Weekly Digest: Put a Smile on Your Face

Your essential weekly digest—market trends, smart investments, and must-know airdrop news.

TL;DR

Market Sentiment: The cryptocurrency market is recovering, with $226 million in inflows into digital assets. The supply of BTC on exchanges dropped to the lowest level in seven years, signaling long-term investor confidence. Whales increased their reserves, while the leverage ratio rose, reflecting growing speculative activity. Bitcoin is strengthening its connection to global liquidity, solidifying its role as a macroeconomic asset.

Yield Opportunities: Stablecoin and delta-neutral strategies offer diverse opportunities to maximize yield while minimizing risk, with platforms like Dolomite, SyrupFi, Berachain, Ethena Labs, and Pendle providing unique approaches to stablecoin optimization, leverage, and liquidity management.

New Airdrops: GOAT Network, Tari, MegaETH, Monad, and Succinct offering unique rewards, while new models like Discount Tickets aim to revolutionize crypto incentives.

Upcoming TGEs and Token Sales: Token listings ($GUN, $K, $SEED), sales ($AAA, $RESOLV, $SHM), mainnet launches ($OG, $INIT), and unlocks ($SUI, $SOL, $ARB, $APT).

Key Developments:

BlackRock's BUIDL fund has expanded to Solana;

Berachain's innovative Proof of Liquidity mechanism went live.

Special note: The Future of Real-World Asset Finance.

Research of the week: “Rethinking Ownership, Stablecoins, and Tokenization”

End of March: Disappointments and April Expectations

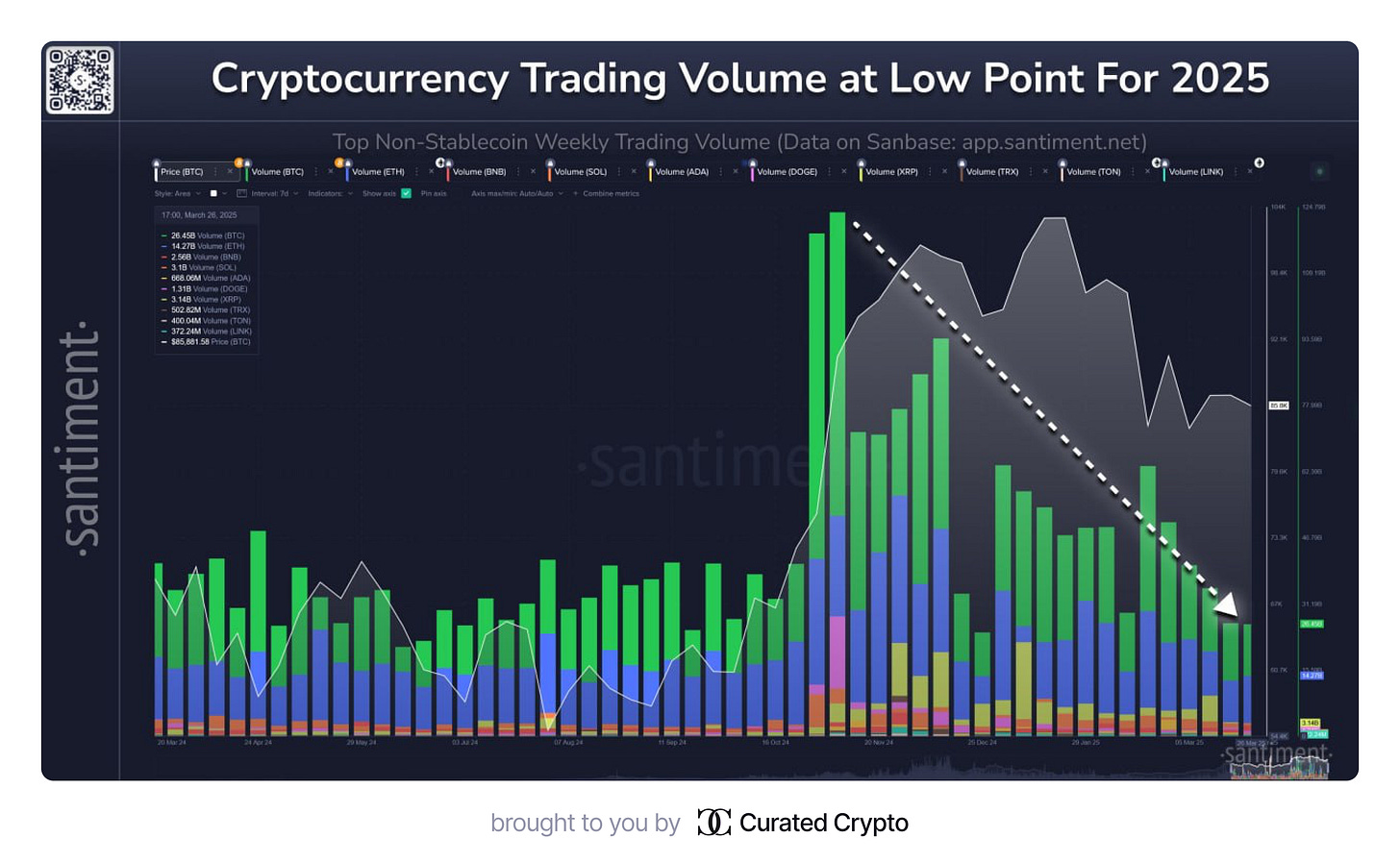

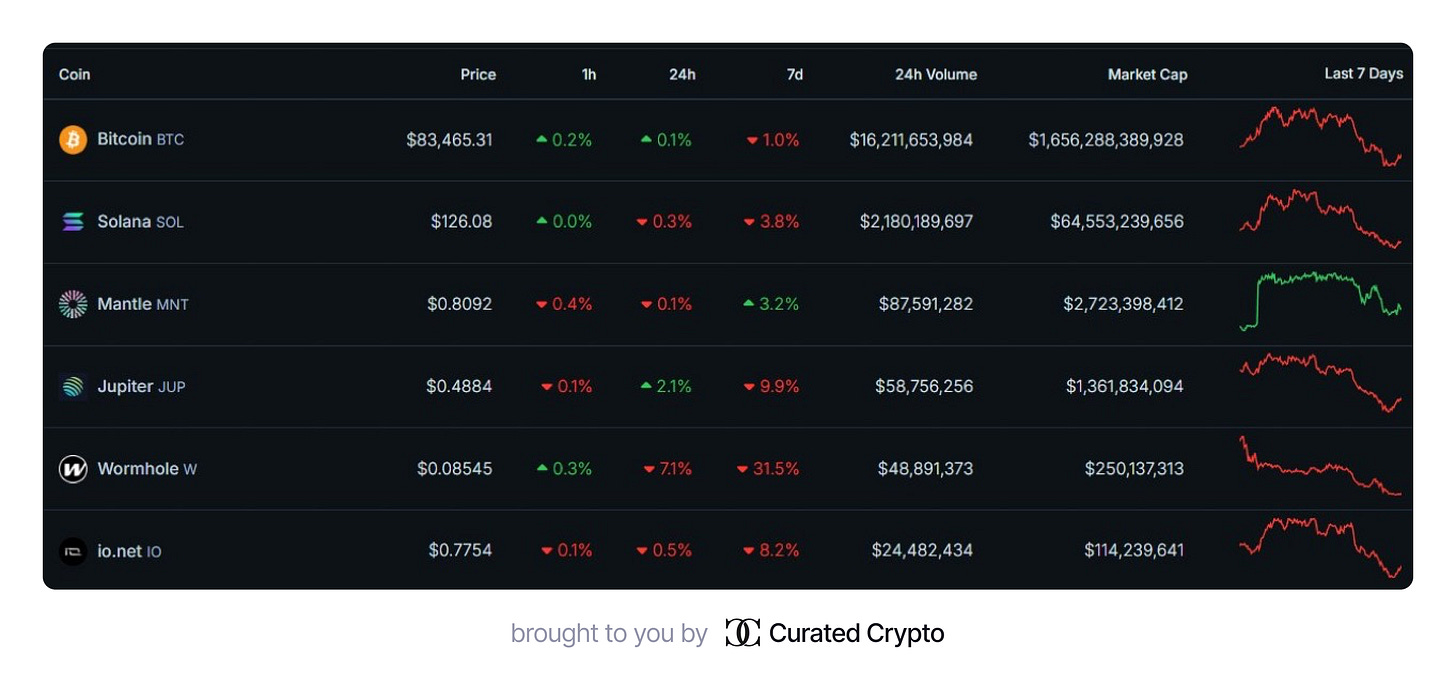

The end of March 2025 marked a challenging period for the cryptocurrency market and related companies. Trading volumes in cryptocurrencies dropped to their lowest levels since December 2024, according to data from analytics firm Santiment, reflecting a decline in trader interest in digital assets. At the same time, stocks of many crypto companies not only erased all gains from the post-Trump victory rally but also fell below their values at the time of his election.

Historically, April has been one of the most profitable months for Bitcoin, with an average return of 27% since 2010. Some analysts believe that easing selling pressure could lead to a rebound in cryptocurrency prices in the coming weeks. However, macroeconomic risks, including U.S. tariff wars, remain significant obstacles to market recovery.

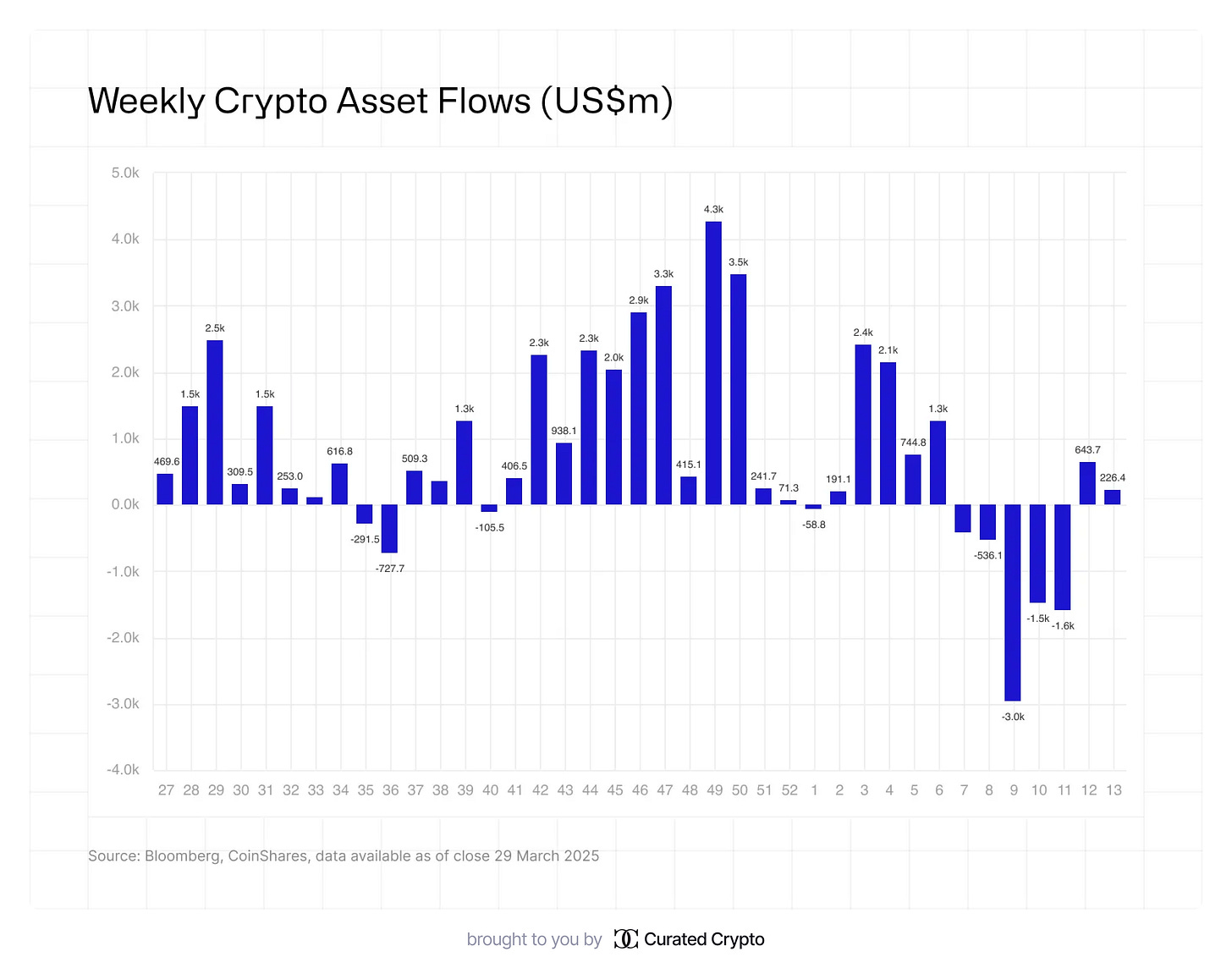

Shifting Tides in Crypto Investments

The crypto investment landscape experienced a notable shift last week, signaling cautious optimism among investors. According to CoinShares’ latest report, digital asset investment products saw inflows of $226 million, marking a recovery after weeks of persistent outflows.

Bitcoin Leads the Charge

Bitcoin investment products attracted $195 million, accounting for the lion’s share of total inflows.

Notably, products with short positions on Bitcoin continued to experience outflows for the fourth consecutive week, losing $2.5 million over this period. This suggests waning interest in bearish bets against Bitcoin.

Renewed Interest in Altcoins

For the first time in five weeks, altcoins recorded positive inflows, collectively bringing in $33 million after enduring outflows totaling $1.7 billion.

Top-performing altcoins included:

Ethereum: $14.5 million

Solana: $7.8 million

XRP: $4.8 million

Sui: $4 million

Macro Data and Market Sentiment

On Friday, there was a slight outflow of $74 million, coinciding with the release of U.S. Personal Consumption Expenditures (PCE) data, which came in higher than expected. This reignited concerns over potential hawkish monetary policy from the Federal Reserve.

After weeks of capital flight, the crypto investment market appears to be regaining momentum. Bitcoin remains the primary focus for investors, while altcoins are beginning to recover lost ground. However, macroeconomic uncertainties—particularly around U.S. monetary policy—continue to cast a shadow over market sentiment.

Market Dynamics of Bitcoin

Whale Activity Signals Confidence

One of the most active groups of Bitcoin whales, wallets holding between 1,000 and 10,000 BTC, has resumed accumulation after a prolonged five-month selling period. Their holdings have risen from 5.30 million BTC to 5.52 million BTC, indicating renewed confidence in the asset’s long-term potential. Historically, whale activity has been a strong indicator of market sentiment, and their recent moves suggest optimism regarding Bitcoin’s price trajectory.

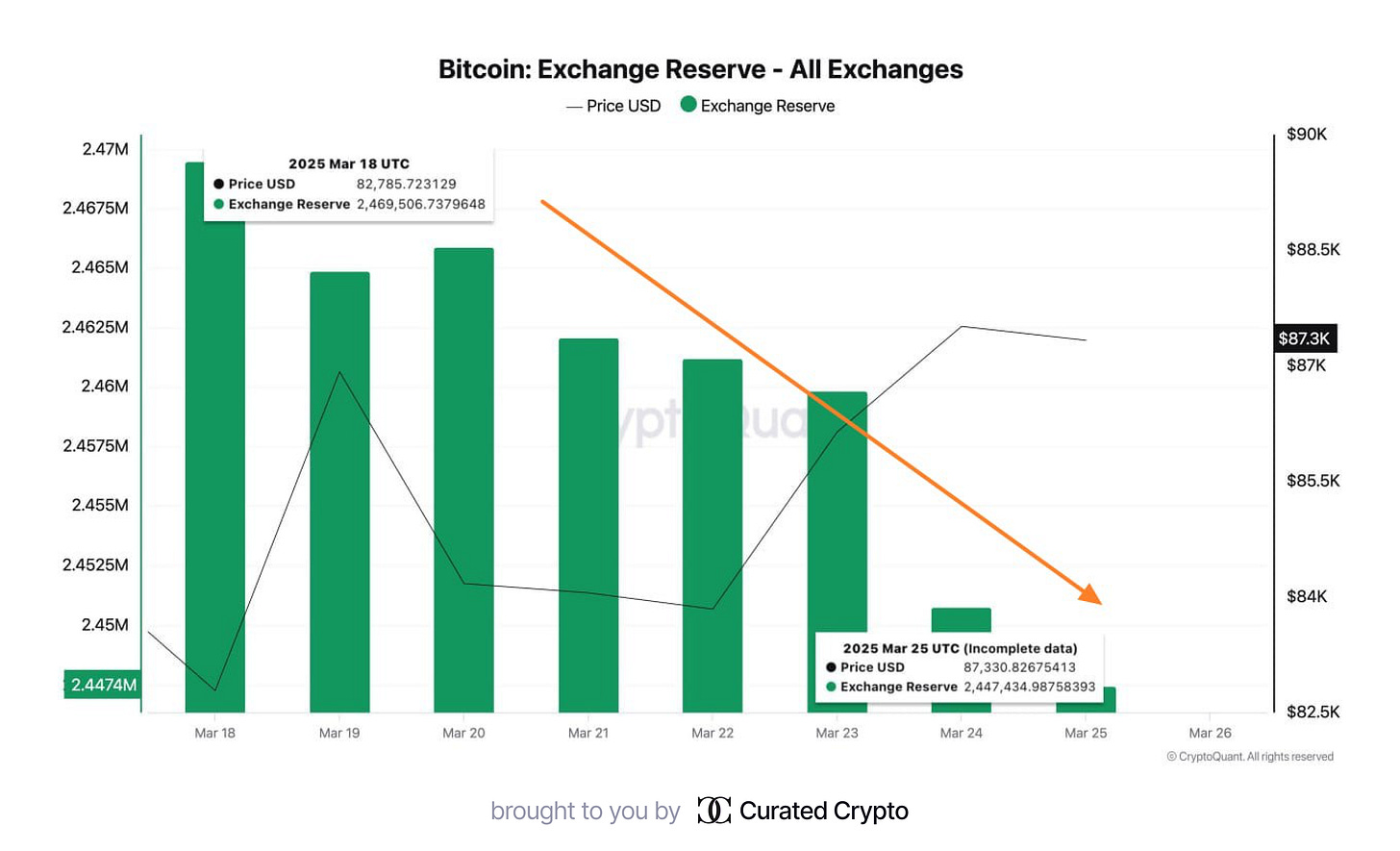

Declining Exchange Reserves

Data from CryptoQuant highlights a significant decline in Bitcoin reserves on exchanges. As of March 25, the exchange reserve dropped to 2.447 million BTC, marking a consistent downtrend since March 18. This reduction aligns with broader market behavior, where Bitcoin supply on exchanges has fallen to just 7.53%—the lowest level in over seven years.

Key implications:

Lower exchange reserves often indicate reduced sell-off pressure.

Investors are increasingly moving assets to private wallets, signaling long-term holding strategies.

Leverage Ratio Peaks

The Estimated Leverage Ratio (ELR) across all exchanges has surged to 0.257, its highest level in recent months. This sharp increase reflects heightened speculative activity among traders using borrowed funds to amplify their positions. While this can drive short-term price volatility, it also underscores growing confidence in Bitcoin’s upward momentum.

Risks associated with high leverage:

Increased likelihood of liquidation events.

Potential for sharp price swings due to cascading effects.

Supply Dynamics and Institutional Confidence

The combination of whale accumulation and declining exchange reserves paints a bullish picture for Bitcoin:

Reduced sell-off pressure: With fewer coins available on exchanges, the risk of sudden price drops diminishes.

Institutional confidence: Long-term investors appear to be positioning themselves for future gains.

The convergence of whale activity, declining exchange reserves, and rising leverage ratios suggests a pivotal moment for Bitcoin’s market dynamics. While speculative activity introduces short-term risks, the overall trend points toward growing confidence among major players and long-term holders. Investors should remain vigilant but optimistic as these indicators continue to evolve.

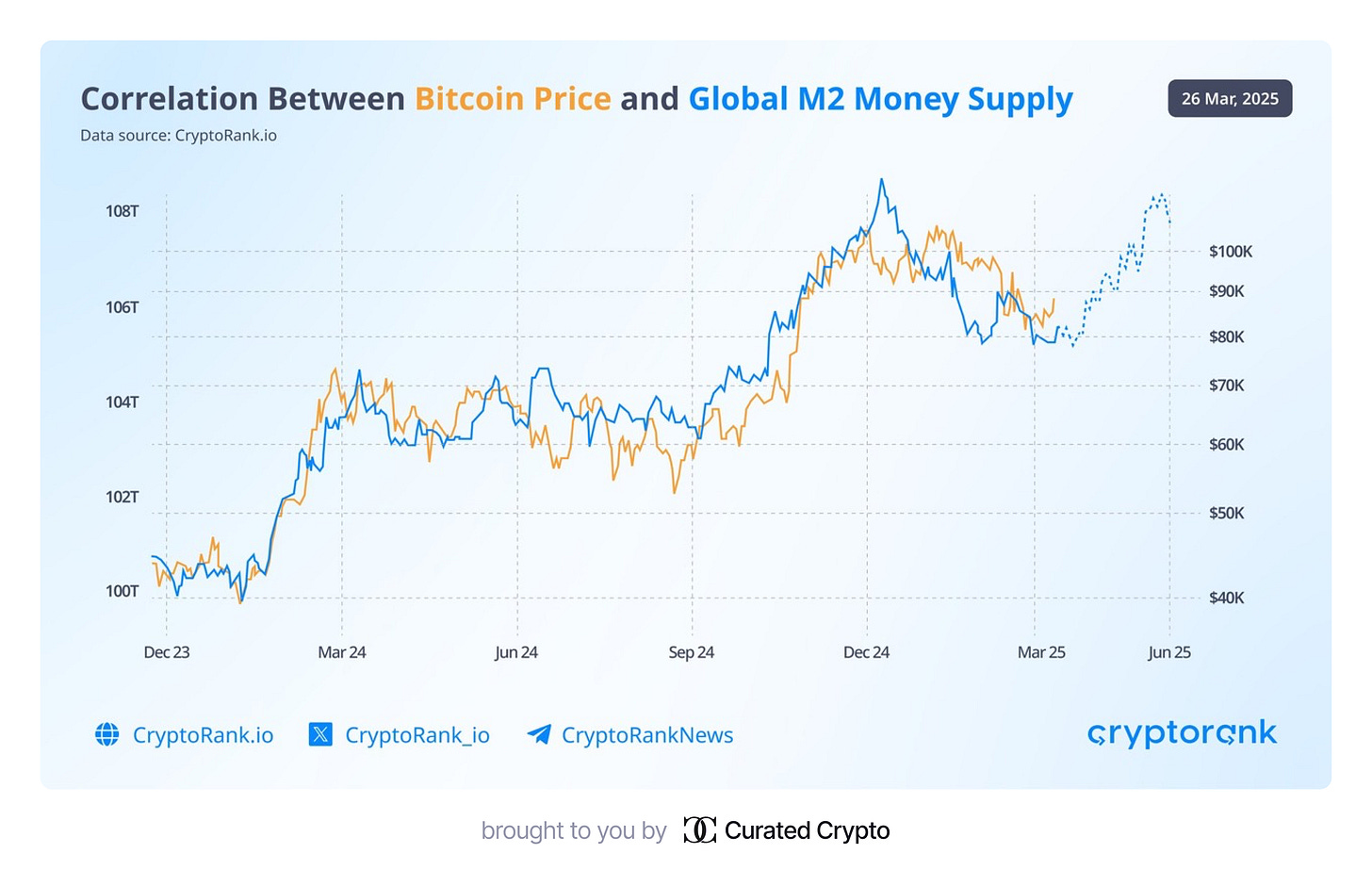

Bitcoin and Global Liquidity: A Strengthening Correlation

The Role of Global M2 Money Supply

Bitcoin’s price has historically demonstrated a strong correlation with the global M2 money supply, a broad measure of liquidity encompassing cash, checking deposits, and near-money assets. As liquidity expands, risk assets like Bitcoin tend to benefit from increased capital inflows. Conversely, tightening liquidity often leads to corrections in asset prices.

Recent data shows that the global M2 money supply has reached an all-time high of $108 trillion, marking a significant increase from its January low of $104.5 trillion. This expansion aligns with Bitcoin’s recovery from recent lows and suggests potential bullish momentum in the coming months.

Bitcoin as a Macro Asset

Bitcoin’s growing institutional adoption and its correlation with macroeconomic trends position it as a potential institutional-grade macroeconomic asset. Analysts have noted that Bitcoin responds strongly to liquidity changes, with a correlation coefficient of 0.94 relative to global M2 trends over the long term.

This relationship highlights Bitcoin’s sensitivity to monetary policy shifts:

Expansionary policies: Increased liquidity often drives Bitcoin prices higher.

Contractionary policies: Reduced liquidity can lead to price stagnation or declines.

Delayed Reaction and Market Dynamics

While liquidity expansion typically benefits Bitcoin, its price movements often exhibit a lag of approximately 10 weeks following major shifts in global M2. This delayed response underscores the importance of monitoring both the rate of change in liquidity and broader macroeconomic trends.

Institutional Interest and Adoption

Institutional investors continue to play a pivotal role in shaping Bitcoin’s market dynamics. Large-scale investments by companies like Tesla and MicroStrategy, alongside the introduction of regulated financial products such as Bitcoin ETFs, have contributed to price stabilization and increased adoption.

Furthermore, Bitcoin’s unique characteristics—such as its non-sovereign nature, predictable monetary policy, and global accessibility—make it an attractive alternative asset for diversification amid uncertain economic conditions.

The strengthening correlation between Bitcoin’s price and the global M2 money supply suggests that liquidity trends will remain a crucial driver for its market performance. As central banks continue to inject liquidity into the global financial system, Bitcoin could experience further upward momentum. However, investors should remain mindful of potential delays in price reactions and macroeconomic risks that could impact liquidity flows.

Crypto Yield Insights: Weekly Opportunities

Stablecoin Strategies Overview

Here’s a concise breakdown of some of the most promising stablecoin strategiescurrently available.

Dolomite and E-MODE

Dolomite’s E-MODE unlocks significant potential with $400M in BOYCO liquidity. For example:Pair: srUSD/HONEY

Collateral yield: 7%

Borrow cost: 2.55%

Leverage 10x = total yield 47%

SyrupFi on Contango

SyrupUSDC offers a steady 7% APR, with the option to lock funds for 6 months to earn an additional +5% SYRUP emissions. Liquidity pools make it easy to exit when needed.Euler Labs and Berachain

Berachain’s ecosystem is thriving with borrowing opportunities. For instance, $NECT generates cPOLLEN, which can be swapped for fully liquid POLLEN during TGE via Ramen Finance.Beefy

Beefy aggregates the best stablecoin liquidity pools with no token emissions or management overhead—just pure yield.Ethena Labs

Ethena Labs boasts a current yield of 8.6% APY with a TVL of $2.4B USDe, making sUSDe cycles on Contango particularly appealing.

These are just five highlights! You can find three more strategies in the original thread.

Delta-Neutral Strategies: Maximizing Returns with Minimal Risk

Delta-neutral strategies are a powerful tool for minimizing exposure to price fluctuations while generating high returns. Below are some examples and approaches to delta-neutral strategies that can be particularly useful for DeFi investors.

Examples of High-Yield Strategies

Using Compound and Morpho Labs

ETH yields up to 86.34% APY.

Leverage up to 11.76x is available.

A unique feature is earning on borrowing ETH (5.07%).

Reservoir loops: srUSD/rUSD and srUSD/USDC

srUSD/rUSD offers ~30% APY plus bonus rewards on principal.

srUSD/USDC optimizes yield through stable assets.

“Cheat Cycles” with Euler Finance and Pendle

Example: PT-wstscUSD/USDC cycle on Euler started at ~40% APY.

Cheat cycles maximize returns while minimizing risk.

SwapX Positions

Stablecoin yields: >20%.

ETH yields: >10%.

Auto-compounding is possible via Beefy Finance.

Advanced Lending via SyrupFi and Morpho Labs

Yields up to 91.5% LTV with 11.76x leverage.

Deep liquidity enables consistent returns.

Pendle Fixed Rates

Fixed yields: 12-15% over periods exceeding 100 days.

A straightforward approach without leveraging.

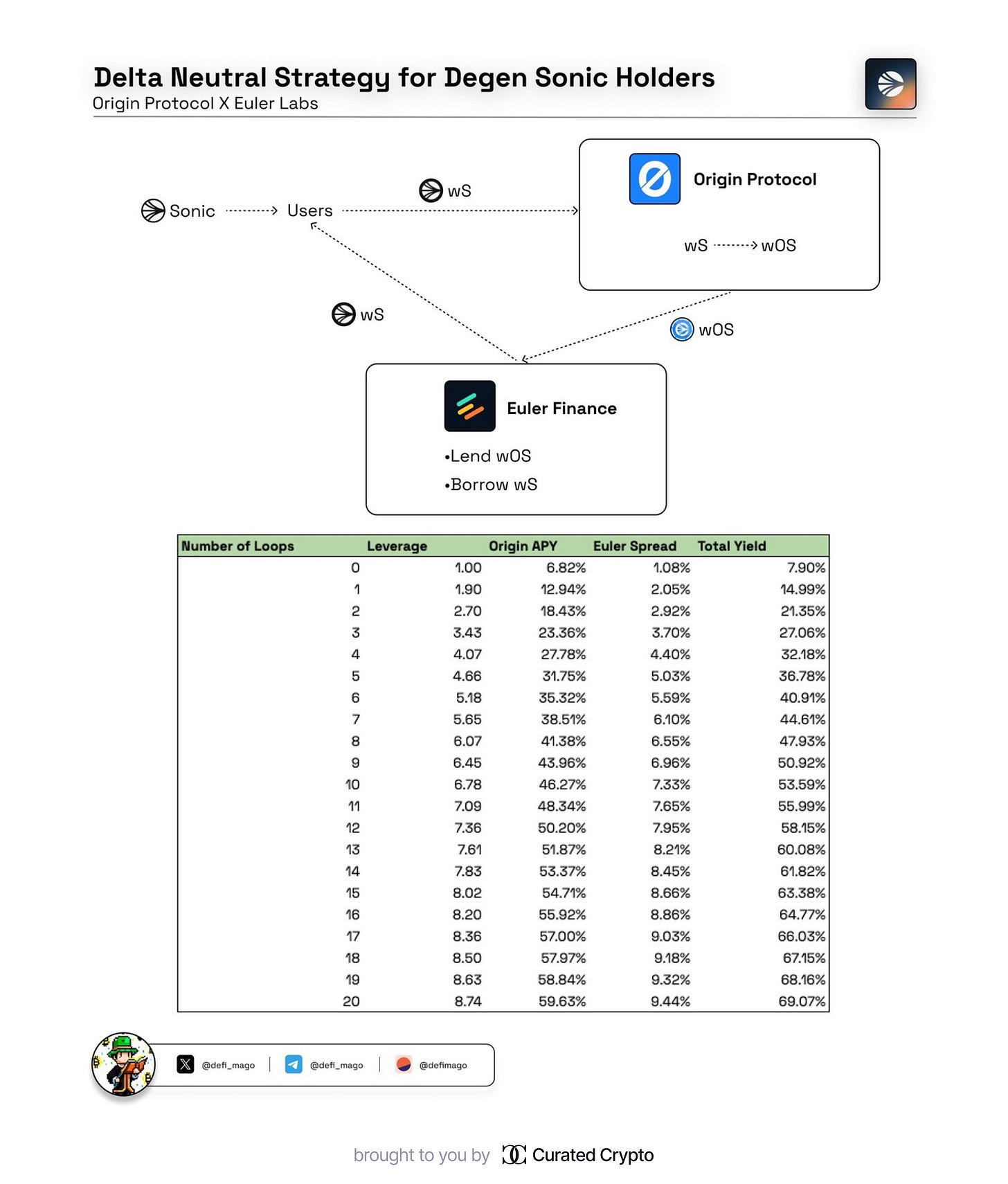

Sonic $S Strategy

For Sonic $S holders, a delta-neutral strategy can yield up to 70% APY while maintaining market neutrality:

Key Steps

Deposit $S or $wS into Origin Protocol to earn wOS (~6.82% APY).

Use wOS as collateral on Euler Labs to borrow wOS (deposit yield: 5.15%, borrow rate: 4.07%).

Yield Optimization

Maximum leverage: 9.75x.

Recursive borrowing can boost returns significantly (~20 cycles).

Risks

Liquidation risk due to a narrow buffer between LTV (89%) and the liquidation threshold (92%).

High gas fees for multiple transactions.

Delta-neutral strategies offer a unique opportunity to achieve high yields while minimizing market risks. However, it’s crucial to consider potential challenges, such as liquidation risks and transaction costs, to effectively manage your portfolio and achieve financial goals.

A Comparison of Pendle and Sonic Labs

In the world of DeFi, there are numerous strategies for generating yield, but choosing the right platform depends on your goals and risk tolerance. Let’s compare two leading platforms: Pendle and Sonic Labs, which offer different approaches to earning.

Key Features of the Platforms

Pendle:

Focuses on tokenizing future yield.

Allows splitting an asset’s yield into two tokens:

PT Token: Guarantees the return of principal.

YT Token: Grants rights to future yield.

Example: You can lock stETH and earn a stable base yield of around 5%. By staking the PENDLE token, yields can increase up to +200%.

Sonic Labs:

A platform for advanced strategies like liquidity provision and arbitrage.

Utilizes a point system (Sonic Points), which are later converted into $S tokens.

Offers high flexibility but with increased risk.

Yield Comparison

Pendle: Provides stable base yields with opportunities for enhancement through staking and trading YT tokens.

Sonic Labs: Potentially higher yields due to complex strategies, though outcomes depend on the $S token price.

Risks

Pendle:

YT token prices depend on interest rates and can drop sharply.

PT tokens ensure stable returns but lack growth potential.

Sonic Labs:

Conversion of Sonic Points to $S occurs at an unknown rate, adding uncertainty.

Strategies require deep market understanding.

Combined Strategy

To maximize returns, you can use both platforms. For example, acquire YT tokens through Pendle and transfer them to Sonic Labs to gain point multipliers.

Who Should Use Each Platform?

If you’re looking for stable and predictable returns with minimal involvement, Pendle is your choice.

If you’re ready for advanced strategies and higher risks for greater profits, Sonic Labs is the way to go.

Ultimately, your choice between Pendle and Sonic Labs depends on your priorities: stability or high potential with risk.

Be sure to check out this article “Yield Basis: Real Yield On Bitcoin”

Boosting Earnings Through Airdrop Farming

Crypto Spring 2025: Top 5 Promising Airdrops

Spring 2025 promises to be an exciting time for crypto enthusiasts. Several intriguing projects are on the horizon, ready to generously reward their early users. From innovative Layer-2 solutions to high-performance blockchains, each project offers unique opportunities for participation and potential earnings. Let’s explore the five most promising airdrops to keep on your radar in late March to early April 2025.

GOAT Network

What it offers:

Bitcoin Layer-2 solution with smart contract and DeFi integration.

Ongoing rewards system “One Piece Project” instead of a one-time airdrop.

GEC tokens (Proof of Activity) and GOAT Points, convertible to GOATED after TGE.

How to participate:

Bridge assets (BTC, BTCB, DOGE) to the platform.

Mint soulbound NFT.

Actively participate in the Telegram bot and complete missions.

Key dates:

Alpha Mainnet launched on March 17, 2025

TGE expected by the end of 2025

Tari

What it offers:

Proof-of-Work Layer-1 network for digital asset management.

5% of total XTM token supply reserved for airdrops.

Distribution expected 6 months after mainnet launch (April 2025).

How to participate:

Mine tXTM testnet tokens.

Complete quests on the airdrop platform.

Invite new users.

Buy Yat tokens for additional earnings.

Key dates:

Mainnet launch: April 2025

Airdrop distribution: Expected October 2025

MegaETH

What it offers:

New Ethereum Layer-2 project.

Potential airdrop for early users and testnet participants.

How to participate:

Join the official MegaETH Discord server.

Follow official social media accounts.

Register EVM wallet through Discord bot.

Participate in the testnet when launched.

Key dates:

Testnet launch: Expected early April 2025

Monad

What it offers:

High-performance blockchain focusing on scalability.

Recently launched testnet.

How to participate:

Join Monad Discord community.

Participate in testnet.

Hold minimum 0.01 ETH on Ethereum Mainnet.

Get “Full Access” role in Discord to receive 5 MON tokens.

Key dates:

Testnet launched: February 19, 2025

Mainnet and token distribution: TBA

Succinct

What it offers:

Decentralized proof network for optimizing blockchain verification.

Limited testnet for 20,000 testers.

Keep an eye on the X/Discord announcements to find out when new spots will be added to the testnet and try to be one of the first to find the code.

How to participate:

Go to the website, connect your wallet, Twitter/X account, enter the code and deposit 10 USDC

Open the Games tab and play all available games. You will earn stars for doing so. The more stars, the better!

Claim your earned stars on the Claim stars tab

Track your progress in the leaderboard:

Key dates:

Limited testnet launched: March 12, 2025

Token distribution expected: May 31, 2025

Remember that participation in airdrops carries certain risks, and there’s no guarantee of receiving tokens or their future value. Always verify official project sources before participating.

10 Paths to Free Crypto Treasures

Missed previous airdrops? Here are five active projects that can help you earn tokens by completing simple tasks.

1. Sahara

Funding: $43M

What to do: Complete daily tasks to earn points.

Time required: <1 minute per day.

Funding: $5M

What to do: Complete tasks on Monad testnet. Use referral code: VMqpGvGt.

Time required: <1 minute per day.

3. Newton

Funding: $83M

What to do: Participate in quests and earn CREDITS.

Time required: <1 minute per day.

4. Mira (Klok)

Funding: $9M

What to do: Chat with AI to earn points.

Time required: <1 minute per day.

5. Sapien AI

Funding: $15.5M

What to do: Complete tasks and help train AI to earn points.

You can find 5 more projects in the original thread!

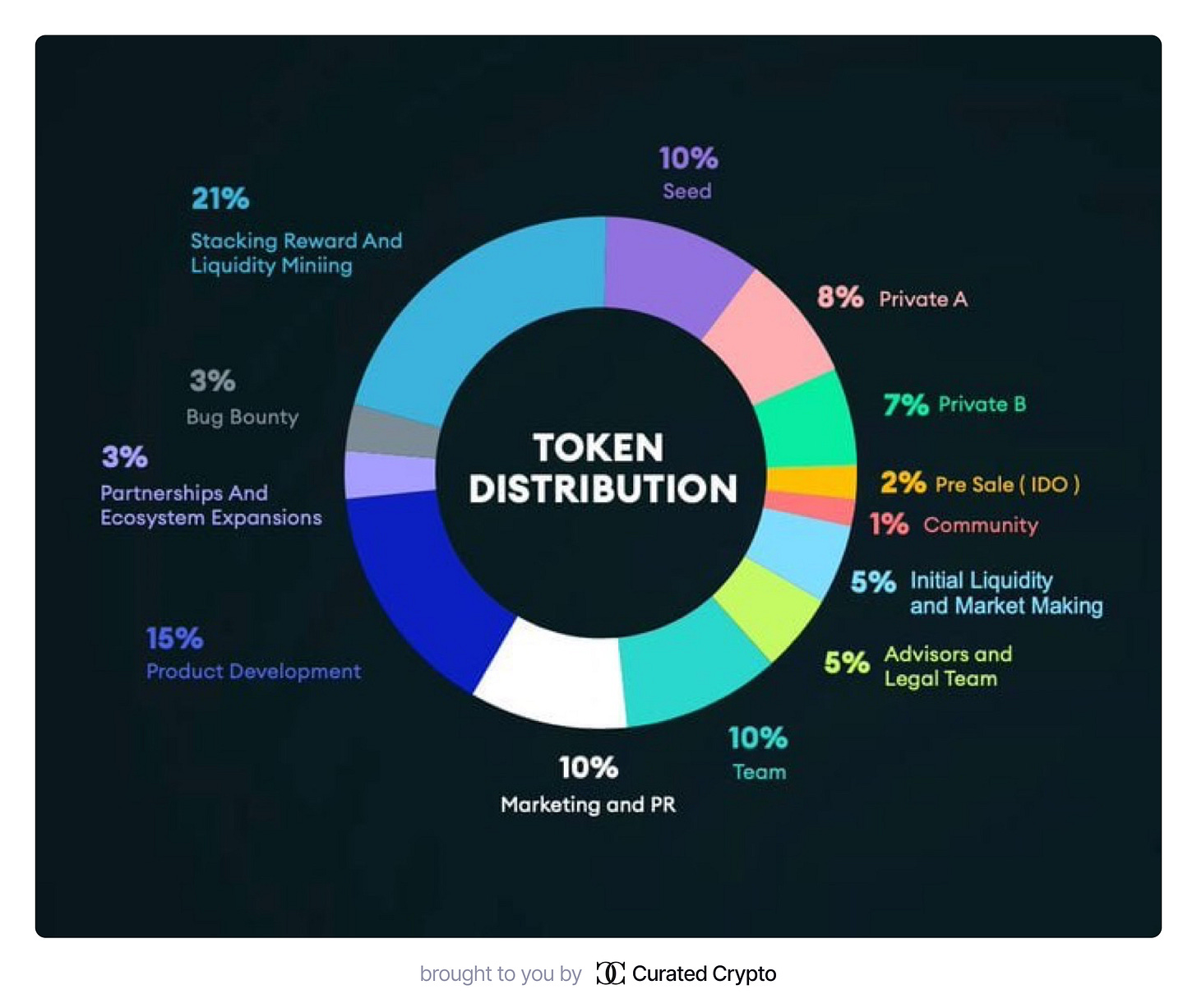

We strongly recommend not to pay attention to the overview “What's the best token distribution in 2025?”

Discount Tickets: A New Paradigm in Crypto Rewards

Traditional airdrops often face challenges such as sybil attacks and mercenary capital, which dilute rewards and undermine long-term engagement. Enter Discount Tickets, a novel approach introduced by Stable Jack, designed to reward loyal users while providing VC-like investment opportunities. Here’s how it works:

The Problem with Traditional Airdrops

Lack of clarity around timelines and reward amounts.

Sybil attackers exploit systems, extracting value without contributing meaningfully.

Retail participants often end up with minimal rewards, while large-scale “farmers” benefit disproportionately.

How Discount Tickets Work

What Are They? Discount Tickets grant users the right to purchase native tokens (e.g., $JACK) at a discounted price compared to market value.

Who Gets Them? Users who actively support the protocol through staking, liquidity provision, or other contributions.

Flexibility: Users can cash out immediately or continue trading yield and price volatility without risking their principal.

Why Choose Stable Jack?

No Liquidation Risk: Unlike some platforms, funds are protected from liquidation.

No Impermanent Loss (IL): Single-sided pools eliminate IL risk and price slippage.

Broad Scope: Covers yield, volatility, and points trading with a principal-protected pool system.

Key Features of $JACK and Current Opportunities

Public Sale Live: $JACK is available for purchase on Fjord Foundry with no whitelist, KYC, or registration required.

Community-First Approach: $15K max cap ensures fair distribution among participants.

Future Plans: Revenue-sharing, buy-backs, and additional airdrops post-launch.

With its innovative approach and upcoming token generation event (TGE), Stable Jack is poised to redefine crypto rewards while expanding across ecosystems like Avalanche, Ethena, and Sonic. If you’re looking for sustainable rewards and long-term growth opportunities, now is the time to explore Discount Tickets!

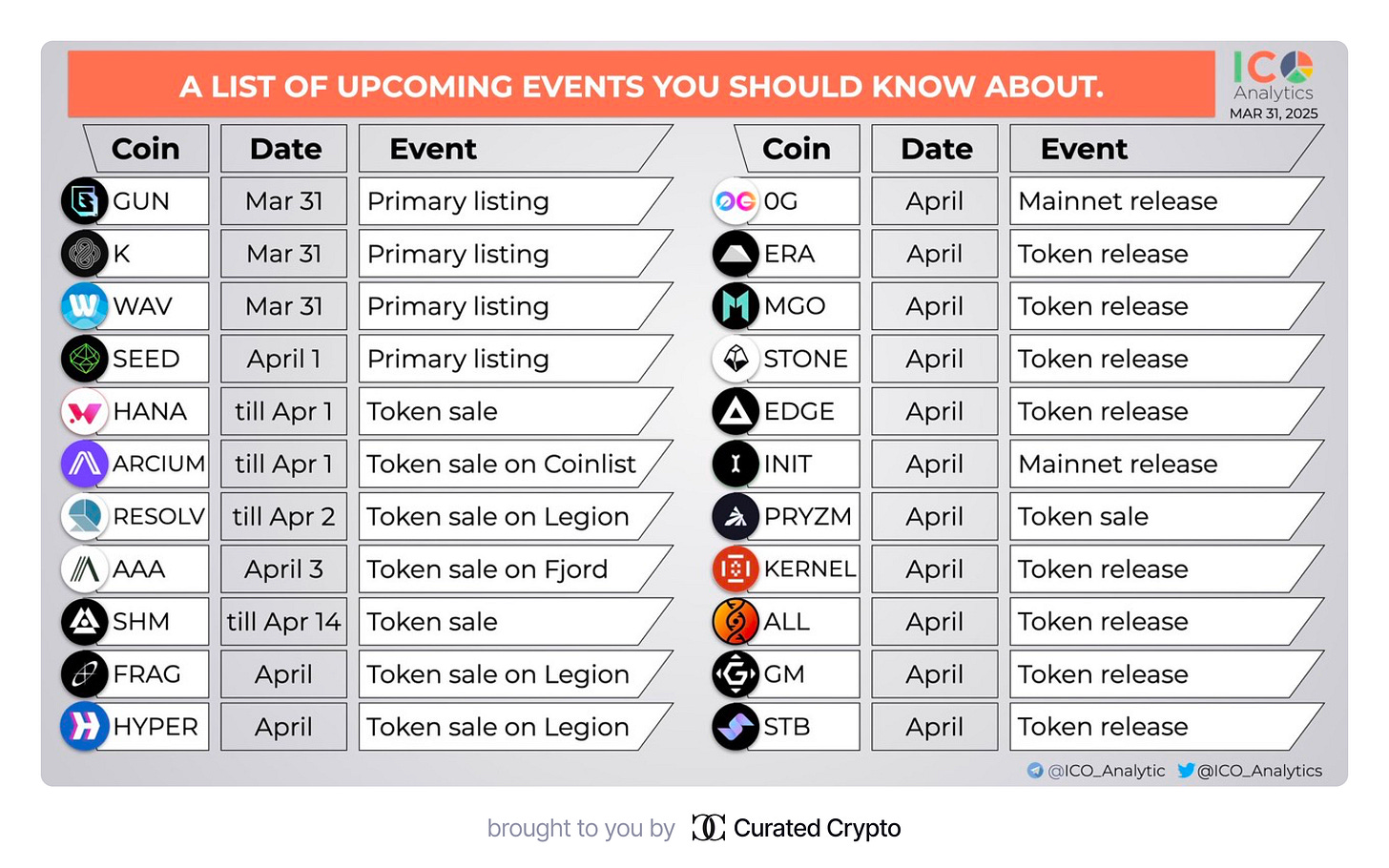

Mastering TGE: Key Token Offerings

April 2025: Key Upcoming Events in the Crypto Industry

April is shaping up to be a dynamic month for the cryptocurrency sector, with numerous projects gearing up for token sales, listings, and mainnet launches. Below is a detailed overview of the major events that investors and blockchain enthusiasts should keep an eye on.

Primary Listings

Token listings on exchanges are often accompanied by increased trading activity and market interest. Here are the upcoming listings:

$GUN, $K, $WAV — March 31.

$SEED — April 1.

Token Sales

April offers several opportunities for token sales across platforms like Coinlist, Legion, and Fjord. Key dates include:

$HANA — token sale ends April 1.

$ARCIUM — token sale on Coinlist ends April 1.

$RESOLV — token sale on Legion ends April 2.

$AAA — token sale begins April 3 on Fjord.

$SHM — token sale runs until April 14.

$FRAG, $HYPER, $PRYZM — token sales throughout April (on Legion and via auction).

Mainnet Launches

Several projects are set to launch their mainnets this month, marking significant milestones in their development:

$OG — mainnet release in April.

$INIT — mainnet release in April.

Token Releases

April will also see the release of tokens from multiple projects, potentially driving market activity:

$ERA, $MGO, $STONE, $EDGE, $KERNEL, $ALL, $GM, $STB — token releases scheduled for April.

April 2025 is packed with critical events that could impact the crypto market. From primary listings to mainnet launches and token sales, these developments provide opportunities for investors to engage with emerging projects and technologies.

Links to the projects can be found in the original thread.

Top 5 Hot Blockchain Projects and Their Upcoming Token Launches

The cryptocurrency market is showing signs of recovery, paving the way for innovative blockchain projects to emerge. Below are five promising projects set to launch their tokens soon, each with unique features and significant potential.

1. Initia: A Multichain Ecosystem

Initia is a Layer 1 blockchain that incorporates Layer 2 solutions to create a modular application network. It addresses Ethereum’s scalability challenges by offering an “integrated” ecosystem. Key features include:

Enshrined Liquidity: 50% of INIT tokens are paired with other ecosystem tokens.

InitiaDEX: A decentralized exchange built using the Move programming language.

Support for EVM, MoveVM, and WasmVM to attract developers from various ecosystems.

The project has raised $14 million in funding and plans to launch its mainnet in April 2025.

2. Fogo: The Fastest Layer 1 Blockchain

Fogo leverages Firedancer, a high-performance Solana client developed by Jump Crypto, capable of processing up to 1 million transactions per second. Key highlights include:

Solana Virtual Machine (SVM) for seamless migration of Solana-based applications.

Multi-Zone Consensus: Validators are distributed across geographic zones to enhance network speed and efficiency.

Fogo has secured $13.5 million in investments and aims to launch its mainnet in mid-2025.

3. Succinct: Simplifying Zero-Knowledge Proofs (ZKPs)

Succinct addresses the complexity of implementing ZK-proofs by offering a shared infrastructure for proof generation. This allows developers to focus on building applications like bridges, oracles, and more. Notable partnerships include Polygon, Celestia, and Gnosis. The project has raised $55 million and is preparing for its token launch soon.

4. Resolv: A Delta-Neutral Stablecoin

Resolv introduces a dual-token model (USR and RLP) that separates risk between users while ensuring all assets are backed by cryptocurrencies like ETH and BTC. With $636.9 million in Total Value Locked (TVL), Resolv is gearing up for the launch of its $RESOLV token in early 2025.

5. Snapchain: Blockchain for Decentralized Social Media

Snapchain is designed to support Farcaster, a decentralized social media platform. Key innovations include:

Data Pruning: Removing old data to free up storage space.

User Sharding: Dividing users into shards for better scalability.

Backed by Merkle Manufactory, Snapchain has raised $150 million and plans to launch its mainnet on April 15, 2025.

These projects showcase groundbreaking approaches to scalability, speed, and decentralization, making them some of the most anticipated developments in the crypto industry this year!

Top 10 Upcoming Token Unlocks in April 2025

April 2025 is set to be a significant month for the cryptocurrency market, with major token unlock events scheduled. These unlocks could impact token prices and market dynamics. Below is a list of the top 10 upcoming token unlocks:

1. Official Trump ($TRUMP)

Value: $445.69M (20% of Market Cap)

Amount: 40M TRUMP

Date: April 18

2. Sui ($SUI)

Value: $221.71M (0.80% of Market Cap)

Amount: 80.14M SUI

Date: April 1

3. Circular Protocol ($CIRX)

Value: $152.16M (99.1% of Market Cap)

Amount: 44.50B CIRX

Date: April 12

4. Solana ($SOL)

Value: $66M (0.09% of Market Cap)

Amount: 472,990 SOL

Date: April 7

5. Aptos ($APT)

Value: $67.06M (1.87% of Market Cap)

Amount: 11.31M APT

Date: April 12

6. MANTRA ($OM)

Value: $45.92M (0.72% of Market Cap)

Amount: 7.07M OM

Date: April 18

7. Ethena ($ENA)

Value: $41.18M (1.78% of Market Cap)

Amount: 94.19M ENA

Date: April 2

8. Axie Infinity ($AXS)

Value: $36.48M (6.70% of Market Cap)

Amount: 10.72M AXS

Date: April 12

9. Arbitrum ($ARB)

Value: $35.61M (2% of Market Cap)

Amount: 92.63M ARB

Date: April 16

10. Polyhedra ($ZKJ)

Value: $33.80M (25.7% of Market Cap)

Amount: 15.50M ZKJ

Date: April 19

These unlock events may lead to increased market volatility as more tokens enter circulation, potentially affecting liquidity and prices.

Key Events Reshaping the Landscape

Crypto Calendar for April 2025

April 2025 is packed with significant events in the crypto world. Below is a detailed breakdown of key dates and happenings:

Week 1: April 1–4

April 2:

Launch of Terraform Labs Loss Claims Portal.

Decision on $LOOM delisting by Upbit.

Unlock of $SUI tokens worth $152M.

April 3:

Coinbase International lists BNB L3 (FAI Perp).

Unlock of $WAV tokens, valued at $177M.

April 4:

Federal Reserve Chair Jerome Powell speaks.

Release of U.S. unemployment rate and nonfarm payroll data.

Week 2: April 7–11

April 7:

Unlock of $SOL tokens ($66M).

Launch of MBX on Immutable ZKVM.

April 9:

Airdrop claim for holders of $IOST tokens.

Unlock of $MOVE tokens ($22M).

April 10:

Court hearing for Do Kwon (LUNA/LUNC) in the U.S.

April 11:

First SEC Virtual Asset Task Force meeting.

Week 3: April 14–18

April 14: Deadline for SEC-Binance lawsuit pause decision.

April 15:

Premiere of “An Ethereum Story” featuring Vitalik Buterin (Apple TV).

Launch of YGG LOL Land project.

April 16: Deadline for $XRP appeal statement submission to the SEC.

April 18: Unlock of $TRUMP tokens ($412M, representing 20% of circulating supply).

Week 4: April 21–25

April 21: Tesla’s earnings call announcement.

April 23: Release of Beige Book (U.S.) and Meta/ZBCH earnings reports.

April 24: Financial reports from Google and Microsoft.

April 25: Second SEC Virtual Asset Task Force meeting.

Other Highlights

Upgrade to THORChain V3.4.0 (April 6–7).

Unlocks for $APT ($60M) and Vine Dev Token (April TBD).

Ethereum Pectra Upgrade scheduled for April 30.

Cryptocurrency Market Insights for the Upcoming Week

$BTC (Bitcoin)

On April 2, former U.S. President Donald Trump is expected to introduce new tariffs, which could have implications for global markets, including cryptocurrencies 💀. Investors should closely monitor how this development impacts Bitcoin’s price and overall market sentiment.

$S (Sonic)

Sonic is gearing up to launch Native USDC on its platform alongside a major network upgrade. These updates could enhance the platform’s functionality and attract more users, potentially driving demand for $S tokens.

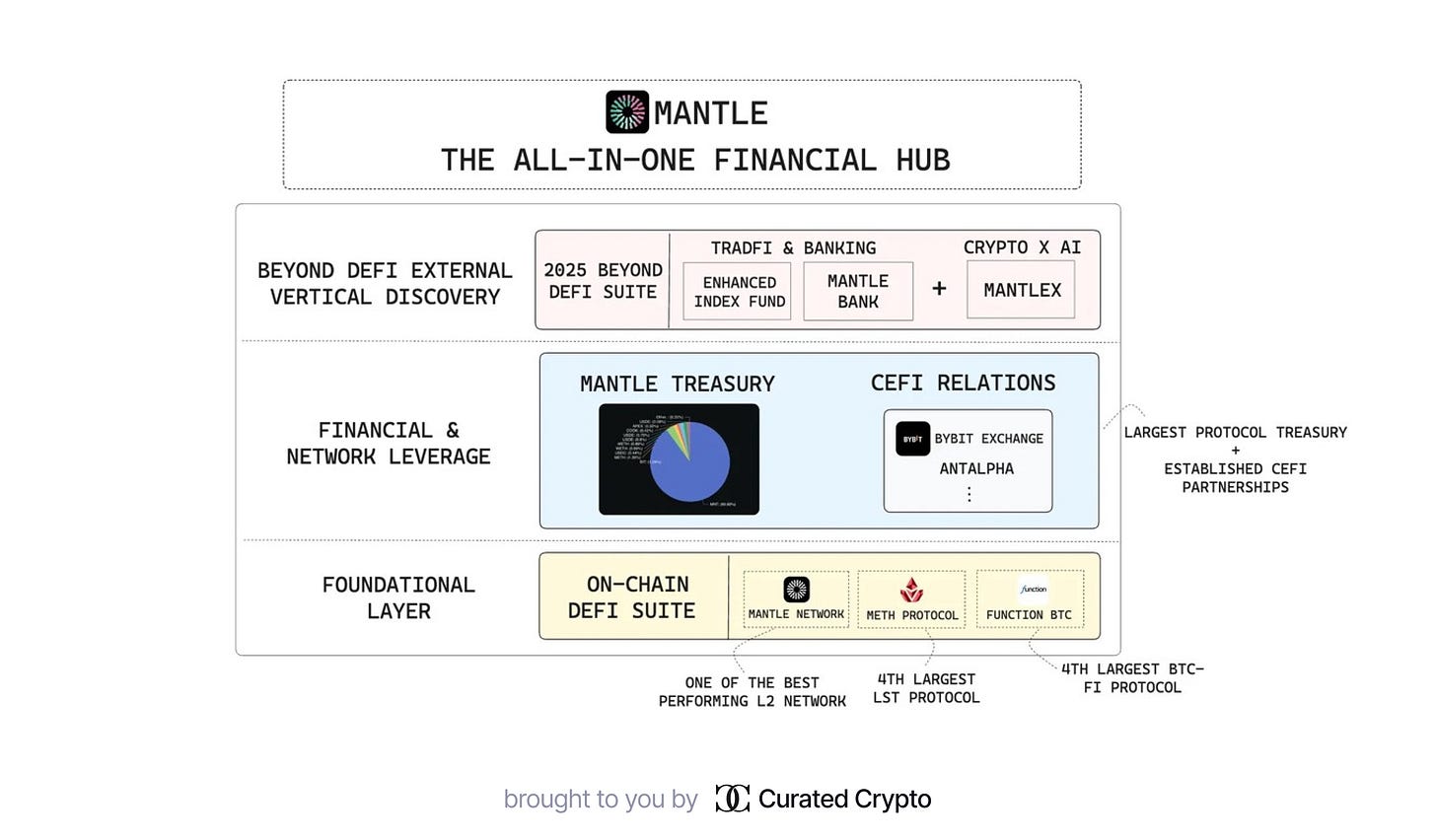

$MNT (Mantle)

Mantle is set to unveil its roadmap for Q2 on April 2. The roadmap will include details about the upcoming index fund and Mantle Banking services. These initiatives aim to expand Mantle’s ecosystem and provide users with innovative financial solutions.

$IO (Ionet)

Ionet is preparing to announce new corporate partnerships in the coming weeks. The network has seen significant growth recently, with revenues increasing by over 150% in the past three months. These partnerships could further strengthen Ionet’s position in the market.

$JUP (Jupiter Exchange)

Jupiter Exchange is about to release its updated mobile application, Jupiter Mobile v2. This new version promises improved features and functionality, which could enhance user experience and drive adoption of $JUP tokens.

$W (Wormhole)

On April 3, $117 million worth of $W tokens will be unlocked, representing approximately 47% of its circulating supply. This event could lead to increased market activity and volatility for $W as investors react to the sudden influx of liquidity.

Protocols in Focus

Highlights of the Week:

BlackRock's BUIDL fund has expanded to Solana, signaling growing institutional interest in the blockchain.

Chainlink partnered with Abu Dhabi Global Market to develop compliant tokenization frameworks in the UAE.

Sonic announced the development of a high-yield algorithmic stablecoin offering an annual APR of up to 23%.

Beraborrow introduced its token, $POLLEN, and scheduled its public sale on Fjord Foundry for March 28.

Ethereum’s final testnet for the Pectra Upgrade has successfully launched.

dYdX initiated its token buyback program, aiming to enhance token value.

Hyperliquid launched spot trading for ETH, expanding its trading capabilities.

Berachain's innovative Proof of Liquidity mechanism went live, revolutionizing liquidity management.

Resolv announced plans to expand to new chains and add BTC as a backing asset for its stablecoin.

CARV launched Infinite Play, a data-powered engine that rewards gamers while collecting valuable insights for game developers.

Rysk Finance introduced a new DeFi primitive that unlocks upfront yield on any asset.

WorldLibertyFi revealed plans to launch its own stablecoin, further diversifying the DeFi ecosystem.

Kernel DAO, the team behind Kelp DAO, released an innovative airdrop checker tool.

Asset manager Fidelity, overseeing $5.8 trillion, filed for an on-chain U.S. Treasury fund, marking another step toward institutional adoption of blockchain technology.

Polymarket added support for Solana deposits, enhancing accessibility for users.

These developments highlight the rapid evolution of blockchain technology and DeFi innovations, showcasing partnerships, product launches, and institutional moves shaping the crypto landscape.

Mantle: Roadmap for 2025 and Future Prospects

Mantle Official, positioning itself as a comprehensive financial hub, is actively expanding the boundaries of its ecosystem. In 2025, the company plans to move beyond DeFi, focusing on new verticals and innovative solutions.

Achievements in 2024

DeFi Ecosystem: Mantle has built a robust infrastructure with high stablecoin liquidity ($453M) and a total DeFi TVL of $259M. The platform supports both native applications and integrations with leading dApps like Pendle Finance and Merchant Moe.

Technological Innovations: Mantle became the first to implement ZK Validity Rollup through a partnership with Succinct Labs. Additionally, it integrated EigenDA, ensuring scalability, censorship resistance, and enhanced security.

Key Ecosystem Projects

mETH Protocol: One of the largest ETH LSTs (Liquid Staking Tokens) with a peak TVL of $2B. Its optimized restaking structure enables higher yields via platforms like EigenLayer and Symbiotic Finance.

FunctionBTC: The institutional-grade $FBTC reached record deposits (14,090 $FBTC), ranking just behind LBTC by Lombard Finance and cbBTC by Coinbase. A key advantage is its partnerships in the CeDeFi space through Bybit.

New Verticals for 2025

Mantle aims to expand beyond traditional DeFi by introducing three key initiatives:

Enhanced Index Fund: A product designed for long-term institutional investors with optimized returns.

Mantle Bank: An innovative banking solution combining fiat and crypto operations.

MantleX: Integration of artificial intelligence within its ecosystem (DeFAI).

Competitive Advantages

Mantle boasts several strengths:

Extensive industry connections.

Strong treasury resources.

Reliable DeFi infrastructure.

These assets position the company to confidently explore new directions and strengthen its market presence.

Mantle Official demonstrates a strategic approach to growth, leveraging innovation and partnerships to explore new niches. With the growing potential of DeFi and Web3, the company is uniquely positioned for continued success in 2025 and beyond.

From RWA Tokenization to RWAfi — The Future of Real-World Asset Finance

The financial landscape is undergoing a significant transformation. In 2023 and 2024, Real-World Asset (RWA) tokenization gained momentum as a revolutionary way to digitize physical assets like real estate, commodities, and bonds on the blockchain. However, tokenization was merely the foundation. As we step into 2025 and beyond, the focus has shifted to RWAfi (Real-World Asset Finance), which integrates RWAs into decentralized finance (DeFi) ecosystems for enhanced utility and liquidity.

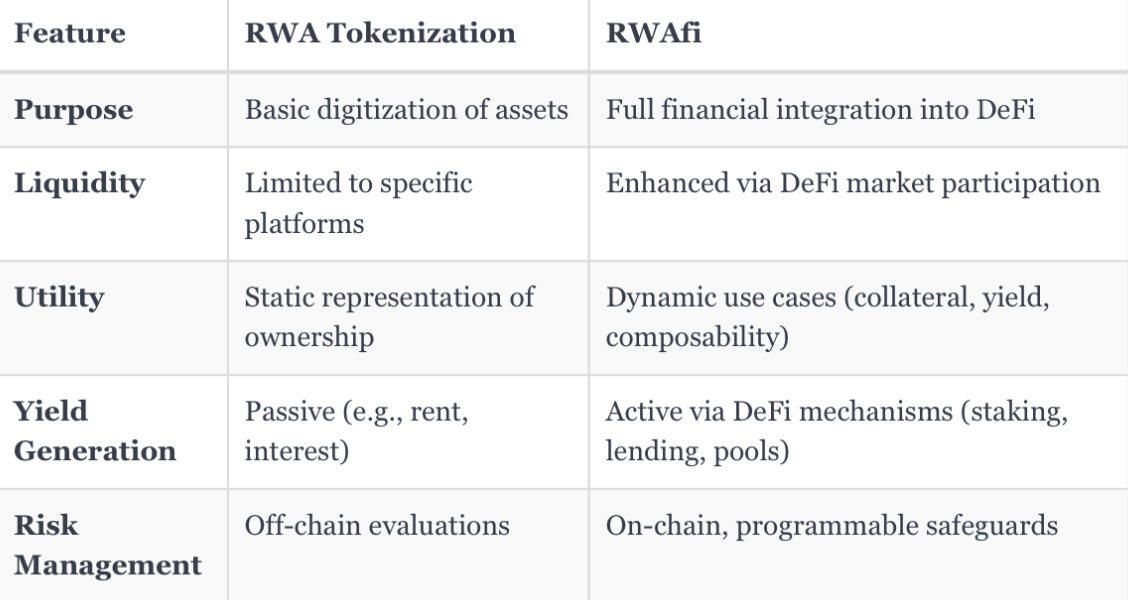

RWA Tokenization vs. RWAfi: Key Differences

The attached comparative table highlights the evolution from RWA tokenization to RWAfi. Below is an analysis of the distinctions:

FeatureRWA TokenizationRWAfiPurposeBasic digitization of assetsFull financial integration into DeFiLiquidityLimited to specific platformsEnhanced via DeFi market participationUtilityStatic representation of ownershipDynamic use cases (collateral, yield, composability)Yield GenerationPassive (e.g., rent, interest)Active via DeFi mechanisms (staking, lending, pools)Risk ManagementOff-chain evaluationsOn-chain, programmable safeguards

RWAfi transforms tokenized assets into active participants in DeFi ecosystems. This shift unlocks new opportunities for yield generation, risk management, and liquidity optimization.

Key Players in the RWAfi Arena

The rise of RWAfi has brought several innovative projects to the forefront. Leading players driving this transformation include:

Plume: Positioned as the powerhouse of RWAfi with Layer-1 blockchain infrastructure designed for seamless integration of RWAs into DeFi.

GAIB: Focused on tokenizing computational power for AI applications.

ZOTH, Mystic Finance, Rooster Protocol, and Nest Credit: Each contributing unique solutions for asset management and financial innovation.

Among these, Plume Network ($PLUME) stands out as a particularly bullish prospect due to its robust ecosystem and commitment to advancing RWAfi technologies.

Market Potential

The tokenized asset market reached $17.9 billion in 2025, yet this represents only a fraction of the multi-trillion-dollar global asset market. Analysts predict exponential growth as RWAfi expands access to liquidity and enables dynamic financial use cases for previously static assets.

Challenges Ahead

Despite its potential, RWAfi faces obstacles:

Regulatory uncertainty surrounding digital assets.

Scalability and interoperability between blockchains.

Limited awareness among traditional investors regarding blockchain-based finance.

Addressing these challenges will be critical for widespread adoption of RWAfi solutions.

RWAfi is poised to redefine how real-world assets interact with financial markets. By integrating RWAs into DeFi ecosystems, it offers unprecedented opportunities for yield generation, liquidity enhancement, and risk management. With projects like Plume Network leading the charge, RWAfi is set to become a cornerstone of blockchain-based finance in 2025 and beyond.

Investors should keep a close eye on this sector as it continues to mature and unlock new possibilities in the global financial landscape.

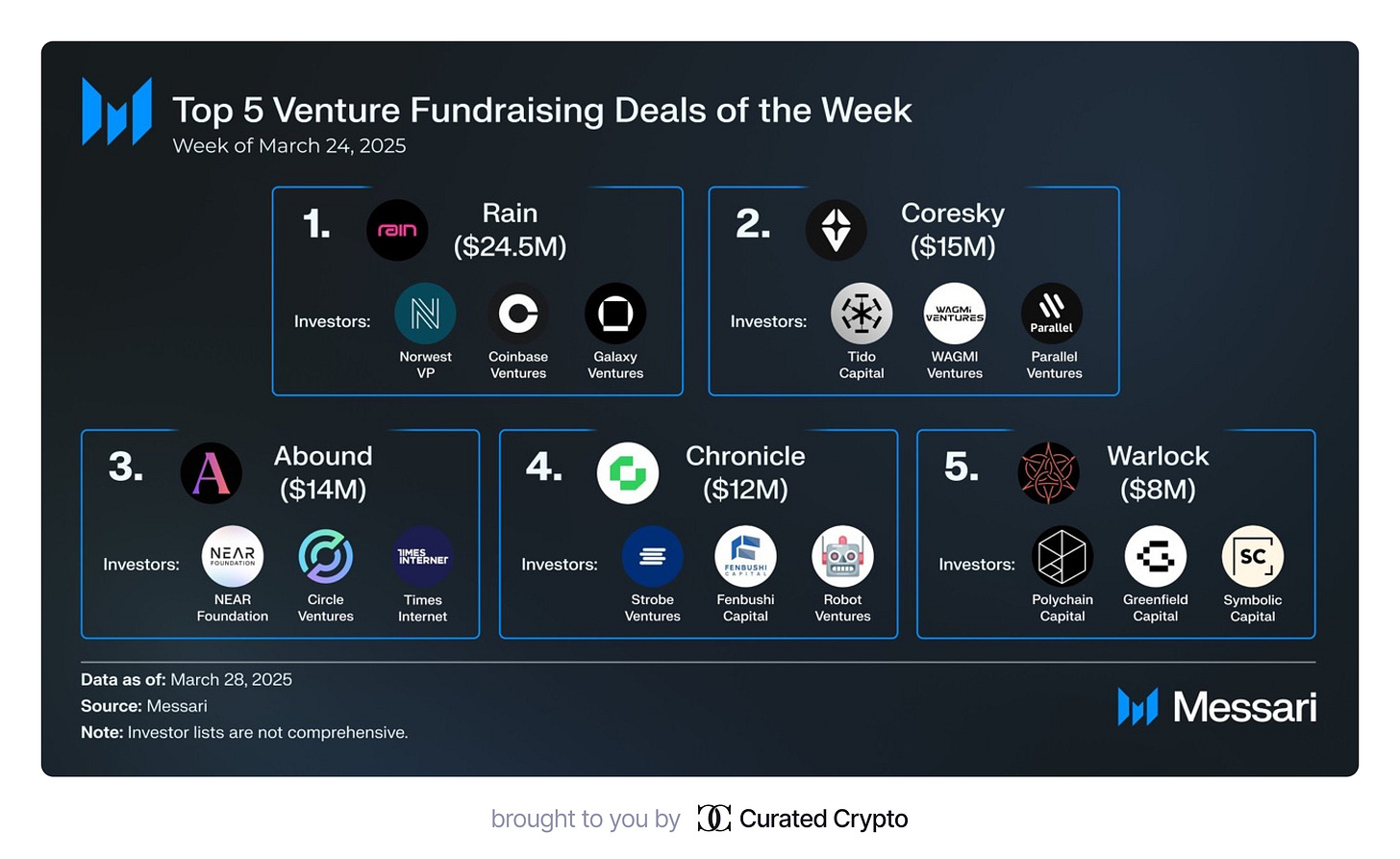

Key VC Rounds of the Week

Top 5 Venture Fundraising Deals of the Week (March 24, 2025)

The venture capital landscape continues to thrive, with significant investments pouring into innovative projects across the blockchain and tech sectors. Below are the top five fundraising deals of the week, as reported by Messari:

1. Rain — $24.5M

Rain secured the largest funding round of the week, raising $24.5 million. The project attracted backing from prominent investors:

Norwest VP

Coinbase Ventures

Galaxy Ventures

2. Coresky — $15M

Coresky raised $15 million in funding, showcasing strong interest from venture capital firms. Key investors include:

Tido Capital

WAGMI Ventures

Parallel Ventures

3. Abound — $14M

Abound secured $14 million in investments, with contributions from major names such as:

NEAR Foundation

Circle Ventures

Times Internet

4. Chronicle — $12M

Chronicle raised $12 million, supported by notable investors:

Strobe Ventures

Fenbushi Capital

Robot Ventures

5. Warlock — $8M

Warlock closed its funding round at $8 million, gaining support from key players:

Polychain Capital

Greenfield Capital

Symbolic Capital

The week ending March 28, 2025, demonstrates continued investor confidence in blockchain and tech innovation. Rain’s impressive $24.5 million round leads the pack, followed closely by Coresky and Abound. These deals signal strong momentum for projects driving advancements in decentralized finance, blockchain scalability, and Web3 infrastructure.

With high-profile investors such as Coinbase Ventures, NEAR Foundation, and Polychain Capital actively participating, these projects are set to shape the future of technology and finance in 2025 and beyond.

Shaping the Market: Long-Term Insights from Crypto News

Terraform Labs Opens Crypto Claims Portal Amid Bankruptcy Proceedings

Terraform Labs, the company behind the collapsed TerraUSD and LUNA ecosystem, launched its “Crypto Loss Claims Portal” on March 31, 2025. This marks a critical step in its Chapter 11 bankruptcy process, which began in January 2024 following the catastrophic $40 billion collapse of its ecosystem in 2022.

Key Details of the Claims Process

Eligible creditors must register their claims by April 30, 2025, to be considered. Late submissions will not be accepted. The claims portal requires creditors to provide proof of ownership for their crypto holdings, including:

Wallet addresses for assets held natively.

Read-only API keys for assets stored on centralized exchanges.

Transaction logs and account statements as manual evidence (subject to longer review times).

Terraform emphasized that claims supported by manual evidence will undergo individualized reviews and may not receive initial determinations within the expedited timeline.

Potential Repayments

As part of a reorganization plan approved by U.S. Bankruptcy Judge Brendan Shannon in September 2024, Terraform Labs could repay creditors between $185 million and $442 million. This plan follows Terraform’s record-breaking $4.47 billion settlement with the SEC over allegations of fraud against users and creditors.

Challenges Ahead

Despite the launch of the claims portal, Terraform faces significant hurdles:

Restoring trust among creditors after its ecosystem collapse.

Managing complex reviews for claims backed by manual evidence.

Ensuring compliance with regulatory frameworks following its SEC settlement.

The opening of the claims portal is a pivotal moment in Terraform Labs’ bankruptcy unwind, offering creditors a chance to recover losses from one of crypto’s most infamous collapses. However, with tight deadlines and intricate submission requirements, creditors must act swiftly to ensure their claims are processed. The outcome of this process will likely shape perceptions of accountability and recovery within the broader crypto industry.

FDIC Ends Use of “Reputational Risk” in Bank Oversight Amid Crypto Industry Criticism

The U.S. Federal Deposit Insurance Corporation (FDIC) has announced it will no longer use the concept of “reputational risk” in its bank oversight practices. This decision follows criticism from the crypto industry, which argued that such policies unfairly restricted their access to financial services.

FDIC’s Decision and Implications

Acting FDIC Chairman Travis Hill, appointed in January 2025, stated that regulators should not use reputational risks to critique banks’ actions. He emphasized that most reputational threats are tied to traditional risks, such as credit or market risks, which are already under regulatory control. The FDIC plans to formalize this change through new rules and has begun removing references to reputational risk from its internal documents.

Broader Regulatory Context

The Office of the Comptroller of the Currency (OCC) has also decided to eliminate reputational risk assessments from its guidelines. This aligns with broader efforts to ensure fair treatment of crypto companies, which have faced challenges accessing banking services due to perceived reputational concerns.

Industry Reaction

Crypto industry leaders welcomed the move. Matthew Sigel of VanEck called it a “major victory against ‘Operation Choke Point 2.0,’” referring to alleged efforts by regulators to limit crypto firms’ financial access. He noted that future financial flows would now be based on economic performance rather than political bias.

This shift marks a significant step toward ensuring equal access to banking services for all market participants, including crypto firms, while promoting transparency in regulatory practices.

Visa to Launch Tokenized Asset Platform on Ethereum Blockchain

Visa has announced the launch of its Visa Tokenized Asset Platform (VTAP), designed to enable banks to issue and manage fiat-backed tokens on the Ethereum blockchain. The platform aims to bridge traditional banking systems with blockchain technology, allowing financial institutions to digitize and automate processes for trading real-world assets like commodities and bonds.

Key Details of VTAP

Pilot Programs: The first pilots will begin in late 2025, with Spain’s BBVA as the initial participant. BBVA plans to create fiat-backed tokens using Ethereum’s smart contracts.

Use Cases: VTAP supports real-time settlements, interbank transfers in wholesale CBDC markets, and cross-border payments for multinational corporations.

Technical Integration: The platform will leverage APIs for seamless operations across blockchain networks, emphasizing interoperability.

Institutional Adoption of Ethereum

Simultaneously, Ethereum is witnessing accelerated institutional adoption. Coinbase now controls 11.42% of staked Ether (ETH), amounting to 3.84 million ETH across 120,000 validators. While this highlights growing interest from institutions, it raises concerns about centralization risks within the Ethereum network.

Visa’s VTAP initiative and the increasing institutional use of Ethereum signal a pivotal moment for integrating blockchain technology into traditional finance while balancing decentralization concerns.

Research Spotlight

You’re Attracted to Red Flags: In Dating & In Crypto

The author draws parallels between toxic relationships and investments in failing crypto projects, highlighting how psychological blind spots lead to recurring mistakes.

Author: Rosie

Why DePIN Matters

The article explores how Decentralized Physical Infrastructure Networks (DePIN) can disrupt monopolistic industries like energy, telecom, and transportation by enabling user-owned, transparent, and efficient networks. It discusses DePIN’s potential to democratize infrastructure, reduce costs, and foster permissionless innovation while addressing challenges like verification and market adoption.

Author: Guy Wuollet

Rethinking Ownership, Stablecoins, and Tokenization

The article explores the intersection of traditional finance and crypto, focusing on tokenization and stablecoins. It examines how tokenization could transform asset ownership systems, the inefficiencies of current models, and its regulatory challenges. It also discusses stablecoins’ impact on monetary policy and their global benefits in promoting USD dominance and cross-border payment efficiency.

Author: Bridget Harris

AI Agents in Cryptoland: Practical Attacks and No Silver Bullet

This paper explores the security vulnerabilities of AI agents in blockchain-based financial ecosystems, focusing on context manipulation attacks. It demonstrates how adversaries can exploit unprotected input channels, memory modules, and data feeds in frameworks like ElizaOS, leading to unauthorized transactions and protocol violations. The study highlights the insufficiency of prompt-based defenses and emphasizes the need for secure and fiduciary-responsible AI models.

Authors: Atharv Singh Patlan, Peiyao Sheng, S. Ashwin Hebbar, Prateek Mittal, Pramod Viswanath

The Great Crypto Wallet Roast: Burned and Learned

Stacy Muur delivers a humorous yet insightful review of popular crypto wallets, evaluating them based on key metrics like security, network support, user experience, and transparency. While roasting their flaws, the article also highlights their achievements in democratizing financial control.

Author: Stacy Muur