APR

Total yield: 61.73% APY

wanS maturity: 157 days

Key Takeaways

Origin and Angle offer similar total yields

The main difference is in token maturity periods

Choice between Origin and Angle depends on individual investor goals

40% of $S supply is already staked, confirming the strategy’s profitability

This strategy allows for significant yield on $S with minimal risk, using a structured approach to liquid staking looping.

The Quiet Bitcoin Revolution: How the US is Embracing BTCFi

Recent information suggests that the United States is quietly accumulating Bitcoin (BTC) without selling, signaling the dawn of a new era in BTCFi (Bitcoin Finance). Experts advise not to miss this opportunity to stay ahead in the future.

To gain exposure to BTCFi, it’s recommended to use the SolvProtocol platform and multiply $S points on SiloFinance. Here are some strategies to maximize points:

SolvBTC.BBN/SolvBTC pool:

SolvBTC.BBN: 2x Sonic Points, 3x Solv Points, 1x Babylon Points, increased Silo Points

SolvBTC: 2x Sonic Points, 3x Solv Points

s/scUSD pool:

$S: 8x Sonic Points, Silo Points

$scUSD: 12x Sonic Points, 1.5x Rings Points, Silo Points

wstkscUSD/USDC pool:

wstkscUSD: 12x Sonic Points, 2x Rings Points, Silo Points

USDC: 10x Sonic Points, increased Silo Points

stS/S pool (for stS holders from Beets):

$stS: 8x Sonic Points, Silo Points

$S: 8x Sonic Points, increased Silo Points

Additionally, Silo Finance v2 offers opportunities to leverage Pendle Finance yields, including new markets for PT-wstkscUSD and PT-wstkscETH paired with USDC and ETH respectively.

Experts claim that while many are still debating whether to buy BTC, “smart money” is already profiting from BTCFi on Silo v2. It’s recommended not to miss this opportunity and join the revolution in the world of cryptocurrencies and decentralized finance.

Don’t fall behind in the BTCFi revolution – start leveraging these strategies on SolvProtocol and Silo Finance v2 to maximize your potential gains in this emerging financial landscape.

Boosting Earnings Through Airdrop Farming

Top Testnets to Watch in Q2 2025: A Comprehensive Guide

As we approach the second quarter of 2025, the blockchain and cryptocurrency landscape continues to evolve rapidly. Here’s a curated list of promising testnets that developers and enthusiasts should keep an eye on:

Upcoming Testnets with Significant Funding

Sentient ($85M): A new open AGI economy for AI developers and creators, backed by Pantera and Framework.

Chaos Labs ($79M): Offering cutting-edge risk management solutions for DeFi.

Plasma ($24M): A platform for zero-fee payments built on Bitcoin.

Mira ($9M): A decentralized infrastructure platform aimed at universalizing AI.

Yala ($8M): A modular infrastructure offering a lending protocol allowing users to borrow stablecoins with over-collateralization.

Succinct ($55M): A decentralized zk-proof protocol utilizing proof competition.

RISC Zero ($52M): Building a next-generation scalable blockchain using zero-knowledge proof technology and RISC-V zkVM.

Double Zero ($28M): The world’s first N1 chain (not L1 or L2).

Somnia ($270M): An L1 chain boasting over 1 million TPS and sub-cent fees.

Lens Chain ($46M): A chain for social finance.

Testnets to Avoid or Reconsider

It’s crucial to note that some frequently advertised testnets are no longer relevant or do not offer incentives:

Nillion (completed)

0G Labs (no airdrop in testnet)

MegaETH (appears to be non-incentivized)

Base (legal issues with airdrop)

Initia (nearing completion, 90%)

As the blockchain ecosystem continues to expand, it’s essential to focus on current and incentivized testnets. The projects listed above represent some of the most promising opportunities for developers and early adopters in the coming months. However, always conduct your own research and stay informed about the latest developments in this rapidly changing field.

Top 5 DePIN Projects to Participate in for Upcoming Airdrops

Decentralized Physical Infrastructure Networks (DePIN) are gaining traction in the blockchain space. Here are five promising projects to consider for potential future airdrops:

1. DAWN

Complete all social tasks

Accumulate points

2. Bless

Register via email

Engage in farming and complete quests

3. Nodepay

Sign up using your email

4. Gradient Network

Complete all tasks

5. Grass

Create an account

Farm maximum points

Key Takeaways:

Install browser extensions for each project

Complete all available tasks and quests

Engage in farming activities to accumulate points

Stay active within each project’s ecosystem

By participating in these DePIN projects, you position yourself for potential future airdrops. Remember to always conduct your own research and stay informed about project developments and community updates.

Mastering TGE: Key Token Offerings

Upcoming Crypto Events: March-April 2025

Below is a curated list of upcoming events in the crypto space, including token sales, mainnet launches, and other major milestones. Links to the official Twitter accounts of the projects are embedded for easy access.

March 2025

Magpie Protocol ($FLY): Token sale on Fjord — March 21.

Hana Network ($HANA): Token sale ongoing until April 1.

Shardeum ($SHM): Token sale ongoing until April 14.

Arcium ($ARCIUM): Token sale on CoinList — March 24.

Nillion ($NIL): Primary token listing — March 24.

Lit Ptotocol ($LITKEY): Token sale on Legion — March 24.

Stable Jack ($JACK): Token sale — March 26.

Resolv ($RSLV): Token sale on Legion — March 27.

Walrus ($WAL): Mainnet release — March 27.

Pollen ($POLLEN): Token sale — March 28.

End of March - Early April

KernelDAO ($KERNEL): Token release — March 31.

Stable ($STB): Token sale — March 31.

Arcadia Finance ($AAA): Token sale — April 3.

Additional Projects (Dates TBD in March)

Mango Network ($MGO): Token release.

Corn ($CORN): Token release.

0G Labs ($OG): Mainnet release.

Initia ($INIT): Mainnet release.

Pryzm ($PRYZM): Token sale.

This timeline provides insight into key developments in the crypto industry for late March and early April. Follow the official accounts for real-time updates.

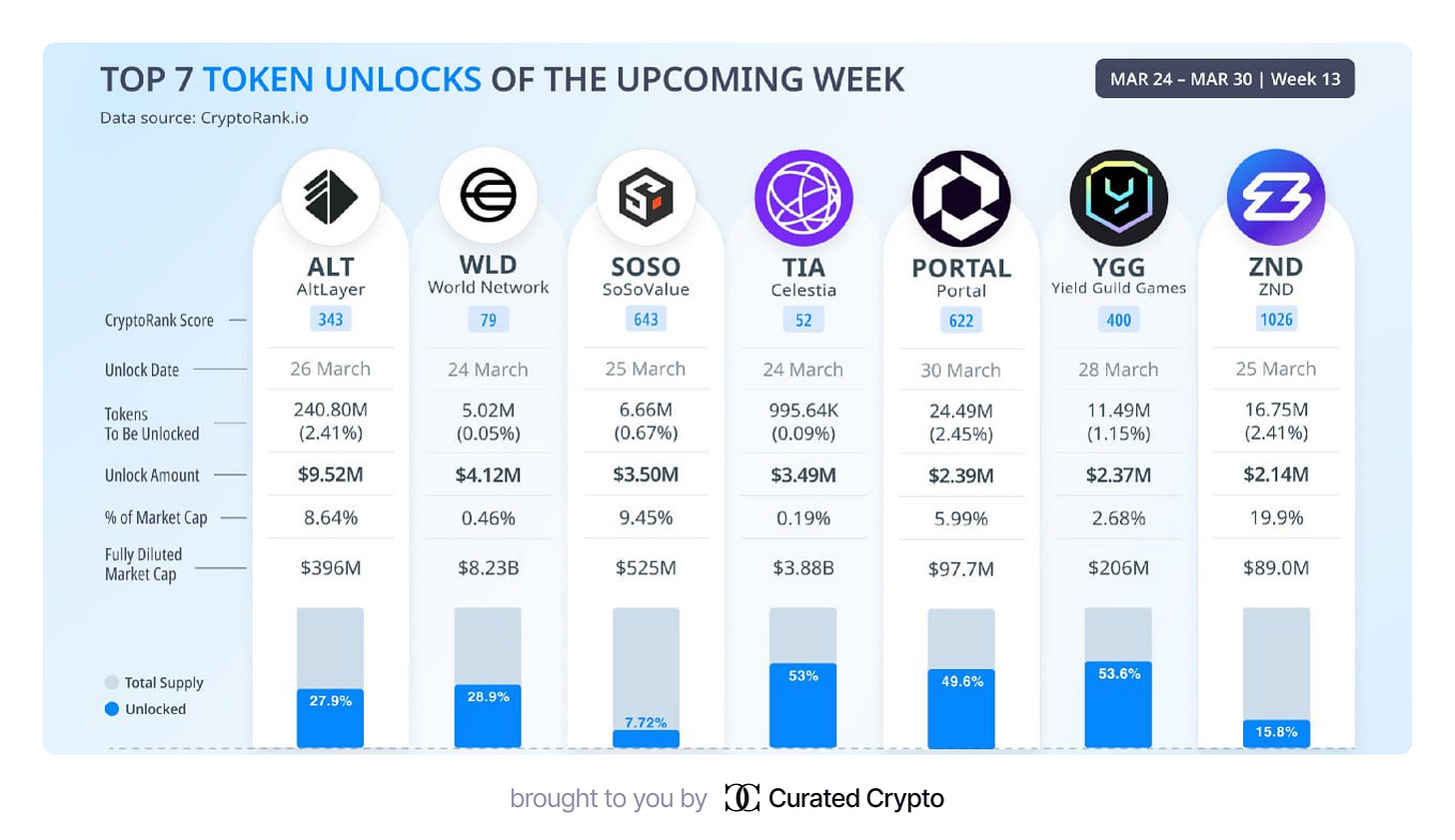

Token Unlocks This Week (March 24–30, 2025)

Top 7 Token Unlocks

This week, several major token unlock events are expected, which could impact market liquidity and token prices. Here are the top 7 tokens with the largest unlock amounts:

$ALT (AltLayer)

Unlock Date: March 26

Tokens to be unlocked: 240.80M (2.41% of total supply)

Unlock Amount: $9.52M

Percentage of Market Cap: 8.64%

Fully Diluted Market Cap: $396M

$WLD (World Network)

Unlock Date: March 24

Tokens to be unlocked: 5.02M (0.05% of total supply)

Unlock Amount: $4.12M

Percentage of Market Cap: 0.46%

Fully Diluted Market Cap: $8.23B

$SOSO (SoSoValue)

Unlock Date: March 25

Tokens to be unlocked: 6.66M (0.67% of total supply)

Unlock Amount: $3.50M

Percentage of Market Cap: 0.67%

Fully Diluted Market Cap: $525M

$TIA (Celestia)

Unlock Date: March 24

Tokens to be unlocked: 995.64K (0.09% of total supply)

Unlock Amount: $3.49M

Percentage of Market Cap: 0.19%

Fully Diluted Market Cap: $3.88B

$PORTAL (Portal)

Unlock Date: March 30

Tokens to be unlocked: 24.49M (2.45% of total supply)

Unlock Amount: $2.39M

Percentage of Market Cap: 5.99%

Fully Diluted Market Cap: $97.7M

$YGG (Yield Guild Games)

Unlock Date: March 28

Tokens to be unlocked: 11.49M (1.15% of total supply)

Unlock Amount: $2.37M

Percentage of Market Cap: 2.68%

Fully Diluted Market Cap: $206M

$ZND (ZND)

Unlock Date: March 25

Tokens to be unlocked: 16.75M (2.41% of total supply)

Unlock Amount: $2.14M

Percentage of Market Cap: 19.9%

Fully Diluted Market Cap: $89M

Weekly Insider Unlocks

In addition to public unlocks, insider token releases are scheduled this week, totaling over $8,600,000 in value.

Key Unlocks:

$MMX (March 24)

Unlock Amount: $1.18M (38.33% unlocked)

Impact: Represents 1.07% of circulating supply.

$HOOK (March 25)

Unlock Amount: $600K (49.50% unlocked)

Impact: Represents 1.76% of circulating supply.

$VENOM (March 25)

Unlock Amount: $1.24M (28% unlocked)

Impact: Represents 0.51% of circulating supply.

$ALT (March 25)

Unlock Amount: $3.83M (27.91% unlocked)

Impact: Represents 3.61% of circulating supply.

$ALEPH (March 26)

Unlock Amount: $166K (83.60% unlocked)

Impact: Represents 1.34% of circulating supply.

$YGG (March 28)

Unlock Amount: $1.31M (76.71% unlocked)

Impact: Represents 1.50% of circulating supply.

$AITECH (March 28)

Unlock Amount: $218K (79.84% unlocked)

Impact: Represents 6.79% of circulating supply.

$PINKSALE (March 28)

Unlock Amount: $118K (74.27% unlocked)

Impact: Represents 0.48% of circulating supply.

This week’s token unlock events include both public and insider releases, with significant amounts across multiple projects like ALT, WLD, and YGG potentially influencing market dynamics and liquidity trends for these assets.

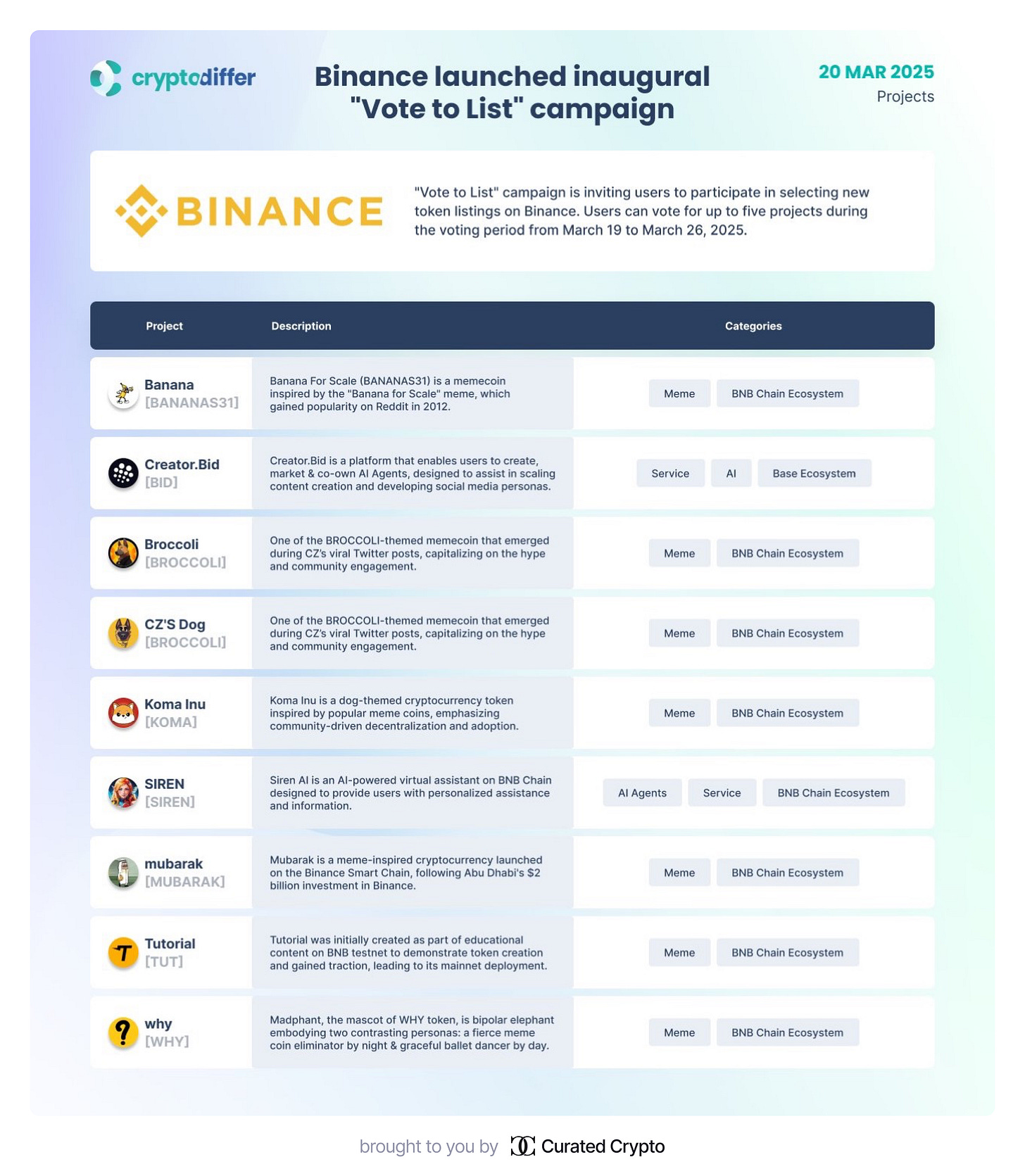

Binance Launches Inaugural “Vote to List” Campaign

Binance has introduced its first-ever “Vote to List” campaign, inviting users to participate in selecting new tokens for listing on the platform. The voting period runs from March 19 to March 26, 2025, allowing users to vote for up to five projects.

Participating Projects

Banana ($BANANAS31)

Inspired by the “Banana for Scale” meme that gained popularity on Reddit in 2012.

Category: Meme | BNB Chain Ecosystem

Creator.Bid ($BID)

A platform enabling users to create, market, and co-own AI agents, focusing on scaling content creation and developing social personas.

Category: Service | AI | Base Ecosystem

Broccoli ($BROCCOLI)

A meme token born from viral Twitter posts by Binance CEO CZ, leveraging community engagement and hype.

Category: Meme | BNB Chain Ecosystem

CZ’s Dog ($BROCCOLI)

Another Broccoli-themed memecoin inspired by CZ’s viral tweets, emphasizing community-driven engagement.

Category: Meme | BNB Chain Ecosystem

Koma Inu ($KOMA)

A dog-themed cryptocurrency inspired by popular meme coins, focusing on decentralization and community adoption.

Category: Meme | BNB Chain Ecosystem

SIREN ($SIREN)

An AI-powered virtual assistant token built on BNB Chain, offering personalized assistance and information.

Category: AI Agents | Service | BNB Chain Ecosystem

Mubarak ($MUBARAK)

A meme-inspired cryptocurrency launched after Abu Dhabi’s $2 billion investment in Binance.

Category: Meme | BNB Chain Ecosystem

Tutorial ($TUT)

Initially created as an educational token on Binance Testnet to demonstrate token creation, later deployed on the mainnet.

Category: Meme | BNB Chain Ecosystem

Why ($WHY)

Features Madphant, a two-faced elephant mascot embodying contrasting personas: a fierce meme coin eliminator at night and a graceful ballet dancer by day.

Category: Meme | BNB Chain Ecosystem

How to Participate

Binance users can cast their votes for their favorite projects and influence which tokens will be listed next on the platform!

Key Events Reshaping the Landscape

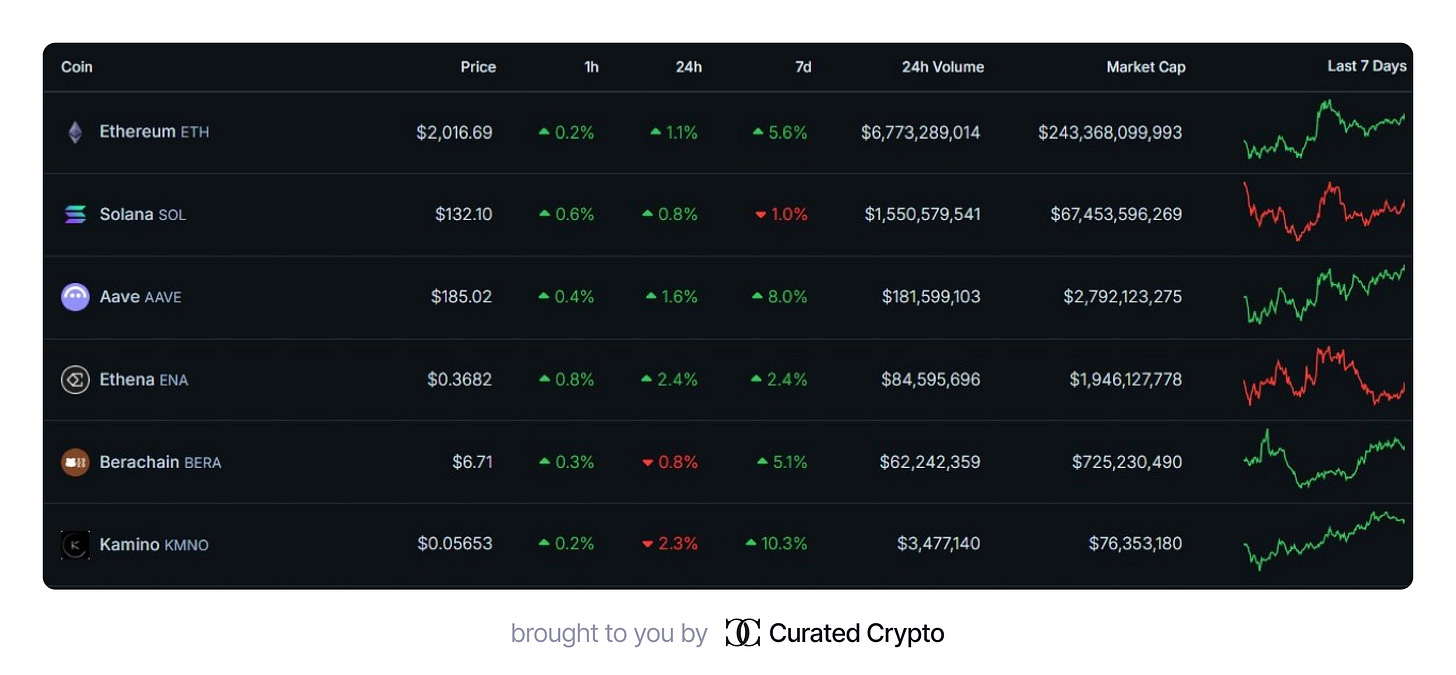

Crypto Week Ahead: Key Events to Watch

As we enter a new week in the dynamic world of cryptocurrencies, several important events are on the horizon. Here’s a rundown of what to expect in the coming days:

$SOL (Solana): The deadline for the Grayscale Solana spot ETF decision passed on March 23. Market participants are now eagerly awaiting the outcome and its potential impact on SOL’s price.

$AAVE (Aave): The AAVE token buyback is expected to commence before the end of this month. This move could potentially affect the token’s supply and price dynamics.

$BERA (Berachain): The launch of Proof of Liquidity on Berachain took place on March 24. Ecosystem applications are now competing for token emissions, which could drive increased activity and interest in the BERA token.

$ENA (Ethena): The third season of Ethena’s token distribution campaign has concluded. A portal for token claiming is likely to open soon, which may lead to increased circulation and trading activity for ENA.

$ETH (Ethereum): The activation of the Pectra upgrade for Ethereum on the Hoodi platform is scheduled for March 26. This update could bring new features or improvements to the Ethereum ecosystem.

$KMNO (Kamino): A major product release announcement from Kamino is anticipated in the near future. This could potentially drive interest and activity around the KMNO token.

These events highlight the ongoing development and evolution in the cryptocurrency space. Investors and enthusiasts should keep a close eye on these projects as their outcomes may influence market trends and individual token performances in the coming week.

Latest DeFi Developments: Key Updates in the Crypto Space

Here are the top 7 most significant updates in the decentralized finance (DeFi) and cryptocurrency sectors this week:

Solana’s ETF Milestone: The first-ever US ETFs for Solana are launching today, marking a groundbreaking step for the cryptocurrency in traditional finance.

Ripple’s Legal Victory: XRP announced that the SEC has dropped its lawsuit against the company, potentially reshaping the regulatory landscape for cryptocurrencies.

Mantle Network Upgrade: The full activation of EigenDA on Mantle Network promises improved censorship resistance and bandwidth expansion, enhancing network efficiency.

Andre Cronje’s DEX Plans: The DeFi pioneer revealed plans to launch a DEX capable of competing directly with major centralized exchanges like Binance and Coinbase.

Uniswap’s Growth Fund: Uniswap DAO has approved a $165.5M funding plan aimed at fostering ecosystem growth and innovation.

Binance Alpha 2.0: This new feature allows CEX users to buy any DEX tokens directly on Binance, further integrating centralized and decentralized exchange functionalities.

Institutional Crypto Outlook: A Coinbase survey revealed that 83% of institutions plan to increase their crypto holdings in 2025, signaling growing confidence in the sector.

For additional updates, including developments from Ethena, Hyperliquid, Cosmos, and more, check out the original thread for the remaining 7 key highlights!

Protocols in Focus

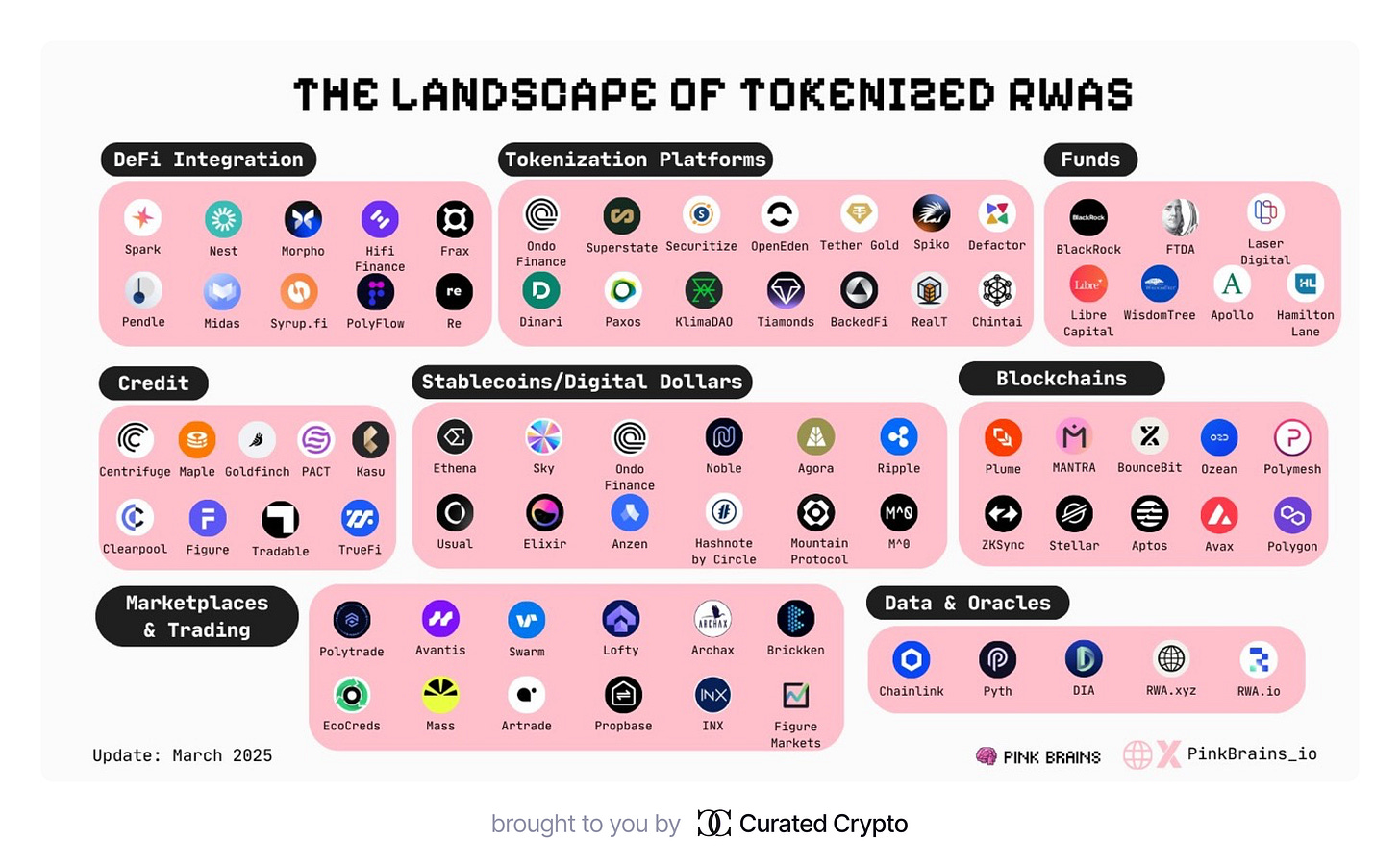

The Landscape of Tokenized RWAs

Tokenized Real-World Assets (RWAs) are transforming the financial industry by bridging traditional assets with blockchain technology. As of March 2025, the total value of tokenized assets on blockchains has reached $18.83 billion, marking an 18.2% increase in the past month. Since 2023, the volume of tokenized assets has grown fivefold, with treasury bonds accounting for $4.22 billion (+400% YoY). Major financial institutions like BlackRock and JPMorgan are actively entering this space.

Key Categories of RWAs

Tokenization encompasses various asset classes, including real estate, bonds, stocks, commodities, and private equity. It brings benefits such as:

Liquidity: For traditionally illiquid assets like real estate and environmental credits.

Fractional Ownership: Revolutionizing access to private equity.

Institutional Demand: Treasury bonds and stablecoins backed by RWAs.

Important Segments and Projects

DeFi Integration

Platforms integrating RWAs into decentralized finance:

Spark: Liquidity layer for USDS and USDC.

Nest Credit: Staking protocol for RWAs.

Pendle: Yield trading platform for RWAs.

Midas RWA: Institutional-grade liquid staking tokens.

Tokenization Platforms

Leading platforms enabling asset tokenization:

Securitize: Pioneer in tokenizing over $1 billion worth of assets.

Tether Gold (XAUt): Gold-backed tokens.

KlimaDAO: Tokenizing carbon credits.

Funds

Prominent funds investing in tokenized RWAs:

BlackRock BUIDL Fund: Largest fund for tokenized treasury bonds ($1 billion AUM).

FTDA Benji Fund: Mutual fund tokenization.

Credit

Innovative credit solutions powered by blockchain:

Figure: Lending platform for real estate and crypto-backed loans.

Goldfinch: Access to institutional credit pools.

Stablecoins/Digital Dollars

Stablecoins backed by RWAs:

Ethena USDtb: Backed by institutional treasury funds.

Ondo USDY: Overcollateralized token supported by short-term bonds.

Blockchains

Specialized and general-purpose blockchains for RWAs:

Specialized chains like Plume Network, MANTRA Chain, and general chains like Ethereum, Polygon, Avalanche, Solana.

Marketplaces & Trading

Platforms facilitating RWA trading:

Polytrade, Swarm Markets, and others offering multi-asset marketplaces.

Data & Oracles

Infrastructure supporting RWA tokenization:

Chainlink: Data feeds enabling large-scale tokenization.

Pyth Network: Price data for equities and other assets.

Growth Projections

According to Chainlink, the tokenized asset market could reach a staggering $10 trillion by 2030, while Security Token Market predicts a potential size of $30 trillion, driven by stocks, real estate, bonds, and gold. Institutional interest continues to fuel this growth.

Solana vs Ripple: A Comparative Analysis of Real-World Utility and Use Cases

Solana and XRP are two popular cryptocurrencies with different goals and technologies. While both aim for efficiency and low transaction costs, their main focus areas differ significantly.

Key Features

Solana:

High-performance blockchain platform for decentralized applications (DApps)

Uses a unique Proof-of-History (PoH) consensus mechanism

Capable of processing over 65,000 transactions per second

Focuses on DeFi, NFTs, and the gaming industry

XRP Ledger:

Designed for fast and inexpensive international money transfers

Uses a consensus protocol with independent validators

Transaction confirmation time of 3-5 seconds

Oriented towards the banking sector and cross-border payments

Technologies and Applications

Solana employs PoH in combination with Proof-of-Stake, ensuring high network performance. Main application areas include:

Decentralized Finance (DeFi)

Creation and trading of NFTs

Blockchain games with NFT and DeFi element integration

XRP Ledger uses the Ripple Protocol Consensus Algorithm (RPCA). Key directions:

Cross-border payments with instant liquidity

On-Demand Liquidity service for banks and payment providers

Development of Central Bank Digital Currencies (CBDCs)

Challenges and Prospects

Both platforms face regulatory challenges. Solana experiences reputational issues due to the proliferation of meme coins, while Ripple is involved in a lawsuit with the SEC.

Despite this, analysts predict growth for both cryptocurrencies. By 2025, Solana’s price is expected to reach $664-$802, and XRP $1.80-$8.40, depending on regulatory clarity and institutional adoption.

Overall, Solana positions itself as an Ethereum competitor in the smart contract space, supporting DeFi, NFTs, and games, while Ripple focuses on the banking sector and payments, aiming to become an alternative to SWIFT.

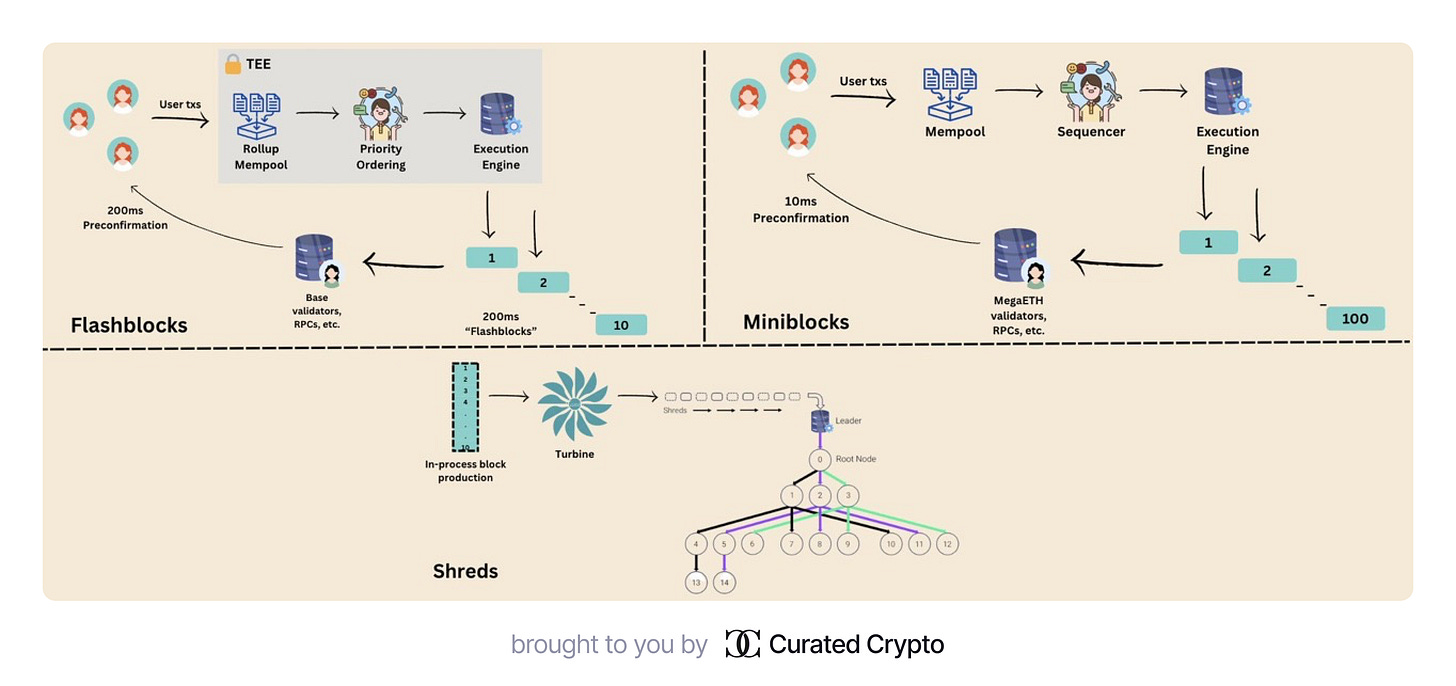

Comparing Preconfirmation Strategies: Base Flashblocks, MegaETH Miniblocks, and Solana Shreds

In the rapidly evolving world of blockchain technology, different platforms are implementing innovative strategies to improve transaction speed and user experience. This analysis compares the preconfirmation approaches of Base, MegaETH, and Solana.

Key Concepts

Preconfirmations are “trusted guarantees” provided by block producers that a transaction will be included in the next block. This approach:

Improves user experience

Adds a temporary trust assumption on the block producer

Platform-Specific Implementations:

Base Flashblocks

Block time: 2 seconds

Tools update and share state updates every 2 seconds

State is preconfirmed by the sequencer, not yet finalized

MegaETH Miniblocks

Planned block time: 1 second

Uses a preconfirmation strategy similar to flashblocks

Sequencer provides transaction inclusion confirmations as the block is built

Solana Shreds

Typical block time: 400 milliseconds

Block producer breaks the block into smaller “shreds”

Shreds are committed to the Proof of History (PoH) and propagated to the network

Safety Considerations

Solana:

Risk of leader being offline, resulting in skipped slots

Chance of dishonest leader, though this risk is lower than the skip rate

MegaETH:

Single sequencer model relies on the sequencer not being malicious

Risks include sequencer going offline or Ethereum L1 reorgs

Block Times in L2s

While L1 blockchains require block times for efficient consensus, L2s without consensus still benefit from fixed block times:

Enables efficient implementation of mechanics like EIP1559

Provides a consistent framework for updates and state changes

Future Outlook

As blockchain technology advances, we can expect:

Faster sub-second preconfirmations becoming the norm

Successful platforms will focus on heavily disincentivizing corrupt behavior

This comparison highlights the ongoing innovation in blockchain scalability and user experience, with each platform offering unique approaches to balance speed, security, and reliability.

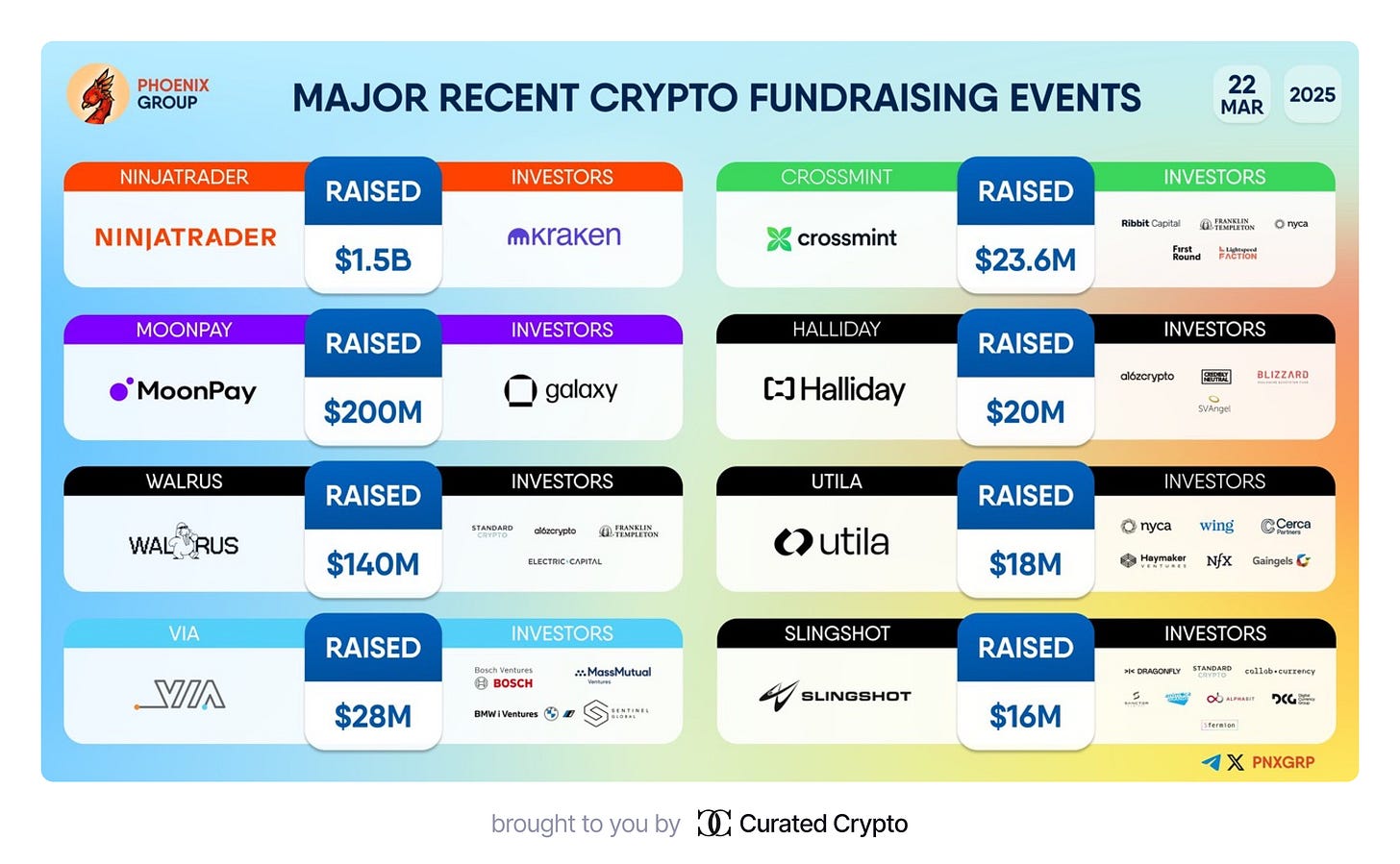

Key VC Rounds of the Week

Major Recent Crypto Fundraising Events

On March 22, 2025, several groundbreaking fundraising rounds in the cryptocurrency space were announced, showcasing significant investments from major players. Below is a comprehensive overview of the projects, funds raised, their investors, and project descriptions:

NinjaTrader

Funds Raised: $1.5 billion

Description: A cloud-based futures trading platform offering multi-device integration for active traders. It provides access to popular futures markets, customizable tools, and low-cost trading options.

Investor: Kraken

MoonPay

Funds Raised: $200 million

Description: Described as “PayPal for crypto,” MoonPay enables seamless fiat-to-crypto transactions and supports NFT purchases through its payment infrastructure.

Investor: Galaxy

Walrus

Funds Raised: $140 million

Description: An Android app designed for contactless card cloning and emulation, primarily used in physical security assessments.

Investors: Standard Chartered, Electric Capital, Franklin Templeton

VIA

Funds Raised: $28 million

Description: VIA leverages AI and blockchain to help energy companies unlock the value of their data.

Investors: Bosch Ventures, MassMutual Ventures, BMW i Ventures

Crossmint

Funds Raised: $23.6 million

Description: Provides APIs for wallets, payments, tokenization, and more to simplify blockchain integration for developers.

Investors: Ribbit Capital, First Round Capital, Franklin Templeton

Halliday

Funds Raised: $20 million

Description: Automates blockchain workflows for cross-chain transactions and smart contract execution.

Investors: a16zcrypto, Blizzard, SVAngel

Utila

Funds Raised: $18 million

Description: A self-custody wallet platform and API designed for secure digital asset management by organizations.

Investors: NYCA, Wing, Cerca Capital

Slingshot

Funds Raised: $16 million

Description: A web app supporting game voting, funding, and launches with AI integration in the Roblox ecosystem.

Investors: Dragonfly, Animoca Brands, Standard Crypto

These fundraising rounds underline the increasing interest in blockchain technology across various industries such as energy, gaming, finance, and entertainment. The involvement of prominent investors highlights the growing trust in crypto innovation as a driver of future technological advancements.

Decrypting Market Trends: A Look at Long-Term Crypto Effects

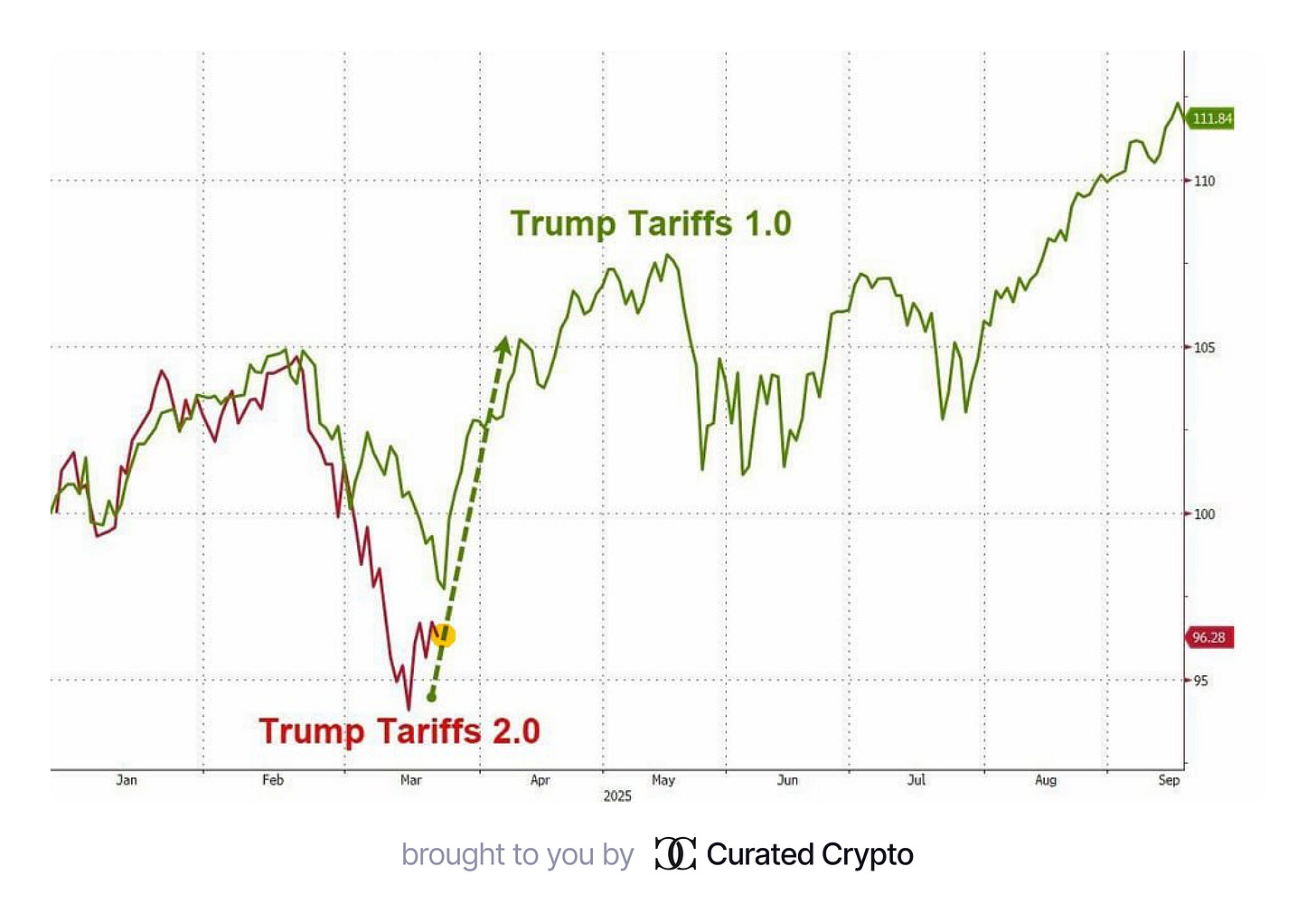

Trump’s Economic Playbook: Echoes of 2017-2021 in 2025

Donald Trump’s return to the White House has created a sense of déjà vu in financial markets. Comparing his current economic strategies to his first term provides insights into his approach and potential market impacts. As in 2017-2021, Trump is focusing on deregulation, tax cuts, and tariffs. However, the market response this time is more subdued, with concerns about the impact on deficits and debt.

Trump’s aggressive trade policies continue to cause significant market volatility. The proposed 10% tariffs on all imports and 60% tariff on Chinese imports have led to a 7.1% drop in the S&P 500 since January 2025. This mirrors the situation in 2018 when tariffs on Chinese goods caused the S&P 500 to fall 5% and Nasdaq 9.5% in Q4. The familiar pattern of early rallies followed by tariff-driven falls and corrections persists.

Despite similarities in economic strategy, the current situation differs from Trump’s first term. The cryptocurrency market now has significant institutional and governmental influence. The economic context, including post-pandemic recovery and global geopolitical tensions, is also different. Moreover, investors seem less convinced about the long-term benefits of Trump’s current policies.

While Trump’s 2025 economic strategies echo his first term, market reactions and economic outcomes may differ significantly. The complexities of policy execution, changing macroeconomic conditions, and evolving market dynamics make it crucial to avoid simplistic comparisons or predictions. Investors and analysts must closely monitor both the policies themselves and their real-world impacts on trade, inflation, and economic growth.

SEC Clarifies Stance on Proof-of-Work Mining

The U.S. Securities and Exchange Commission (SEC) has recently provided clarity on its position regarding Proof-of-Work (PoW) cryptocurrency mining. Here are the key points:

The SEC considers that PoW mining does not constitute an offer and sale of securities under the Securities Act of 1933, provided certain criteria are met.

This applies to decentralized PoW networks where mining is used to participate in the consensus mechanism.

The clarification is applicable to both individual miners and mining pools.

While Bitcoin is not explicitly mentioned, it and other PoW-based cryptocurrencies (such as Dogecoin, Litecoin, Monero) fall under this definition.

This SEC decision aligns with the pro-cryptocurrency policies of the Trump administration, which has promised to make the U.S. a “Bitcoin superpower.” It is expected that new bills on stablecoins and crypto market structure will be passed in the coming months, creating a more favorable regulatory environment for the development of the digital asset industry in the United States.

The clarification provides much-needed regulatory certainty for miners and could potentially encourage more investment and innovation in the PoW mining sector. However, it’s important to note that this guidance is specific to PoW mining and does not necessarily extend to other aspects of cryptocurrency operations or other consensus mechanisms.

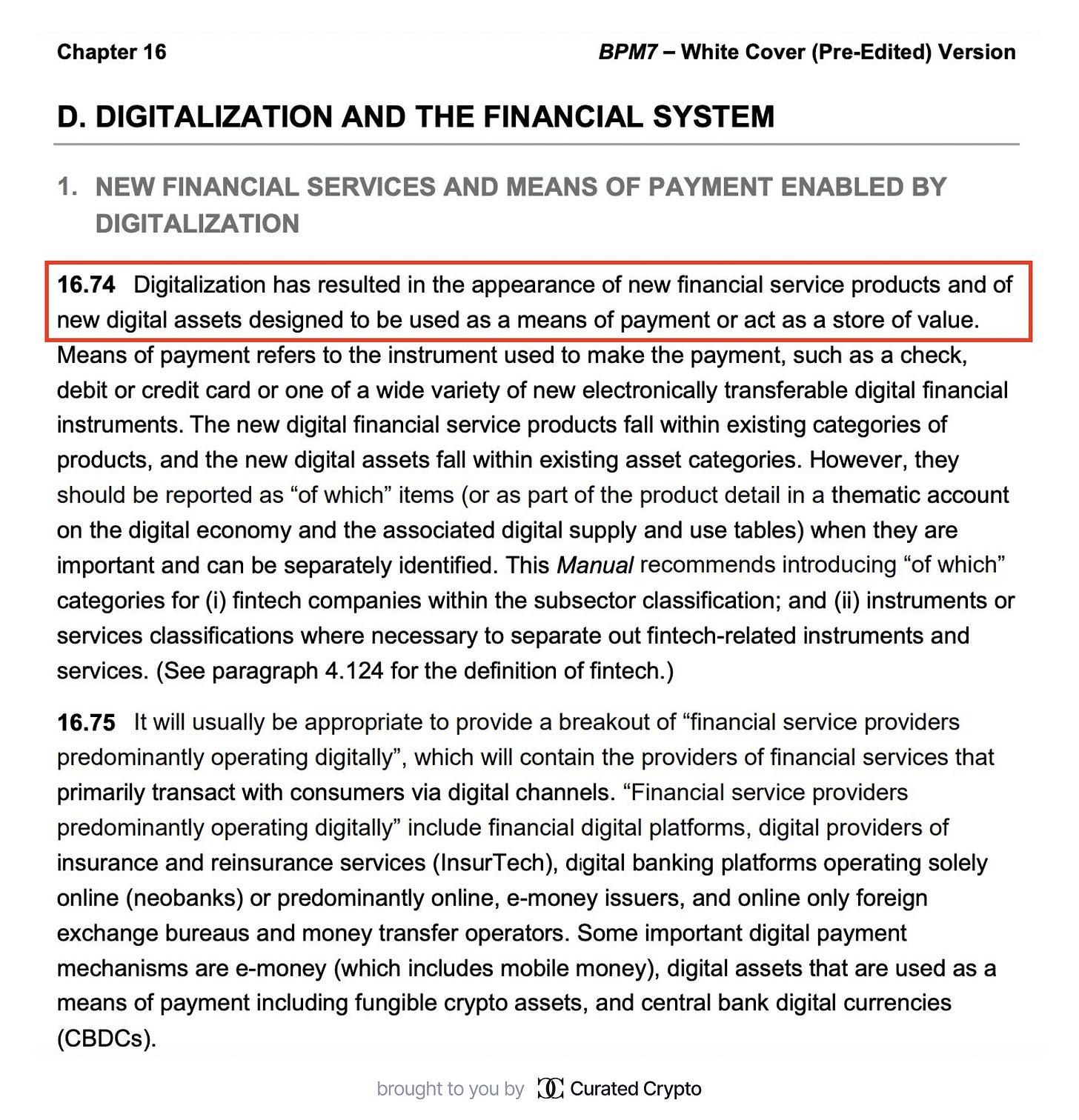

IMF Updates Macroeconomic Standards: Digital Assets Included in BPM7

The International Monetary Fund (IMF) has released the seventh edition of its Balance of Payments and International Investment Position Manual (BPM7), marking a significant shift in global economic reporting. For the first time, Bitcoin and other cryptocurrencies are officially included in the framework, classified as non-produced, non-financial assets, similar to land or gold. This update reflects the growing importance of digital assets in the global economy and provides countries with tools to track their impact on trade, investment, and financial systems.

Key Changes in BPM7

Cryptocurrencies: Bitcoin and similar assets are categorized as stores of value without liabilities, distinguishing them from stablecoins, which are classified as financial instruments due to their backing by issuers.

Crypto Mining and Staking: These activities are now recognized as exportable computer services, aligning with broader trends in the digital economy.

Platform Tokens: Assets like Ethereum and Solana are treated as equity-like holdings within international financial accounts.

Implementation Timeline

The IMF encourages member countries to adopt BPM7 by 2029-2030, with technical assistance provided to ensure smooth integration. This includes training programs, peer reviews, and regional cooperation mechanisms to support implementation.

Implications for Global Finance

The inclusion of digital assets in BPM7 enhances data transparency and positions cryptocurrencies as integral components of international economic statistics. This development underscores their growing acceptance in mainstream finance and is expected to influence policymaking, regulation, and investment strategies worldwide. By providing a standardized framework, BPM7 ensures that digital asset flows are accurately tracked across borders, fostering greater accountability in global financial systems.

Research Spotlight

How to Prepare for Utility Season

This blog post discusses the author's belief in an upcoming "utility season" in the crypto space. It outlines a research framework for identifying promising projects and details what characteristics the author looks for when evaluating potential investments in utility-focused cryptocurrencies and blockchain projects.

Author: The Defi Investor

Top 15 Must-Have Crypto Research Tools

This comprehensive thread outlines 15 essential tools for cryptocurrency research and analysis. The author covers a wide range of resources, including platforms for fundamental investing, smart money tracking, market data analysis, and specialized tools for various crypto sectors like DeFi, Solana, DePin, and RWA. Each tool is briefly described with its key features and use cases, providing a valuable resource for both novice and experienced crypto investors looking to enhance their research capabilities.

Author: hitesh.eth

Cryptographic Signatures: The Key to Web3 Security

This thread explores the critical role of cryptographic signatures in Web3 interactions and provides guidance on avoiding scams. The author emphasizes that 99% of scams still exploit users' lack of understanding of these signatures. Key points include different types of signatures, risks associated with off-chain signatures, importance of checking raw data before signing, and implementing multiple security layers. The author concludes by stressing the importance of understanding cryptographic signatures for safe Web3 interactions.

Author: The Smart Ape

Digital Hygiene: Essential Practices for Online Security and Privacy

This comprehensive guide outlines crucial steps for improving digital security and privacy. The author covers various topics including password management, two-factor authentication, hardware security keys, biometrics, disk encryption, secure messaging, browser choices, and more. The post emphasizes the importance of being proactive in protecting one's digital life and offers practical advice for implementing these security measures.

Author: Andrej Karpathy

DePAI: The Missing Link in Crypto Evolution

The article explores the concept of DePAI (Decentralized Physical AI) as a key element in the development of the cryptocurrency ecosystem. DePAI combines artificial intelligence, robotics, Web3, and DePIN, offering solutions to crypto industry problems such as slow transactions and security risks. The author emphasizes DePAI's potential in decentralizing AI and robotics governance, which could lead to a revolution in AI and digital finance.

Author: Defileo