Weekly Dose of Alpha: X-Mas Eve Deep Dive

Your one-stop weekly summary of market insights and updates for traders, investors, and those on the hunt for airdrops.

TL;DR

Market Sentiment: The stablecoin market has surged by $30 billion since the election, with daily increases of $750 million, providing significant liquidity. Last week, Bitcoin’s drop to $92,500 triggered panic selling, often a bullish sign. Institutional demand continues to tighten Bitcoin's supply. Meanwhile, Pudgy Penguins NFTs saw a 240% increase, and Ethereum NFT sales reached $304M, signaling growth in the NFT market.

Yield Opportunities: Bitwise launched a Solana staking ETP in Europe, and sBTC went live on Stacks Mainnet, offering a 5% APY on Bitcoin assets.

New Airdrops: Binance added CAT and PENGU to its HODLer Airdrops, and Fuel Network began its 1B FUEL token distribution to 200,000 participants

Upcoming TGEs and Token Sales: Sony's Soneium (Ethereum L2, airdrop on Dec 26), Azuki's Animecoin, Kraken's Inkonchain (mainnet live), Uniswap's Unichain (launching soon), and ConsenSys' Linea (active post-launch).

Key Developments:

Ethena rolls out stablecoin backed by BlackRock's BUIDL token;

Kraken announces the launch of Ink blockchain on the mainnet.

Special note: Recent funding rounds backed by top tier angels.

Research of the week: The flywheel of the hype machine

Panic or the Disco?

Two weeks ago, Bitcoin’s rally reached new all-time highs above $107,000, driven by institutional demand and monetary easing expectations, with stablecoin liquidity playing a crucial role. AI agents and cult memecoins also emerged as important narratives. Last week, stablecoin-driven liquidity and institutional demand continued to support Bitcoin's price, while NFTs, especially Pudgy Penguins, gained significant momentum.

Stablecoins Driving Market Liquidity

The stablecoin market is experiencing robust and steady growth, with the total supply making consistent daily gains. Since the election, the market cap of stablecoins has surged by $30B, translating to an average increase of $750M per day.

This growth is reflected in exchange activity, where an average of $40M USDT has been deposited daily over the past eight weeks. These inflows inject significant liquidity, supporting price stability and enhancing market confidence, as highlighted in our latest analysis on Substack.

Market Turmoil

Last week, Bitcoin’s drop to $92,500 triggered widespread panic among “weak hands,” with short-term holders selling at a loss—a historically bullish signal for market recovery. Simultaneously, the number of “buy the dip” calls in the crypto community reached an 8-month high, a sentiment typically viewed as bearish in the short term.

The key indicators reflect a curious sentiment: the realized profit ratio remains low compared to previous cycles, indicating that the whales have not yet started significant profit taking. Additionally, the bitcoin funding rate, analyzed using the 30-day EMA, shows no signs of overheating at the end of the cycle.

The market is also experiencing what analysts call the 3rd great Bitcoin supply shock. BTC balances on exchanges continue to decline sharply, coinciding with surging demand from institutional giants like BlackRock and Microstrategy.This dynamic hints at tightening supply and growing corporate accumulation, which could significantly impact Bitcoin’s price trajectory in the coming months.

NFT Revival: Hype or Signal?

This month, both Bitcoin and Pudgy Penguins NFTs have surpassed the $100,000 mark, indicating strong momentum in the crypto and NFT markets.

Bitcoin began the 30-day period at around $88,000 and traded above $100,000, marking a ~14% increase.

Pudgy Penguins started at 9.45 ETH ($30,000) and soared to 26.15 ETH ($103,000), delivering an impressive ~240% surge.

The Penguins' rise is fueled by the $PENGU token launch hype, set to expand the ecosystem to Solana, alongside Ethereum's price growth and strong community support.

Over the past 7 days, NFT activity on Ethereum has increased significantly.

It's hard to say at this point if this spike in activity is a sign of a longer-term revival or just traders trying to game the Pudgy Penguin airdrop.

According to Galaxy Research, the NFT market is recovering, with trading volumes growing rapidly. Data from DefiLlama indicates that Ethereum-based NFT sales reached $304 million in a week, marking explosive growth in this market.

Passive Yield Opportunities: Weekly Highlights for Smart Investors

This week presented a range of compelling options for generating passive income, both within DeFi and elsewhere. Here’s what stood out:

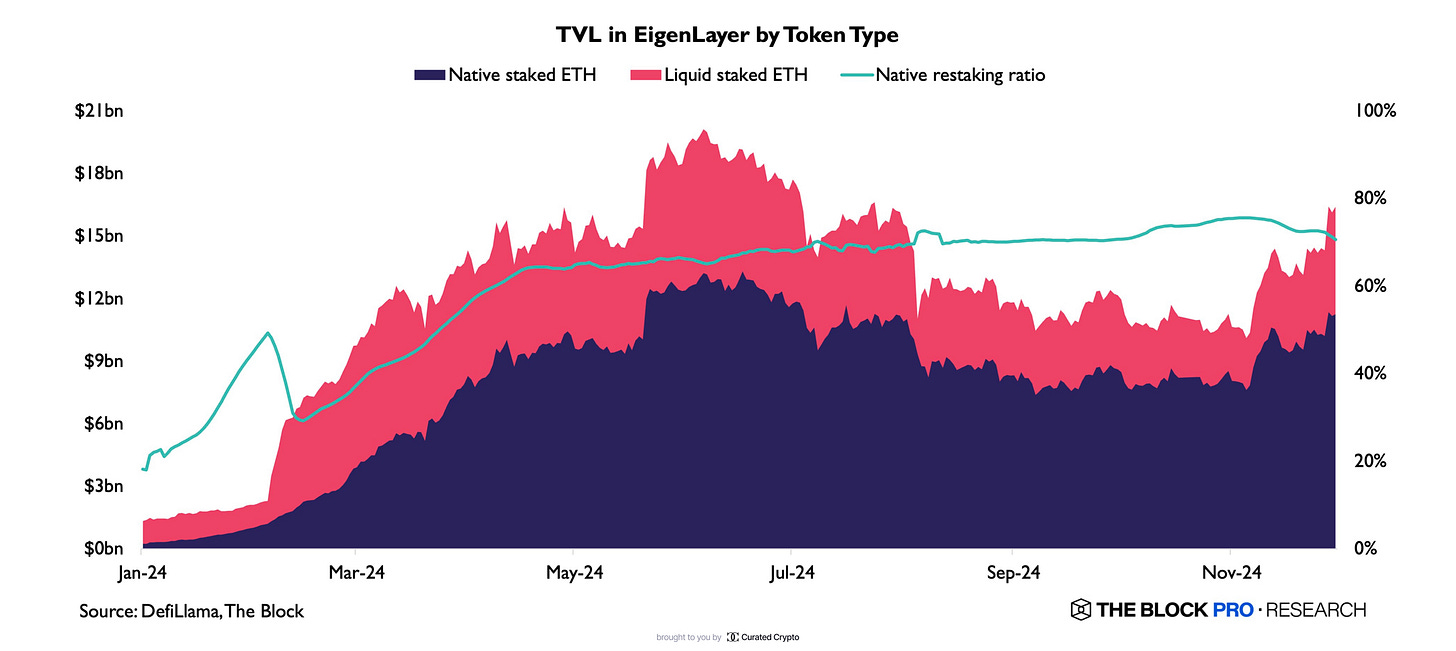

Restaking Trends in 2024

EigenLayer's Stellar Growth: EigenLayer emerged as the frontrunner in restaking, starting the year with $1.3 billion in total value locked (TVL). It reached an impressive peak of $20 billion by June before stabilizing at $16 billion, despite a dip in Q3.

Rising Stars in Restaking: Protocols like Babylon, focused on Bitcoin ($2.3 billion TVL), and Symbiotic, centered on Ethereum ($2.4 billion TVL), captured significant attention and adoption.

Ether.fi's Dominance: Ether.fi solidified its position as the top liquid restaking protocol of 2024, amassing $7.3 billion in TVL and becoming the fourth-largest DeFi application globally.

Dive Deeper: For an in-depth analysis, explore "Restaking Trends in 2024,". Source.

Key Developments in Crypto Staking ETPs

Bitwise Expands in Europe: Bitwise has launched a Solana staking exchange-traded product (ETP) in Europe, marking a strategic move as its US-based applications for similar products remain under review. This ETP allows European investors to gain exposure to Solana while benefiting from staking rewards.

Hedera HBAR Joins Euronext: A new Hedera HBAR ETP has debuted on Euronext, further diversifying staking opportunities for institutional and retail investors in the European market.

sBTC Launches on Stacks Mainnet

sBTC Goes Live: The highly anticipated sBTC is now available on the Stacks Mainnet, positioning itself as one of the most decentralized Bitcoin derivatives on Layer 2 networks.

Decentralized Management: sBTC is secured by a network of signers, including prominent institutional players, ensuring robust and transparent management.

Attractive Yield: Holders can earn a competitive 5% APY passively, making sBTC an appealing option for those seeking yield on Bitcoin assets.

This launch marks a significant milestone for Bitcoin interoperability and decentralized finance on the Stacks ecosystem.

Insights for Airdrop Hunters:

If airdrops are on your radar, this week was packed with exciting updates and significant rewards in the crypto world:

Pudgy Penguins Launch PENGU Token on Solana

PENGU Token Goes Live: Pudgy Penguins have officially launched their PENGU token on the Solana blockchain, adding a new layer of engagement for their vibrant community.

Claim Window: Holders can claim their PENGU tokens within an 88-day window, after which any unclaimed tokens will be permanently burned.

This move highlights the project’s growing presence on Solana and aims to expand its ecosystem while rewarding loyal supporters.

Binance Adds CAT and PENGU to HODLer Airdrops

New Airdrop Additions: Binance has included Simon's Cat (CAT) and Pudgy Penguins (PENGU) in its popular HODLer Airdrops program, offering new incentives for token holders.

Reward Opportunities: Eligible users holding CAT or PENGU can now participate in the airdrops, further boosting the appeal of these tokens in the market.

This update reflects Binance's ongoing commitment to supporting diverse token ecosystems and rewarding its community.

Fuel Network Announces 1B FUEL Genesis Drop

Massive Token Distribution: Fuel Network has revealed plans for its genesis drop, distributing 1 billion FUEL tokens to 200,000 eligible participants.

Significant Milestone: This distribution marks a major step in Fuel Network's journey, aiming to reward early supporters and promote adoption of its high-performance modular blockchain.

Key Dates: The token drop began on December 19, offering a unique opportunity for participants to engage with the ecosystem.

Weekly Sui Airdrops Update

Ready for Sui Airdrops? If you’ve got some free time this weekend and want to explore Sui Airdrops but aren’t sure where to begin, this series is here to help you out!

This Week’s Featured Projects: We’re spotlighting six promising projects to check out:

Stay tuned for more airdrop opportunities and updates in our weekly series!

Key Upcoming TGEs, Listings, and Product Releases

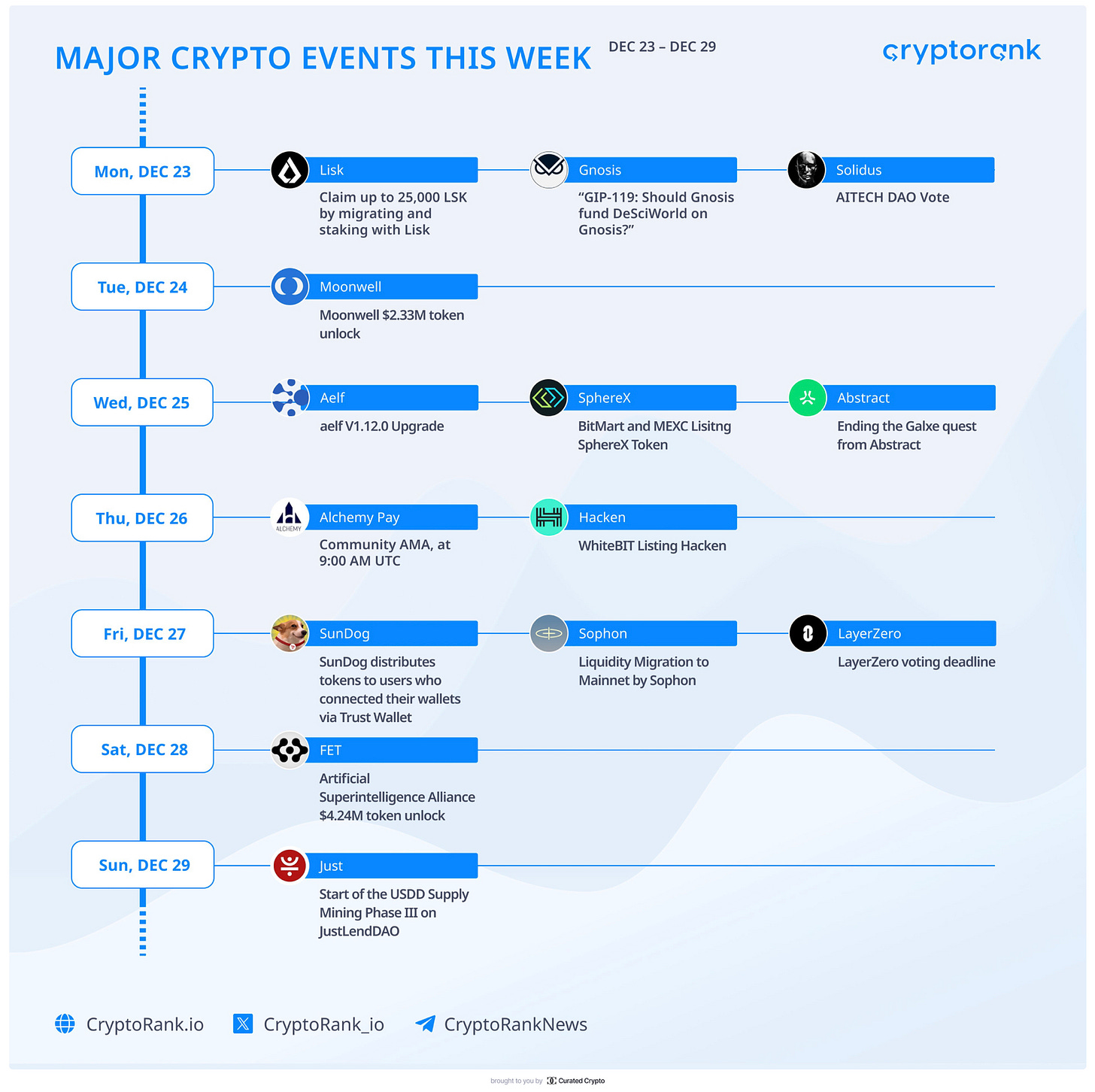

Major Crypto Events This Week

Dive into the most electrifying moments in the crypto universe:

December 23:

Claim up to 25,000 $LSK by migrating and staking with Lisk

GIP-119 Proposal: Should Gnosis fund DeSciWorld on Gnosis Chain?

AITECH DAO Vote

December 24:

$WELL $2.33M token unlock

December 25:

aelf Blockchain V1.12.0 Upgrade

BitMart and MEXC listing Spherex Tech Token

Ending the Galxe quest from Abstract

December 26:

AlchemyPay community AMA at 9:00 AM UTC

WhiteBIT listing Hacken

December 27:

SunDog distributes tokens to users who connected via Trust Wallet

Liquidity Migration to Mainnet by Sophon

LayerZero voting deadline

December 28:

$FET $4.24M token unlock

December 29:

Start of the $USDD Supply Mining Phase III on JustLendDAO

Top Blockchains with Upcoming Token Generation Events Backed by Major Companies

Here are some notable blockchain projects with upcoming Token Generation Events (TGEs) supported by leading companies:

Soneium by Sony Group: Sony Group has announced the development of Soneium, an Ethereum Layer-2 blockchain. While the mainnet launch date has not been disclosed, an airdrop is confirmed for December 26, 2024. Source

Animecoin by Azuki: Azuki has hinted at an upcoming token launch for Animecoin. The official Azuki account retweeted a video from Animecoin on December 22, 2024, suggesting a new chapter is forthcoming. Source

Inkonchain by Kraken: Kraken's Ink Layer 2 blockchain is now live on the mainnet, arriving ahead of its originally slated release date of early 2025. The network aims to offer one-second block times, facilitating time-sensitive transactions. Source

Unichain by Uniswap: Uniswap has announced Unichain, an Ethereum Layer-2 network designed for DeFi. The mainnet is expected to launch early next year, with the Sepolia testnet already public. Source

LineaBuild by ConsenSys: ConsenSys has launched Linea, a Layer-2 blockchain solution. The mainnet went live at EthCC in Paris, and the network has seen significant on-chain activity since its launch. Source

Major events & developments: Watching protocols

Crypto Watchlist for the Week Ahead

This week has seen significant venture capital funding across various sectors in the crypto and tech space:

$BTC – MicroStrategy Joins Nasdaq 100

◦ Main Event: December 23

◦ MicroStrategy will be added to the Nasdaq 100, becoming the first BTC-focused company to earn a spot. Source.$HYPE – Hyperliquid Token Performance

◦ Update: Ongoing

◦ Hyperliquid token continues to show significant strength during the latest BTC dip, proving its resilience. Source.$FTM – Sonic Gateway Goes Live

◦ Main Event: Next week

◦ The native bridge between Sonic and Ethereum L1, Sonic Gateway, will be going live soon. Source.$PENDLE – Airdrop Snapshot

◦ Main Event: December 31

◦ The snapshot for the PENDLE airdrop for stakers will be taken. Source.$FLUID (previously $INST) – Fluid DEX Proposal

◦ Update: Live now

◦ A proposal for deploying Fluid DEX on Arbitrum L2 is now live for voting. Source$ZRO – LayerZero Fee-Switch Proposal

◦ Main Event: December 27

◦ Voting for LayerZero’s fee-switch proposal ends, and if it passes, a buy-and-burn mechanism for ZRO will be activated. Source.

Upcoming Unlocks

Top 7 Token Unlocks of the Upcoming Week

The following tokens with the largest unlock amount will be unlocked next week:

IDEX (ID)

◦ Unlock Amount: $35.32MImmutable X (IMX)

◦ Unlock Amount: $32.43MGrass (GRASS)

◦ Unlock Amount: $9.49MYield Guild Games (YGG)

◦ Unlock Amount: $5.57MNFPrompt (NFP)

◦ Unlock Amount: $3.85MGT Protocol (GTAI)

◦ Unlock Amount: $2.52MMoonwell (WELL)

◦ Unlock Amount: $2.33M

These upcoming token unlocks have the potential to affect token prices and market trends. Investors and traders should keep a close eye on these dates, as they could significantly impact market sentiment.

Protocols in Focus

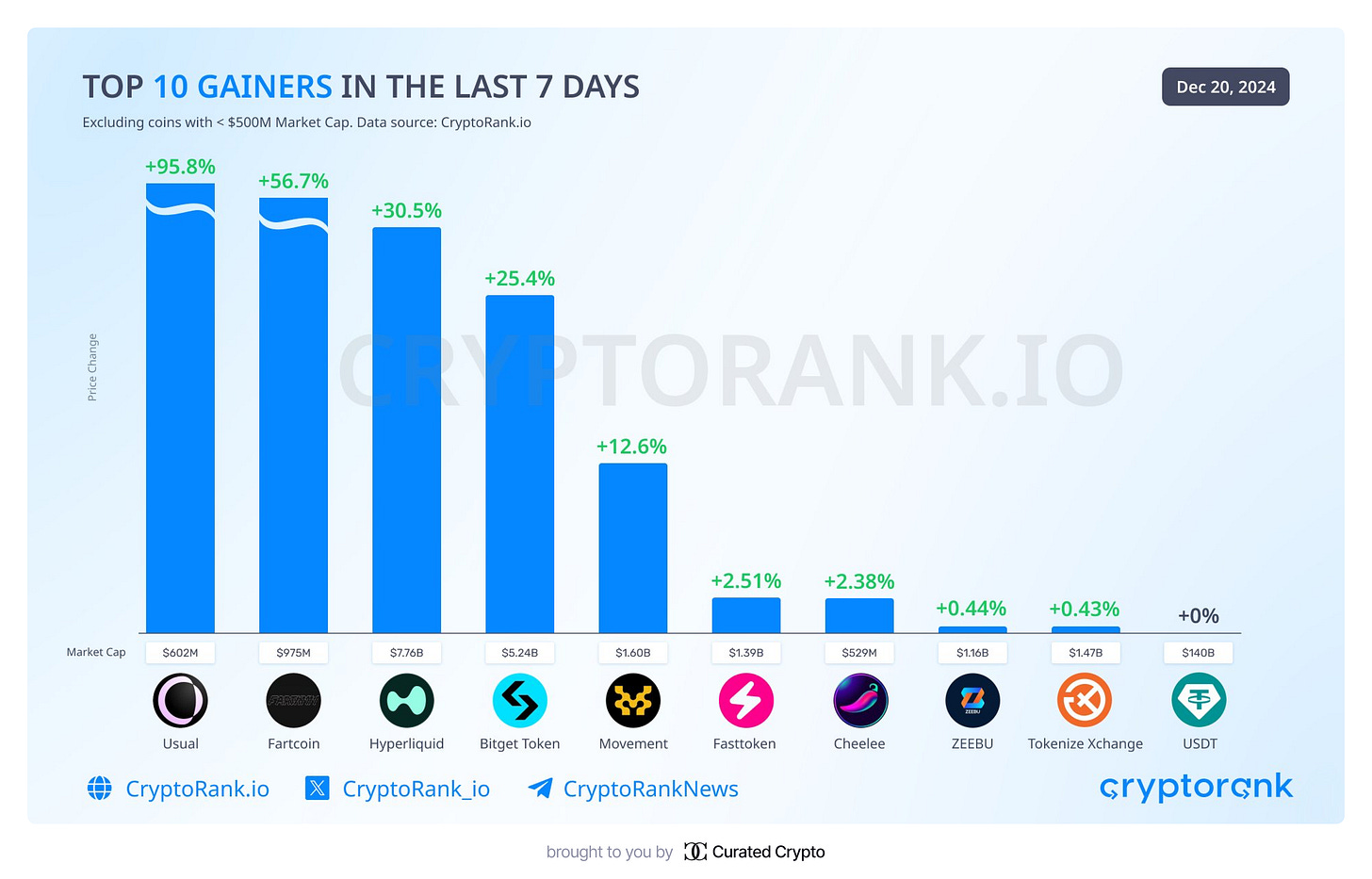

Top 10 Gainers in the Last 7 Days

Despite the market downturn, newly launched tokens like $USUAL, $MOVE, and $HYPE have maintained strong upward momentum. Meanwhile, stablecoins have demonstrated resilience amidst the market turbulence. Additionally, tokens such as $Fartcoin and $BGB are moving counter to the broader market trends.

Key Updates in the Hyperliquid Ecosystem

◦ Hyperliquid’s token platform, powered by the HYPE token, is rapidly gaining traction in the DeFi space. Its airdrop, one of the largest in the cryptocurrency market, has generated significant buzz and is driving adoption.

◦ With a focus on decentralized liquidity, Hyperliquid is poised for continuous growth and innovation in the DeFi sector.

Details

World Liberty Financial and Ethena Partnership: sUSDe Integration

◦ World Liberty Financial, backed by Donald Trump, is exploring a collaboration with Ethena, beginning with the implementation of sUSDe. This partnership has the potential to significantly impact both the traditional financial and decentralized finance sectors.

◦ Through sUSDe, Ethena is positioning itself to redefine the concept of "Internet Bonds," challenging traditional government bonds in terms of adoption and use.

Details

Exploring XProtocol’s Blockchain Solutions

◦ XProtocol is a cutting-edge blockchain protocol that aims to address major scalability and interoperability challenges. The platform is designed to bridge disparate blockchain ecosystems, contributing to a more connected decentralized future.

◦ By enhancing blockchain infrastructure, XProtocol is positioning itself as a critical component in the future of decentralized technology.

Details

Chainbase: Revolutionizing Blockchain Data Analytics

◦ Chainbase is transforming the way blockchain data is analyzed by integrating AI-driven tools for more efficient on-chain data processing. This innovation will help decentralized applications make smarter, data-backed decisions.

◦ With a clear focus on providing the best on-chain data for the emerging AI economy, Chainbase is becoming an essential tool for both DeFi applications and broader blockchain ecosystems.

Details

Product Updates of the Week

The past week has seen several important developments related to stablecoins:

Ethena rolls out stablecoin backed by BlackRock's BUIDL token

Ethena has launched a stablecoin supported by BlackRock's BUIDL token, bringing more stability and enhancing its decentralized finance (DeFi) capabilities.

The partnership blends traditional finance with blockchain technology.

This is expected to foster more confidence in the project and its long-term potential.

Kraken announces the launch of Ink blockchain on the mainnet

Kraken has launched the Ink blockchain, expanding its offerings beyond traditional crypto exchanges.

The launch enhances its decentralized services and paves the way for new blockchain solutions.

This move emphasizes Kraken's commitment to growing in the Web3 space.

Solana network reaches new heights in transaction volume

Solana sets a new record for daily transaction volume, further cementing its position as a leading blockchain.

In November, 55% of global crypto users were active on the Solana network.

This growth highlights Solana’s increasing adoption and influence within the crypto market.

Nexus attracts 1.5 million nodes in testnet phase for decentralized supercomputer

Nexus continues to build its decentralized supercomputer, drawing attention with 1.5 million nodes in its testnet phase.

The project’s massive node participation is a promising sign of its potential success.

Nexus aims to redefine the decentralized computing space and improve blockchain scalability.

Key VC Rounds of the Week

Let's take a look at those projects that have received funding above $100M:

0G Labs

Total raised: $250 million in token purchase commitment.

Additional funding: $40 million for decentralized AI OS development and $35 million earlier this year.

Focus: Leveraging decentralization to prevent dominant entities from controlling large datasets, especially in the rapidly growing AI field.

Monad

Total raised: $225 million in Paradigm-led round.

Focus: Building a Layer 1 blockchain to rival Ethereum and Solana, with a new type of Ethereum Virtual Machine that enables parallel processing for instant block finality.

EVM Compatibility: Easy transition for Ethereum developers to port existing apps.

Celestia

Total raised: $100 million led by Bain Capital Crypto.

Goal: Achieving higher throughput, with the ability to handle transactions comparable to Visa, using 1GB blocks.

Competitors: Ethereum (50 TPS), Solana (up to 65,000 TPS but averages around 400 TPS).

Berachain

Total raised: $100 million Series B round.

Co-led by: Framework Ventures and Brevan Howard Digital.

Use of funds: Focus on economic growth, expanding global presence, and enhancing engineering resources.

Target regions: Hong Kong, Singapore, Southeast Asia, Latin America, and Africa.

You can learn about the rest of the projects from the source.

This week has seen significant venture capital funding across various sectors in the crypto and tech space:

Yei Finance

Raised: $2M

Overview: Yei Finance is a non-custodial money market protocol focused on offering secure and decentralized financial solutions.

Significance: This funding highlights the increasing demand for innovative DeFi tools that enhance user control over assets.

Uranium Digital

Raised: $1.7M

Overview: A blockchain project dedicated to modernizing uranium trading by streamlining processes and improving transparency in the commodities market.

Significance: The project’s focus demonstrates how blockchain is being applied to niche yet critical industries like energy trading.

Lens Protocol

Raised: $31M

Overview: A blockchain-based social graph designed to power decentralized social networks, fostering user-centric platforms without intermediaries.

Significance: Lens Protocol’s raise underscores the growing interest in decentralized alternatives to traditional social media platforms.

Plume Network

Raised: $20M

Overview: An L1 blockchain platform integrating real-world assets (RWAs) into the blockchain ecosystem to bridge traditional and digital economies.

Significance: The project is set to redefine how RWAs are tokenized and traded within the blockchain space, enhancing global accessibility.

Hexagate

Funding Type: M&A round with participation from Chainalysis.

Overview: A Web3 security platform focused on addressing vulnerabilities in decentralized applications and blockchain systems.

Significance: This funding highlights the vital role of security in Web3's evolution, ensuring user trust and platform resilience.

These developments emphasize the diversified interest and strategic investments shaping the future of crypto and tech industries.

Crypto News of the Week: Long-Term Market Impacts

Federal Reserve Rate Cut and Its Implications

The Federal Reserve recently lowered its key interest rate by 25 basis points, bringing it to 4.25–4.5%. While announcing the decision, Fed Chair Jerome Powell emphasized that the institution does not hold Bitcoin and has no plans to advocate for legislative changes to do so, reinforcing the Fed's traditional stance on cryptocurrency.

Economic Projections and Market Impact

The Fed’s updated forecasts suggest moderate economic adjustments by 2025:

Unemployment Rate: Expected to decrease slightly to 4.3% (previously 4.4%).

PCE Inflation: Estimated at 2.5%, reflecting an uptick from earlier projections of 2.1%.

GDP Growth: Anticipated to rise to 2.1%, marginally up from September's 2.0% projection, with long-term growth stable at 1.8%.

Despite a broader market correction and record ETF outflows late last week, global crypto investment products recorded net inflows of $308 million, continuing an 11-week streak of positive momentum. However, the Fed’s rate decision triggered significant withdrawals of nearly $1 billion from crypto funds, highlighting ongoing sensitivity to macroeconomic policy changes.

This mixed picture underscores the evolving dynamics between monetary policy and digital asset markets.

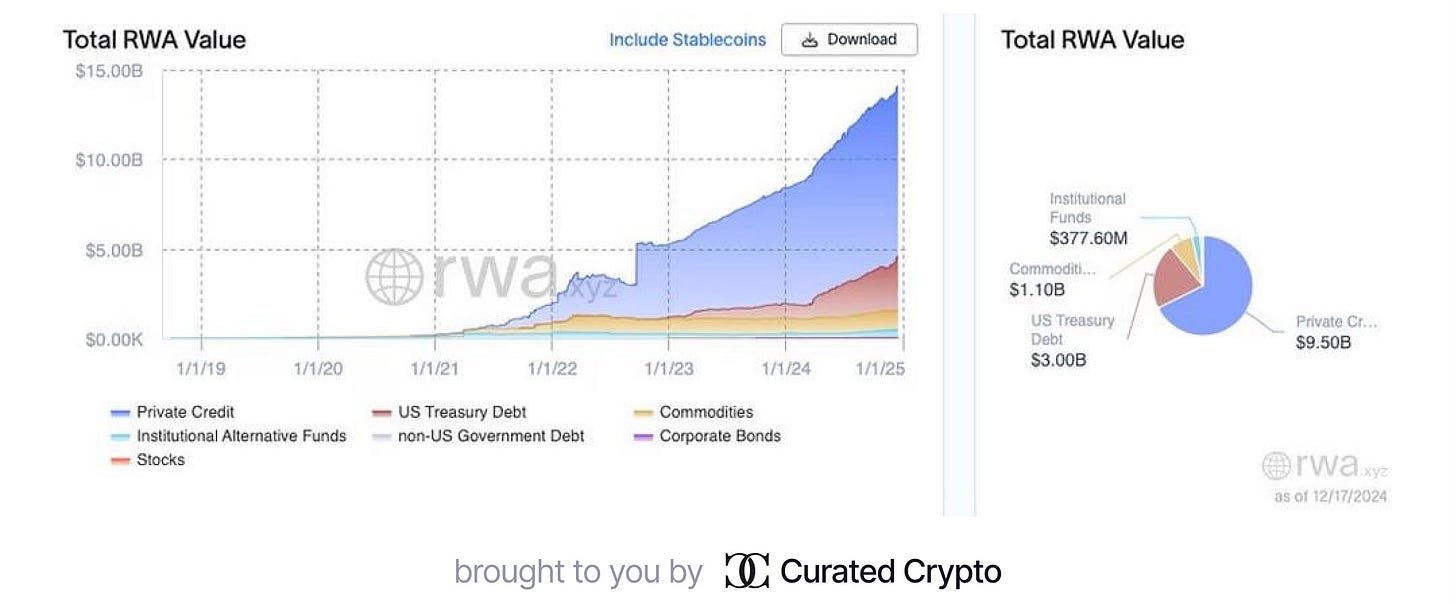

Tokenized RWA Market Surpasses $14 Billion

The global market for tokenized real-world assets (RWAs) has reached a significant milestone, exceeding $14 billion in total value. This represents a remarkable 66% year-over-year growth, underlining the increasing adoption of blockchain-based tokenization.

According to projections by Bitwise, the RWA market is expected to expand dramatically, potentially reaching $50 billion by 2025. This growth highlights the sector's transformative potential in bridging traditional finance and blockchain technology, providing enhanced liquidity and accessibility to a range of real-world assets.

El Salvador Strikes Deal with IMF: Bitcoin Policy Shift

El Salvador has entered into a historic agreement with the International Monetary Fund (IMF), securing a $1.4 billion loan to support its economy. As part of the deal, the country will implement significant policy changes, notably removing the mandatory acceptance of Bitcoin as payment by businesses.

The IMF has also imposed restrictions on Bitcoin-related activities in the public sector, prohibiting purchases and transactions with the cryptocurrency. However, the government retains its ability to buy one Bitcoin daily, a policy that garnered attention when it purchased 22 BTC during last week’s market dip.

These developments mark a significant shift in El Salvador's pioneering approach to Bitcoin adoption while balancing fiscal policies and international cooperation.

Binance Survey Reveals Key Crypto Trends for 2024

Binance's recent survey reveals key insights into crypto trends for 2024:

23.89% of respondents believe AI tokens have the most growth potential.

19% see meme coins as the second most promising.

12% prioritize DeFi projects.

Notably, 45% of respondents joined the crypto market only in 2024, showcasing a surge in new participants. This data highlights growing investor interest in AI and meme-driven markets.

For more details, check the full survey results here.

Research Spotlight

You're not bullish enough on stablecoins

The article "You're not bullish enough on stablecoins" discusses the growing importance of stablecoins in the cryptocurrency market. It argues that these digital assets, offering price stability, are increasingly essential for the global financial ecosystem, especially as decentralized finance (DeFi) continues to expand. The author suggests that stablecoins could provide significant growth opportunities as their adoption broadens, challenging the dominance of more volatile cryptocurrencies.

Key Predictions - The Year Ahead for Markets 2025

The article "Key Predictions - The Year Ahead for Markets 2025" from Delphi Digital outlines predictions for the cryptocurrency market in 2025, covering key trends that could shape the industry. It highlights factors like regulation, market adoption, and emerging technologies, with experts projecting that these elements will drive innovation and market growth. The article emphasizes that significant changes are likely, setting the stage for new opportunities and challenges.

DeFi Year Ahead 2025

The report "DeFi Year Ahead 2025" from Delphi Digital forecasts the future of decentralized finance in 2025. It explores potential trends in DeFi protocols, evolving regulatory frameworks, and technological advancements. The report also highlights the growing adoption of DeFi platforms and the emergence of new solutions that could address scalability, security, and user experience. Investors and industry participants should watch for significant changes that could reshape the DeFi ecosystem.

Tokenized AI agents: a new foundation or just a fancy wrapper?

The article "Tokenized AI agents: a new foundation or just a fancy wrapper?" examines the rise of AI-powered tokens and their potential to reshape decentralized networks. It explores whether these AI agents represent a revolutionary step in the integration of blockchain and artificial intelligence or if they are merely another marketing trend. The report delves into how tokenized AI agents could impact various sectors, from decentralized finance to governance and beyond.

The year ahead for AI + DePIN 2025

The article "The year ahead for AI + DePIN 2025" discusses the significant role decentralized physical infrastructure networks (DePIN) are expected to play in the AI landscape in 2025. It explores how AI integration with blockchain technologies could transform industries and accelerate the adoption of decentralized solutions. The piece anticipates the evolution of AI applications and how they will drive the future of blockchain networks and decentralized finance.

DePIN’s role in the next crypto wave

The article "DePIN’s role in the next crypto wave" explores the growing impact of decentralized physical infrastructure networks (DePIN) on the future of blockchain and cryptocurrency. As these networks evolve, they are expected to drive significant innovations, particularly in how physical assets and data are managed and accessed. DePIN represents the next phase in the crypto industry, offering promising developments for both tech and economic sectors.

The flywheel of the hype machine

The article "The flywheel of the hype machine" explores how the cycle of hype and speculation in the cryptocurrency and tech sectors fuels rapid adoption and market fluctuations. It delves into the psychological mechanisms driving this phenomenon and its implications for investors and the industry at large. By understanding the dynamics of this "hype machine," stakeholders can better navigate volatility in emerging markets.

Mastering Airdrops: How to build and spot winners using psychology

The article "Mastering Airdrops: How to build and spot winners using psychology" discusses strategies to effectively launch and identify successful airdrops. It emphasizes understanding the psychological triggers that influence investor behavior and how to leverage these insights to maximize the impact of airdrops. By applying behavioral psychology principles, businesses and crypto projects can create more engaging, high-impact campaigns that resonate with their target audience.