Weekly Dose of Alpha: Come Up Trumps

Stay ahead with this ultimate guide for investors and crypto enthusiasts—featuring top trends and insights.

TL;DR

Market Sentiment: Bitcoin is hitting all-time highs thanks to the big players, while retail is lagging behind. Meanwhile, the supply of stablecoins reached a record $114.6 billion, derivatives trading volumes soared, but unpopular opinion says the altcoin season is fading, requiring selective asset strategies in an oversaturated market.

Yield Opportunities: Sui market recovery fuels high yields like 30.02% APR. Stablecoins with point programs, such as Reservoir and Rings Protocol, attract users. Avalon Finance’s USDa offers 20% APY + 25% APY in $AVL, making it a DeFi standout.

New Airdrops: Jupiter DEX, Plume Network, and Obol Collective launched major airdrops last week, rewarding active users, early contributors, and stakers with significant token allocations.

Upcoming TGEs and Token Sales: Exciting pre-TGE blockchain projects include Abstract Chain, Berachain, Soon, Eclipse, Monad, Story Protocol, and Kaito AI.

Key Developments:

Uniswap V4 will officially go live next week;

Mode is set to launch its AI Mode Terminal.

Special note: Projects with high inflation rates for 2025.

Research of the week: The DePIN Ecosystem Landscape

New Cards, Same Game: Record Inflows & Familiar Market Dynamics

In the third week of January, crypto investment products saw record inflows, with Bitcoin leading, while institutional interest in Ethereum grew and DeFi markets matured. Despite a drop in retail demand, Google searches for "how to buy crypto" reached an all-time high.

This week’s analysis will focus on the second half of January, where we saw key developments such as significant token unlocks, strategic fundraising rounds, regulatory shifts, and emerging trends in DeFi, all shaping the outlook for February.

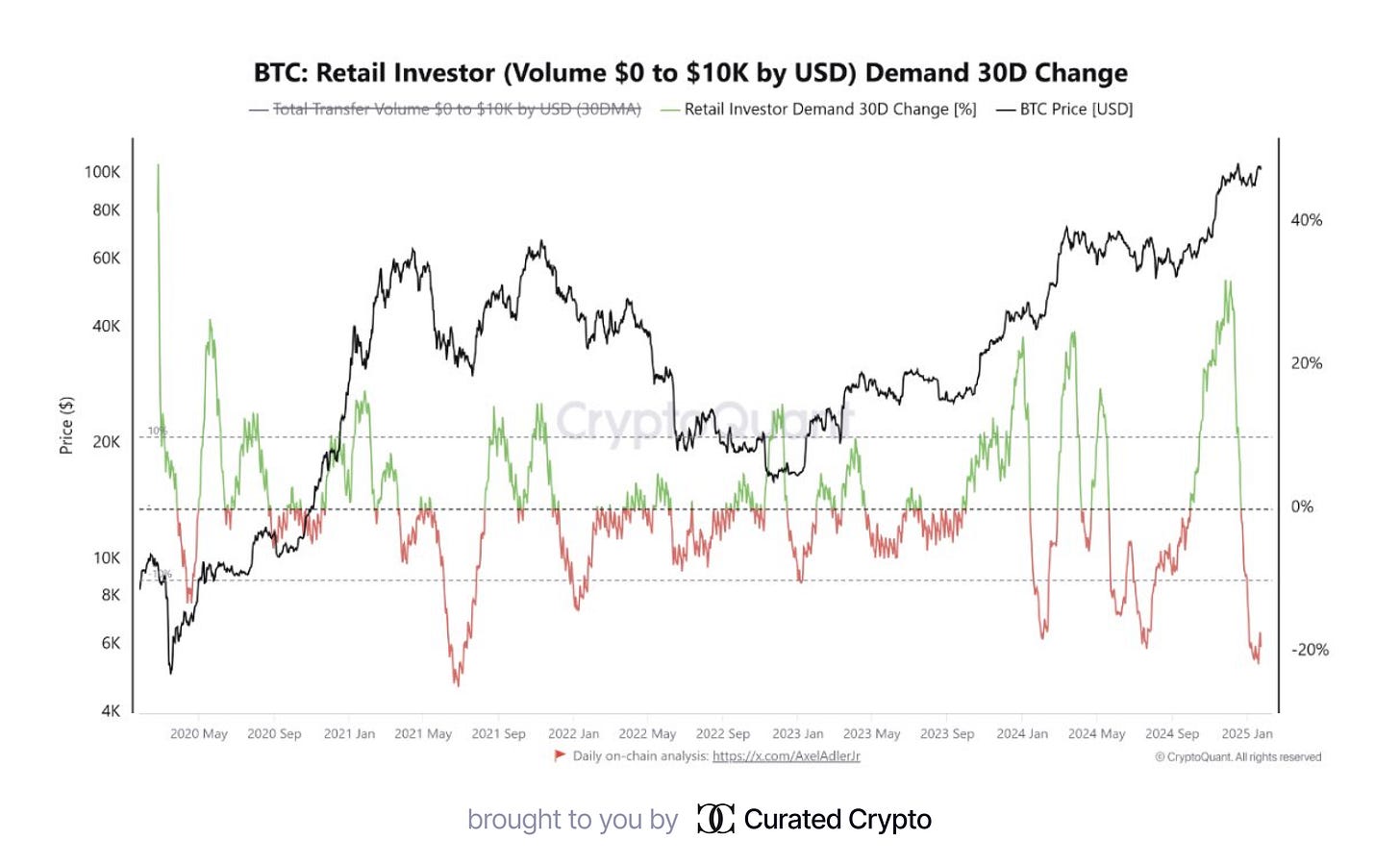

Retail Demand Lags Despite Bitcoin Approaching New Highs

Bitcoin’s price has neared all-time highs, but retail participation remains notably weak. On-chain activity for transactions under $10K has declined by 19.34% in recent days, highlighting subdued engagement from smaller investors. This trend is surprising given the heightened price volatility typically associated with increased retail activity.

Historically, retail demand spikes during volatile periods, yet the current market is showing an atypical behavior. After a peak in December, retail activity began to taper off, reflecting a cautious sentiment likely driven by consolidation phases.

Despite low retail demand, the on-chain structure remains stable and unstretched, creating a favorable environment for further price uptrends. This balance indicates that the market has room for growth without the immediate risk of overextension.

For now, Bitcoin's upward momentum appears to be fueled by larger players, with retail investors potentially waiting for clearer signals. This dynamic could shift as new developments unfold, signaling opportunities for renewed participation in the market.

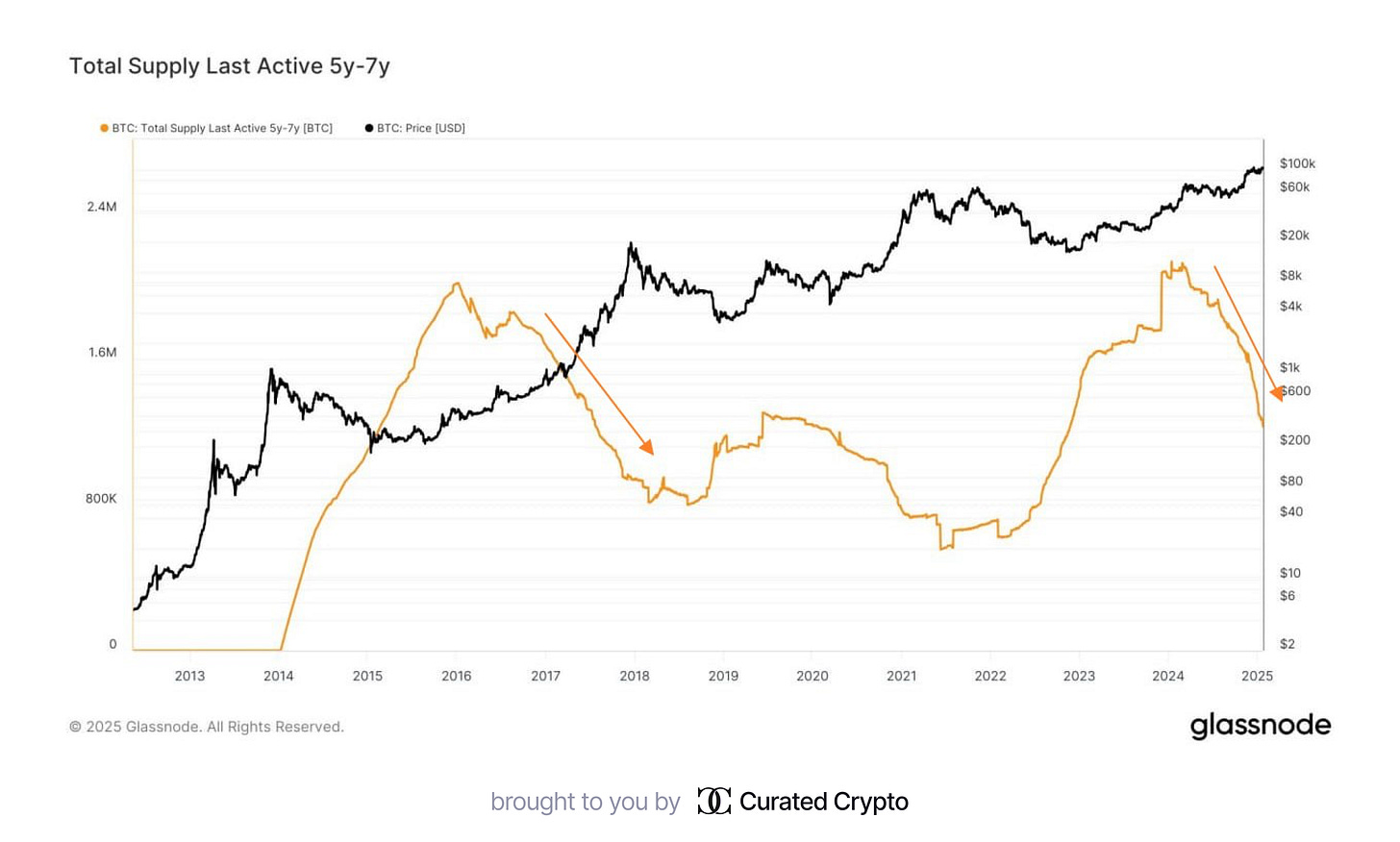

BTC Options Turn Bullish Amid Supply Shock

BTC options on CME show the strongest bullish sentiment since the U.S. elections, with increased confidence driven by significant inflows into spot ETFs. Over the past week, ETFs purchased 16,500 BTC, while miners only added 3,150 BTC to the supply, emphasizing a growing imbalance between demand and supply.

Long-term holders continue to reduce their liquid supply, mirroring trends observed during the 2016–2018 bull cycle.This sustained reduction suggests a tightening supply shock, as highlighted in previous analyses (“X-Mas Eve Deep Dive”)

As ETFs absorb more BTC, and liquid supply dwindles, market fundamentals remain historically bullish. This setup reflects a strengthening foundation for Bitcoin's upward trajectory in the coming months.

With demand rising and supply growth slowing, the market is entering a phase where scarcity may drive prices higher, signaling potential opportunities for strategic investors.

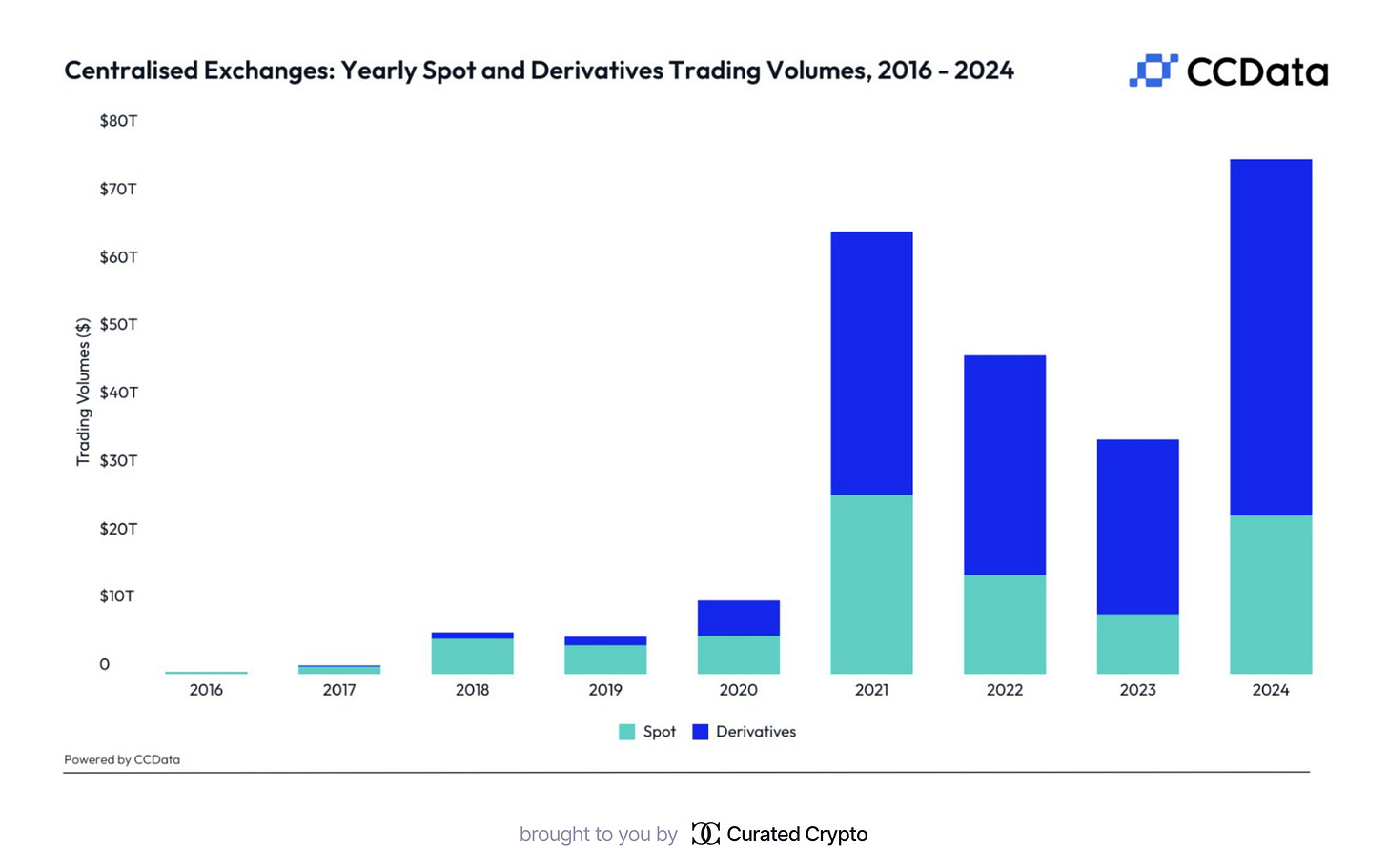

Stablecoins and Trading Volumes Break Records in 2025

The total ERC20 stablecoin supply reached an all-time high of $114.6B, continuing its rapid growth since November 2024. This surge is partly attributed to increased market activity following Donald Trump’s inauguration. Investors appear to be converting fiat into stablecoins as a signal of growing confidence and preparation for future market opportunities.

Solana emerged as a major driver of this growth. Its stablecoin market cap rose by 112% YTD, reaching $10.8B, thanks to a significant USDC issuance by Circle. Solana is now the third-largest blockchain for stablecoins, trailing only Ethereum ($116B) and TRON ($59B). In addition, Solana's DEX volumes hit an astounding $220B in January, outpacing Ethereum’s $69B by more than threefold.

On centralized exchanges, 2024 saw a record-breaking $75.8T in annual trading volumes, surpassing the previous high of $65.1T set in 2021. Derivatives trading now accounts for 69.2% of total volumes, up significantly from 59.5% in 2021. December alone recorded $7.58T in monthly derivatives trading, marking the third consecutive month of growth.

The combination of record stablecoin supply, high trading volumes, and expanding derivatives activity suggests a strong foundation for liquidity and potential bullish momentum in 2025. As market participants position themselves for the next cycle, these metrics underscore the growing significance of stablecoins and derivatives in shaping the crypto landscape.

Why the Classic Altcoin Season May Be Over

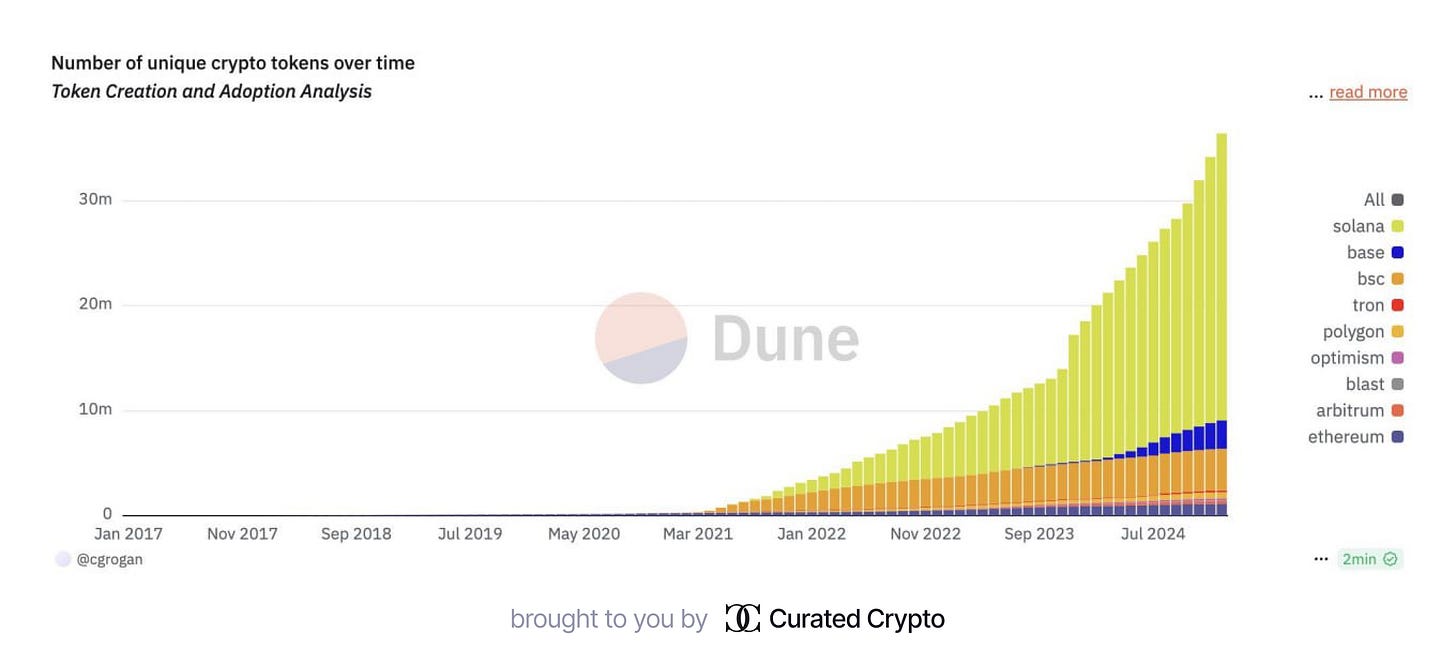

Experts suggest the traditional altcoin season is unlikely to return, citing the massive growth in the number of tokens on the market. From fewer than 3,000 altcoins during the 2017–2018 bull run to over 36.4 million tokens today, the market has undergone a major shift, diluting capital across an overwhelming supply.

This dilution has led to significant challenges for investors. While the total altcoin market cap nears its all-time high, portfolios remain at record lows for many. Unlike past cycles where most altcoins surged, today's environment requires precise asset selection. Only a few projects see exponential growth, while most offer modest returns.

Despite the challenges, it’s not all bad news. Capital can still concentrate around quality tokens, specific sectors, or narratives during periods of market euphoria. Upcoming liquidity injections and potential quantitative easing (QE)could further boost market conditions, driving selective altcoin growth.

The takeaway? Timing is no longer enough. Investors must focus on selecting the right assets and navigating a more competitive market environment to succeed.

Crypto Yield Insights: Weekly Opportunities

Top $SUI Farming Yields This Week

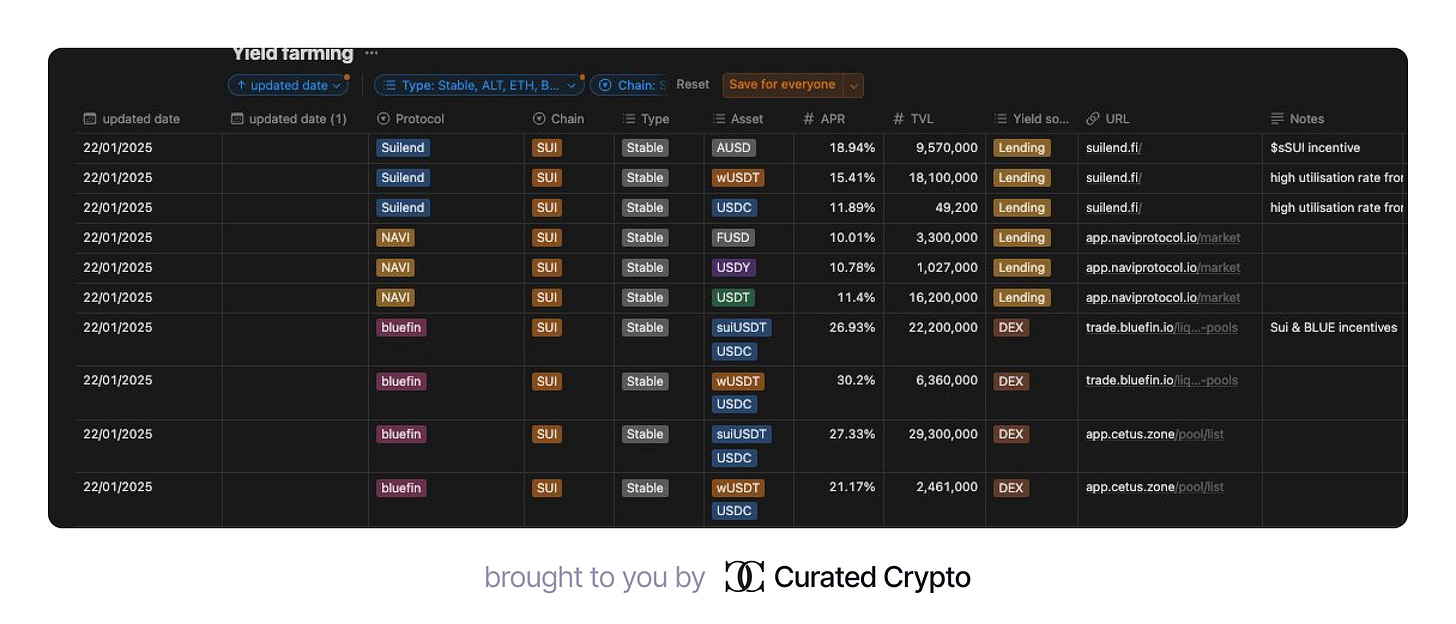

The Sui market is gradually recovering, presenting lucrative farming opportunities. Here are some of the best yields this week:

30.02% APR for $wUSDT/$USDC on Bluefin (6.3M TVL)

26.93% APR for $suiUSDT/$USDC on Bluefin (22.2M TVL)

18.94% APR for $AUSD on Suilend (9.57M TVL)

10.01% APR for $FUSD on NAVI Protocol (3.3M TVL)

Sui Foundation is driving significant yield opportunities and price growth.

Top Stablecoins Offering Point Rewards Programs

Stablecoins with integrated point programs are becoming increasingly popular for incentivizing users. Here's a quick breakdown:

1. Reservoir (rUSD, srUSD)

Rewards: Up to 3 points/day (ppd) for Berachain LP.

Target: 20 billion points with up to 500% APR (unleveraged) depending on FDV.

2. Resolv Labs (USR, wstUSR, RLP)

Real Yields:

USR: +25-40%

wstUSR: +5-12% (+12% yield)

RLP: +10-24% (+40% yield).

Pendle market offers 60 ppds for USR, potentially undervalued.

3. Rings (scUSD, stkscUSD, etc.)

Offers yield-enhancing features and dual-point rewards from Sonic Labs and Rings Protocol.

4% weekly airdrop allocation incentivizes early deposits.

Explore more projects and their potential in this detailed thread.

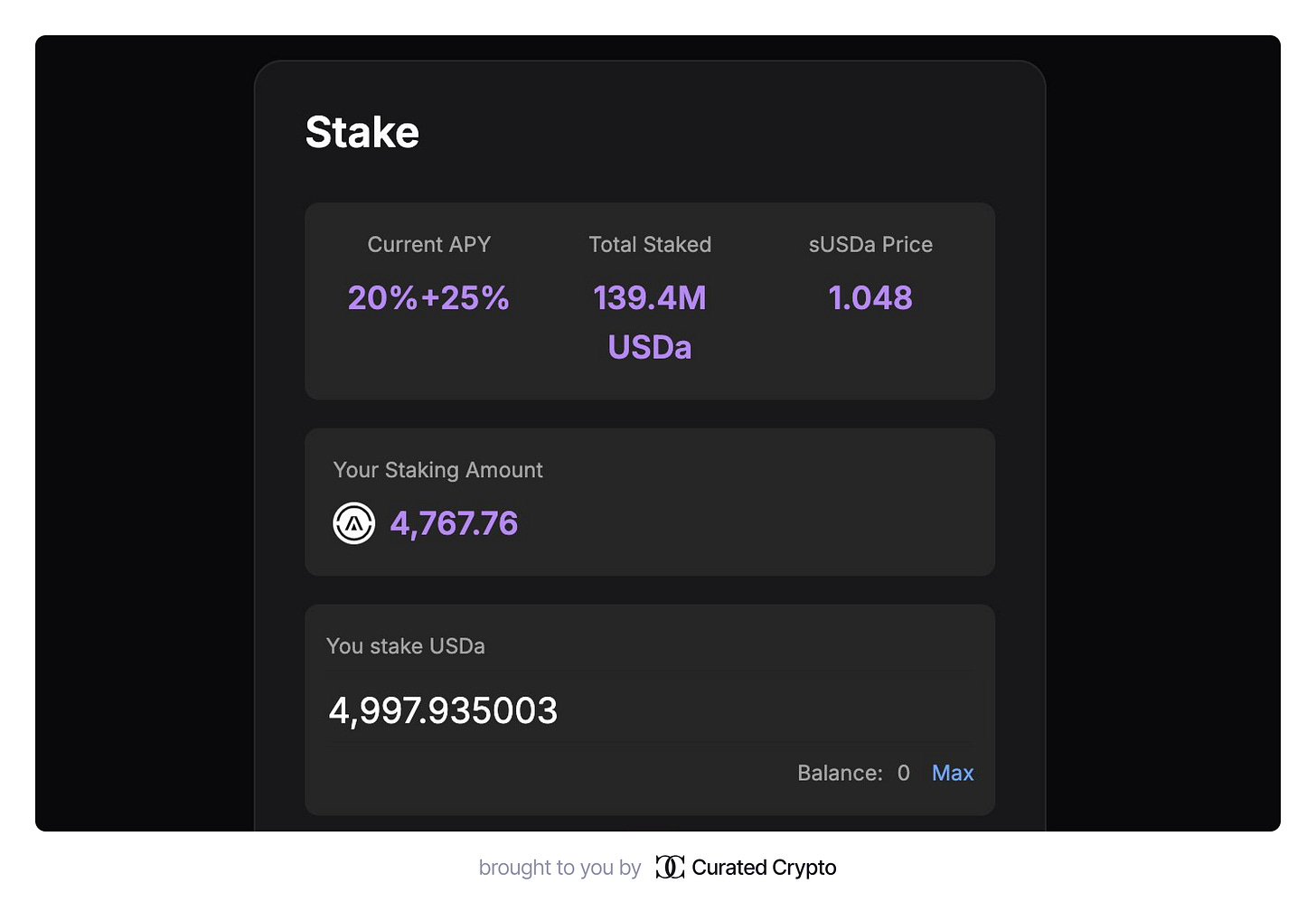

Avalon Finance's USDa: A Rising Star in CDPs

Since its mainnet launch in November, Avalon Finance’s USDa has quickly risen to become the second-largest collateralized debt position (CDP) in Web3, with a total value locked (TVL) of $826M.

This impressive growth is largely driven by its attractive yields. USDa, the world’s largest Bitcoin-backed CDP, provides 20% APY when staked in USDa and an additional 25% APY in $AVL.

These high returns make USDa one of the most lucrative dollar-pegged assets in the DeFi space, positioning Avalon Finance as a standout in CeDeFi lending.

It is highly recommended that you pay attention to thread: “Ethereum ETFs with Staking. What сould it mean for investors and the network?”

Boosting Earnings Through Airdrop Farming

Actual Airdrops of the Last Week:

Jupiter DEX – $JUP Airdrop

Jupiter DEX will distribute 700M JUP tokens, valued at over $600M, to its community as part of the Jupuary programapproved last year. This massive allocation aims to reward active supporters and users.

Plume Network – $PLUME Distribution

RWA-focused platform Plume Network has announced its TGE. In Season 1, PLUME tokens will be allocated to early contributors. Check eligibility and claim here: Plume Claim Page.

Obol Collective – $OBOL Airdrop

Validator-oriented protocol Obol Collective has launched its token, $OBOL, with airdrops for individual stakers, Rocketpool operators, and early adopters. Verify your eligibility here: Obol Claim Page.

These airdrops mark significant opportunities for active users to engage with innovative protocols and earn rewards!

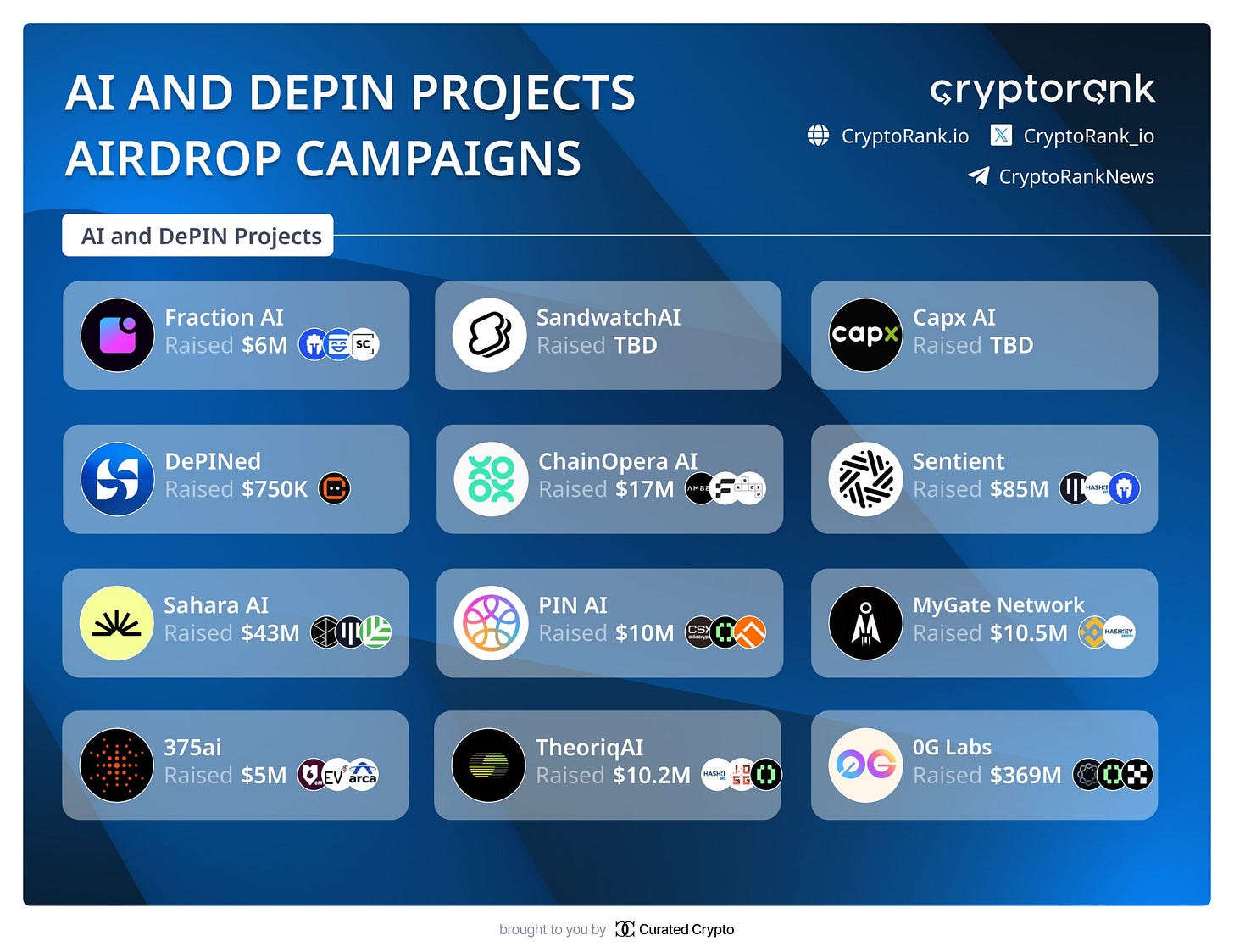

AI and DePIN Airdrop Opportunities

Explore promising AI and DePIN projects offering airdrop campaigns, ideal for those looking to earn tokens without major investments. Here's a snapshot of some noteworthy projects:

Fraction AI: Raised $6M

Sandwatch: Fundraising status TBD

ChainOpera AI: Raised $17M

Sahara AI: Raised $43M

Sentient: Raised $85M

Notably, 0G Labs leads the pack with a massive $369M raised. For detailed insights and participation, visit CryptoRank.

Additional updates: CryptoRank's Post.

Biggest Airdrops of 2025

Tier 1 (High Anticipation):

Tier 2 (Strong Potential):

Tier 3 (Emerging Opportunities):

Under Question:

Projects like BackPack, Eclipse, and Mayan are rumored but unconfirmed.

Links are given to either airdrop tracks, potential opportunities, or just official accounts so you can keep up with the projects and their giveaways.

Mastering TGE: Key Token Offerings

Top Pre-TGE Projects by Fundraising: Key Contenders to Watch

It is a list of notable projects that are expected to announce their Token Generation Event (TGE) soon. These ventures have already secured impressive funding, highlighting their strong potential and investor interest.

Explore more about these projects and their funding details on CryptoRank.

For additional insights, visit this source.

Let's look at some of these projects in more detail below.

The Most Anticipated Pre-TGE Projects for Q1-Q2 2025

A curated list of the most exciting blockchain projects currently in the pre-TGE stage—all poised to make waves in the crypto space this year.

1. Abstract Chain

A Layer 2 blockchain built on Ethereum, Abstract Chain enhances scalability and reduces transaction fees for consumer-focused applications.

Parent Company: Igloo Inc. (behind the Pudgy Penguins NFT project)

Launch: Mainnet scheduled for January 2025.

Key Collaborators: Cube Labs.

Stay updated via X / AbstractChain.

2. Berachain

An EVM-compatible Layer 1 blockchain built on the Cosmos SDK, Berachain has one of the largest and most passionate communities.

Funding Raised: $142M from Polychain Capital, Robot Ventures, and HashKey Capital.

Launch: TGE expected in Q1-Q2 2025 (after significant anticipation since last year).

Follow updates on X/Berachain.

3. Soon

A high-performance blockchain platform designed for scalability and interoperability, Soon is a Layer 2 network settling on Ethereum.

Recent Achievements:

Raised $20M through NFT public sale.

Received angel investments from Anatoly Yakovenko, Lily Liu, and Alex Pruden.

Campaign: The Big Bang Season 1.

Explore the campaign at discover.soo.network.

4. Eclipse

An Ethereum Layer 2 scaling solution using the Solana Virtual Machine (SVM), Eclipse focuses on enhancing Ethereum’s scalability.

Funding Raised: $65M from Polychain Capital, Delphi Ventures, and Placeholder Ventures.

Community Campaign: Farm Grass (points) through their active initiative.

Details here: X/EclipseFND.

5. Monad

A high-performance blockchain blending scalability innovations with Ethereum Virtual Machine (EVM) compatibility.

Funding Raised: $244M from Paradigm, OKX Ventures, DragonFly, and others.

Ecosystem Insight: A detailed overview of projects building on Monad is available online.

Dive deeper into Monad’s ecosystem.

6. Story Protocol

Story Protocol transforms intellectual property (IP) management and monetization in the digital age.

Funding Raised: $134.3M from a16z, Polychain Capital, and SamsungNext.

Testnet Activity: A variety of projects are actively building on its testnet.

Explore the Story Protocol ecosystem.

7. Kaito AI

A crypto analytics platform offering mindshare and sentiment analysis, Kaito AI is rapidly growing its presence.

Yaps Program: Rewards users for social media engagement and content creation.

Potential Airdrop: The community speculates about a token launch, with rewards for leaderboard leaders.

Track your points on the Yapps leaderboard.

These projects represent some of the most promising innovations in the blockchain and cryptocurrency ecosystem. Stay tuned for updates as they move closer to their TGEs!

Major Industry Turning Points

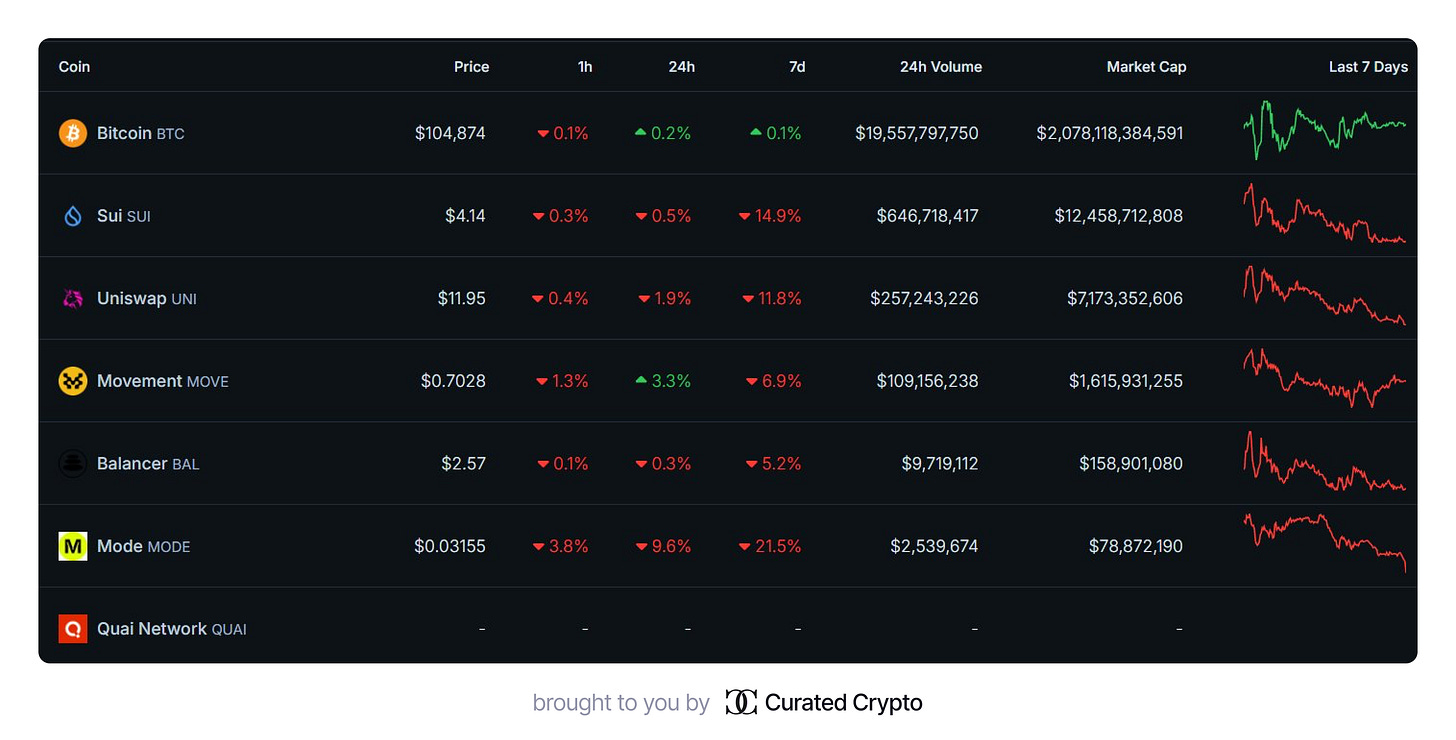

Crypto Watchlist: Key Events for the Week Ahead

A closer look at the top crypto events and updates shaping the market in the coming days:

1. $UNI (Uniswap V4)

Uniswap V4 will officially go live next week, introducing highly customizable pools that are set to redefine decentralized liquidity provision.

More details: X/Uniswap.

2. $BTC (Bitcoin)

The next FOMC interest rate decision is scheduled for Jan. 29. This could have a significant impact on Bitcoin's price movements.

Stay updated with FOMC developments via trusted market trackers.

3. $MODE (Mode)

Mode is set to launch its Mode Terminal, an AI-powered interface designed to simplify on-chain interactions and improve user experience.

Follow updates: X/Mode.

4. Quai Network

Quai’s mainnet will officially launch on Jan. 29. This highly scalable Proof-of-Work blockchain aims to revolutionize blockchain efficiency and throughput.

Learn more about Quai Network: X/QuaiNetwork.

5. $BAL (Balancer V3)

The much-anticipated Balancer V3 will launch on Arbitrum by the end of January, bringing enhanced features and capabilities to the protocol.

Follow updates: X/Balancer.

6. $SUI (Sui)

A $266M SUI token unlock is scheduled for Feb. 1, which could affect the token's liquidity and price dynamics.

Stay informed on SUI's market movements via trusted trackers. More details about other unlocks in the next part.

7. $MOVE (Movement)

The Movement Mainnet will launch in early February. As a Move-based Ethereum Layer 2, Movement aims to deliver high performance for scalable applications.

Keep an eye on Movement's progress: X/MovementNetwork.

Stay vigilant—these events could bring significant opportunities and market shifts. Keep these projects on your radar this week!

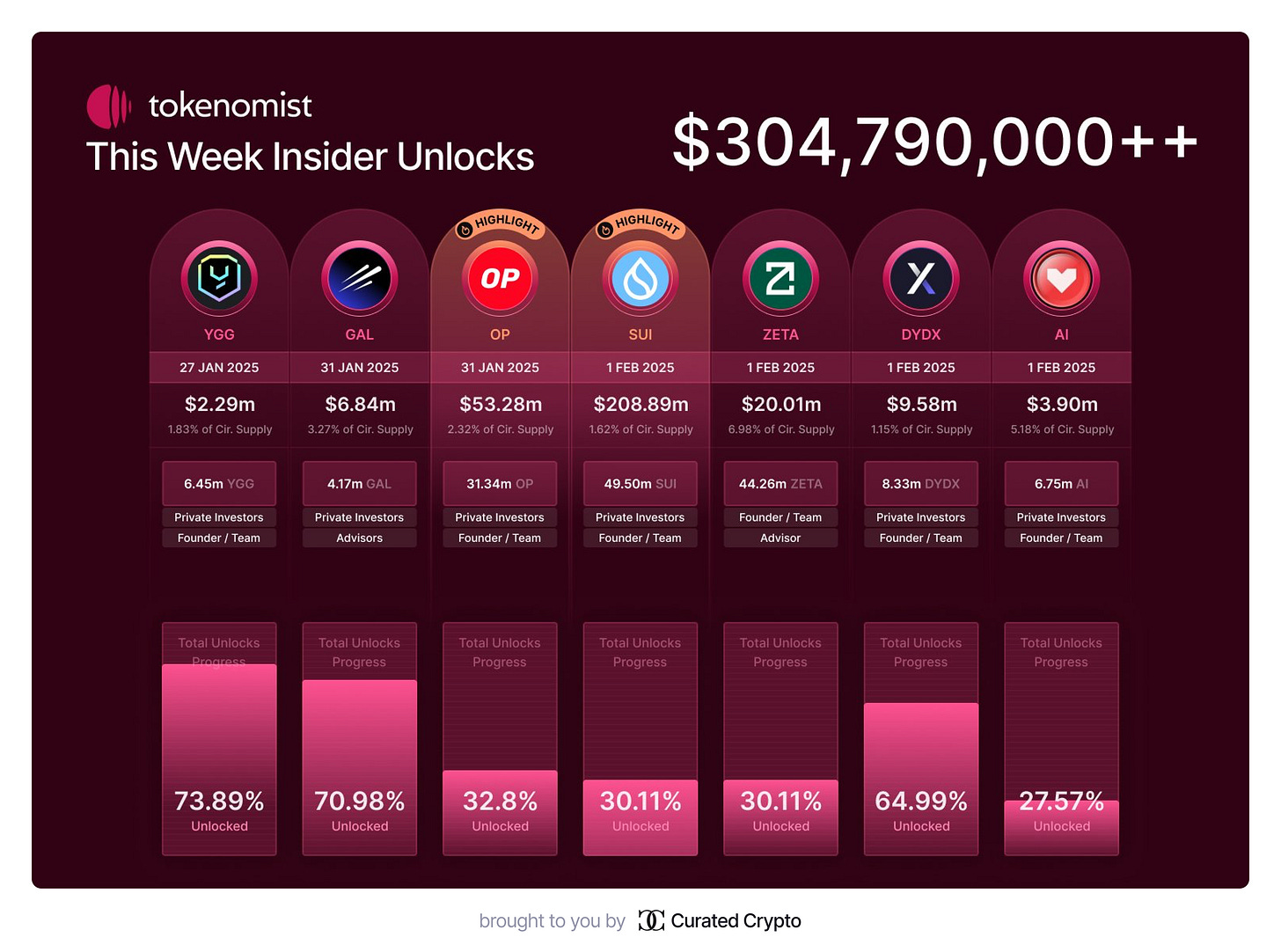

Insider Unlocks: January 27 – February 2, 2025

A total of $304.8M+ are set to be unlocked during this period. Here's a breakdown of the key unlock events:

Insider Unlock Highlights

1. $SUI (Sui)

Unlock: $208.89M (1.62%)

The largest unlock this week, signaling significant changes in liquidity.

2. $OP (Optimism)

Unlock: $53.28M (2.32%)

A critical moment for Optimism stakeholders.

3. $ZETA (ZetaChain)

Unlock: $20.01M (6.98%)

Among the higher unlock percentages this week, potentially impacting the market significantly.

4. $DYDX (dYdX)

Unlock: $9.58M (1.15%)

Watch for any immediate shifts in trading behavior.

5. $GAL (Galxe.g)

Unlock: $6.84M (3.27%)

Substantial release for this week.

6. $AI (Sleepless AI)

Unlock: $3.90M (5.18%)

AI tokens maintain their relevance in unlock schedules.

7. $ YGG (Yield Guild Games)

Unlock: $2.29M (1.83%)

A smaller yet notable unlock to track.

Why Focus on Insider Allocations?

These unlocks primarily impact Founders, Teams, Advisors, and Private Investors, offering insights into their trust and commitment to the project.

Stay tuned for updates on potential market movements and prepare to make data-driven decisions with a focus on liquidity and insider behavior.

Full report: Tokenomist Insider Unlocks

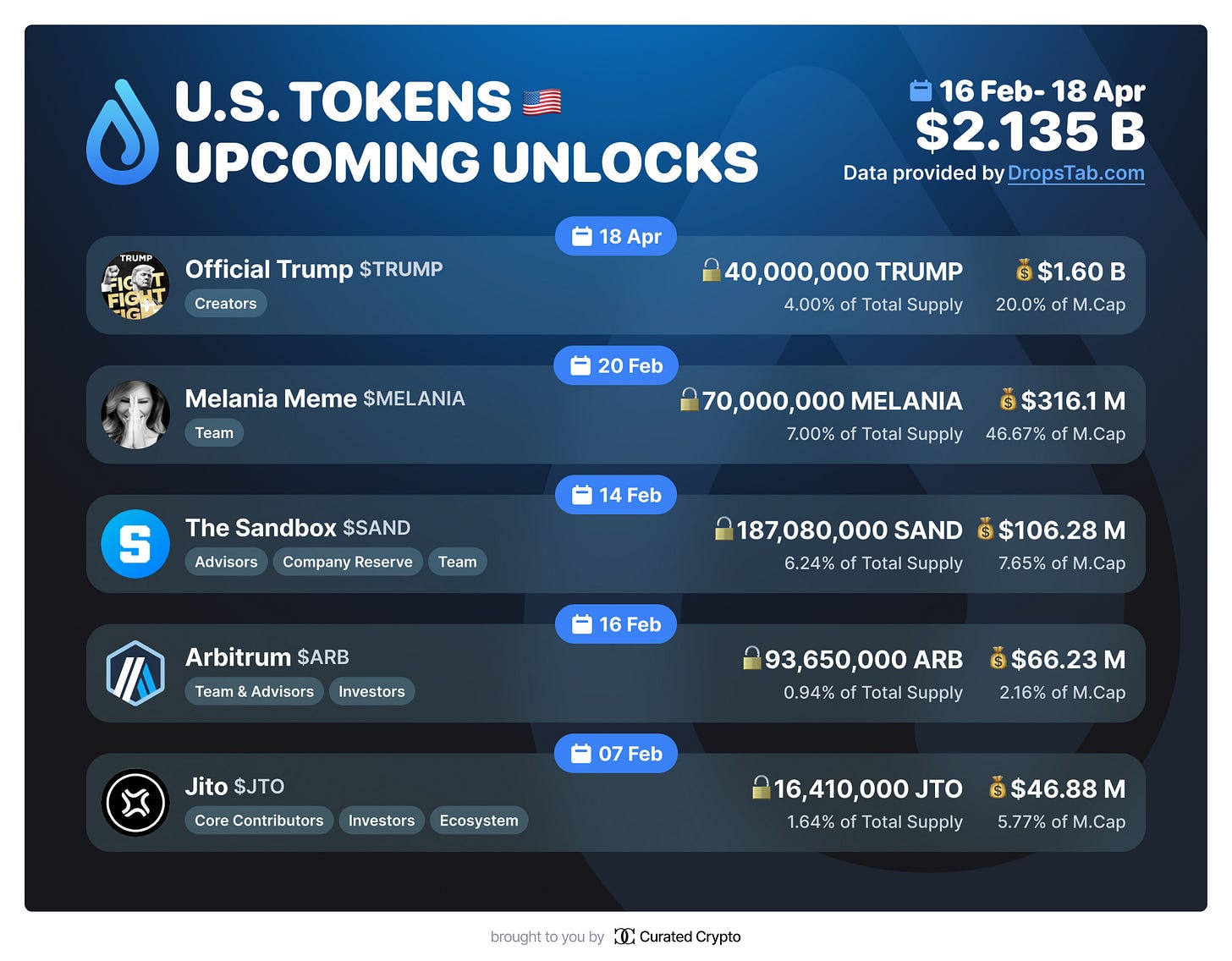

U.S. Tokens Upcoming Unlocks

Keep an eye on these significant token unlocks happening soon in the U.S. market. Here's the breakdown:

Token Unlock Highlights

1. $TRUMP

Unlock Value: $1.60B

The largest unlock in this list, with potential market impact.

2. $MELANIA

Unlock Value: $316.1M

Significant release, second only to $TRUMP.

3. $SAND (The Sandbox)

Unlock Value: $106.28M

Watch for liquidity changes as this unlock unfolds.

4. $ARB (Arbitrum)

Unlock Value: $66.23M

A notable unlock for the Layer-2 project.

5. $JTO (Jito)

Unlock Value: $46.88M

Smaller compared to others but still worth tracking.

Token unlocks are key events for market liquidity and price fluctuations. Track these releases to anticipate movements and plan accordingly.

Full insights: DropsTab Vesting Dashboard

Protocols in Focus

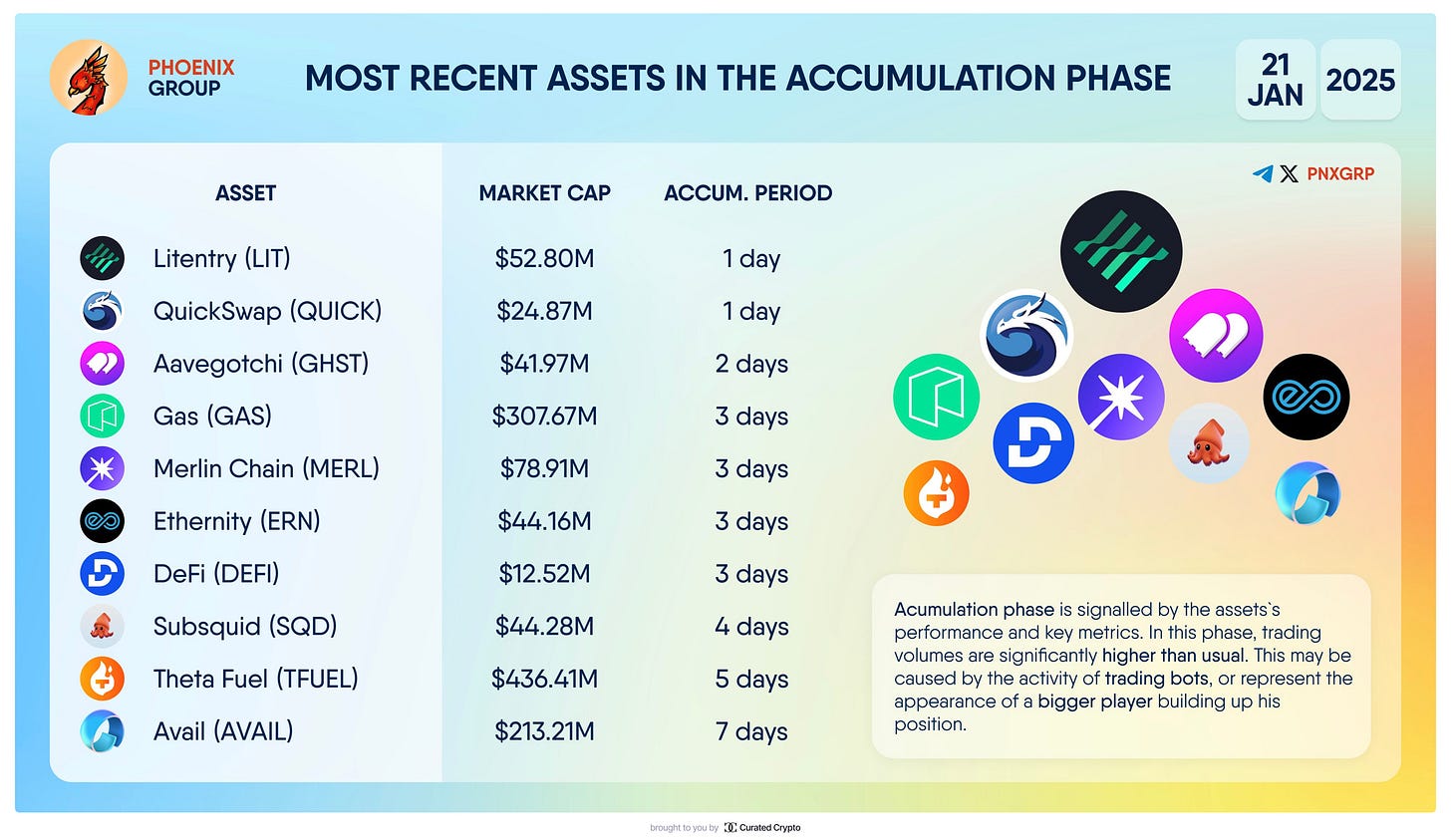

Assets in the Accumulation Phase: Who’s Building Positions?

Here’s a list of assets currently in the accumulation phase—a period marked by significantly higher-than-average trading volumes. This could indicate the presence of large players or increased activity from trading bots.

Top Assets in Focus

Litentry ($LIT)

Market Cap: $52.80M

Accumulation Period: 1 day

QuickSwap ($QUICK)

Market Cap: $24.87M

Accumulation Period: 1 day

Aavegotchi ($GHST)

Market Cap: $41.97M

Accumulation Period: 2 days

Gas ($GAS)

Market Cap: $307.67M

Accumulation Period: 3 days

Merlin Chain ($MERL)

Market Cap: $78.91M

Accumulation Period: 3 days

Ethernity (ERN)

Market Cap: $44.16M

Accumulation Period: 3 days

DeFi ($DEFI)

Market Cap: $12.52M

Accumulation Period: 3 days

Subsquid ($SQD)

Market Cap: $44.28M

Accumulation Period: 4 days

Theta Fuel ($TFUEL)

Market Cap: $436.41M

Accumulation Period: 5 days

Avail ($AVAIL)

Market Cap: $213.21M

Accumulation Period: 7 days

Why Does It Matter?

The accumulation phase is characterized by increased trading activity, which can:

Signal interest from large investors or institutions;

Indicate potential price volatility or upward momentum.

Top 10 Crypto Projects with High Inflation Rates for 2025

Inflation doesn’t only impact traditional currencies like the dollar—it also affects crypto assets. Here are some projects with the highest inflation rates this year, calculated using the Initial and Final Unlocked Supply.

Quick terminology refresher:

Initial Unlocked Supply: Token supply at the start of 2025 (January).

Final Unlocked Supply: Token supply by the end of 2025 (December).

Inflation Rate Formula:

(Final Supply - Initial Supply) / Initial Supply x 100Note: Occasional token burns are not factored into the calculations.

Data Source: CryptoRank.io

Top Inflationary Projects

$ENA (Ethena)

Initial Supply: 5%

Final Supply: 27.9%

Net Increase: 22.9%

Inflation Rate: 458%

$SAGA (Saga)

Initial Supply: 6%

Final Supply: 29%

Net Increase: 23%

Inflation Rate: 383%

$SPEC (Spectral)

Initial Supply: 10.3%

Final Supply: 34.2%

Net Increase: 23.9%

Inflation Rate: 232%

Want to see 7 more high-inflation projects?

Dive into the full thread: Defi Warhol

High inflation can significantly impact token prices, investor sentiment, and project sustainability. Always factor inflation into your decision-making when assessing long-term investments.

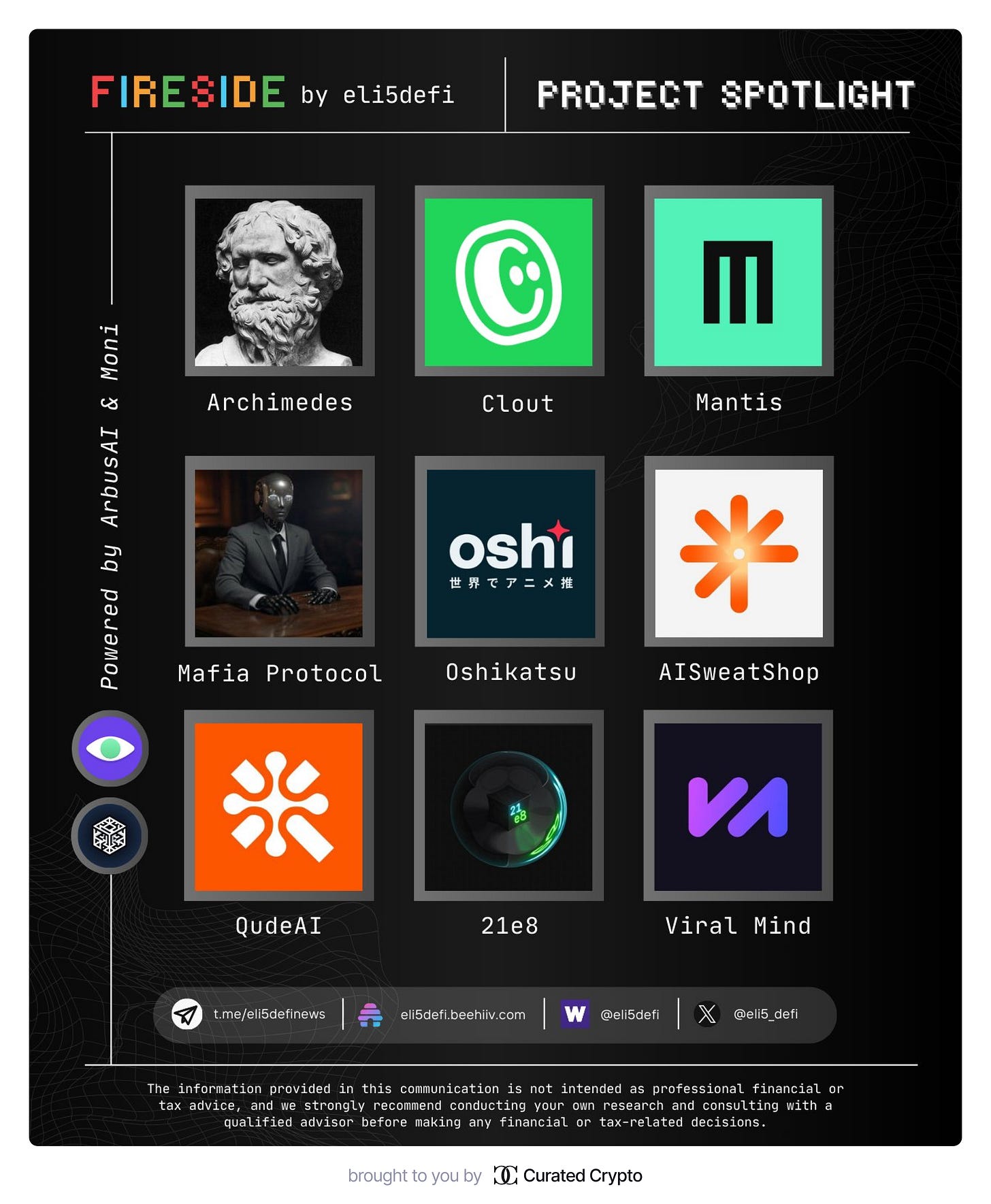

Project Spotlight – Week 4/2025

Explore these 9 cutting-edge projects poised to make waves in the blockchain and AI space.

Archimedes

Category: AI & Trading

Archimedes AI, developed by AlphaNet, uses Hypermatrix AI strategies focused on a $BTC perpetual directional trading strategy.

Clout

Category: Creator Economy

A platform for influencers and creators to launch their own tokens, letting fans invest directly in them.

Recent token $PASTERNAK achieved 125x growth, making it highly sought-after. Currently available on iOS.

Mantis ($M, Upcoming)

Category: Cross-chain DeFi AI

Mantis integrates Ethereum and Solana for cross-chain DeFAI.

Powered by DISE LLM, enabling personalized AI agents, advanced strategies, and collaborative vault tools.

Mafia Protocol ($MAFIA)

Category: GameFi

Built on @StoryProtocol, Mafia Protocol uses AI agents to play the Mafia game.

Users can predict outcomes, vote, and earn $MAFIA tokens through ecosystem participation.

Oshikatsu ($OSHI)

Category: Anime & Blockchain

A blockchain platform connecting anime creators and fans, fostering collaboration and transparent licensing.

Backed by @polychain and @superscrypt, it rewards users for participation in the anime production process.

AISweatShop ($ASS)

Category: DeFi & DeSci AI

A platform for developing DeFi/DeSci AI agents on the @Arbitrum network.

Currently in closed beta featuring projects like Gameboi ($GMB) and Overlord ($OVER).

Qude ($QUDE)

Category: Open-Source AI Development

QudeAI offers tools to build and interact with AI agents on the @Solana blockchain.

Features include an API, SDK, and a community module for sharing agents.

21e8

Category: Computational Data Markets

Building data markets to optimize global content distribution.

Recently launched Shagate, a revolutionary initiative combining optical waveguide photonics with natural energy fields to advance analog supercomputing.

Viral Mind ($VIRAL)

Category: AI-Powered Data Collection

ViralMind rewards users with $VIRAL tokens for collecting high-quality data to train AI agents.

Trained agents can be deployed and monetized seamlessly.

Learn more: Full Thread

Stay ahead by keeping these innovative projects on your radar!

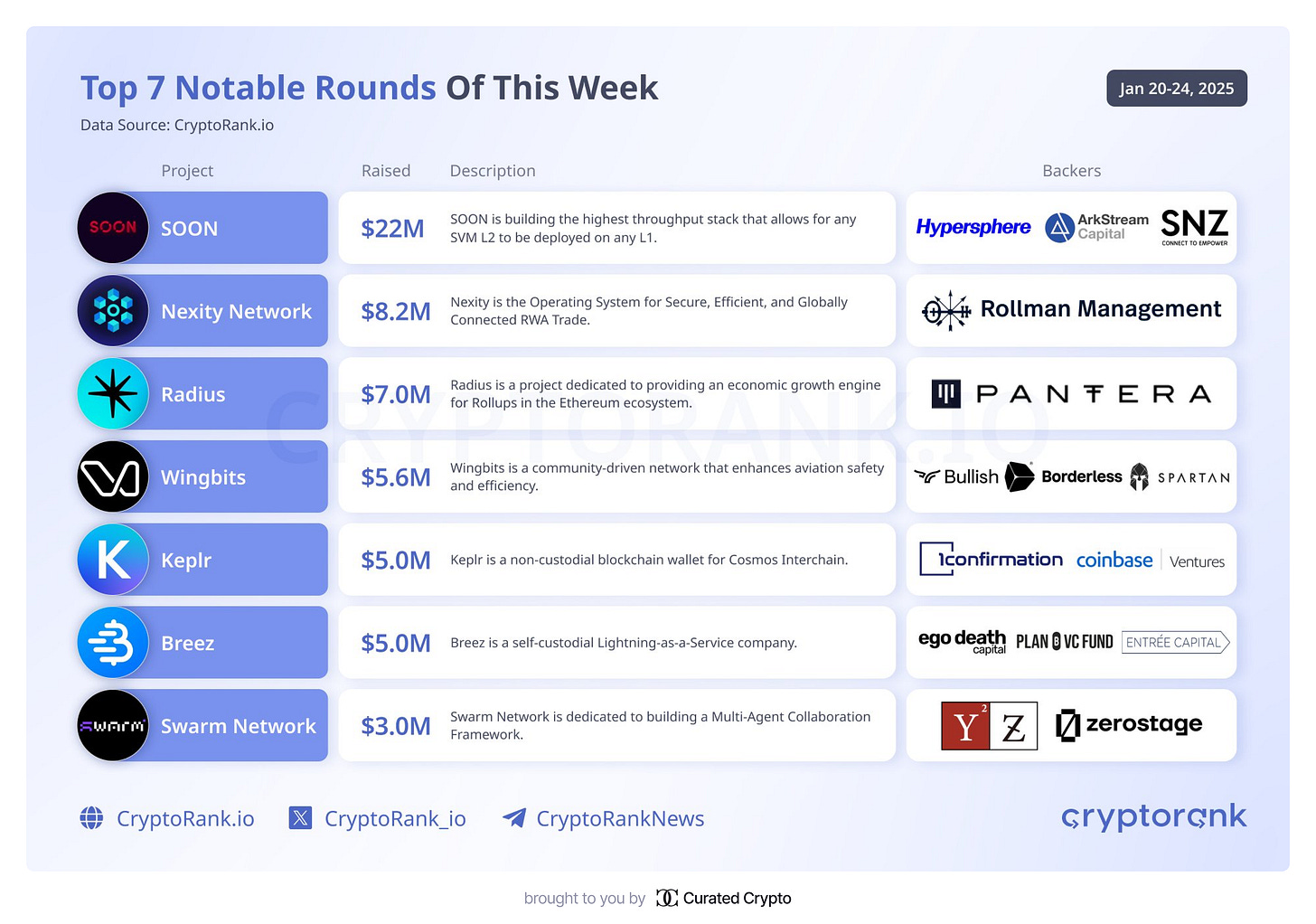

Key VC Rounds of the Week

Top 7 Notable Funding Rounds

Here are the standout funding rounds from this week, featuring innovative projects across the crypto ecosystem:

SOON

Funding: $22M

SOON is a high-performance Layer 2 network utilizing a decoupled SVM execution layer to enhance scalability and interoperability.

Nexity

Funding: $8.2M

Nexity offers next-gen blockchain solutions with a focus on DeFi innovations and improved scalability.

Radius

Funding: $7M

Radius is redefining decentralized infrastructure, delivering cutting-edge tools for seamless blockchain interactions.

Wingbits

Funding: $5.6M

Wingbits provides decentralized services with an emphasis on security and efficiency in blockchain transactions.

Keplr Wallet

Funding: $5M

Keplr, a leading crypto wallet, raised funds at a $50M valuation to expand its user-friendly multichain wallet features.

Breez

Funding: $5M

Breez focuses on creating seamless Lightning Network integrations for Bitcoin users.

Swarm Network

Funding: $3M

Swarm is building decentralized storage solutions optimized for scalability and accessibility.

Explore more funding rounds and insights here: CryptoRank.io.

Major Fundraisers to Watch This Week

This week brought some notable developments in the crypto fundraising landscape. Here are the highlights:

Circle Acquires Hashnote

Deal Value: $1.3B

Circle, the issuer of USDC stablecoin, has acquired Hashnote, a leader in tokenized Real-World Assets (RWA). This move strengthens Circle's foothold in the growing RWA market.

Humanity Protocol

Funding: $20M (Strategic Round)

Humanity Protocol focuses on building decentralized identity solutions, aiming to create equitable systems for users worldwide.

World Liberty Financial

Funding: $10M

World Liberty Financial is revolutionizing cross-border payments with a blockchain-first approach, leveraging stablecoins and tokenized assets for seamless transactions.

Shaping the Market: Long-Term Insights from Crypto News

Major Regulatory Update: President Trump Signs Executive Order on Crypto

In a significant move for the crypto industry, President Donald Trump has signed an executive order aimed at clarifying regulations in the digital asset sector. The order seeks to solidify America's leadership in the global digital asset economy. Key highlights include:

Presidential Working Group on Digital Asset Markets

The order establishes a Presidential Working Group focused on developing a federal regulatory framework for digital assets, including stablecoins.

The group will be chaired by the White House's AI and crypto czar and include key officials such as the Treasury Secretary and the Chairman of the SEC.

Strategic National Digital Assets Stockpile

The Working Group will also assess the creation of a national digital assets stockpile, furthering the U.S. government’s position in the digital economy.

Key Directives & Prohibitions

Prohibition on CBDCs: The order bans agencies from establishing or promoting central bank digital currencies (CBDCs).

Regulatory Overhaul: The group will also review which digital asset regulations should be rescinded or modified, moving towards a more innovation-friendly regulatory environment.

The order revokes the Biden administration's framework for international engagement on digital assets.

With this move, President Trump aims to halt what his administration sees as regulatory overreach that has previously hindered crypto innovation, positioning the U.S. as a leader in digital financial technology.

Euro Zone's Response to U.S. Push for Stablecoins: Digital Euro on the Horizon

In light of U.S. President Donald Trump's executive order to promote stablecoins and crypto development, European Central Bank (ECB) board member Piero Cipollone stressed the need for a digital euro. Here’s what you need to know:

Trump’s Push for Dollar-backed Stablecoins

Trump’s executive order outlines his plan to promote dollar-backed stablecoins globally, further emphasizing the growth of this cryptocurrency asset.

Stablecoins, typically pegged to the U.S. dollar, are designed to offer exposure to short-term interest rates, much like money market funds.

Digital Euro: A Response to Trump’s Strategy

Cipollone noted that the rise of stablecoins could lead to further disintermediation of banks, with customers moving away from traditional banking systems, thereby undermining banks' fee generation and client base.

To counter this, the ECB sees the digital euro as a necessary solution to maintain its competitive edge and provide customers with a secure digital payment alternative.

Unlike stablecoins, a digital euro would be operated by banks but guaranteed by the ECB, potentially allowing even those without a bank account to make digital payments.

Key Features of the Digital Euro

The digital euro would likely come with a cap on holdings, possibly a few thousand euros, and would not be remunerated (i.e., no interest on holdings).

It aims to give users easy access to secure, ECB-backed digital payments without the need for a bank account.

As Trump’s push for stablecoins gains global momentum, the ECB is gearing up to introduce a digital euro to ensure the euro zone stays competitive in the evolving digital currency landscape.

President Trump Grants Pardon to Silk Road Founder Ross Ulbricht

In a historic move, President Donald Trump has granted a pardon to Ross Ulbricht, the founder of the Silk Road marketplace, ending his over-decade-long imprisonment.

Silk Road and Ulbricht's Role

From 2011 to 2013, Ross Ulbricht ran the Silk Road marketplace under the alias Dread Pirate Roberts.

The platform was known for facilitating illegal drug sales and money laundering, serving over 100,000 buyers and processing hundreds of millions of dollars in illicit transactions.

But it was the platform that made bitcoin popular and that's why the crypto community considers Ross Ulbricht a legend

The FBI reported that Silk Road made $13 million in Bitcoin through commissions.

Ulbricht’s Conviction and Sentence

Ulbricht was arrested on October 1, 2013, in San Francisco by the FBI.

In 2015, he was convicted on charges of conspiracy to traffic narcotics and money laundering.

Ulbricht was handed a sentence of two life terms plus 40 years without parole, which sparked intense debate over the fairness of his punishment.

Trump labeled the sentence as “ridiculous” in his announcement, signaling his support for Ulbricht’s release.

Reactions to the Pardon

Ulbricht’s pardon is expected to generate sharp reactions from both supporters and critics.

Supporters argue that his sentence was disproportionate, while opponents highlight the scale of criminal activitytied to the Silk Road and its impact on society.

Ross Ulbricht’s pardon has reignited conversations about criminal justice, internet freedom, and the dark web as the debate over his legacy continues.

Be sure to read Andy Greenberg's interview from 12 years ago with Ross, who was then still at the helm of Silk Road under the nickname DPR

An Interview With A Digital Drug Lord: The Silk Road's Dread Pirate Roberts

Research Spotlight

Tokenomit’s Annual Report ‘24

Tokenomit’s Annual Report for 2024 provides an in-depth analysis of the state of the crypto market. The report offers a comprehensive overview of tokenomics, offering valuable insights for investors and stakeholders looking to understand the market’s evolving landscape.

Source: Tokenomit’s Annual Report ‘24

The DePIN Ecosystem Landscape

This research dives into the DePIN (Decentralized Physical Infrastructure Networks) ecosystem, exploring its impact on the physical infrastructure industry and its potential to reshape data and energy systems through blockchain technology. It examines the evolving trends, challenges, and opportunities within the DePIN space, offering an outlook on how the sector could develop in 2025 and beyond.

Source: The DePIN Ecosystem Landscape

Bridging Web2 and Web3: How Automate Framework & DeFAI Empower AI Agents for Financial Transactions

This article outlines how the Automate Framework and DeFAI (Decentralized AI) are bridging the gap between Web2and Web3, enabling AI agents to perform autonomous financial transactions. By exploring the integration of AI-driven solutions in decentralized finance (DeFi), the piece discusses how these innovations drive efficiency and unlock new possibilities for both businesses and consumers.

Source: Bridging Web2 and Web3

From Startup to Scale-up: How to Harness Crypto APIs for Web3 Success in 2025

This article offers valuable insights for businesses looking to scale their operations within the Web3 space. It focuses on crypto APIs, outlining how they can be effectively harnessed to streamline integration with blockchain networks, drive operational efficiencies, and scale Web3 ventures. The piece also looks at the tools and strategies that will enable startups to evolve into successful, scalable Web3 projects.

Source: From Startup to Scale-up

Your Branding Sucks (and Nobody Cares)

This post takes a direct look at branding mistakes in the crypto space, providing actionable advice for entrepreneurs and projects seeking to enhance their visibility and market appeal. It emphasizes the importance of the fact that if your product is good enough, users will ignore almost everything else.

Source: Your Branding Sucks

10 Extensions to Navigate DeFi as Safely as Possible

This guide presents 10 essential extensions for navigating the decentralized finance (DeFi) landscape securely. The piece highlights critical tools and resources that can enhance security, help users manage risks, and ensure safe interaction with various DeFi protocols.

Source: 10 Extensions to Navigate DeFi